Under ideal circumstances, no one would ever run out of money in retirement, and they’d have enough resources to meet all their essential expenses and more. But with the potential for stock market volatility and continuing inflation, more people are searching for predictable income strategies to help meet their retirement needs.

“Now might be the time to consider an annuity even as interest rates come down,” says Stefne Lynch, vice president of product management and client engagement at Fidelity. “Fixed annuities allow you to lock in guarantees and security. Some annuities also offer flexibility around things like accessing principal or controlling the timing around taking distributions. ”.

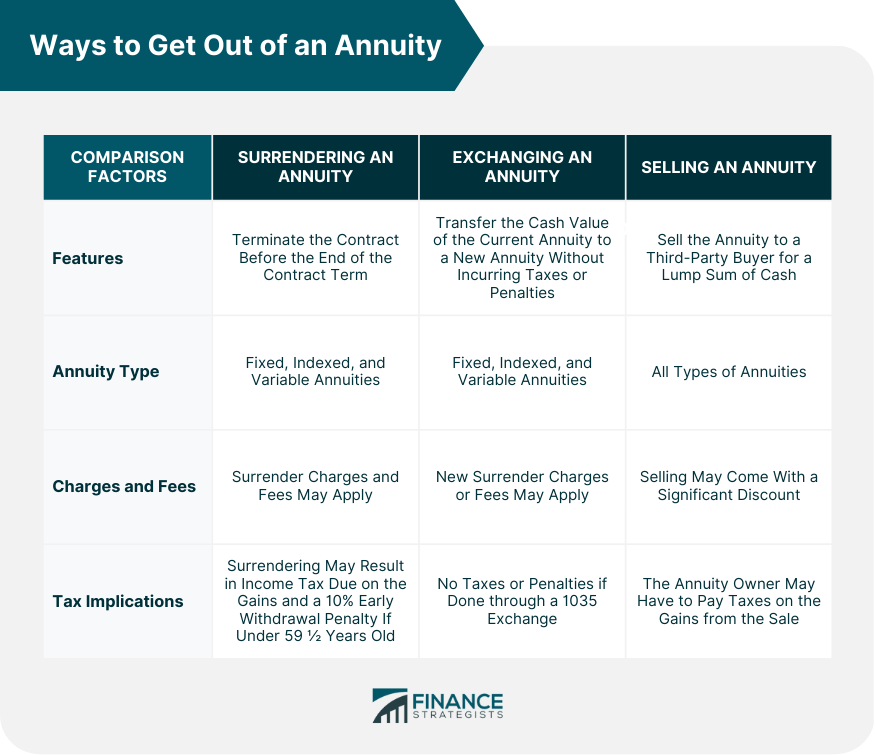

Different kinds of annuities can help people save more for retirement in different ways. Others can provide a steady stream of income for people who are retired or about to retire. People may have been less likely to invest in annuities in the past, in part because they had a bad reputation for being hard to understand and charging high fees. There are many types of annuities available today. Some are easier to understand, cost less, and have extra features that can help you reach your financial goals.

“Annuity products have come a long way in recent years, enabling people to better match a specific annuity to their unique needs and preferences,” says Lynch.

To help simplify things, you can think of purchasing an annuity as existing on a life-stage continuum. When you’re saving for retirement, an annuity can offer market exposure, and growth potential that could complement other parts of your portfolio that are invested more conservatively, such as in CDs and bonds. They can also offer tax deferral as you build your nest egg.

As you begin to approach retirement, you may want some market exposure without taking on too much risk. There are annuities that can reduce market volatility risk, or you may even consider starting to purchase annuities that provide an income stream at a date you set in the future.

Lastly, when you retire, the need to cover your essential expenses can be critical. Annuities that provide regular payments can give you (and your spouse) guaranteed income either for life or a set period of time.

Ultimately, annuities can help manage 3 main retirement risks; namely, market volatility, the possibility you could outlive your savings, and the risk inflation will eat away at your savings.

