Many savers have made after-tax contributions to a 401(k) or other defined contribution retirement plan. If your account balance contains both pretax and after-tax amounts, any distribution will generally include a pro rata share of both.

Example: Your account balance is $100,000, consisting of $80,000 in pretax amounts and $20,000 in after-tax amounts. You request a distribution of $50,000. Your distribution consists of $40,000 pretax and $10,000 after-tax.

The Smart Way to Make Your Retirement Money Work Harder

Hey, fellow savers for retirement! If you’ve been putting money into your 401(k) after taxes, I have some great news for you! After taxes, you can put those funds into a Roth IRA. This could be one of the smartest tax moves you ever make. Let’s look at how this works and why it might change the way you plan to retire.

What Are After-Tax 401(k) Contributions Anyway?

Let’s be clear about what we’re talking about first. There are three different ways you can put money into a workplace retirement plan, such as a 401(k).

- Pre-tax contributions – These reduce your taxable income now, but you’ll pay taxes when you withdraw the money in retirement.

- Roth contributions – You pay taxes on this money before contributing, but qualified withdrawals in retirement are completely tax-free.

- After-tax contributions – These don’t reduce your taxable income like pre-tax contributions, but they allow you to put more money in your 401(k) beyond the standard limits.

In 2025, employees can put in a total of up to $23,500 in pre-tax and Roth contributions. But if you add in after-tax contributions, like employer matches and profit sharing, you can put in up to $70,000! This is a huge benefit for people who make a lot of money or save a lot.

The Tax Treatment Dilemma

Here’s where things get interesting When you eventually withdraw money from your 401(k), your after-tax contributions come out tax-free (since you already paid tax on them), but any earnings on those after-tax contributions are taxed as ordinary income

If you follow the rules for taking money out of a Roth IRA, however, both the money you put in and the money that grows can be taken out tax-free when you retire.

So basically, rolling your after-tax 401(k) money to a Roth IRA means potentially avoiding taxes on all future earnings from that money. That’s like finding free money under your retirement mattress!

The Big Question: Can I Roll After-Tax 401(k) to Roth?

Short answer: YES, you absolutely can!

The IRS has provided clear guidance on this (Notice 2014-54, for you tax nerds out there). You can roll over your after-tax contributions from your workplace plan to a Roth IRA without paying additional taxes.

But – and this is important – there are some rules you need to follow.

How the Rollover Process Works

Let’s break down how this works with a real-world example.

Say Andrew has $1 million in his 401(k):

- $800,000 is pre-tax money (including contributions and earnings)

- $200,000 is after-tax contributions

- Of that $800,000 pre-tax portion, $100,000 represents earnings on the after-tax contributions

Scenario 1: Complete Rollover

The simplest approach is to roll over the entire balance. Andrew could:

- Direct the after-tax contributions ($200,000) to a Roth IRA

- Direct the pre-tax money ($800,000) to a traditional IRA

This is a clean, tax-efficient move that the IRS explicitly allows.

Scenario 2: Partial Rollover (If Plan Allows)

If Andrew’s plan tracks contribution sources separately and allows partial withdrawals, he could:

- Take a withdrawal of just his after-tax balance ($300,000 total, which includes $200,000 in after-tax contributions and $100,000 in earnings)

- Roll the after-tax contributions ($200,000) to a Roth IRA

- Roll the earnings on those contributions ($100,000) to a traditional IRA

However, what Andrew can’t do is cherry-pick just his after-tax contributions while leaving everything else in the plan. The IRS doesn’t allow that.

As the IRS clearly states: “You can’t take a distribution of only the after-tax amounts and leave the rest in the plan.” Any partial distribution must include a proportional share of both pre-tax and after-tax amounts.

The Pro-Rata Rule: The Tax Rule You Need to Understand

When you take a distribution from a retirement account that contains both pre-tax and after-tax money, the IRS applies what’s known as the “pro-rata rule.” This means that any distribution includes a proportional mix of pre-tax and after-tax dollars.

For example, if your account is 80% pre-tax and 20% after-tax, any withdrawal will consist of 80% pre-tax and 20% after-tax money.

