Are you considering moving your Local Government Pension Scheme (LGPS) benefits to a private pension plan? This decision isn’t straightforward and deserves careful consideration. I’ve compiled everything you need to know about transferring your LGPS pension to help you make an informed choice.

Understanding Your LGPS Transfer Options

The LGPS is a defined benefit pension scheme that provides secure retirement benefits. If you’re thinking about transferring out, here’s what you should know first:

Key Requirements for Transferring Out

- You cannot transfer out while actively contributing to the LGPS – you must leave the scheme first

- You must request a transfer at least one year before your state pension age or normal pension age (whichever comes first)

- Your transfer request will be processed within three months of receipt

- The pension fund will assume you want to transfer to a defined contribution scheme unless you specify otherwise

It’s important to note that if you already have an LGPS pension in payment you cannot transfer any deferred benefits out of the scheme. Also if you have multiple sets of deferred benefits in the LGPS in England and Wales, you must transfer all of them or none at all.

The Transfer Process Explained

If you want to move your money from the LGPS to a private pension, you must do the following:

- Request a transfer value – Register or log in to the online Member Self Service portal

- Review the transfer details – You’ll receive a Transfer Advice Confirmation Form

- Return the confirmation form – You have three months from receiving the guaranteed transfer value

- Seek appropriate advice – Depending on your circumstances, you might need to consult with MoneyHelper and/or get independent financial advice

- Provide additional information – The pension fund may request more details to complete their checks

Remember that the government requires pension schemes to check for warning signs or “red flags” to protect your pension from fraudulent activity. These checks aren’t necessary if you’re transferring to another authorized master trust scheme, authorized collective defined contribution scheme or other public service pension plan.

Important Considerations Before Transferring

Before proceeding with a transfer, here are some crucial factors to consider:

Benefits of Staying in the LGPS

- Defined benefit structure – The LGPS provides guaranteed benefits based on your salary and service

- Inflation protection – Your pension increases to help protect against rising costs

- Death benefits – The scheme provides valuable benefits for your dependents

- Ill health provisions – Enhanced benefits if you need to retire early due to health reasons

Potential Drawbacks of Transferring Out

- Loss of guaranteed income – Private pensions typically don’t offer the same level of certainty

- Investment risk – You’ll be responsible for managing investment decisions and risks

- Complexity – Managing your own pension can be challenging without expertise

- Fees and charges – Private pensions often come with ongoing management fees

Why People Consider Transferring Out

Despite the security of the LGPS there are reasons why some consider transferring

- Flexibility – Private pensions may offer more options for accessing your money (especially after the Freedom and Choice rules)