Are you worried about running out of money in retirement? You’re not alone. As retirement planners, we’ve heard this concern from countless clients over our 16+ years in the business. The question “do annuities ever run out of money?” is more common than you’d think, especially with today’s volatile stock market and people living longer than ever before.

Yes, annuities can run out of money, but they don’t have to. If you set up the right annuity the right way, it can give you a steady income for life.

When Annuities Can Run Out of Money

Despite their reputation as a reliable income source. certain types of annuities and specific situations can cause these retirement vehicles to deplete

Fixed-Term Annuities Have Built-In Expiration Dates

If you choose a fixed-term annuity that pays out for 10 or 20 years, your payments will stop when that term ends. It’s right there in the contract plain as day. These annuities are designed to stop paying after the predetermined period – so technically, they do “run out of money” by design.

Excessive Withdrawals Can Drain Your Account

Taking too much money too quickly is a surefire way to deplete your annuity. While many contracts allow penalty-free withdrawals (typically around 10% annually), regularly exceeding recommended withdrawal amounts can rapidly drain your account.

I had a client who consistently withdrew 15% from his variable annuity annually. Despite my warnings, he continued, and his account was nearly empty within seven years. Ouch!

Market Performance Affects Variable Annuities

Variable annuities tie your money to market performance, which introduces risk. During market downturns, your account value can decrease substantially, especially if you’re making withdrawals simultaneously.

Think about people who had variable annuities when the economy crashed in 2008. The value of many people’s accounts dropped by 30 to 40 percent, and those who kept making withdrawals during this time saw their account values drop even faster.

High Fees Can Erode Your Principal

Some annuities (especially variable ones) come with substantial fees that can eat away at your principal over time. These might include:

- Administrative fees

- Mortality and expense risk charges

- Subaccount management fees

- Rider fees

When these fees combine with withdrawals and poor market performance, your annuity might deplete faster than expected.

How to Make Sure Your Annuity Never Runs Out of Money

Now for the good news! There are several strategies to ensure your annuity provides income for as long as you need it:

Choose Lifetime Income Options

The most straightforward way to ensure your annuity never runs out is to choose a lifetime income annuity. These products are contractually obligated to pay you for as long as you live, regardless of how long that might be.

One client told me, “I sleep better knowing that my basic expenses are covered by work that I can’t quit.” People who are worried about the market going up and down or living a long time will value this peace of mind very highly.

Add a Guaranteed Lifetime Income Rider

For deferred annuities like fixed indexed or variable annuities, adding a guaranteed lifetime income rider provides security. These riders ensure you’ll receive income payments for life, even if your account value drops to zero.

Yes, these riders come with fees (typically 0. 5% to 1. 5 percent a year), but many clients think the peace of mind is worth the price.

Consider Joint Life Options

If you’re married, consider a joint life payout option. This ensures that payments continue as long as either you or your spouse is alive, adding another layer of security.

We recently set up a joint life annuity for a couple where the husband had health concerns. The wife had peace of mind knowing her income would continue uninterrupted if her husband passed away first.

Follow the 4% Rule for Withdrawals

Limiting your annual withdrawals to approximately 4% of your initial retirement portfolio can significantly extend the life of your annuity. This strategy, known as the 4% rule, helps manage your withdrawal rate to reduce the risk of depleting your funds.

Diversify Your Retirement Income

Don’t rely solely on an annuity for all your retirement income needs. Combining annuity payments with Social Security benefits, pensions, investment withdrawals, and emergency savings creates a more robust retirement plan.

One client uses her annuity to cover essential expenses while leaving her investment portfolio for discretionary spending and unexpected costs. This balanced approach provides both security and flexibility.

