A Roth IRA can be a great way to put money away for retirement, letting you save and invest dollars youve already paid taxes on, and potentially freeing you from worry about taxes in retirement when you withdraw the money.

But many Roth IRA account owners may not understand the 5-year aging requirement, also known as the 5-year rule, which can have a big impact on withdrawals from these accounts. Falling afoul of this rule can result in taxes or penalties—possibly both.

To review, if you put money into a traditional IRA, you may get a tax break depending on your income. But if you put money into a Roth IRA, you don’t get a tax break. While contributions are made with money that has already been taxed, earnings may grow tax-free and there are no required minimum distributions (RMDs) to be made. RMDs are withdrawals that you must make by age 73 or face penalties.

You can withdraw your contributions from a Roth IRA tax-free and penalty-free at any time. The same does not apply to account earnings, however, which must meet the 5-year rule.

Are you wondering if you can tap into your Roth IRA once you’ve had it for 5 years? This is one of the most common questions I hear from retirement savers, and honestly the answer isn’t as straightforward as we’d like. The infamous “5-year rule” for Roth IRAs creates a lot of confusion, but I’m here to break it down for you in simple terms.

The Quick Answer

Yes, you can withdraw money from your Roth IRA after 5 years, but there are important rules that determine whether you’ll face taxes or penalties

It’s important to remember that withdrawals from your Roth IRA are taxed differently after 5 years. This is true no matter what your age is or what kind of withdrawal you make (contributions vs. withdrawals). earnings) will determine if you’ll owe taxes or penalties.

Understanding the Roth IRA Basics

Before diving into the 5-year rule, let’s refresh what makes Roth IRAs special:

- After-tax contributions: Unlike traditional IRAs, Roth contributions are made with money you’ve already paid taxes on

- Potential tax-free growth: Your investments can grow without being taxed

- No required minimum distributions (RMDs): You’re not forced to take money out at any age

- Tax-free qualified withdrawals: When you follow the rules, you pay no taxes on withdrawals in retirement

The Roth IRA 5-Year Rule Explained

The 5-year rule means that at least 5 years must pass between the beginning of the tax year of your first contribution to a Roth account and when you withdraw earnings. This waiting period is known as the “5-year aging requirement.”

Here’s where it gets tricky – there are actually different 5-year rules for:

- Original Roth IRA contributions

- Converted funds from traditional IRAs to Roth IRAs

When Does the 5-Year Clock Start?

For contributions, the clock starts on January 1st of the tax year you made your first contribution. For example, if you contribute to a Roth IRA in April 2025 for the 2024 tax year, the 5-year period actually begins on January 1, 2024.

This means you could meet the 5-year rule in just under 4 calendar years in some cases!

Withdrawal Rules: Contributions vs. Earnings

The most important thing to understand is that withdrawal rules differ for your contributions versus your earnings:

Contributions

Good news: You can withdraw your original contributions from a Roth IRA at any time, tax-free and penalty-free. This applies regardless of your age or how long you’ve had the account.

Over the years, you may put $30,000 into your Roth IRA. You may take out up to that amount whenever you want without any problems.

Earnings

This is where it gets complicated: Withdrawals of earnings are subject to both the 5-year rule and age requirements.

Withdrawal Rules Based on Age and Account Age

Let me break this down by age group and how long you’ve had your Roth IRA:

If You’re Under Age 59½

Roth IRA less than 5 years old:

- Contributions: Can be withdrawn tax-free and penalty-free

- Earnings: Subject to both income taxes AND a 10% early withdrawal penalty

Roth IRA more than 5 years old:

- Contributions: Can be withdrawn tax-free and penalty-free

- Earnings: Still subject to income taxes AND a 10% early withdrawal penalty UNLESS you qualify for an exception

If You’re Age 59½ or Older

Roth IRA less than 5 years old:

- Contributions: Can be withdrawn tax-free and penalty-free

- Earnings: Subject to income taxes but NO penalty

Roth IRA more than 5 years old:

- Contributions: Can be withdrawn tax-free and penalty-free

- Earnings: Can be withdrawn COMPLETELY tax-free and penalty-free (this is the ideal scenario!)

Exceptions to the Rules

Life happens, and you may need to use your retirement funds before you planned. Additionally, there are a few situations in which the 2010 early withdrawal penalty (but not necessarily income taxes) on earnings may not apply to you:

Common Exceptions to the 10% Penalty:

- First-time home purchase (up to $10,000 lifetime maximum)

- Qualified education expenses

- Birth or adoption expenses

- Unreimbursed medical expenses or health insurance if unemployed

- Disability or death

- Distributions made in substantially equal periodic payments

- Survivors of domestic abuse

- Federally qualified disaster distributions

- IRS levy

Roth Conversions and the 5-Year Rule

If you’ve converted funds from a traditional IRA to a Roth IRA, there’s a separate 5-year rule to be aware of. Each conversion has its own 5-year waiting period before you can withdraw the converted amount penalty-free if you’re under 59½.

