If youâve been using a credit card responsibly, you might be wondering about a credit limit increase, sometimes called a credit line increase.

There are no guarantees that a credit card issuer will increase your credit limit. But there are some steps you can take to help you qualify. Learn more about how credit limit increases work and how you may be able to get one.

Having a higher credit limit can be beneficial in several ways. It gives you more purchasing power and allows you to better manage your credit utilization ratio. This ratio measures how much of your total available credit you are using. Experts recommend keeping your credit utilization below 30%. A higher credit limit makes it easier to stay under this threshold. However, requesting and receiving a credit limit increase is not always guaranteed. Fortunately, some card issuers give you the option to add money to your account to raise your limit. Here’s what you need to know.

How Credit Limits Are Determined

When you first open a credit card account, the issuer will establish your initial credit limit based on your creditworthiness. This involves looking at factors like your income, existing debts, credit score and history of managing credit. In general, consumers with excellent credit scores and finances will qualify for higher starting limits.

After your account is open, the issuer may periodically review your account and increase your limit without you having to request it. This can happen if you have a track record of on-time payments and responsible credit use. However, there is no guarantee your limit will be raised unless you specifically ask for an increase.

Requesting a Higher Limit

Many card issuers allow existing accountholders to request a credit limit increase The process is usually simple, You can submit a request online or call their customer service number The issuer will then conduct a hard inquiry and review your creditworthiness,

However a request does not automatically mean your limit will be raised. The company may deny it if they feel you are at risk of taking on too much debt. Having existing balances close to your limits late payments or other negative marks on your credit report can result in a denial.

Making a Security Deposit

While a request may or may not be approved, some credit card companies give you the option to add money to your account to increase your credit limit.

With this arrangement, your credit limit is directly tied to the security deposit you provide. The more money you deposit, the higher your limit can potentially be. Many card issuers allow deposits between $200 and $5,000. Once you deposit money, your credit limit will be increased by that amount.

The deposit is held by the issuer as collateral in case you default on the account. It is not applied towards your balance. You still have to make your monthly payments as required. While the funds are on deposit, they may earn a small amount of interest.

If you eventually close the credit card account after making a deposit, the card company will refund your deposit. Allow 2-4 weeks to receive a check.

Pros of Adding a Security Deposit

-

Quick and guaranteed way to increase your credit limit. Requesting a credit limit increase can take time and may be denied. Depositing money immediately raises your limit.

-

Improve your credit utilization ratio. A higher credit limit can help keep your utilization low. This has a positive impact on your credit scores.

-

Build your credit. Using the card responsibly demonstrates you can handle more available credit. This helps establish a positive credit history.

-

Earn interest on the deposit. The deposited funds may earn a small APY. This provides a bit of return while they are held by the card issuer.

Cons of Adding a Security Deposit

-

You lose access to the deposited funds. You cannot spend or withdraw the money while the bank holds it as collateral.

-

There may be fees. Some card issuers charge fees to process security deposits. They may also deduct fees from your deposited amount.

-

You can overspend. Having a higher limit provides more room to overspend if you are not careful about your budgeting. Use discipline.

-

Repayment is still required. Depositing money does not negate your responsibility to pay your statement balances. Failing to do so results in interest and penalties.

Tips for Adding a Security Deposit

-

Only deposit what you need to raise your limit to a utilization level you are comfortable with. Don’t tie up funds unnecessarily.

-

Be conservative with spending on the card. Treat the higher limit carefully.

-

Make payments on time and in full each month. This demonstrates responsibility.

-

Ask for deposit refunds promptly when closing accounts. Don’t let funds remain on deposit unnecessarily.

-

Consider rewarding credit cards that offer sign-up bonuses equal to or greater than your planned deposit amount.

The Bottom Line

Adding money to your credit card account to increase your credit limit can be an effective strategy. It provides an instant and guaranteed way to raise your limit compared to requesting an increase that may be denied. Just be sure to budget carefully and spend responsibly with the higher limit. Maintain good account habits, and the higher limit can help improve your credit standing over time.

