Cashing out a 401(k) early can be tempting, but it can come at a cost. If you cash out your 401(k) too soon, you will be charged fees unless you meet one of the early withdrawal exemptions. Find out more about how taking money out of a 401(k) early affects your taxes and decide if it’s the right choice for you before you do it.

It permanently extends tax cuts from the Tax Cuts and Jobs Act and raises the limit on how much state and local sales tax and property tax (SALT) you can deduct. It also cuts energy credits passed under the Inflation Reduction Act and changes taxes on tips and overtime for some workers. It also changes Medicaid, raises the debt ceiling, and change the rules for Pell Grants and student loans. Updates to this article are in process. Check our One Big Beautiful Bill article for more information.

Quick Answer Yes in certain circumstances you can go to jail related to 401(k) withdrawals – but it’s not for the reason most people think. While taking an early withdrawal itself won’t land you in prison, fraudulent activities surrounding your withdrawal might.

Have you been looking at your 401(k) balance lately and wondering if you could take money out early? Maybe you’re having a hard time with money and are thinking about a hardship withdrawal. “Can I go to jail for taking money out of my 401(k)?” you may have asked yourself.

This is a question we get all the time at our financial advisory firm, and honestly, it’s a complicated topic with some serious misconceptions floating around Let’s clear things up so you can make informed decisions about your retirement savings

The Truth About 401(k) Withdrawals and Legal Consequences

First things first: taking a legitimate early withdrawal from your 401(k) will NOT send you to jail. However, that doesn’t mean there aren’t potential legal consequences in certain situations.

According to reliable sources, the truth is more nuanced

- Legitimate withdrawals: No jail time, but financial penalties apply

- Fraudulent activities: Yes, potential jail time

Let me break this down further.

When 401(k) Withdrawals Can Lead to Jail Time

While simply taking money out early won’t land you behind bars, there are scenarios where 401(k)-related actions could result in criminal charges:

1. Lying About Hardship Status

If you falsely claim a hardship to qualify for a withdrawal when no real hardship exists, you’re committing fraud. The consequences of false hardship withdrawal can range from fines and penalties to tax implications or even jail time.

One article specifically states: “If you’re caught lying about eligibility for a hardship withdrawal, you may face additional fees, fines, and even imprisonment.”

2. Tax Evasion

A real-world example comes from a case mentioned in one of the sources where prosecutors actually sought jail time for someone related to 401(k) withdrawals. While the judge ultimately allowed the individual to avoid prison, the attempt to prosecute demonstrates that serious legal consequences are possible.

3. Intentional Misrepresentation

The IRS takes intentional misrepresentation very seriously. If you deliberately misrepresent your financial situation to qualify for a hardship withdrawal, you could face criminal charges beyond just the standard penalties and taxes.

The Real Penalties You’ll Face for Early 401(k) Withdrawals

Most people who take money out of their 401(k) too early will face legal and financial consequences. When people take money out before age 59½, these things usually happen:

1. Taxes

The IRS considers hardship withdrawals taxable income. This means you’ll have to pay income tax on the money you take out at your current tax rate, which may be a lot higher than the rate you’ll pay when you retire.

2. Early Withdrawal Penalty

If you’re under 59½, you’ll typically face a 10% early withdrawal penalty on top of the income tax. For example, if you withdraw $10,000, you’ll immediately lose $1,000 to penalties, plus whatever you owe in taxes.

As one article explains: “From your initial $10,000 take-home amount, your immediate take-home could be $7,000 after taxes and penalties.”

3. Lost Growth Potential

Maybe the biggest fine isn’t from the IRS at all; it’s what you could have done instead. There’s no way to get back the money you took out because of hardship once you’ve done it. This means you won’t get the tax breaks that come with your contributions and won’t be able to see the growth of your investment.

Legitimate Reasons for Penalty-Free 401(k) Withdrawals

The IRS does allow certain hardship withdrawals without the 10% penalty (though you’ll still owe income tax). These include:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses related to military service

Starting in 2024, there’s also a new provision: “you can withdraw $1,000 from your 401(k) per year for emergency expenses” without facing the early withdrawal penalty, though you’ll still owe income tax.

Will Your Employer Know About Your Hardship Withdrawal?

Another common question we receive is whether employers know when employees take hardship withdrawals. The answer is yes – if you make a 401(k) withdrawal, your employer will know.

This is because:

- Your employer’s plan administrator processes the request

- They may require documentation to verify your hardship

- The withdrawal affects your account, which employers can access

Do You Need Proof for a Hardship Withdrawal?

While the IRS doesn’t necessarily require you to provide proof to your employer, your specific 401(k) plan might. According to one source: “You may need to supply supporting documentation of your hardship, including legal documents, invoices, and bills.”