There is one important difference: the five-year waiting period for conversions only applies to avoid the 2010 penalty if you are under the age of 55. When you reach 59½, you can take out any converted amounts at any time without any fees.

The Ordering Rules for Roth IRA Withdrawals

When you take money out of your Roth IRA, the IRS considers it withdrawn in this specific order:

- Regular contributions (always tax-free and penalty-free)

- Converted amounts (following conversion rules)

- Earnings (subject to the rules we’ve discussed)

This ordering rule is actually pretty beneficial because it allows you to access your contributions first before touching earnings that might trigger taxes or penalties.

Real-Life Examples

Let’s look at some examples to make this clearer:

Example 1: Sarah (Age 40)

Sarah opened her first Roth IRA 3 years ago. She’s contributed $18,000 total, and her account has grown to $22,000.

- She can withdraw up to $18,000 (her contributions) tax-free and penalty-free.

- If she withdraws any of the $4,000 in earnings, she’ll pay income tax PLUS a 10% penalty because she’s under 59½ and hasn’t met the 5-year rule.

Example 2: Michael (Age 62)

Michael opened his Roth IRA 4 years ago. He’s contributed $30,000, and his account has grown to $40,000.

- He can withdraw his $30,000 in contributions tax-free and penalty-free.

- If he withdraws from the $10,000 in earnings, he’ll pay income tax but NO penalty because he’s over 59½ (but hasn’t met the 5-year rule yet).

Example 3: Jennifer (Age 65)

Jennifer opened her Roth IRA 10 years ago. She’s contributed $45,000, and her account has grown to $75,000.

- She can withdraw ALL $75,000 completely tax-free and penalty-free because she’s over 59½ AND has met the 5-year rule.

Important Considerations

Before making any Roth IRA withdrawals, keep these things in mind:

-

Think long-term: Just because you CAN withdraw from your Roth IRA doesn’t mean you SHOULD. The power of tax-free compound growth is significant!

-

Keep records: Maintain good records of all your contributions so you know exactly how much you can withdraw tax-free.

-

Consider alternatives: If you need cash, explore other options before tapping retirement accounts.

-

No RMDs: Unlike traditional IRAs, Roth IRAs have no required minimum distributions, so you can leave your money to grow tax-free for as long as you want.

Contribution Limits to Be Aware Of

While not directly related to withdrawals, it’s worth noting the current contribution limits:

For 2024:

- $7,000 per year ($8,000 if you’re 50 or older)

- Income limits start phasing out eligibility at $146,000 for single filers and $240,000 for married filing jointly

For 2025:

- $7,000 per year ($8,000 if you’re 50 or older)

- Income limits start phasing out eligibility at $150,000 for single filers and $246,000 for married filing jointly

Bottom Line: When Can I Withdraw From My Roth IRA After 5 Years?

Let me make this super clear:

-

You can withdraw your contributions at ANY time, regardless of how long you’ve had the account.

-

To withdraw earnings completely tax-free and penalty-free, you need to meet BOTH:

- Have had a Roth IRA for at least 5 years

- Be at least 59½ years old

-

If you’re under 59½ or haven’t met the 5-year rule, you might still qualify for exceptions to avoid penalties.

Final Thoughts

Roth IRAs offer incredible flexibility and tax advantages compared to other retirement accounts. While the 5-year rule adds some complexity, understanding how it works can help you make the most of this powerful retirement tool.

Remember that just cause you can take money out doesn’t mean ya should! The greatest benefit of a Roth IRA is the potential for decades of tax-free growth. Every dollar you withdraw early is a dollar that won’t be compounding for your future.

If you’re still confused about your specific situation (and honestly, who wouldn’t be with these complex rules?), it’s always a good idea to consult with a tax professional or financial advisor before making withdrawals from your Roth IRA.

What about inherited Roth IRAs and the 5-year rule?

As was already said, the 5-year rule also applies to Roth IRAs that were passed down, and the rules for them can be tricky. Although the new owner must be at least 59½ years old, it must have been 5 years since the start of the tax year when the original account owner made the first contribution. If you take money out of an account that you earned after 5 years, you might have to pay income tax on it. But if you take money out because someone died, or because you inherited the account, you will never have to pay taxes on it.

What is the 5-year aging rule?

The 5-year rule for Roth IRAs means that at least 5 years must elapse between the beginning of the tax year of your first contribution to a Roth account and withdrawal of earnings. If fewer than 5 years have passed before you make a withdrawal of earnings, the withdrawal is considered a nonqualified distribution and may be subject to either taxes or penalties (or both).

