Next time you drive to work or take a trip to the grocery store, take a look at all the different types of vehicles on the road next to yours. You’ll probably see a fair share of family SUVs, powerful pickup trucks, popular sedans, and maybe even a fancy sports car . . . the list goes on and on.

While we all drive vehicles that come in all kinds of shapes and sizes, we all want the same thing—a car or truck that’s reliable, meets our needs, and will take us where we need to go.

When it comes to our financial and retirement goals, investments (the financial industry sometimes calls them investment vehicles) work the same way. They can help you get closer to your ultimate destination.

Hey there! I’m thrilled to share with you the investment strategies that Dave Ramsey, one of America’s most trusted financial advisors, recommends. I’ve been following Dave’s advice for years, and his straightforward approach has helped millions of Americans get out of debt and build wealth through what he calls the “Baby Steps.”

The cool thing about Dave’s investing philosophy is that it’s not complicated at all. It’s practical, tested, and has created thousands of “Baby Steps Millionaires” – regular folks who followed his principles and built seven-figure net worths.

So, let’s dive into what Dave Ramsey actually recommends when it comes to investing!

Dave Ramsey’s Core Investment Philosophy

Before I share specific investments it’s important to understand that Dave’s investing approach is built on these key principles

- Get out of debt and save an emergency fund first

- Invest 15% of your income in tax-advantaged retirement accounts

- Invest in good growth stock mutual funds

- Keep a long-term perspective and invest consistently

- Work with a financial advisor

Let me break these down for ya…

First Things First: Follow the Baby Steps

Dave is adamant that you shouldn’t start investing until you’ve

- Paid off all debt except your house (Baby Step 2)

- Built a fully funded emergency fund of 3-6 months of expenses (Baby Step 3)

Why? Because your income is your most important wealth-building tool! If your money is tied up in monthly debt payments, you can’t build wealth effectively. Dave compares this to trying to run a marathon with your legs tied together – not gonna work so well!

Also, without an emergency fund, you might end up tapping into retirement investments when unexpected expenses come up, totally wrecking your financial future

Invest 15% in Retirement Accounts (Baby Step 4)

Once you’ve knocked out debt and saved your emergency fund, Dave recommends investing 15% of your household income for retirement. This is where the fun begins!

Dave suggests using tax-advantaged accounts in this specific order:

The Order of Operations for Retirement Investing

Dave uses this simple formula: Match beats Roth beats Traditional

- First: Contribute enough to get the full employer match in your 401(k), 403(b), or TSP. That’s free money!

- Second: Max out Roth options – either a Roth 401(k) at work or a Roth IRA

- Third: If you haven’t hit 15% yet, go back to your traditional 401(k)/403(b)/TSP

A little interesting fact: According to Dave, about 8 out of 10 millionaires invested in their company’s 401(k), and 3 out of 4 also invested outside company plans. So don’t underestimate those “boring” workplace retirement plans!

What Specific Investments Dave Recommends

Now for the million-dollar question (literally): What exactly does Dave Ramsey recommend investing in?

The answer is simple: growth stock mutual funds.

Dave recommends spreading your investments equally across these four types of mutual funds:

1. Growth and Income Funds (25%)

- Also called large-cap or blue-chip funds

- Invest in big, established American companies

- Create a stable foundation for your portfolio

- Lower risk, moderate returns

2. Growth Funds (25%)

- Sometimes called mid-cap or equity funds

- Focus on medium-sized U.S. companies with growth potential

- Moderate risk and returns

- Performance tends to follow overall market trends

3. Aggressive Growth Funds (25%)

- Invest in smaller companies with high growth potential

- Higher risk but possibility of higher returns

- More volatile than the other categories

- The “wild child” of your investment portfolio

4. International Funds (25%)

- Invest in large companies outside the U.S.

- Provides geographical diversification

- Different from global funds (which include U.S. stocks)

- Helps spread risk beyond American markets

Why Dave Only Recommends Mutual Funds

You might wonder why Dave doesn’t recommend individual stocks, bonds, real estate investment trusts (REITs), cryptocurrency, or other investments. Here’s why:

- Diversification: Mutual funds instantly spread your money across many companies

- Professional management: Fund managers do the research and decision-making

- Reduced risk: Not putting all your eggs in one basket

- Proven track record: Long-term returns of around 10-12% historically for the stock market

- Simplicity: Easy to understand compared to more complex investments

Dave specifically avoids recommending single stocks because they carry too much risk. If one company tanks, so does your investment.

