Are you approaching 60 and wondering if you can start receiving your NHS pension while still contributing to the healthcare system you love? Good news! The answer is a resounding yes – you can absolutely take your NHS pension at 60 and carry on working

This option gives many healthcare professionals the best of both worlds – financial security through pension payments plus the ability to continue earning while doing the job they’re passionate about. Let’s explore exactly how this works and what options are available to you.

Your Main NHS Pension Options at 60

If you are 60 years old and still want to work for the NHS, you have two main choices:

1. Partial Retirement

From October 2023, members of the 1995 Section can now access partial retirement (previously only available to the 2008 Section and 2015 Scheme members) This popular option allows you to

- Take between 20% and 100% of your pension benefits

- Continue working in your current NHS job

- Keep contributing to the 2015 NHS Pension Scheme

- No need to take a break or change jobs

The main requirement is that you have to lower your pensionable pay by 10% for at least the first year (or make a pensionable commitment if you’re a practitioner).

2. Retire and Re-join

Alternatively you can

- Take your full pension

- Have a short break from work (usually 24 hours)

- Return to NHS employment on a new contract

- Re-join the NHS Pension Scheme to keep building future benefits

This option has been available to members of the 2008 Section and 2015 Scheme, and is now also available to 1995 Section members.

The 16-Hour Rule is Gone!

Good news for people who are thinking about retiring and then coming back to work: the government got rid of the old 16-hour rule on April 1, 2023. Before, members of the 1995 Section could only work 16 hours a week in the first month after retiring so that their pension payments would not be affected.

Now, you can work as many hours as you choose immediately after retiring – as long as you’ve taken that 24-hour break from your previous role. This gives you much more flexibility in planning your return to work.

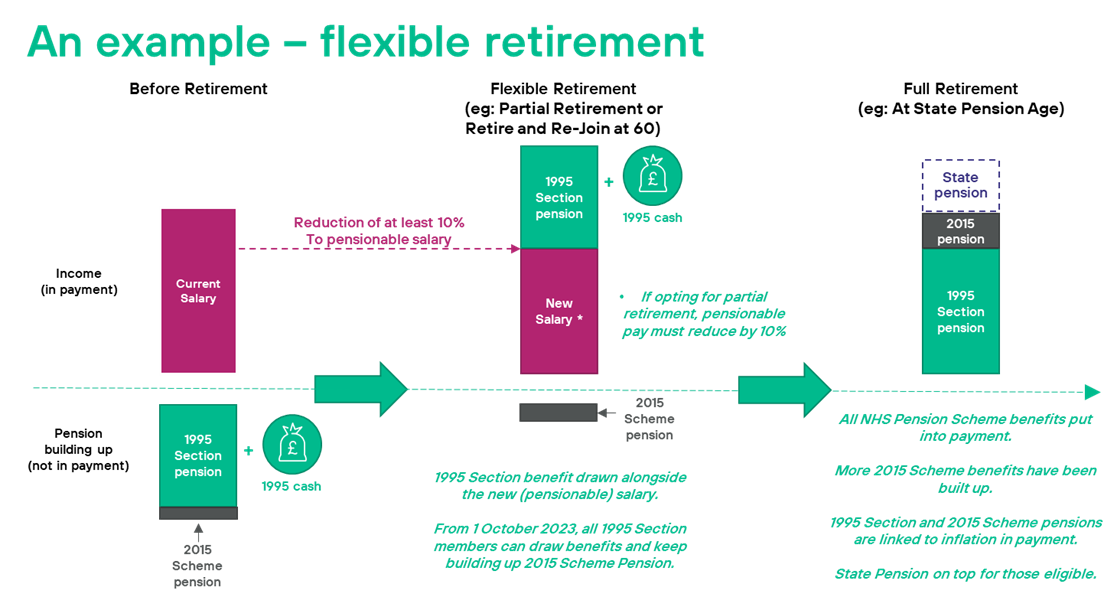

Let’s Look at an Example

To make this more concrete, let’s consider a real-life scenario:

Imagine you’re 55 years old and a member of the 1995 Section with a pensionable salary of £47,672. You decide to:

- Take 100% of your 1995 Section benefits at age 55 through partial retirement

- Reduce your hours by 50% (working part-time)

- Continue contributing to the 2015 Scheme until age 60

Your pension benefits could look like this:

At partial retirement (age 55):

- 1995 Section pension: £13,348 per year for life

- Lump sum: £44,449

When fully retiring at 60:

- Additional 2015 Scheme benefits: £8,239 per year for life

This gives you both immediate pension income while still working part-time, plus additional pension benefits when you fully retire.

Will My Pension Be Reduced if I Return to Work?

A common concern is whether returning to work might impact your pension payments. Here’s the situation:

Your pension will not be affected if:

- You’re over the normal pension age (60 for 1995 Section, 65 for 2008 Section, and State Pension Age or 65 if later for 2015 Scheme)

- You retired before the normal pension age

- You’re receiving actuarially reduced early retirement benefits

Your pension could be reduced (known as “abatement”) if:

- You return to NHS work before reaching normal pension age

- You retired on or after October 1, 2011, and received redundancy benefits

- You’re under a retirement scheme like “retirement in the interest of efficiency of the service”

But members with the Special Class or Mental Health Officer status can’t get abatement until March 31, 2025. This is good news for these members.