The good news: According to IRS Notice 2014-54, distributions sent to multiple destinations at the same time are treated as a single distribution. This means you can direct all pre-tax amounts to a traditional IRA and all after-tax amounts to a Roth IRA, as long as you’re doing it as part of the same overall distribution.

Let’s Get Practical: Example of a Rollover

Let me walk you through a practical example to illustrate how this might work.

Imagine your 401(k) has $100,000, with $80,000 in pre-tax money and $20,000 in after-tax contributions.

According to the IRS, you could request:

- A direct rollover of $80,000 in pre-tax amounts to a traditional IRA

- A direct rollover of $20,000 in after-tax amounts to a Roth IRA

Or, if you wanted some cash now:

- A direct rollover of $80,000 in pre-tax amounts to a traditional IRA

- A direct rollover of $10,000 in after-tax amounts to a Roth IRA

- A distribution of $10,000 in after-tax amounts to yourself (tax-free!)

What About Just the Earnings?

A common question I get asked: “Can I roll over my after-tax contributions to a Roth IRA and the earnings on those contributions to a traditional IRA?”

The answer is yes! The IRS confirms this is allowed. Earnings associated with after-tax contributions are considered pre-tax amounts in your account. So you can direct those earnings to a traditional IRA while sending your actual after-tax contributions to a Roth IRA.

Benefits of Rolling to a Roth IRA

Why would you want to do this rollover in the first place? Here are some compelling reasons:

1. Tax-Free Growth Forever

Once your money is in a Roth IRA, all future growth is potentially tax-free (assuming qualified withdrawals). This is huge!

2. More Investment Choices

Most 401(k) plans limit you to a selection of investments. With an IRA, you’ll typically have access to a much wider range of investment options.

3. No Required Minimum Distributions (RMDs)

Unlike 401(k)s and traditional IRAs, Roth IRAs don’t require you to take minimum distributions starting at age 73. Your money can continue growing tax-free for as long as you want.

4. Greater Withdrawal Flexibility

Roth IRAs offer more flexibility for early withdrawals. You can withdraw your contributions (but not earnings) at any time without taxes or penalties. There are also penalty-free withdrawal options for first-time home purchases and qualified education expenses.

Things to Consider Before Rolling Over

Before you rush to roll over your after-tax 401(k) money to a Roth IRA, consider these factors:

Check If Your Plan Allows In-Plan Roth Conversions

Some employers offer the option to convert after-tax contributions to Roth within the plan. This might be simpler in some cases.

Employer Plan Benefits

401(k)s sometimes offer institutional pricing that isn’t available in IRAs. They also provide stronger creditor protection under federal law and may allow loans.

Partial Rollover Implications

If you’re considering a partial rollover, be aware this might affect eligibility for net unrealized appreciation treatment on employer stock in your plan.

Pre-1987 Contributions

Contributions made before 1987 have different rules. If you have these, consult a tax advisor.

Step-by-Step Guide to Rolling Over After-Tax 401(k) to Roth IRA

-

Check your plan documents to confirm your plan allows for distributions and to understand any restrictions.

-

Contact your plan administrator to request information about your account balance, including the breakdown of pre-tax and after-tax amounts.

-

Open a Roth IRA (if you don’t already have one) and a traditional IRA (for the pre-tax portion).

-

Request a direct rollover specifying that:

- After-tax contributions should go to your Roth IRA

- Pre-tax money (including earnings on after-tax contributions) should go to your traditional IRA

-

Ensure the rollover is done directly (trustee-to-trustee) to avoid withholding requirements.

-

Keep detailed records of the transaction for tax reporting purposes.

-

Consult with a tax advisor if your situation is complex.

Common Questions About Rolling After-Tax 401(k) to Roth IRA

Can I just roll over my after-tax contributions and leave the rest in my 401(k)?

No, the IRS doesn’t allow this. You can’t selectively distribute only the after-tax portion. Any partial distribution must include a proportional share of both pre-tax and after-tax amounts.

