Are you wondering if you can move some of your 401(k) to an IRA without touching the rest? Maybe you’re still working but want to invest some of your retirement savings in a different way. Or maybe you’ve already quit your job but aren’t sure if you want to move everything at once.

Well, I’ve got good news for you. In many cases, you can transfer part of your 401(k) to an IRA – but there are important rules, limitations, and considerations you should understand before making this financial move.

Partial 401(k) Rollovers: The Basics

Before diving into the specifics, let’s clarify what we’re talking about. A partial 401(k) rollover means transferring some, but not all, of your 401(k) retirement funds to an Individual Retirement Account (IRA).

This is not the same as a complete rollover, in which you move your entire 401(k) balance to a new account, usually when you quit your job or your company ends your retirement plan.

Can You Do a Partial Rollover While Still Employed?

The short answer is yes – but with limitations.

According to Ameriprise Financial, “numerous 401(k) plans allow employees to transfer funds to an IRA while they are still with their employer.” However, not every plan permits this type of in-service withdrawal or rollover.

Want to do a partial rollover while still working for the same company? Here’s what you need to know:

-

Plan-specific rules apply: Some 401(k) plans allow for “in-service” withdrawals, typically at age 59½. If you’re under age 59½, or if your plan doesn’t have that withdrawal provision, options are limited.

-

Formerly rolled over funds: If you moved money from an old 401(k) to your current plan, you might be able to move just that amount to an IRA, but not the rest.

-

After-tax contributions: Some plans allow you to roll over after-tax contributions (not Roth contributions) to an IRA while still employed.

-

Temporary contribution bans: Ameriprise warns that “some plan sponsors impose a temporary ban on further 401(k) contributions for employees who withdraw funds before leaving the company.” You’ll want to check if this applies to your plan before proceeding.

Can You Do a Partial Rollover After Leaving Your Job?

This scenario is more straightforward. When you leave a job, you typically gain more control over your 401(k) funds.

According to The Motley Fool, “When you leave your job for any reason, you have the option to roll over a 401(k) to an IRA.”

But what about partial rollovers specifically? The Motley Fool notes: “Plans have different rules and requirements for 401(k) assets. Some 401(k) plans offer equal flexibility to both current and former employees while others place restrictions on withdrawal types and frequency. For example, some plans may allow partial withdrawals while others may require that you either leave all the funds in the plan or perform a full rollover or cash payout.”

So yes, partial rollovers after leaving a job are often possible, but it depends on your specific plan’s rules.

Why Would You Want to Do a Partial Rollover?

There are several good reasons you might consider moving just a portion of your 401(k) to an IRA:

1. Diversification of Investment Options

As Ameriprise points out, “Investment options in your 401(k) can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments.”

Fidelity echoes this benefit, noting that with an IRA, “You can generally choose from a wider range of investments than you can in an employer’s retirement plan.”

2. Downside Protection

Ameriprise notes that “With some 401(k) plans, you may not have investment choices that allow you to lock in the gains that you have made over the years.” This becomes increasingly important as you approach retirement age.

3. More Control Over Your Money

With an IRA, you’re the owner and have greater access rights. As Ameriprise explains, “The assets in your IRA are also not subject to blackout periods. With a 401(k) plan, the qualified plan trustee owns the plan, and assets may be subject to blackout periods in which participant transactions, like withdrawals or investment changes, could be limited.”

4. Flexible Distribution Options

Fidelity highlights that IRAs offer penalty-free withdrawals for certain life events like a first-time home purchase, birth, or college expenses. Ameriprise adds that “With an IRA, you have the flexibility to take distributions when you would like and can choose the amount of withholding. 401(k) plan distributions are limited by the plan rules and are subject to mandatory 20% withholding.”

Reasons to Keep Money in Your 401(k)

While rolling over to an IRA has benefits, there are good reasons to keep at least some money in your 401(k):

1. Loan Availability

Ameriprise points out that “Your 401(k) may permit you to take out a loan from the account, but this is typically only for active employees.” You cannot take loans from IRAs.

2. Early Retirement Benefits

According to Ameriprise, “Most 401(k)s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59½ to avoid paying a 10% penalty.”

3. Potential Fee Advantages

Ameriprise warns, “IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401(k) investments.”