Different Types of Annuities and Their Depletion Risk

Not all annuities are created equal when it comes to the risk of running out of money:

| Annuity Type | Can It Run Out? | Risk Level |

|---|---|---|

| Immediate Lifetime Annuity | No (as long as insurer is solvent) | Low |

| Fixed-Term Annuity | Yes (by design after term ends) | Medium |

| Variable Annuity (without riders) | Yes (subject to market performance) | High |

| Fixed Indexed Annuity (without riders) | Yes (possibly, depending on withdrawals) | Medium |

| Any Annuity with Lifetime Income Rider | No (as long as insurer is solvent) | Low |

Real-World Example: The Tale of Two Retirees

Let me share a quick story of two clients with different approaches:

Mary chose a variable annuity without income guarantees, making withdrawals of 6% annually. After a market downturn and continued withdrawals, her account was significantly depleted within eight years.

John selected an immediate annuity with lifetime payments. Despite living 5 years longer than expected, his payments continued uninterrupted until his passing at age 92.

The difference? Mary’s annuity could (and did) run out of money, while John’s was structured to provide lifetime income.

What About Insurer Solvency?

One concern that often goes overlooked: annuity guarantees are only as solid as the financial health of the insurance company backing them. If the insurer goes bankrupt, your guaranteed payments could be at risk.

However, there are protections in place:

- State guaranty associations provide some protection (typically $100,000 to $250,000, depending on your state)

- Insurance companies are heavily regulated and maintain reserves

- Major insurers often have strong financial ratings from agencies like A.M. Best or Moody’s

To minimize this risk, we recommend choosing insurers with top financial strength ratings and potentially splitting larger annuity purchases among multiple insurance companies.

How We Can Help Ensure Your Annuity Lasts

At our company, we take a comprehensive approach to help ensure your annuity meets your lifetime needs:

-

Thorough Assessment: We start with a detailed analysis of your retirement goals, income needs, and risk tolerance.

-

Strategic Product Selection: We recommend annuity products with the right features and guarantees for your specific situation.

-

Proper Allocation: We help determine how much of your retirement savings should be allocated to annuities versus other investments.

-

Withdrawal Planning: We develop a sustainable withdrawal strategy to minimize the risk of depleting your funds prematurely.

-

Ongoing Reviews: We conduct periodic reviews to ensure your annuity continues to meet your needs as circumstances change.

Common Questions About Annuities Running Out of Money

Can I outlive my annuity payments?

With a lifetime annuity or appropriate income rider, no. These products are specifically designed to provide income no matter how long you live. However, with fixed-term annuities or improperly managed variable annuities, you absolutely can outlive the payments.

What happens if I need more money than my scheduled annuity payments?

Many annuities offer some flexibility for withdrawals, but taking more than planned can accelerate depletion. Some contracts allow for hardship withdrawals or have provisions for long-term care needs. We recommend maintaining a separate emergency fund for unexpected expenses.

Are there fees for guaranteeing lifetime income?

Yes, lifetime income riders typically come with annual fees ranging from 0.5% to 1.5% of your account value. While this reduces your overall return, many clients consider it a worthwhile “insurance premium” against longevity risk.

The Bottom Line: Plan Carefully to Prevent Depletion

So, do annuities ever run out of money? The truthful answer is: it depends on the type of annuity you choose and how you manage it.

With proper planning and the right features, your annuity can provide income you can’t outlive. Without those protections, an annuity could indeed run dry, potentially leaving you without a crucial income source when you need it most.

The key takeaways:

- Choose lifetime income options if you want guaranteed income for life

- Be cautious with withdrawal rates, especially from variable annuities

- Consider adding income riders for additional protection

- Work with a knowledgeable advisor who understands these complex products

- Diversify your retirement income sources

Remember, the goal isn’t just to have an annuity – it’s to have the right annuity with the right features to support your unique retirement needs.

We’ve been helping clients navigate these decisions for over 16 years. If you’re concerned about outliving your money or wondering if an annuity is right for you, schedule a free consultation with us today. We’ll help you understand your options and develop a plan that provides the income security you deserve in retirement.

Don’t leave your financial future to chance – with proper planning, your annuity can provide the reliable income stream you need for life.