Even if your plan doesn’t require documentation upfront, you should keep records. Why? Because “although the IRS does not approve hardship withdrawals from 401(k)s, you may still be audited.”

Better Alternatives to Consider Before Taking a Hardship Withdrawal

Before you tap into your retirement savings, consider these alternatives:

1. Negotiate with Creditors

Try working out a payment plan with your creditors to avoid the need for a withdrawal.

2. Borrow from Your 401(k) Instead

If your plan allows it, you can borrow up to 50% of your vested balance or $50,000, whichever is less. Unlike a withdrawal, you’ll repay this with interest to your own account.

3. Sell Non-Retirement Assets

Consider selling stocks, bonds, or other non-retirement assets first.

4. Seek Financial Assistance

Explore government assistance programs, loans from family or friends, or even crowdfunding platforms.

The Bottom Line: Think Twice Before Withdrawing

While you won’t go to jail simply for taking an early withdrawal from your 401(k), the combination of taxes, penalties, and lost growth can devastate your retirement plans. And if you’re dishonest in the process, then yes – legal consequences including jail time become a real possibility.

As financial advisors, we always recommend exploring all other options before tapping into your retirement savings. Your future self will thank you!

FAQs About 401(k) Withdrawals and Legal Consequences

Can I withdraw money from my 401(k) with no penalty?

You can only withdraw funds from your 401(k) with no penalty if you’re at least 59½ years old or if you qualify for specific exceptions like certain medical expenses, disability, or first-time home purchases.

What happens if I lie about a hardship withdrawal?

Lying to get a 401(k) hardship withdrawal can have serious consequences, including legal repercussions for fraud, financial penalties, tax implications, and potentially imprisonment.

Do I have to pay back a hardship withdrawal?

No, you’re not required to pay back withdrawals of 401(k) assets taken as hardship distributions. However, unlike loans, these withdrawals permanently reduce your retirement savings.

Will I get audited for a hardship withdrawal?

While not guaranteed, hardship withdrawals can trigger IRS audits. Ensure you have documentation to prove your hardship in case of an audit.

What triggers a 401(k) audit?

If your business has 100 or more eligible participants at the beginning of the plan year, you must undergo a 401(k) audit through a third party. Individual withdrawals may also be subject to scrutiny during IRS audits.

Remember, your retirement savings are meant to support you in your golden years. We’ve seen too many clients regret early withdrawals when they reach retirement age. If you’re considering tapping into your 401(k) early, please consult with a financial advisor first to explore all your options!

Have you ever considered taking an early withdrawal from your retirement account? What alternatives did you find? Share your experiences in the comments below!

A 401(k) loan or an early withdrawal?

Retirement accounts, such as 401(k) plans, help people save for retirement. The tax code rewards saving. It does this by offering tax benefits for contributions. It usually penalizes those who withdraw money before age 59½.

Getting a loan or taking money out of your 401(k) early can often get you the money you need quickly. But, be mindful of the tax implications.

Tapping your 401(k) early

If you need money but want to avoid high-interest credit cards or loans, you can make an early withdrawal from your 401(k). But, this option often has tax consequences.

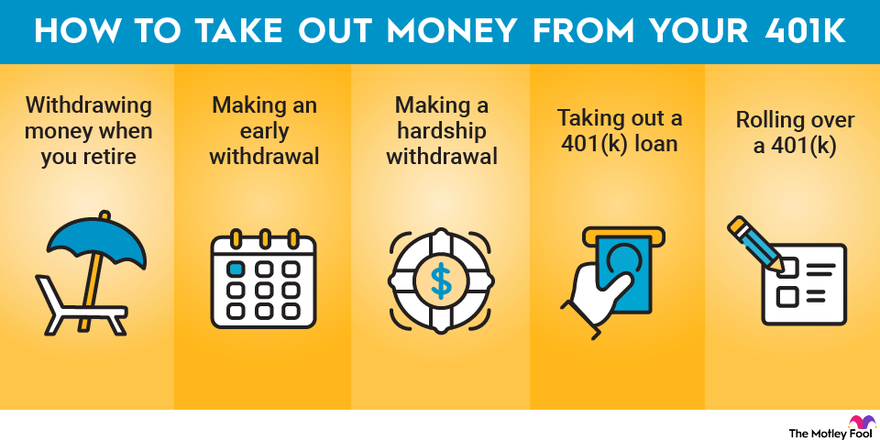

If you understand the impact of an early withdrawal on your finances, you might want to continue. If so, there are two ways to go about it—cashing out or taking a loan. But how do you know which is right for you? And what are the tax consequences you should be expecting?.