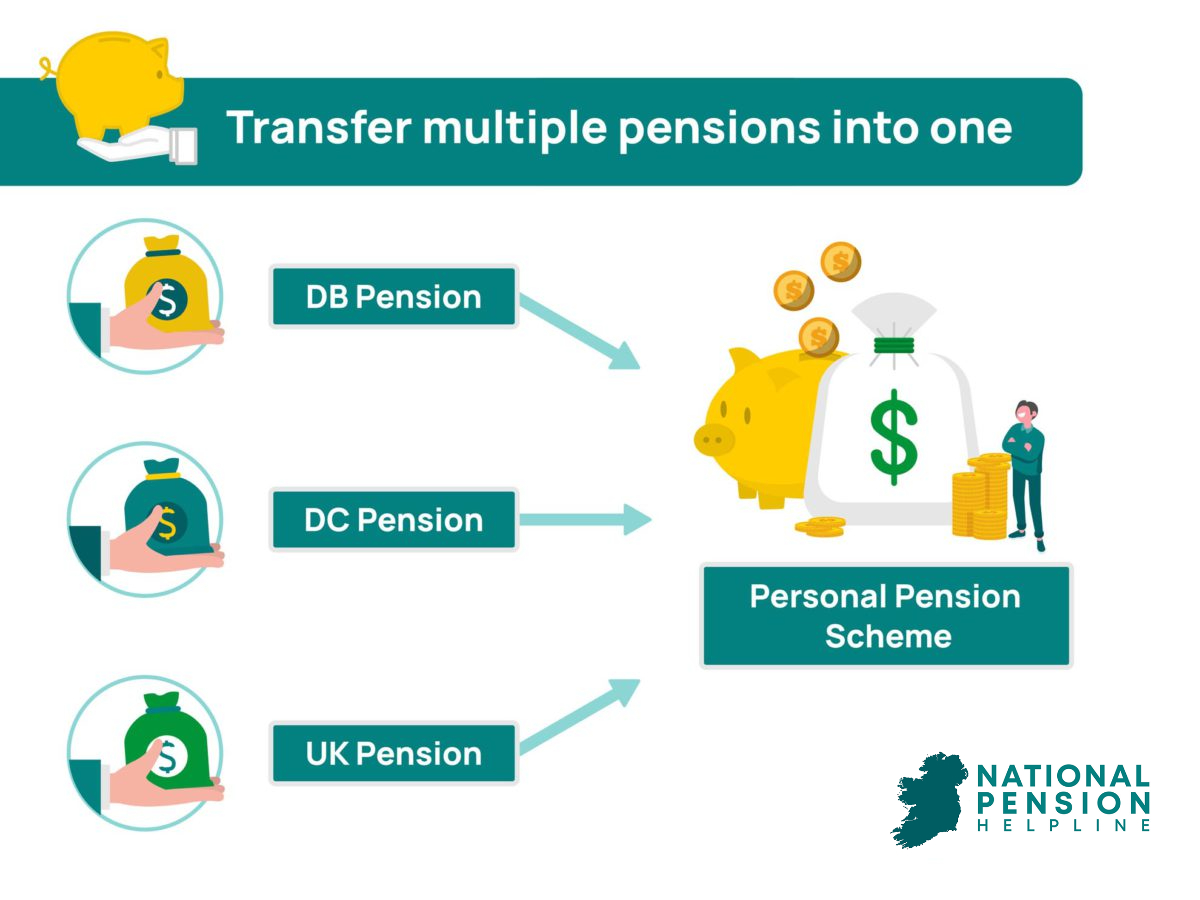

- Consolidation – Bringing multiple pensions together in one place

- Investment control – Making your own decisions about how your pension is invested

- Estate planning – Different options for what happens to your pension when you die

Seeking Professional Advice

Choosing to leave the LGPS is a big choice that could affect your future finances. The government recognizes this and has put safeguards in place:

- For transfers of significant value, you’re legally required to seek appropriate independent financial advice

- This advice must come from a financial adviser authorized by the Financial Conduct Authority

- Consulting with MoneyHelper about pension scams is also recommended but is not a substitute for proper financial advice

Transferring INTO the LGPS

There are different rules if you want to move other pensions INTO the LGPS instead of OUT OF it:

- You must notify the pension fund within one year of joining the LGPS

- You’ll receive an estimate of the benefits the transfer would provide

- You can then decide whether to proceed with the transfer

- If you’ve lost track of previous pension schemes, visit www.gov.uk/find-pension-contact-details to locate them

Types of Pensions You Can Transfer In

The LGPS may accept transfers from various pension arrangements:

- Previous LGPS benefits

- Other public service pension schemes (potentially under preferential “Club transfer” rules)

- Previous employer’s pension schemes

- Self-employed pension plans

- Pension ‘buy-out’ policies

- Personal pension plans

- Stakeholder pension schemes

- Additional Voluntary Contributions (AVC) arrangements

- Approved overseas pension schemes (subject to pension fund approval)

There may be special “Club transfer” rules for people coming from another public service pension scheme who haven’t been a member of a public service scheme for more than five years. These rules can provide more favorable transfer terms.

My Experience with Pension Transfers

I’ve helped many clients understand their pension transfer options over the years. One thing I’ve noticed is that there’s no one-size-fits-all answer. For some people, staying in the LGPS provides the security they want for retirement. Others value the flexibility of private pensions, particularly if they have other substantial retirement savings.

