This article answers the question, “Where do rich people keep their money?” It also looks at how they save it, and, most importantly, how they invest it and expand it to create generational wealth.

There are over 56 million millionaires and 2640 billionaires in the world. The US is home to over 21 million millionaires and 735 billionaires, making it the ultimate spot for the wealthy. China, India, Germany, and Russia are some of the other countries with the richest people.

There are a lot more millionaires now than there were a hundred years ago, but a million dollars is worth a lot less than it used to be. Simply put, a million will not get you remotely as much as it could’ve in the 90s. Still, it’s a lot.

The financial (and personal) habits of high-net-worth individuals have always interested the masses. Many people try to adopt these habits to acquire the same results. For some, it works – for others, it doesn’t.

That’s because you don’t find success by running after a one-size-fits-all solution. You can get it by following a complete plan that looks at every part of your life and gives you tax breaks, a better way of life, and financial freedom all at the same time.

However, you won’t find that strategy in a podcast or a book. You’ll find it by going to the right people, and that’s where we come in.

Over 100 countries’ tax, citizenship/residence, banking, and business structures are all kept up to date in Nomad Capitalist’s database, which is the largest in the world. Simply put, we know all the options and can tell you the one that best fits your needs. All you have to do is reach out to us, and we will help you go where you’re treated best.

Ever wondered if the mega-rich folks like Elon Musk or Bill Gates worry about retirement planning like the rest of us? Do billionaires even bother with 401(k)s or IRAs when they have mountains of cash? The answer might surprise you!

The Billionaire Retirement Secret

Yes, billionaires DO have retirement accounts – and they’re often using them in ways that would make your financial advisor’s jaw drop These ultra-wealthy individuals don’t just have retirement accounts; they’ve turned them into powerful wealth-building machines that work differently than yours and mine

Let me break down what I’ve discovered about how the ultra-rich approach retirement savings,

How Billionaires Use Retirement Accounts

Billionaires and other high-net-worth individuals use retirement accounts differently than average folks. While we’re trying to save enough for a comfortable retirement, they’re using these accounts as tax strategy powerhouses.

Here’s how they approach retirement accounts:

-

Tax Advantages: Billionaires love tax benefits just like the rest of us! Roth IRAs particularly appeal to them because withdrawals in retirement are completely tax-free.

-

Diversification Strategy: Even with billions, spreading money across different types of accounts helps manage risk.

-

Long-Term Growth: The rich understand the power of tax-deferred growth over decades.

-

Estate Planning: Retirement accounts can be part of sophisticated wealth transfer strategies.

The Peter Thiel Roth IRA Bombshell

The most stunning example of billionaire retirement account strategy comes from PayPal co-founder Peter Thiel. According to ProPublica, Thiel had a mind-blowing $5 BILLION in a Roth IRA as of 2019!

Yes, you read that correctly – BILLIONS, not millions, in a retirement account that most of us struggle to max out at $6,500-7,500 per year.

How’d he do it? Through what some might call a financial “hack”:

- Open a Roth IRA with a small initial contribution

- Use that money to purchase startup stock at fractions of a penny per share

- Watch as those investments explode in value

- Never pay taxes on any of the growth (the magic of Roth accounts!)

Above 70% of Thiel’s estimated net worth of $6 billion, this $5 billion is more than 8 billion. That’s a crazy amount of money that will never be taxed!

What Percentage of Wealth Do the Rich Keep in Retirement Accounts?

According to data from wealth manager Empower, high-net-worth individuals (those with $1-5 million in investable assets) keep a significant portion of their wealth in retirement accounts:

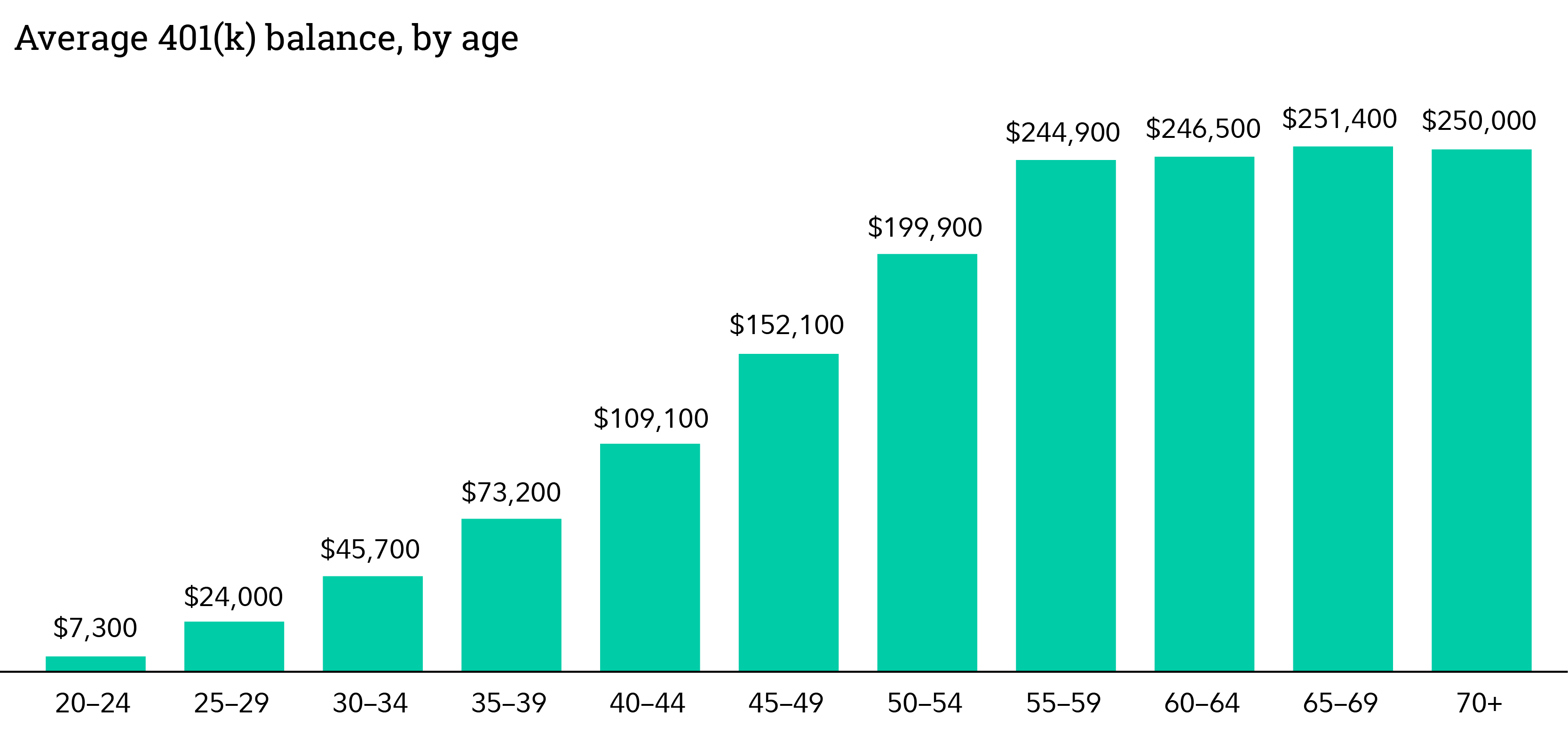

- Those in their 20s: 22% in retirement accounts

- Those in their 30s: 38% in retirement accounts

- Those in their 40s: 54% in retirement accounts

- Those in their 50s: 62% in retirement accounts

- Those in their 60s: 63% in retirement accounts (peak)

- Those in their 70s: 56% in retirement accounts

- Those in their 80s: 47% in retirement accounts

- Those in their 90s: 21% in retirement accounts

On average, wealthy people keep over 54% of their net worth in retirement accounts!

This is a lot more than the average person, whose retirement accounts only make up about 27% of their net worth.

How Do Billionaires Get Around Contribution Limits?

You might be thinking, “Wait a minute! How do billionaires get millions or billions into retirement accounts when there are strict annual contribution limits?”

Great question! They use several strategies:

1. The Backdoor Roth IRA

There are limits on how much money people can put into a Roth IRA, but there is a legal way to get around them:

- Contribute to a traditional IRA (no income limits)

- Convert that traditional IRA to a Roth IRA (no income limits on conversions)

- Pay taxes on the conversion amount

2. Strategic Investment Choices

Like Peter Thiel, some billionaires invest their retirement funds in high-potential startups or assets that could multiply many times over.

3. Early Planning

Many started young and consistently contributed over decades.

4. Business Owner Advantages

Many wealthy individuals own businesses and can set up specialized retirement plans with much higher contribution limits, like:

- Cash balance plans (allowing contributions of $300,000+ per year!)

- SEP IRAs

- Solo 401(k)s

The “Mega IRA” Phenomenon

The Government Accountability Office (GAO) reported that as of 2019, about 28,000 taxpayers had IRAs worth at least $5 million. Even more shocking, 497 individuals had IRAs worth $25 million or more, with an average balance exceeding $150 million!

Lawmakers are paying close attention to these “mega IRAs” because they say they aren’t what retirement accounts were meant to do. In the 1970s, IRAs were made to help regular Americans save for retirement, not as tax havens for the very rich.

Billionaires Who Advocate for Retirement Accounts

Warren Buffett, one of the world’s richest people, has actually advocated for Roth IRAs because of their tax advantages and growth potential. When one of the greatest investors of all time recommends something, we should probably listen!

Should Regular Folks Follow the Billionaire Retirement Strategy?

While we can’t all be Peter Thiel, there are some lessons we can learn from how billionaires approach retirement:

-

Max out your contributions – If possible, contribute the maximum to your retirement accounts each year.

-

Start early – The magic of compound growth works better with time.

-

Consider tax diversification – Having both traditional and Roth accounts gives you flexibility in retirement.

-

Be strategic with investments – While most of us can’t buy pre-IPO startup shares, we can still be thoughtful about investment choices.

