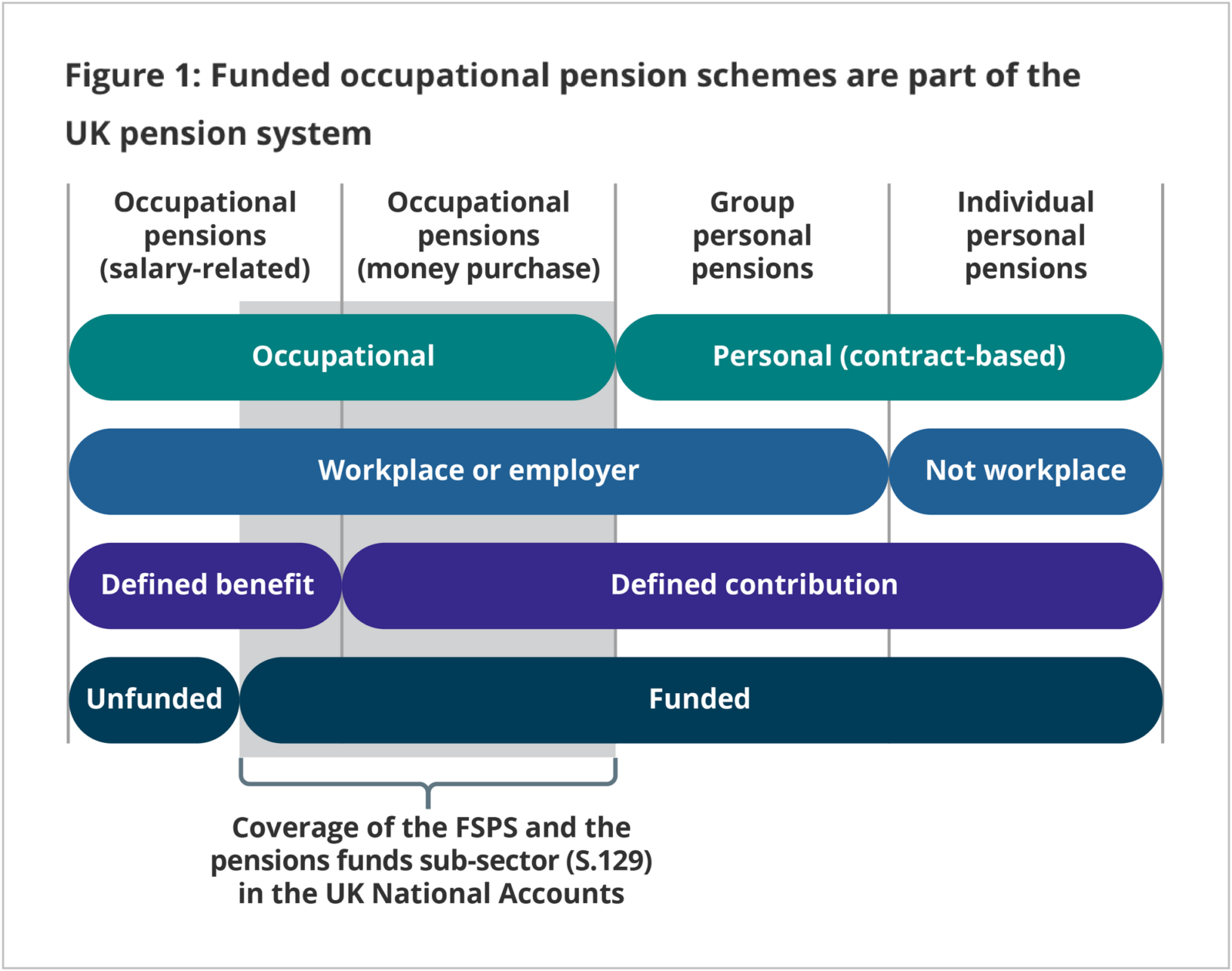

Many companies offer the benefits of a pension scheme to their employees. They take a variety of forms but the main types are:

Under these schemes, contributions are paid into a pension fund constituted and administered under irrevocable trust. The trustees invest or use the fund’s money in some other way that helps the fund (and, in the end, the beneficiaries). Members’ benefits are paid out of the fund as a whole and they have title neither to any separate part of the fund nor to any specific assets; that is to say, there is a common trust fund. Any superannuation fund which constitutes a common trust fund will fall within this category.

In these schemes, contributions are paid to a life office to provide pension, lump sum and/or death benefits. Each member’s benefits are secured by way of an insurance policy or policies (or possibly under a group policy which incorporates a number of individual policies) and such insurance is specifically earmarked for the individual member. Contributions may be paid either directly to the life office by the employer, or to one or more trustees who will make the necessary arrangements for the insurance (with the life office) and for the payment of benefits. Any retirement benefit scheme which does not operate through a common trust fund will fall within this category.

