Roth IRAs for kids are a great retirement tool, because children have decades for their contributions to grow tax-free, and contributions can be withdrawn tax-free and penalty-free at any time.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not provide advisory or brokerage services, and it does not tell investors whether to buy or sell certain stocks, bonds, or other investments.

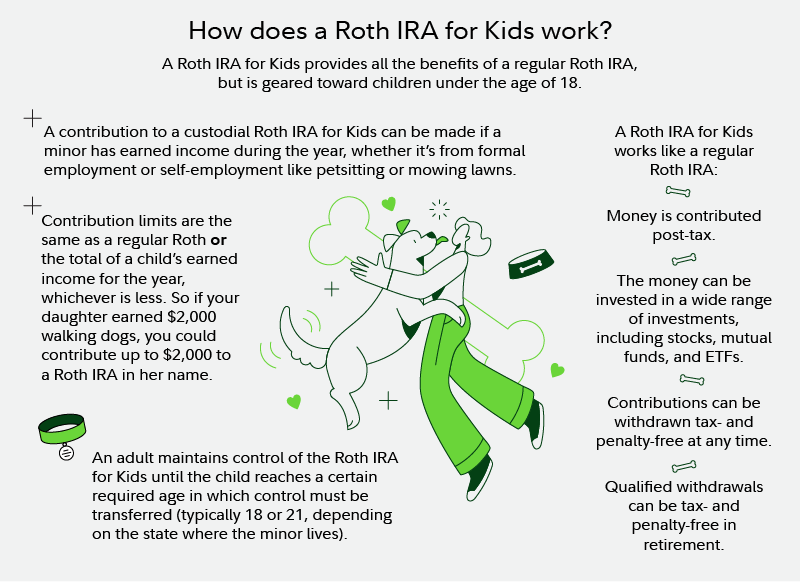

A custodial Roth IRA is a retirement account owned by a minor with earned income but managed by their custodian until they turn 18 or 21, depending on state laws where the minor lives.

The account follows the same rules as a Roth IRA: contributions are made with after-tax dollars, which grows tax-free in the account through investments, and is withdrawn tax-free in retirement.

Age is not a limit. Even babies, if they have earned income, can have and contribute to a Roth IRA.

Earned income is a requirement. An individual can get a Roth IRA if they can show income on a W-2 or another tax form.

Annual contribution limits apply. As with any other IRA, the limit for contributing to a custodial Roth IRA is $7,000 or the total of the minors earned income for the year, whichever is less.

Opening a Roth IRA for your child could help jumpstart their preparation for retirement. When you invest, compound interest is a big part of how your money grows, but it depends on how long you wait. Investing early is a huge advantage that is hard to beat.

Most kids, whether they’re teens or not, don’t think about retirement a lot. It’s easy to see why they wouldn’t want to save for retirement when they have homework, soccer practice, and are trying to figure out why their crush didn’t text them back.

But as parents, we have the opportunity to set our kids up for financial success early on One powerful tool is a Roth IRA for kids – but there’s a catch that many parents don’t realize until they try to set one up

The Short Answer: No, You Can’t (But There Are Alternatives)

No, you cannot open a Roth IRA for your child if they do not have earned income. This is a strict IRS requirement that applies to everyone, regardless of age The keyword here is “earned” income – meaning money from actual work

Let me explain why and what your options are instead.

The Earned Income Requirement Explained

To contribute to any IRA (including a Roth IRA), a person must have earned income. For kids, this means:

- They must have received payment for actual work

- The work and payment must be legitimate and documentable

- The contribution can’t exceed their earned income or the annual limit ($6,500 in 2023), whichever is less

So if your 14-year-old earned $2,000 from summer jobs, you could only contribute up to $2,000 to their Roth IRA that year – not the full $6,500 limit.

You don’t have to count gift money, chore allowances, or investment income as earned income. The IRS is pretty clear about this.

Creative Ways to Generate Earned Income for Your Child

If you’re determined to open a Roth IRA for your child, here are some legitimate ways they can earn income (even at young ages):

For Younger Kids (Under 14)

- Performing in TV, movies, or theatrical productions

- Modeling for businesses (even your own business website!)

- Delivering newspapers

- Babysitting

- Minor chores around other people’s homes (not just yours)

- Making evergreen wreaths (strangely specific, but it’s in the rules!)

For Teens (14+)

- Traditional summer jobs (lifeguarding, dishwashing, retail)

- Lawn care services

- Social media content creation (if they generate income as a “kidfluencer”)

- Working in a family business (as long as it’s legitimate work)

Keep in mind that state laws can be stricter than federal laws regarding child labor, so check your local regulations.

Why a Roth IRA for Kids Is Worth the Effort

Before we look at alternatives, let’s understand why so many financial advisors recommend Roth IRAs for kids who do have earned income:

- Tax-free growth: Money grows tax-free and can be withdrawn tax-free in retirement

- Early withdrawals flexibility: Contributions (but not earnings) can be withdrawn anytime without penalties

- Time is literally money: A child who invests $24,000 by age 18 could have over $1 million at retirement without adding another penny!