4. Special Treatment for Company Stock

The Motley Fool advises, “If you stay in your old workplace plan, special tax treatment may be available for your company stock (Net Unrealized Appreciation).”

How to Do a Partial 401(k) to IRA Rollover: Step-by-Step

If you’ve decided a partial rollover makes sense for you, here’s how to do it:

1. Check Your Plan Rules

Contact your 401(k) administrator to confirm:

- If partial rollovers are allowed in your situation

- What the specific requirements and limitations are

- If there will be any penalties or restrictions on future contributions

2. Choose a Brokerage for Your IRA

The Motley Fool recommends considering these factors:

- Cost (look for $0 trading commissions and minimal fees)

- Available investments

- Customer service quality

- Platform usability

- Research tools

3. Open Your IRA (If You Don’t Already Have One)

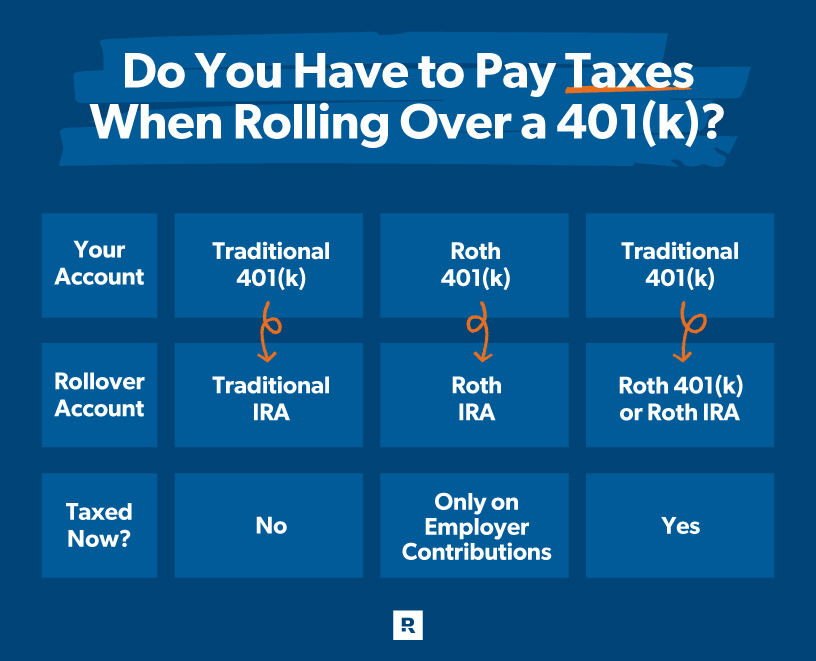

Choose between a Traditional IRA or Roth IRA. Remember, if you roll pre-tax 401(k) funds into a Roth IRA, you’ll owe taxes on the conversion.

4. Request the Partial Rollover

Complete the required paperwork with your 401(k) administrator. Be very specific about the amount you want to roll over.

5. Choose Your Transfer Method

Fidelity explains you’ll have two options:

- Direct rollover (preferred): Have your old provider send the money directly to your new IRA provider

- Indirect rollover: Receive a check made payable to you, then deposit it yourself within 60 days

As Fidelity warns, “If a rollover check is made payable directly to you, you must deposit the money into your IRA within 60 days of receiving the check to avoid income taxes and a possible early withdrawal penalty.”

6. Invest Your Newly Transferred Funds

Once the money arrives in your IRA, be sure to actually invest it according to your strategy. Otherwise, it might sit in a money market fund earning minimal returns.

Special Considerations for Partial Rollovers

Tax Implications

Generally, there are no tax implications for direct rollovers from a traditional 401(k) to a traditional IRA. However, if you convert to a Roth IRA, you’ll owe taxes on the converted amount.

Mixed Pre-Tax and After-Tax Contributions

If your 401(k) has both pre-tax and after-tax money, The Motley Fool advises: “For after-tax assets, your options are a little more varied. You can roll the funds into a Roth IRA tax-free. You also have the option of taking the funds in cash or rolling them into an IRA along with your pre-tax savings.”

Tracking Basis in Mixed Rollovers

The Motley Fool warns, “If you choose the latter option, it is important that you keep track of the after-tax amount so that when you start taking distributions, you’ll know which funds have already been taxed. IRS Form 8606 is designed to help you do just this.”

The Bottom Line: Is a Partial 401(k) to IRA Transfer Right for You?

