Are you approaching 62 and wondering if you can tap into that IRA you’ve been building for years? I’ve got good news for you – yes, you absolutely can cash out your IRA at age 62! But before you rush to make that withdrawal, there are some important things you should understand about the process, potential taxes, and how it might affect your retirement plans.

The Short Answer

Yes, you can cash out your IRA at age 62. Once you reach the magical number 2059, the IRS lets you take money out of your traditional IRA without having to pay the dreaded 2010 early withdrawal penalty. However, just because you can doesn’t always mean you should. Let’s dive deeper into what you need to know.

Understanding IRA Withdrawals: The Basics

IRAs (Individual Retirement Accounts) are tax-advantaged accounts designed to help you save for retirement They come in two main flavors – Traditional IRAs and Roth IRAs – and each has different rules when it comes to withdrawals

Traditional IRA Withdrawal Rules

When withdrawing from a Traditional IRA at age 62, here’s what you need to know

- No Early Withdrawal Penalty: Since you’re over 59½, you won’t face the 10% early withdrawal penalty

- Income Tax Applies: You will have to pay ordinary income tax on your withdrawal amount

- Potential Tax Bracket Impact: Large withdrawals could push you into a higher tax bracket

- State Taxes May Apply: Depending on where you live, you might owe state income taxes too

Charles Schwab’s website says, “You can take money out of your IRA at any time after age 59½, but you’ll have to pay income taxes on some or all of it.” “.

Roth IRA Withdrawal Rules

If you have a Roth IRA, the rules are a bit different and potentially more favorable:

- Tax-Free Withdrawals: If your Roth IRA has been open for at least five years and you’re over 59½, withdrawals (including earnings) are completely tax-free!

- No Mandatory Distributions: Unlike Traditional IRAs, Roth IRAs don’t require minimum distributions at any age

For Roth IRAs, the rules state that your withdrawals are tax-free if:

- You’ve owned the Roth IRA for at least five years, AND

- You’re at least 59½ years old when taking the money out

Tax Implications of Cashing Out Your IRA at 62

Everyone loves talking about taxes, right? If you cash out your IRA at age 62, there may be big tax consequences:

For Traditional IRAs:

- Ordinary Income Tax: The entire withdrawal amount gets added to your taxable income

- Higher Tax Bracket: A large withdrawal could push you into a higher tax bracket

- Potential Tax Shock: Many people underestimate how much they’ll owe in taxes

Let’s say you take out $50,000 from your traditional IRA and make another $40,000 from other sources. That’s $90,000 in taxable income for the year. This could significantly impact your tax situation!.

For Roth IRAs:

- Generally Tax-Free: As long as you’ve had the account for 5+ years and are over 59½

- No Tax Impact: Withdrawals won’t affect your tax bracket

Should You Cash Out Your IRA at 62?

Just because you can cash out your IRA at 62 doesn’t mean it’s the best financial move. Here are some things to consider:

Potential Downsides

- Reduced Retirement Savings: Taking money out early means less compound growth over time

- Tax Consequences: Potentially significant tax hit, especially with Traditional IRAs

- Less Future Income: Smaller nest egg means less income throughout retirement

- Lost Investment Growth: Money withdrawn no longer grows tax-deferred or tax-free

When It Might Make Sense

There are situations where cashing out at 62 could be reasonable:

- Bridge to Social Security: If you need income until you claim Social Security

- Health Issues: Medical expenses that exceed other available resources

- Debt Reduction: Paying off high-interest debt that’s costing more than your IRA is earning

- Major Planned Expenses: Like purchasing a retirement home

Alternative Options to Consider

Before cashing out your entire IRA, consider these alternatives:

- Partial Withdrawals: Take only what you need, leaving the rest to grow

- 72(t) Distributions: If you’re under 59½, this might help avoid penalties

- Roth Conversion: Consider converting some Traditional IRA funds to Roth before withdrawing

- Other Income Sources: Tap non-retirement accounts first

I always tell my clients to look at their entire financial picture before making IRA withdrawals. Sometimes there are better options that won’t disrupt your long-term retirement plans.