- Financial education: It teaches kids about investing, saving, and planning for the future

Alternative Savings Options for Kids Without Earned Income

If your child doesn’t have earned income, don’t worry! There are still great ways to help them save:

1. 529 College Savings Plan

- Tax-advantaged savings for education expenses

- Some states allow use for K-12 expenses

- Can be transferred between family members

- The SECURE Act 2.0 now allows up to $35,000 in a 529 to be rolled over to a Roth IRA over several years (though the child will need earned income for the Roth at that point)

2. UTMA/UGMA Custodial Accounts

- More flexible than Roth IRAs – funds can be used for anything that benefits the child

- No earned income requirement

- No contribution limits

- BUT earnings are taxable, which can reduce growth over time

3. High-Yield Savings Account

- Simple, safe way to teach saving habits

- No earned income requirement

- No contribution limits

- BUT lower returns than investment accounts

4. Help Them Find Ways to Earn Income

- Even small amounts of legitimate earned income open the door to Roth IRA contributions

- Summer jobs, small businesses, or working for family businesses can qualify

- Keep detailed records of all earnings if they’re not reported on W-2s

How Roth IRAs for Kids Actually Work

If your child does eventually earn income, here’s how opening a Roth IRA would work:

- It’s a custodial account: You (or another adult) open and manage it until they reach adulthood (18 or 21, depending on your state)

- The money belongs to the child: While you control the account, the money legally belongs to your child

- Contributions are limited: The lesser of their earned income or $6,500 (2023 limit)

- You can “match” their earnings: Your child doesn’t have to contribute their actual earnings – you can contribute on their behalf (as long as the amount doesn’t exceed their earned income)

- Investment options: You choose the investments, typically low-cost index funds that track the entire market

The Power of Starting Early: A Real Example

Let’s look at what happens if your teen saves $24,000 in a Roth IRA by age 18—that’s about $6,000 a year for four summer jobs:

Putting $24,000 into a low-cost total market index fund that earns about 8% a year would see that amount grow to over $1,025,000 by age 65, and that’s without adding another penny after age 2018!

That’s the magic of compound interest and why so many parents want to start Roth IRAs for their kids as early as possible.

How to Open a Roth IRA for Kids (Once They Have Earned Income)

When your child does earn income, here’s how to open a custodial Roth IRA:

- Verify earned income: Make sure your child actually has legitimate earned income

- Choose a brokerage: Fidelity, Charles Schwab, and Vanguard all offer custodial Roth IRAs

- Gather documentation: You’ll need your child’s Social Security number, your ID, and proof of address

- Complete the paperwork: The adult will be listed as the custodian, the child as the beneficiary

- Fund the account: Contribute up to the lesser of your child’s earned income or $6,500 (2023 limit)

- Choose investments: Typically low-cost, diversified index funds are recommended

Roth IRA vs. Other Options for Kids

Here’s how Roth IRAs compare to other savings options for kids:

| Account Type | Requires Earned Income | Tax Benefits | Access to Funds | Contribution Limits |

|---|---|---|---|---|

| Roth IRA | Yes | Tax-free growth & withdrawals in retirement | Contributions anytime, earnings at 59½ | Lesser of earned income or $6,500 (2023) |

| 529 Plan | No | Tax-free for qualified education expenses | Education expenses only (penalties for other uses) | No technical limit, but gift tax concerns above $17,000/year |

| UTMA/UGMA | No | First $1,150 of earnings tax-free, next $1,150 at child’s rate | Child gets full access at 18-21 | No limit |

| Savings Account | No | None (interest is taxable) | Anytime | No limit |

Record-Keeping Tips for Child Income

If your child does earn income through less formal means (babysitting, lawn mowing, etc.), keep these records:

- Date and type of work performed

- Who hired them

- Amount paid

- How they were paid (cash, check, electronic payment)

- Consider creating simple invoices for your child’s work

While your child may not need to file a tax return if their income is low, having these records can help justify Roth IRA contributions if the IRS ever questions them.

FAQs About Roth IRAs for Kids

Does my child need to file a tax return to open a Roth IRA?

No, filing a tax return isn’t required to make a Roth IRA contribution, though they may need to file if their income exceeds certain thresholds.

Can I contribute my own money to my child’s Roth IRA?

Yes, but only if they have earned income and only up to the amount they earned (or the annual limit, whichever is less).

What happens when my child turns 18?

The custodial Roth IRA typically transfers to a regular Roth IRA in their name when they reach the age of majority in your state (usually 18 or 21).

Can my child withdraw the money early if needed?

Yes, contributions (but not earnings) can be withdrawn at any time without taxes or penalties.

The Bottom Line

While you can’t open a Roth IRA for a child without earned income, there are plenty of alternative ways to help them save for the future. And once they do start earning income, even small amounts, a Roth IRA becomes a powerful option worth considering.

The most important thing is to start some form of saving early and to use it as an opportunity to teach your kids about money, investing, and the incredible power of compound growth over time.

What savings vehicles have you set up for your kids? I’d love to hear your experiences in the comments below!

5 reasons why a Roth IRA can be right for minors

It’s possible that your kids should not have a Roth IRA now that you know if they can. Aside from the momentum of investing early, there are several reasons why a Roth IRA, in particular, can be a good choice for children:

Best custodial Roth IRAs

Of the online brokers that NerdWallet reviews, the following currently offer custodial Roth IRAs. Note that the star ratings are for the brokerage overall, not their custodial Roth IRA specifically.

» Check out our top picks for the best Roth IRA accounts