Important Considerations Before Making Your Decision

Before deciding to take your pension at 60 and continue working, think about:

- Financial implications – How will your overall income change? Will you pay more tax?

- Work arrangements – Will you need to change your hours, role, or employer?

- Long-term plans – How long do you intend to keep working?

- Inflation protection – Remember that your pension will be increased annually in line with the Consumer Price Index to help protect against inflation

NHS Pension Benefits and Inflation Protection

One big advantage of the NHS Pension is its inflation protection. During each year of active service, your 2015 Scheme pension is reviewed to keep pace with the cost of living using the Consumer Price Index (CPI), with an additional 1.5% added. This ensures your pension value stays ahead of inflation.

Once you start receiving your pension, benefits continue to be reviewed annually through the Pensions Increase process.

What About Ill Health Retirement?

If you’re considering retirement due to health concerns, the NHS Pension Scheme offers specific ill health retirement options that differ from the standard retirement pathways.

There are two tiers of ill health retirement:

Tier 1: For those unable to do their current NHS job due to permanent ill health. You’ll receive your earned pension without reduction.

Tier 2: For those unable to carry out any regular employment of similar duration due to permanent ill health. You’ll receive Tier 1 benefits plus an enhancement.

The minimum pension age doesn’t apply for ill health retirement, and these pensions increase each April in line with CPI.

Frequently Asked Questions

Can I take my NHS pension at 60 and work somewhere else?

Yes! You can take your NHS pension at 60 and work in a non-NHS job without any restrictions.

Can I take my NHS pension at 60 and return to full-time NHS work?

Absolutely. You can take your pension at 60 and return to full-time NHS work. You’ll need to re-join the NHS Pension Scheme and start contributing again if you want to build more pension benefits.

What happens if I die before reaching retirement age?

If you die before reaching retirement age, your spouse or civil partner will receive a survivor’s pension. Your children may also be entitled to a pension.

How do I know which NHS Pension Scheme I’m in?

You can find this information on your Total Reward Statement or by contacting the NHS Business Services Authority.

How to Get Started

If you’re interested in taking your NHS pension at 60 while continuing to work, here are the steps to follow:

- Discuss with your manager – Talk about your plans and how they might affect your role and working hours

- Get financial advice – Consider speaking with a financial advisor who specializes in NHS pensions

- Contact NHS Pensions – They can provide specific information based on your circumstances

- Review your options – Consider which approach (partial retirement or retire and re-join) best suits your needs

- Complete the necessary paperwork – Your employer’s HR department can help with this

Conclusion

Taking your NHS pension at 60 while continuing to work offers a flexible approach to the later stages of your career. Whether you choose partial retirement or the retire and re-join option, you can create a balance that works for your financial needs and career aspirations.

The removal of the 16-hour rule and new flexible options make this an increasingly attractive choice for many NHS employees approaching retirement age. The ability to receive your pension while still earning a salary and potentially building additional pension benefits gives you greater control over your financial future.

Remember that everyone’s circumstances are different, so it’s worth seeking personalized advice before making your decision. But rest assured – continuing your valuable contribution to the NHS while enjoying your well-earned pension benefits is absolutely possible!

Plan for partial retirement with a personalised estimate

If you have any difficulties accessing the calculator, try clearing the cache and cookies in your web browser. If youre unsure how to do this, there are guides available online – this process can differ depending on the web browser youre using.

You may need to adjust the zoom in your web browser to view the calculator fully.

With partial retirement, you can take up to 100% of your pension, stay in your job, and carry on building up new pension benefits in the 2015 Scheme. To plan a partial retirement that’s right for you, use the Partial Retirement Calculator to see:

- how much of a lump sum and a pension you might want to get when you retire in part

- the amount your pension benefits will increase each year you work as a member of the 2015 Scheme. This will help you figure out when the best time might be to retire, as the calculator can show you numbers up to 8 years from now.

- any effect on your benefits due to a 20% reduction in your employers’ contribution in the first 12 months after you start partial retirement; this refers to what happens to your pension when your pensionable pay after partial retirement rises to more than 90% of your previous pensionable pay. Where this occurs, the pension in payment will be stopped.

- If you were affected by McCloud, your pension amount will depend on the benefits you choose for the work you did between April 1, 2015, and March 31, 2022.

- The calculator tells you what “safe percentage” of your pension to take when you retire in part so that you don’t have to pay back overpaid pension when you make your McCloud choice later on.

If you’re thinking of applying

If you want to take part-time retirement, you need to agree to a new work arrangement that lets you lower your pensionable pay by at least 10%. For example, you could change your level of responsibility, work fewer hours, or move to a new role. Speak with a member of your HR team to agree an arrangement that works for both you and your employer.

This also applies if youre wanting to take partial retirement of your pension for a second time.

Your pensionable pay must stay at the reduced level for at least 12 months after you take partial retirement, or you’ll no longer be eligible for the pension you’ve taken. During this time, you may still be able to do additional work that doesn’t count towards your pension, such as overtime or bank work. Overtime is non-pensionable for the 12 months following partial retirement whereas bank work is only non-pensionable if you opt out of the NHS Pension Scheme for your bank contract.

Make sure to leave enough time to discuss your suggestions with your employer, as agreement of your new working arrangement needs to be in place before your employer sends us your application for partial retirement.