Once the 5-year rule has been met and the account owner is age 59½ or older, among other exceptions, they may make whats known as a qualified distribution of earnings exempt from both taxes and penalties.1

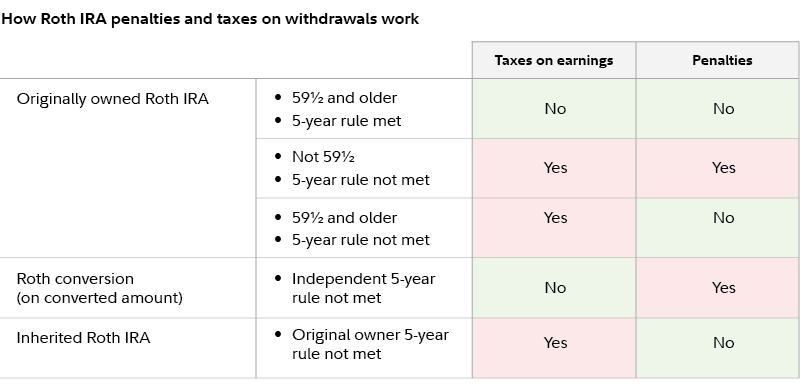

Note: The 5-year aging requirement applies to all Roth IRAs. In addition to withdrawals from originally owned Roth IRAs, it covers inherited Roth IRAs based on when the original owner made the first contribution. Even if the 5-year aging requirement is not met and you owe income taxes, you may not owe penalties due to a variety of exceptions—death, disability and turning age 59½ among them. A separate 5-year aging rule covers converted balances from traditional IRAs to Roth IRAs.

You can also contribute to a Roth IRA for a given tax year up until its filing deadline. Since the 5-year rule starts the clock on January 1 of the tax year of your first contribution, this may, in practice, help you meet the aging requirement sooner. For example, if you contribute to a Roth IRA in April 2025 for the 2024 tax year, you may meet the 5-year rule in a bit under 4 years.

Roth IRA Withdrawal Rules

FAQ

What happens if I withdraw from Roth IRA after 5 years?

Meeting the five-year rule makes it easier for you to make tax-free and penalty-free withdrawals from your Roth IRA. The five-year rule test is important because if you fail it, you could be responsible for taxes and a 2010 penalty on earnings taken out of your account. Internal Revenue Service.

How long do you have to hold a Roth IRA before you can withdraw it?

To take money out of a Roth IRA without being taxed, you must be at least 59½ years old and the account must have been open for at least five years.

How much do I lose if I cash out my Roth IRA?

Most of the time, taking money out of an individual retirement account (IRA) before age 59½ is taxed as gross income and comes with an extra 10% penalty. There are exceptions to the 10 percent penalty, such as using IRA funds to pay your medical insurance premium after a job loss.

Can I pull money out of my Roth IRA without being penalized?

You can withdraw contributions at any time without tax or penalty, even if you are under age 59.5 and you’ve not had a Roth IRA for 5 years. And contributions come out first in Roth IRA withdrawals, so if the amount you’re withdrawing is less than the sum of all contributions, you don’t need to worry about any of this.

Can I withdraw money from my Roth IRA after 5 years?

However, account earnings are exempt from this and are subject to the 5-year rule. Yes, you can withdraw money from your Roth IRA after 5 years, but there are some important rules to keep in mind. The Roth IRA 5-year rule states that you can withdraw your contributions from a Roth IRA at any time without penalty.

How long do you have to make Roth IRA withdrawals?

Basically, any Roth IRA withdrawals must be made at least five years following the initial contribution to the account. While Roth IRA contributions may be withdrawn tax- and penalty-free, the same isn’t true for earnings. Satisfying the five-year rule helps you avoid a 10% penalty when making Roth IRA withdrawals.

What is the 5 year rule for Roth IRA withdrawals?

Misunderstanding the rules could cost you unnecessary taxes or penalties. The 5-year rule is central to Roth IRA withdrawals. It requires that at least five tax years pass before earnings can be withdrawn tax-free. Importantly, this clock starts with your first Roth contribution, not each individual deposit.

Can you withdraw money from a Roth IRA early?

Special exceptions allow early withdrawals without penalties in certain cases. Roth IRAs are unique because you pay taxes upfront on contributions, allowing tax-free growth and potentially tax-free withdrawals later. But the rules around when you can withdraw money depend on whether it is contributions, earnings, or converted funds.

Can I withdraw money from a Roth IRA without penalty?

You can withdraw your contributions from a Roth IRA at any time without penalty. You can withdraw earnings from a Roth IRA without penalty if you meet the 5-year rule and are 59½ or older. You may have to pay taxes and penalties if you withdraw earnings from a Roth IRA before you meet the 5-year rule.

What happens if you withdraw money from a Roth IRA?

You use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase. You become disabled or pass away. Withdrawals from a Roth IRA you’ve had less than five years. If you haven’t met the five-year holding requirement, your earnings will be subject to taxes but not penalties.