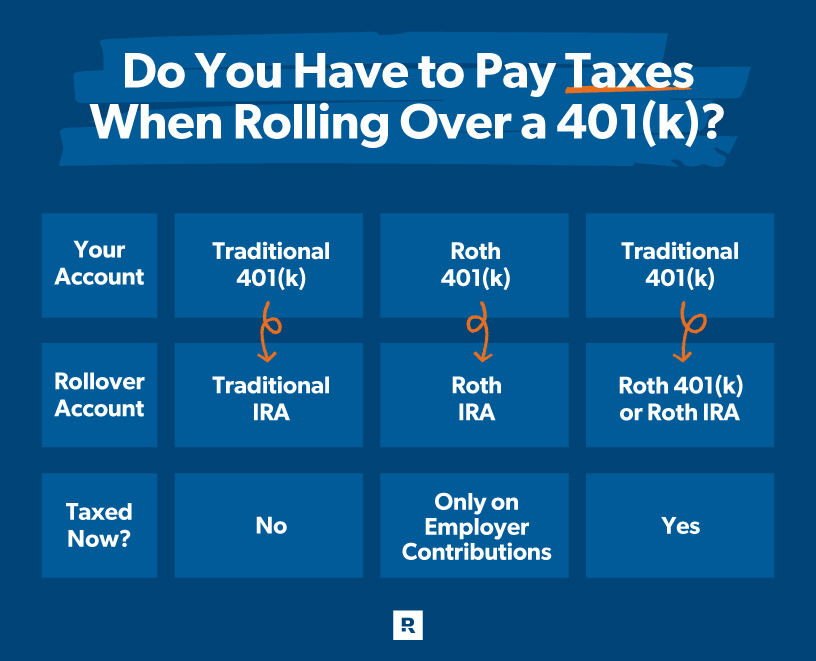

Will I owe taxes on this rollover?

You won’t owe taxes on the after-tax contributions that go to the Roth IRA (since you’ve already paid tax on that money). However, if you roll pre-tax amounts (including earnings on after-tax contributions) to a Roth IRA instead of a traditional IRA, you’d owe income tax on those amounts.

What if my plan doesn’t track pre-tax and after-tax amounts separately?

If your plan doesn’t separately track these amounts, any partial withdrawal would need to include proportional amounts of both pre-tax and after-tax money.

Can I do this if I’m still working at the company with the 401(k)?

This depends on your plan’s rules. Many plans don’t allow distributions while you’re still employed except in cases of hardship or once you reach age 59½.

Wrapping It Up

Rolling your after-tax 401(k) contributions to a Roth IRA can be a powerful strategy to maximize the tax efficiency of your retirement savings. It allows you to transform money that would otherwise generate taxable earnings into completely tax-free growth potential.

However, the rules can be complex, and mistakes could be costly. While this article gives you the basics, I always recommend consulting with a qualified tax advisor or financial planner before making significant moves with your retirement accounts.

Have you rolled over after-tax 401(k) contributions to a Roth IRA? I’d love to hear about your experience in the comments below!

Note: Tax laws can change, and this article reflects information as of October 2025. Always check current IRS guidance before making tax decisions.

Rollovers to multiple destinations

Distributions sent to multiple destinations at the same time are treated as a single distribution for allocating pretax and after-tax amounts (Notice 2014-54). This means you can move all of your pre-tax money to a traditional IRA or retirement plan and all of your after-tax money to a different place, like a Roth IRA.

Example: You withdraw $100,000 from your plan, $80,000 in pretax amounts and $20,000 in after-tax amounts. You may request:

- A direct move of $80,000 in pre-tax funds to a traditional (non-Roth) IRA or another plan’s pre-tax account,

- A direct transfer of $10,000 after taxes to a Roth IRA, and

- A distribution of $10,000 in after-tax amounts to yourself.

Can I roll over just the after-tax amounts in my retirement plan to a Roth IRA and leave the remainder in the plan?

No, you can’t take a distribution of only the after-tax amounts and leave the rest in the plan. Any partial distribution from the plan must include some of the pretax amounts. Notice 2014-54 doesn’t change the rule that each plan distribution must include an equal amount of the account’s pre-tax and after-tax amounts. You could take a full distribution (all pre-tax and after-tax amounts) and directly roll over this much money to a Roth IRA. This would move all of your after-tax contributions to the Roth IRA.

- putting money into a traditional IRA or another eligible retirement plan before taxes, and

- after-tax amounts to a Roth IRA.