How to Choose Good Mutual Funds

When picking mutual funds, Dave suggests looking for these characteristics:

- Long-term track record: At least 10 years of strong returns

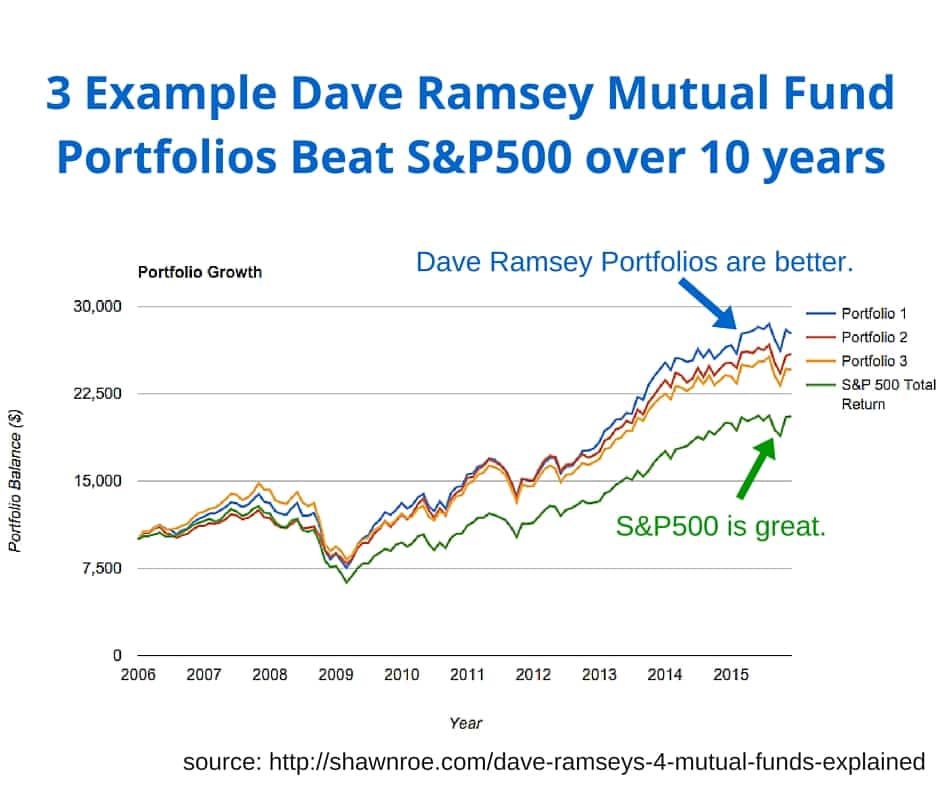

- Consistent performance: Funds that outperform the S&P 500

- Experienced management: Fund managers with proven expertise

- Sector diversity: Coverage across multiple business sectors

- Reasonable fees: While fees matter, don’t get overly fixated on them

Some questions to ask when evaluating a fund:

- How much experience does the fund manager have?

- Does the fund cover multiple business sectors?

- Has it outperformed similar funds over the past decade?

- What are the associated costs?

- How frequently are investments bought and sold within the fund?

The Importance of Long-Term Perspective

Dave is a huge proponent of the buy-and-hold strategy. He compares the stock market to a roller coaster – there will be ups and downs, but only people who jump off before the ride ends get hurt.

Remember that the historical average annual return of 10-12% is just that – an average. Some years will be great, others not so much. The key is to:

- Stay invested during market downturns

- Don’t panic sell when things look bad

- Keep investing consistently regardless of market conditions

- Focus on your savings rate rather than chasing returns

Dave emphasizes that your savings rate (how much and how often you save) is the top indicator of investment success – even more important than picking the perfect funds.

Work with a Financial Advisor

Dave strongly recommends working with a good financial advisor or investment professional. While many people think they can DIY their investments, having a pro in your corner brings several benefits:

- Expert guidance based on years of experience

- Help staying the course during market volatility

- Assistance in selecting appropriate funds

- Support in meeting your retirement goals

Dave offers a service called SmartVestor to help people find investment pros in their area who share his philosophy.

