This content may include information about products, features, and/or services that SoFi does not provide and is intended to be educational in nature.

Stocks can lose all of their value, or fall all the way to zero. When that happens, they’re effectively worthless, and in all likelihood, the company will declare bankruptcy. It’s possible that investors lose their investment, in that case.

Sometimes when a stock goes down in value it can present an investment opportunity, but in other cases the stock could fall to zero and never recover. In the latter case, it may benefit investors to sell before the stock price falls all the way down to zero.

• Margin trading or short selling can result in additional financial losses for investors beyond the initial investment.

Have you ever checked your investment account only to see those dreaded red numbers? It’s a gut-wrenching feeling that makes you question all your financial decisions. I’ve been there too, and lemme tell you – it’s not fun. But understanding what actually happens when your stocks lose value can help you make better decisions when facing losses. Let’s dive into the nitty-gritty of stock losses and what they really mean for investors like us.

The Reality of Stock Losses: More Common Than You Think

First things first – stocks going down isn’t some rare disaster. It’s actually super normal in investing. Even the most successful investors experience losses. The market goes up and down all the time, and individual stocks can be even more volatile.

When we talk about a stock “losing money,” we’re typically referring to its market value dropping below what you paid for it This creates what investors call a “paper loss” – meaning you haven’t actually lost real money until you sell the shares at that lower price.

What Actually Drives Stock Price Changes?

Before panicking about losses, it’s important to understand why stock prices change in the first place. According to Investopedia, stock prices are fundamentally determined by the relationship between supply and demand

- High demand = rising prices

- Low demand = falling prices

Several factors influence this supply/demand relationship

- Company fundamentals: Is the company profitable? Growing? Struggling?

- Industry trends: Is the entire sector facing challenges?

- Market sentiment: Are investors feeling optimistic or fearful?

- Economic conditions: Inflation, interest rates, employment figures

- Company-specific news: Earnings reports, leadership changes, scandals

Different Types of Stock Losses

Not all stock losses are created equal. Here’s a breakdown of the different scenarios you might experience:

Temporary Dips vs. Fundamental Problems

Sometimes stocks drop temporarily due to market volatility or short-term news that doesn’t actually affect the company’s long-term prospects. Other times, losses reflect genuine problems with the business that could lead to prolonged or permanent value destruction.

Partial Losses vs. Complete Loss

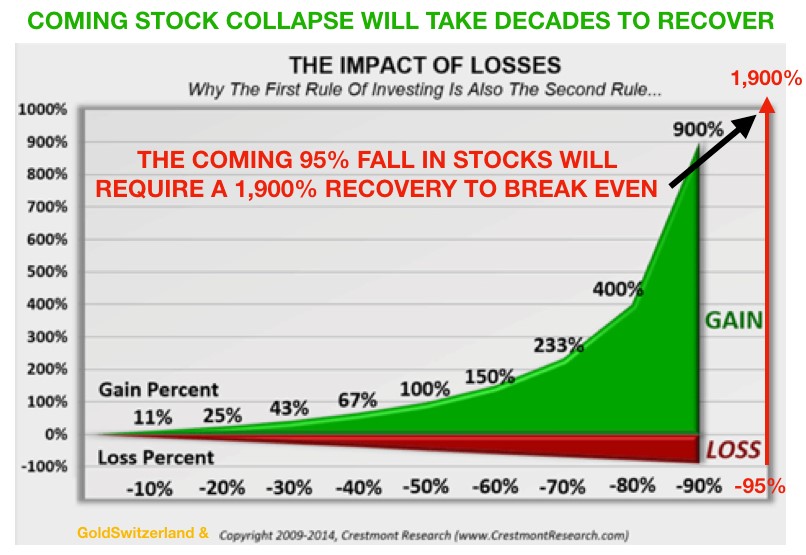

In most cases, stock losses are partial – your investment might be down 10%, 20%, or even 50%, but still worth something. However, in extreme cases like bankruptcy, a stock can actually lose ALL its value and become worthless.

As explained by Investopedia:

“When a company declares bankruptcy, it doesn’t automatically mean it’s absolutely worthless. The company can still hold assets that could be sold, brand recognition, and skilled employees.”