Under these schemes, employers promise to pay the employee a pension at a certain age but make no special provision to set aside funds for the purpose. There is no separate pension fund, and the worker is not protected if the company goes bankrupt or liquidates.

It can be hard to figure out pension plans and VAT registration when you’re not seeing what you’re doing. Many employers and trustees scratch their heads, wondering if their pension plan needs to be VAT registered or even if it can be. The short answer is yes, pension plans can be VAT registered. But this story isn’t just a yes or no question.

This detailed guide will go over the ins and outs of VAT registration for pension schemes. It will cover who is responsible for what, how different types of schemes are handled, and what you can do to make sure you’re following HMRC rules.

Understanding VAT and Pension Schemes

Value-Added Tax (VAT) is a tax put on goods and services that people buy. Before we get into the details, let’s make sure we understand what we’re talking about. The VAT rules for pension plans can be hard to understand because they depend on many things, such as

- The structure of the pension scheme

- The nature of activities undertaken

- Who’s providing services to the scheme

- How the scheme is managed and invested

Pension plans can sign up for VAT and choose to tax a property. This means they can get back any VAT they paid on buying commercial property. This can be particularly important for schemes with property investments.

Who Bears Responsibility for VAT in Pension Schemes?

Understanding who’s responsible for what when it comes to VAT is crucial. Let’s break it down:

Employers’ Responsibilities

Employers typically handle the management aspects of pension schemes and are responsible for VAT on:

- Setting up the pension scheme

- Day-to-day management (collecting contributions, paying pensions)

- Scheme reviews and implementing changes

- Accounting and auditing services

- Actuarial valuations

The good news for employers? They can usually reclaim the VAT incurred on these costs as input tax, reducing their overall VAT burden.

Trustees’ Responsibilities

Trustees, on the other hand, focus more on the investment side of things and are responsible for VAT on:

- Investment advice

- Brokerage charges

- Rent and service charge collection (for property investments)

- Property transactions (purchases, lettings, disposals)

- General trustee services

Unfortunately, unlike employers, trustees typically cannot reclaim the VAT incurred on these investment-related costs as input tax. This is a key distinction that can significantly impact the financial management of a pension scheme.

Types of Pension Schemes and Their VAT Treatment

Different types of pension schemes have different VAT implications. Let’s explore the main types:

Pooled Pension Schemes

These schemes operate under irrevocable trusts where

- Contributions go into a common trust fund

- Assets are invested by trustees for the benefit of the fund

- Members don’t have title to any specific assets

- Benefits are paid from the fund as a whole

For VAT purposes, pooled schemes are treated as a single entity, with the trustees collectively acting as the taxable person if they make taxable supplies.

Non-Pooled Pension Schemes

In these arrangements:

- Contributions are paid to a life office

- Each member’s benefits are secured by specific insurance policies

- Policies are earmarked for individual members

- Contributions may go directly to the life office or through trustees

The VAT treatment depends on whether the services are related to management (potentially recoverable) or investment (typically not recoverable).

Un-Funded Pension Schemes

These schemes work differently:

- Employers promise future pensions without setting aside specific funds

- No separate pension fund exists

- Employees aren’t protected against employer bankruptcy

These have different VAT implications and generally don’t involve the same level of recoverable VAT.

VAT Registration for Pension Fund Trustees

When trustees make taxable supplies using pension fund assets, they collectively become the taxable person for VAT purposes. Registration should be in the names of both the trustees and the pension fund – for example, “Joseph Bloggs and Frederick Bloggs as trustees for the United Workers Pension Scheme.”

It’s worth noting that trustees have a “dual personality” for VAT purposes:

- They may be registered individually for their own business activities

- They may be registered separately as trustees for the pension fund’s business activities

When One VAT Registration Covers Both Trustee and Non-Trustee Activities

There are some situations where a single VAT registration can cover both normal business activities and trustee activities:

- When the sponsoring employer is the sole trustee of its own employees’ pension fund

- When a corporate trustee is the sole trustee and is part of a VAT group

- When a trust company is created specifically to administer a single pension fund

However, HMRC can’t prevent a trader from treating their beneficial and fiduciary activities separately for VAT purposes if they choose to do so.

Group Registrations and Pension Schemes

If a pension scheme is part of a VAT group registration, the rules change somewhat. The group can reclaim VAT incurred on scheme management, but only to the extent that the costs relate to the group members.

This can create both opportunities and complexities, so it’s worth seeking professional advice if your pension scheme might qualify for group registration.