Required Minimum Distributions (RMDs)

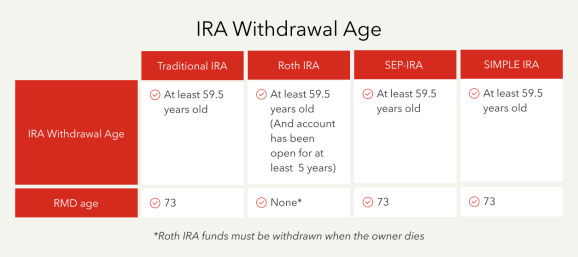

While we’re discussing IRA withdrawals, it’s worth mentioning RMDs. These don’t apply at 62, but you should be aware of them:

- Traditional IRAs: RMDs must begin at age 73 (for those who reach age 70½ after 2019)

- Roth IRAs: No RMDs required during the original owner’s lifetime

So while you can take money out at 62, you’ll eventually be required to start withdrawing from Traditional IRAs when you reach 73.

Real-Life Example

Let me share a quick example. My client Tom reached 62 and wanted to access his $400,000 traditional IRA to buy a vacation home. After we crunched the numbers, he realized that:

- Taking the full amount would add $400,000 to his taxable income

- This would push him into the highest tax brackets

- He’d lose approximately $150,000 to taxes

Instead, we developed a strategy to:

- Withdraw $50,000 per year over several years

- Keep him in a lower tax bracket

- Use some other savings for the down payment

- Finance part of the purchase

This saved him tens of thousands in taxes while still helping him achieve his goal!

Steps to Cash Out Your IRA at 62

If you’ve decided to proceed with cashing out your IRA at 62, here’s how to do it:

- Contact Your IRA Provider: Call the financial institution where your IRA is held

- Specify Withdrawal Amount: Decide if you want partial or full withdrawal

- Choose Delivery Method: Direct deposit, check, or in-kind transfer to another account

- Tax Withholding: Decide if you want taxes withheld (usually a good idea for Traditional IRAs)

- Complete Required Forms: Fill out distribution forms from your provider

- Keep Records: Save documentation for tax filing

As noted by Schwab, they offer clients several withdrawal options including “requesting a check online, writing your own checks via the IRA Check Writing feature, using Schwab MoneyLink, or transferring funds in-kind to a non-retirement account.”

Common Questions About IRA Withdrawals at Age 62

Will I pay taxes on IRA withdrawals after 60?

For Traditional IRAs, yes. As the IRS indicates, distributions are taxed as ordinary income. For Roth IRAs, no taxes apply if you’ve held the account for at least 5 years and are over 59½.

How can I avoid paying taxes on my IRA withdrawal?

For Traditional IRAs, you can’t completely avoid taxes, but you can:

- Spread withdrawals across tax years

- Make qualified charitable distributions (if over 70½)

- Time withdrawals during lower-income years

With Roth IRAs, qualified withdrawals are already tax-free!

Should I withdraw money from my IRA before 70?

This depends on your specific situation. Some people benefit from withdrawals before required minimum distributions begin at 73, especially if they’re in a lower tax bracket now than they expect to be later. Others are better off letting their funds continue to grow tax-deferred as long as possible.

Can I close my IRA and take all the money?

Yes, you can close your IRA at age 62 and take all the money. Just remember that for Traditional IRAs, the entire amount will be added to your taxable income for that year, which could result in a significant tax bill.

Final Thoughts

Cashing out your IRA at age 62 is definitely possible, but it requires careful consideration. The decision should fit within your broader retirement strategy and take into account your tax situation, other income sources, and long-term financial goals.

Before making any decisions, I strongly recommend consulting with a qualified financial advisor or tax professional who can analyze your specific situation and help you make the choice that best supports your retirement dreams.

Remember, just because you can cash out your IRA at 62 doesn’t mean you should. Sometimes the best financial decision is to leave your money invested and growing for as long as possible!

Have you considered cashing out your IRA at 62? What factors are most important in your decision? I’d love to hear your thoughts in the comments below!

Withdraw from an IRA

Your IRA savings is always yours when you need it—whether for retirement or emergency funds. This page will help you understand how your age and other things affect how the IRS handles your withdrawal before you do it.

What type of withdrawal are you making?

Youve reached the age when the IRS requires you to take money from your IRA annually. See the rules and how missing an RMD can bring stiff penalties.