Whether a partial rollover makes sense depends on your specific situation:

-

If you’re still employed: Check if your plan allows in-service distributions. Weigh the benefits of more investment options against potential downsides like temporary contribution bans.

-

If you’ve left your job: Confirm your plan allows partial withdrawals. Consider keeping some money in the 401(k) if you might need a loan or could benefit from the age 55 rule for early withdrawals.

-

If you’re approaching retirement: A partial rollover might give you more control over how you position part of your retirement savings, while maintaining benefits of the 401(k) for the rest.

Remember, retirement planning isn’t one-size-fits-all. We all have different goals, time horizons, and risk tolerances. Consider consulting with a financial advisor who can help you evaluate if a partial 401(k) to IRA rollover aligns with your specific retirement strategy.

Have you done a partial rollover before? What factors influenced your decision? I’d love to hear about your experiences in the comments!

What happens if I don’t make any election regarding my retirement plan distribution?

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If you’re no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you don’t elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

When should I roll over?

You have 60 days from the date you get money from an IRA or retirement plan to move it to another plan or IRA. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control.

You generally cannot make more than one rollover from the same IRA within a 1-year period. You also cannot make a rollover during this 1-year period from the IRA to which the distribution was rolled over.

Beginning after January 1, 2015, you can make only one rollover from an IRA to another (or the same) IRA in any 12-month period, regardless of the number of IRAs you own (Announcement 2014-15 and Announcement 2014-32). The limit will apply by aggregating all of an individual’s IRAs, including SEP and SIMPLE IRAs as well as traditional and Roth IRAs, effectively treating them as one IRA for purposes of the limit.

The one-per year limit does not apply to:

- rollovers from traditional IRAs to Roth IRAs (conversions)

- trustee-to-trustee transfers to another IRA

- IRA-to-plan rollovers

- plan-to-IRA rollovers

- plan-to-plan rollovers

401k Rollover to IRA process explained by a financial advisor

FAQ

Can I transfer part of a 401k to an IRA?

Can I roll over assets into my Traditional IRA? Yes, you can but it’s important to be aware that if you do roll pre-tax 401(k) funds into a traditional IRA, you may not be able to roll those funds back into an employer-sponsored retirement plan. Contact your tax advisor for more information.

What are the disadvantages of rolling over a 401k to an IRA?

Can I move my 401k to an IRA without penalty?

Yes, you can move your 401(k) to an IRA without immediate tax penalties by completing a direct rollover, where the money is transferred directly from your old 401(k) to a new IRA.

Can you rollover only part of your 401k?

Yes. You can use a rollover to move a portion of your funds from a 401(k) to another tax-qualified plan.

Can I transfer my 401(k) to an IRA?

Not every plan allows you to transfer your 401 (k) to an IRA while still employed. Diversification. Investment options in your 401 (k) can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments.

Can I roll over a 401(k) plan to an IRA?

One option is to roll over a 401 (k) plan to an individual retirement account (IRA). An IRA rollover is a way to move your old 401 (k) retirement funds to another account, but there are tax implications to be aware of.

Can I transfer money from a 401k to a vanguard IRA?

Yes. This is how you can move any IRA money you have saved that isn’t in an employer-sponsored plan into a Vanguard IRA: Can I move money from my retirement plan into a Roth IRA? Yes, if you have a Roth 401(k) or 403(b), you can deposit your money tax-free into a Roth IRA.

How do I roll a 401(k) to an IRA?

Let’s walk through each way to roll a 401 (k) to IRA: You must instruct the plan administrator to pay the rollover distribution directly to the trustee of the IRA. , With this option, you’re less likely to face an early withdrawal penalty. You instruct the plan administrator to pay the distribution to you directly and not the final account.

Can a 401(k) be converted to a Roth IRA?

With an IRA, your assets are generally protected from creditors in bankruptcy proceedings, up to a certain limit. However, state law may provide additional protection for IRAs3 If you roll over money from a traditional 401 (k) to a Roth IRA you will be required to pay taxes on the converted amount.

Should I move my 401(k) if I leave my employer?

Leaving an employer isn’t the only time you can move your 401 (k) savings. Sometimes it makes sense to roll over your 401 (k) assets while you continue to work and make further contributions to your company plan. These rollovers may help you more effectively manage your retirement savings and diversify your investments.