What Dave Ramsey Does NOT Recommend

Just as important as knowing what Dave recommends is understanding what he advises against:

❌ Individual stocks

❌ Day trading or market timing

❌ Cryptocurrency

❌ Gold, silver, and precious metals

❌ Whole life insurance as an investment

❌ Variable annuities

❌ Real Estate Investment Trusts (REITs)

❌ Bonds (as a primary investment strategy)

❌ Target date funds (he prefers his four-fund approach)

Final Thoughts on Dave Ramsey’s Investment Recommendations

I think what makes Dave’s investment approach so powerful is its simplicity and consistency. It’s not about getting rich quick or making complex moves – it’s about steady progress over time.

To summarize Dave Ramsey’s investment recommendations:

- Get your financial house in order first (debt-free with emergency fund)

- Invest 15% of income for retirement

- Use tax-advantaged accounts (401(k), Roth IRA)

- Invest in a mix of growth stock mutual funds

- Stay in it for the long haul

- Work with a trusted professional

If you follow these principles consistently over time, you’ve got a solid shot at joining those “Baby Steps Millionaires” Dave talks about. As he often says, building wealth isn’t complicated – it just takes discipline and patience.

Have you started following Dave’s investment strategy yet? I’d love to hear about your experience in the comments!

Real Estate Investment Trusts (REITs)

REITs are basically mutual funds that own or finance real estate. Like mutual funds, REITs sell shares to investors and use that money to buy and manage properties within the fund. REITs generally make money for their investors in several ways, including rent payments, appreciation of property values, and strategically buying and selling properties for a profit.

REITs have made a lot of progress as a legitimate way to invest in real estate over the past decade, and they can be especially appealing if you’re not interested in managing your own rental properties and you’ve already maxed out your tax-advantaged retirement accounts—like your 401(k) and Roth IRA.

Fixed annuities are complex accounts sold by insurance companies and designed to deliver a guaranteed income for a set number of years in retirement.

We don’t recommend annuities because they’re often expensive and charge penalties (called a surrender charge) if you need to get to your money during the first few years after you buy one.

Variable annuities don’t offer the same guaranteed payments that fixed annuities offer. Instead, they’re basically mutual funds stuffed inside an annuity, which means your payments in retirement will depend on the mutual funds’ performance. That’s what makes them variable.

While variable annuities do give you an additional tax-deferred option for mutual fund investing if you’ve already maxed out your 401(k) and IRA savings accounts, you lose a lot of the growth potential because annuities have so many fees that eat away at that growth. And VAs also have surrender charges.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Ramsey Solutions is a paid, non-client promoter of participating pros.

When done the right way, real estate could become one of the most important investment vehicles in your portfolio. Whether you’re purchasing your own home, saving up to buy a rental property, or plan to flip houses like one of those HGTV power couples, owning real estate can be a great way to build wealth.

According to the Federal Housing Finance Agency, home prices have increased each year by 4.2% on average since 2000 (and since 2013, the average rate of growth has been 6.4%).3

But keep in mind that owning real estate isn’t for the faint of heart. It takes work to handle the responsibilities of owning a rental property—from ongoing maintenance, emergency repairs and insurance to finding the right renters who’ll pay on time and won’t burn the place down. Plus, flipping homes is a lot less glamorous than they make it seem on TV.

A lot of people get way too excited about the potential to make money in real estate. They go deep into debt in a desperate attempt to get rich quick as a real estate mogul, only to end up broke . . . don’t do that! If you’re going to invest in real estate, start small, wait until you’re debt-free (including your home), and max out your retirement accounts. Then, pay for your properties in cash, stay local, and work with a real estate agent to help you find the right property for your situation.

How Should I Start Investing?

FAQ

What are the 4 funds Dave Ramsey recommends?

The best way to invest in mutual funds is to have these four types of mutual funds in your investment portfolio: growth and income (large cap), growth (medium cap), aggressive growth (small cap), and international. This will help spread your risk and create a stable, diverse portfolio.

What is Dave Ramsey’s 8% rule?

What if I invest $1000 a month for 5 years?

If you would have invested ₹1,000 per month for 5 years at a conservative 10% p.a. return, you could have accumulated around ₹77,437 today. If you would have consistently invested ₹1,000 per month for 10 years, you could have accumulated a corpus of around ₹2,04,845 today (assumed returns of 10% p.a.).