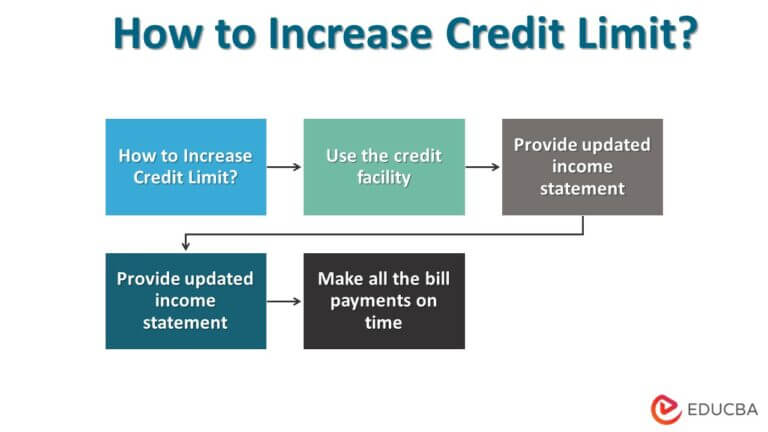

Tips for increasing your credit limit

Getting approved for a credit limit increase can depend on your personal situation. Here are a few things that may improve your chances.

Keep your financial and personal information up to date

Federal regulations require that credit card issuers use up-to-date income information when considering an account for a credit limit increase. Check your account details at least once a year to make sure theyâre up to date. Your issuer may want to know information like your total annual income, employment status, and monthly rent or mortgage payment.

How to Get a HUGE Credit Limit Increase EVERYTIME on Your Capital One Credit Cards (NO HARD PULL)

FAQ

Can you add money to your credit card to increase the limit?

Credit card issuers may have different requirements for when you can increase a secured credit card’s limit. For example, some may allow you to raise your credit limit by making an additional security deposit. Others may increase your credit limit after a certain number of on-time payments.

Can I increase my credit limit by overpaying?

No, overpaying your credit card will not increase your credit limit.

Can I put more money than my limit on my credit card?

Never say never. You can definitely go over your limit to an undisclosed point on a single transaction. Once you’re over the limit, you generally can’t charge anything additional to the card.

What happens if I add money to my credit card?

By “adding” money to your credit card, whether via ATM or at a bank branch, you’re really just paying off part of your balance, which increases your available funds.

Should I increase my credit limit?

Increasing your credit limit can be a helpful move after you’ve started earning more money, as your finances will have more flexibility. Say you typically put $500 per month on your credit card, and your credit limit is $1,000. Your credit utilization is 50%, which is above the recommended 30%.

Does a credit limit increase affect your credit score?

Your credit utilization ratio is one of the major factors used in calculating your credit score. And since a credit limit increase means an increase in your total available credit, it may raise your credit score. However, the type of inquiry your card issuer uses before approving your credit line increase may temporarily lower your credit score.

How do I request a credit limit increase?

All you have to do is log into your account on the issuer’s website or mobile app. Here, you may find an option to request a credit limit increase. If so, select this option and enter any information you’re prompted to update, such as your annual income, employment status and monthly housing payment.

How long does it take to get a credit limit increase?

And remember, policies for credit limit increases differ from issuer to issuer. If you are eligible for a credit limit increase, your request may be approved immediately. But sometimes requests can take a few days to review. And sometimes your issuer may ask for additional information before it approves your request.

Why should I increase my credit card limits today?

The higher your credit score, the more favorable the terms and lower the interest rates on your future credit cards and loans. Understanding how to increase your credit card limits today could result in cost savings down the road when applying for new credit cards, mortgages or auto loans.

Can I increase my credit limit without a credit inquiry?

While some lenders will grant a credit limit increase without performing a credit inquiry, others may do a hard pull before approving your credit limit increase. A hard credit inquiry may lower your credit score by as much as 10 points, and hard credit inquiries can remain on your credit report for up to two years, per FICO.