How tax-deferred annuities can help savers

Deferred annuities can help you grow retirement savings, once you’ve maxed out contributions for the year to qualified plans such as 401(k)s and IRAs, and they aren’t subject to annual IRS contribution limits. 1. Like retirement plans, the growth of your investments is tax-deferred, so you won’t have to pay taxes on them every year. The best use of tax-deferred annuity assets is that they may be converted to an income annuity upon retirement, potentially resulting in lower taxes on the long-term gains.

It’s also possible to take money out of your tax-deferred annuity without turning it into an income annuity. However, the gains would be taxed at regular income tax rates.

Tax-deferred fixed annuities have a fixed rate of return that is guaranteed for a set period of time by the issuing insurance company. In contrast, with tax-deferred variable annuities, the rate of return—and therefore the value of your investment—will go up or down depending on the underlying stock, bond, and money market investment options that you select, allowing you to benefit from any market growth.

Tax-deferred annuities can also help you use a strategy known as the anchor strategy. This strategy uses investments that offer a fixed return over a set period of time, such as CDs or tax-deferred fixed annuities, to protect a portion of your principal. Your remaining assets are then invested in growth-oriented securities such as stock mutual funds or exchange-traded funds (ETFs). The goal is to keep the principal safe in the more conservative part of your portfolio while still letting it grow. This can help investors who are worried about losing money when the market is volatile.

Annuities for people living in retirement

When you’ve reached retirement you may want the security of having a guaranteed source of income that can help cover your essential expenses, just as a paycheck did while you were working, and income annuities can offer a pension-like stream of income for life.5 Income annuities may even increase an investors confidence to enjoy retirement more fully, because they offer dependable income that will last for a lifetime. Retirees will be more confident and comfortable spending money knowing they will always have dependable income in the future.

For example, an immediate fixed income annuity, also known as a single premium immediate annuity (SPIA), can provide immediate income in exchange for a lump-sum investment. It can offer a pension-like cash flow, and the guaranteed income isn’t subject to market volatility. Immediate fixed income annuities even have optional features and benefits such as a cost-of-living adjustment (COLA) to help keep pace with inflation and beneficiary protection such as a cash refund.

A cash refund guarantees that upon the passing of the last surviving annuitant, the beneficiaries will be refunded any difference between your original principal and the payments received—eliminating the fear that the insurance companies will keep your money.

Immediate fixed income annuities may give investors the ability to share in the longevity benefits of the mortality pool. That means assets from other annuitants are pooled together by the insurance company, and those who live longer receive payments from those with shorter life spans. In other words, you won’t be in danger of running out of money. Instead, the longer you live, the more money you could receive.

This hypothetical example assumes an investment by a 65-year-old male in a single-life immediate fixed income annuity with a 10-year guarantee period. Taxes are not reflected in this example. This hypothetical example is for illustrative purposes only. It is not intended to predict or project income payments. Your actual income payments may be higher or lower than those shown here.

A joint and survivor immediate fixed income annuity may offer a simple, low-maintenance way to sustain a portion of retirement income for a surviving spouse or planning partner—which could be an important benefit in circumstances when the remaining spouse is not comfortable making investment decisions or doesn’t have the capacity to do so.

Good to know: If you purchase an immediate fixed income annuity, you may have limited or no access to the annuity principal.

Find out more about fixed income lifetime annuities in Viewpoints: Create income that can last a lifetime.

Finally, you can consider a guaranteed lifetime withdrawal benefit annuity (GLWB). This is an additional feature, called a rider, on either a tax-deferred fixed or variable annuity (based on the underlying investment within the annuity). An annuity with a GLWB provides guaranteed income for life even if the underlying investment account value (meaning the annuity’s) has been depleted.

The variable GLWB annuity allows you to remain invested in the market, but it guarantees income, and that income can increase based on markets, but it will not decrease.6 The longer you defer your income, the larger your payout could be. In addition, you have access to your account value should your circumstances change (surrender charges may apply and the guaranteed income amount will be reduced).

A GLWB annuity can give you more flexibility when you start taking income, including access to the account if your situation changes. That’s a bit different from a single premium income annuity, where you give up control of your money in exchange for a regular, steady lifetime payout.