Practical Example: Property Investments

Let’s consider a real-world example to illustrate how VAT registration works in practice:

A pension scheme purchases a commercial property for £1,000,000 plus VAT of £200,000. If the scheme is VAT registered and opts to tax the property, it can reclaim the £200,000 VAT paid on purchase. The scheme then lets the property to a VAT-registered tenant, charging VAT on the rent, which creates an ongoing VAT recovery position.

Without VAT registration, the scheme would bear the full £200,000 VAT cost, potentially reducing returns for scheme members.

Challenges in Determining VAT Treatment

One of the biggest challenges is determining whether services relate to management (potentially VAT-recoverable) or investment (typically not VAT-recoverable).

HMRC provides guidance on this in Section 5 of VAT Notice 700/17, but the lines can be blurry. For instance, is advice on which fund manager to appoint a management service or an investment service? Such questions often require professional interpretation.

Special Circumstances: Insolvent Companies

When a company is being wound up, the VAT on costs incurred in winding up its occupational pension scheme is deductible under Section 94 of the VAT Act 1994. This is an important consideration for schemes associated with companies in financial difficulty.

Frequently Asked Questions

Who is responsible for VAT on pension scheme contributions?

Employers handle VAT on contributions and can typically reclaim the VAT as input tax.

Can pension schemes reclaim VAT on investment income?

No, pension schemes cannot reclaim VAT on investment income – this is a key limitation.

What’s the VAT treatment of property held by a pension scheme?

It depends on the property’s use. If used for business purposes, VAT on purchase and running costs might be reclaimable. For non-business use, VAT generally can’t be reclaimed.

How are third-party services to pension schemes treated for VAT?

The treatment depends on whether the services relate to management (potentially recoverable) or investment (typically not recoverable).

Practical Steps for Pension Schemes Considering VAT Registration

If your thinking about VAT registration for your pension scheme, consider these steps:

- Assess taxable activities: Determine if the scheme makes taxable supplies exceeding the VAT registration threshold

- Identify recoverable VAT: Analyze which costs might generate recoverable input VAT

- Consider property implications: If the scheme holds or plans to acquire property, evaluate the VAT implications

- Consult specialists: Given the complexity, seek advice from VAT specialists with pension scheme experience

- Document decisions: Maintain clear records of VAT treatment decisions to support future HMRC inquiries

Conclusion

Navigating VAT registration for pension schemes isn’t straightforward, but understanding the rules can lead to significant tax efficiencies, particularly for schemes with property investments or substantial management costs.

The key takeaways are:

- Pension schemes can register for VAT

- Employers and trustees have different VAT responsibilities

- VAT recovery depends largely on whether costs relate to management or investment

- Property investments present special VAT considerations

- Professional advice is valuable given the complexity

While we’ve covered the essentials here, the VAT landscape is constantly evolving. For the most current guidance, refer to HMRC’s VAT Notice 700/17 on Funded Pension Schemes or consult with a qualified tax advisor who can provide tailored advice for your specific circumstances.

Remember, proper VAT management isn’t just about compliance—it can significantly impact the financial health of your pension scheme and ultimately, the benefits available to scheme members.

Registration of pension fund trustees

Pension funds are not people, but when trustees use the fund’s assets to make taxable supplies, the trustees as a whole are the taxable person. Like any other trust, they should be registered in the names of the trustees and the pension fund. For example, ‘Joseph Bloggs and Frederick Bloggs as trustees for the United Workers Pension Scheme’ (see VATREG12900).

Separate registration of trustee and non-trustee activities will be the norm. However, there are some circumstances in which one registration will suffice to cover both:

- the normal business activities of the person, and

- their duties as trustees of the pension fund and the things they did in that role

These circumstances are:

- when the company that sponsors the pension plan is also the only trustee of the plan for the benefit of its own workers

- when a corporate trustee is the only trustee of a pension fund and is also a member of a VAT group

- in cases where a trust company is set up just to handle one pension fund

But we can’t stop a business owner from having his or her personal and business activities treated differently for VAT purposes.

Definition of pension fund trustees

Trustees may be appointed to administer the types of pooled and non-pooled schemes described above. The creation of a trust fund protects present and future beneficiaries by separating the assets of the fund from those of the sponsoring employer’s business. As with other types of trust, there may be one trustee or several and the trustees may be natural persons or corporate bodies. The sponsoring employers themselves may be a trustee of the fund.

As with other trusts, the trustees of a pension fund will have dual personality for VAT purposes. They may be registered individually in respect of their own business activities and then again as trustee in respect of business activities carried on by them on behalf of a pension fund.