What’s crucial is making this decision with full awareness of what you might gain or lose. I’ve seen cases where transferring out made sense for individuals with specific circumstances, but I’ve also encountered situations where people regretted giving up their defined benefit pensions without fully understanding the implications.

The McCloud Remedy and Transfers

If you’re thinking about transferring benefits from another public service pension scheme that you built up between April 2015 and March 2022, be aware that these may be protected by the McCloud remedy. The remedy in the LGPS differs from other public service pension schemes, so read the transfer information carefully to understand how your benefits would be protected.

Final Thoughts

Deciding whether to transfer your LGPS pension to a private pension is a significant financial decision. Here’s my practical advice:

- Don’t rush – take time to understand all implications

- Get proper independent financial advice

- Consider both short-term flexibility and long-term security

- Think about your overall retirement plans and other sources of income

- Be wary of advisers who seem eager to encourage you to transfer without thorough analysis

Remember that once you’ve transferred out of the LGPS, you typically can’t reverse the decision. It’s worth investing time now to ensure you’re making the right choice for your future financial wellbeing.

If you have further questions about pension transfers or retirement planning, feel free to contact us for more information. Your retirement security is too important to leave to chance!

Transferring your pension

FAQ

Can I transfer my civil service pension to a private pension?

If you want to move, you should get a transfer pack and ask Civil Service Pensions to figure out how much your transfer is worth. Depending on who asks for it, Civil Service Pensions will send a transfer out quote and pack to either you or your new scheme. The transfer amount will be guaranteed for three months.

What happens to my local government pension if I leave?

You may leave your job before you want to take your pension. If you have met the the two year qualifying period when you leave, you will have deferred benefits in the LGPS. There is a chance that you could get your pension contributions back if you haven’t met the requirements.

Is a local government pension a private pension?

The LGPS is a registered public service pension scheme.

Can you pay into a company pension and a private pension?

You can contribute to both a SIPP and a workplace pension at the same time. SIPPs offer flexibility – You choose your investments and risk level, but returns are not guaranteed. Workplace pensions are less flexible – However, they include employer contributions and tax-efficient payments.

Can I transfer my pension out of the local government pension scheme?

You can transfer your pension out of the Local Government Pension Scheme (LGPS) if you meet the following criteria: You must be a deferred member (ie no longer paying into the LGPS). If you have more than one LGPS deferred record, you must transfer them all at the same time. You must have paid into your LGPS pension for at least three months.

Can I transfer my LGPS benefits to another pension scheme?

You may be able to transfer your LGPS benefits into another scheme after you stop paying in. You can read about the important things to know and the possible risks below. Can I transfer my pension rights to another pension scheme? You can ask your new pension scheme/provider to request transfer details from us. Or you can contact us directly.

Can I transfer pension benefits from an Approved overseas pension scheme?

You may be able to transfer in pension benefits from an approved overseas pension scheme. Your pension fund may refuse to accept a transfer from a pension scheme other than the LGPS. Your previous pension scheme will offer a sum of money called a transfer value. That transfer value would buy an amount of extra pension in the LGPS.

Can I transfer my pension from the police pension scheme?

You can transfer your pension out of the Police Pension Scheme (PPS) to any HMRC registered pension scheme or some overseas pension schemes, as long as you have paid into the PPS for more than three months.

Can I transfer benefits from another public service pension scheme?

If you are considering transferring out benefits you have built up in another public service pension scheme between 1 April 2014 and 31 March 2022, they may be protected by the McCloud remedy. The remedy in the LGPS is very different from the remedy in other public service pension schemes.

Can I transfer my pension benefits to another scheme?

Whether you’re changing jobs or moving your pensions into one place, you may be able to transfer your pension benefits to another scheme. The information on this page explains the rules and how the process works. Select FAQ Can I transfer my pension out of the scheme? – Video generated with Synthesia