-

Understand the rules – Knowing the ins and outs of retirement accounts can help you maximize their benefits.

When Is Too Much in Retirement Accounts?

Believe it or not, financial advisors say there can be a point where having TOO MUCH in retirement accounts becomes problematic, even for the wealthy:

- Reduced access to funds before age 59½

- Required Minimum Distributions (RMDs) forcing withdrawals

- Potential for higher tax rates in the future

- Limited flexibility with withdrawal options

Rob Duncan, founder of Global Impact Wealth Management, says: “For most Americans, having too much of their net worth in retirement accounts isn’t a major concern. Debating it reveals a significant level of financial success and sophistication.”

Government Attempts to Close Loopholes

The government hasn’t been blind to these billionaire retirement strategies. Various attempts have been made to restrict practices like backdoor Roth IRAs:

- The RISE Act proposed in 2016 would have eliminated Roth IRA conversions

- The Biden administration included provisions to limit these practices in its Build Back Better framework

- The House passed a version that would have prohibited rolling over after-tax contributions from traditional to Roth IRAs

However, most of these attempts haven’t succeeded in becoming law.

FAQs About Billionaires and Retirement Accounts

Do all billionaires have retirement accounts?

Not all billionaires use retirement accounts. Some prefer other wealth management strategies like real estate, private equity, or trusts. But many do utilize retirement accounts as part of their overall financial strategy.

Can I make a million dollars with my 401(k)?

Yes, it’s totally possible! It requires early and consistent saving, maxing out contributions when possible, minimizing fees, and making smart investment choices.

Can you get rich with a 401(k)?

While a 401(k) alone probably won’t make you a billionaire, it can be a crucial piece of your wealth-building strategy. The earlier you start and the more you can contribute, the better your chances.

What are the contribution limits for retirement accounts in 2024?

For 2024, the contribution limit for IRAs is $7,000 ($8,000 if you’re 50 or older), and for 401(k)s it’s $23,000 ($30,500 if you’re 50 or older).

My Takeaway

I find it fascinating that billionaires, with all their wealth, still utilize retirement accounts so heavily. It shows that no matter how rich you get, tax-advantaged growth remains incredibly valuable.

While most of us won’t end up with billion-dollar Roth IRAs, we can still learn from the financial strategies of the ultra-wealthy. Start early, contribute consistently, understand the tax advantages, and make the most of the retirement accounts available to you.

The next time someone asks if billionaires have retirement accounts, you can tell them not only do they have them – they’ve mastered using them in ways most financial advisors never imagined possible!

What’s your retirement savings strategy? Are you maxing out your accounts each year? I’d love to hear your thoughts on how you’re planning for your financial future!

Private Equity and Hedge Funds

Private equity and hedge funds are almost exclusively utilized by the wealthy. Alternatively, public equity is more common among the masses since its shares are traded on the stock exchange.

Private equity funds usually acquire investments from large organizations like universities or pension funds. Moreover, you must demonstrate a particularly high net worth (at least $250,000) to be a private equity fund investor. You also have to be an accredited investor. Many high-net-worth accredited investors invest in private equity.

Hedge funds are not the same as private equity. Hedge funds use pooled funds and follow several strategies to earn massive returns for investors. Hedge funds invest in funds that may make the highest short-term profits.

What Asset Classes Do Rich People Own?

Most people think that millionaires prefer hard assets, with real estate investments being their favorite. Although real estate investments offer good yields, most millionaires and even billionaires lean more toward liquid assets.

Liquid assets are useful because they can be used to pay bills, build up an emergency fund, and quickly settle debts without having to pay extra fees.

Vanguard says that the average US millionaire household has 65% of its wealth in stocks, 20%25 in bonds, and 10% in cash. A study by the Bank of America also found that millionaires keep twenty-five percent of their money in stocks, mutual funds, and retirement accounts.

Millionaires and billionaires keep their money in different financial and real assets, including stocks, mutual funds, and real estate.

Let’s discuss a few asset classes and investments preferred by the wealthy.

Why do wealthy people invest in real estate? Real estate is one of the most common types of tangible assets. People invest in real estate because it’s a long-term investment that retains its value throughout several economic cycles. Residential real estate is a fixed asset that increases in value over the years and offers excellent profit when sold.

Commercial real estate or rental can be used for income generation and is one of the most preferred ways to generate passive income for wealthy individuals.

Many investors start with purchasing personal real estate like a primary home and then purchase other residential properties they use as rentals. Once they get the hang of it, they try their hand at commercial real estate, such as office buildings, hotels, etc.

Millionaires and billionaires usually have large, diverse real estate investment portfolios spanning several countries.

Frontier markets, especially in South America and Asia, offer excellent real estate investment opportunities for investors looking to expand their real estate portfolio beyond the West.

Looking to buy your first property outside your country? Or perhaps, you want to add an exotic offshore location to your real estate portfolio? Nomad Capitalist helps you invest in foreign real estate like a local.

Get in touch with us today and use our decades of experience to buy real estate in fast-growing and stable international markets with total transparency, no hidden commissions, and at real market prices.