But if the company can’t restructure successfully, and all assets go to creditors like banks and bondholders, common stockholders often end up with nothing.

The Real Impact of Stock Losses on Different Investors

The effect of stock losses varies dramatically depending on your investment position:

For Long Position Investors (Most Regular Investors)

If you own stocks the traditional way (a “long position”), losses directly reduce your portfolio value. A complete loss would mean losing 100% of your investment in that particular stock.

For example, if you bought $1,000 worth of shares in Company X, and the stock drops to zero, you’ve lost your entire $1,000 investment.

For Short Position Investors

On the flip side, if you’ve taken a “short position” (an advanced strategy where you essentially bet against a stock), you actually benefit from the stock losing value. A complete loss for the stock would represent a 100% gain for your short position.

This is why Investopedia cautions:

“If you are uncertain about whether a stock can lose all its value, it is probably not advisable to engage in the advanced practice of short selling securities. Short selling is a speculative strategy and the downside risk of a short position is much greater than that of a long position.”

Real-World Example: When Stocks Go to Zero

To understand how a stock can completely collapse, consider the infamous Enron case. Once a high-flying energy company with shares worth $90.75 in 2000, Enron’s stock plummeted to just $0.26 before declaring bankruptcy in December 2001 after massive accounting fraud was uncovered.

This dramatic collapse happened relatively quickly once the truth about the company’s finances came to light, leaving shareholders with essentially worthless investments.

What You Should Do When Your Stocks Lose Money

Alright, so your stocks are down. What now? Here are some practical steps to consider:

1. Don’t Panic – Assess the Situation

First, take a deep breath. Not all stock losses are catastrophic. Ask yourself:

- Is this a market-wide decline or specific to this stock?

- Has something fundamentally changed about the company?

- Is this likely temporary or a sign of deeper problems?

2. Consider Your Investment Timeline

Your reaction should differ based on when you need the money:

- Long-term investors (5+ years): Temporary losses matter less; might be time to hold or even buy more if the company remains fundamentally sound

- Near-term needs: If you need the money soon, you might need to make tougher decisions about cutting losses

3. Evaluate Your Options

You basically have three choices:

- Hold: Wait for a potential recovery

- Buy more: If you believe in the company, this could lower your average purchase price

- Sell: Accept the loss and move your remaining capital elsewhere

4. Learn from the Experience

Every loss contains a lesson. Maybe you:

- Didn’t diversify enough

- Invested in something you didn’t fully understand

- Let emotions drive your decisions

- Ignored warning signs about the company

Tax Implications of Stock Losses

Here’s a silver lining – stock losses can actually help reduce your tax bill:

- Capital loss tax deduction: You can offset capital gains with capital losses

- Excess losses: If your losses exceed gains, you can deduct up to $3,000 against ordinary income

- Loss carryforward: Any unused losses can be carried forward to future tax years

This is one reason why some investors practice “tax-loss harvesting” – strategically selling losing positions to offset gains elsewhere in their portfolio.

How to Protect Yourself From Major Stock Losses

While no investment is risk-free, there are several strategies to limit your exposure to devastating losses:

Diversification Is Your Best Friend

Don’t put all your eggs in one basket! Spread your investments across:

- Multiple companies

- Different industries

- Various asset classes (stocks, bonds, real estate, etc.)

- Geographic regions

As Investopedia notes:

“The best way to ensure that you don’t experience massive losses in stocks is to be well-diversified, research the holdings you invest in, and set thresholds to the downside whereby you will cut your losses and exit positions.”

Do Your Homework

Investing in companies you don’t understand is like gambling. Before buying:

- Research the company’s business model

- Understand how they make money

- Review financial statements

- Consider competitive advantages and threats

Consider Setting Stop-Loss Orders

A stop-loss order automatically sells your stock if it falls to a certain price, limiting your potential losses. However, these aren’t perfect – in fast-moving markets, your execution price might be lower than your stop price.

Remember the Power of Dollar-Cost Averaging

Rather than trying to time the market perfectly, consider investing fixed amounts regularly. This can reduce the impact of volatility and potentially lower your average purchase price during down periods.

Common Questions About Stock Losses

Can a Stock Go Negative?

No. While a company can have more debts than assets (negative net worth), stock prices can only fall to zero, not below. As Investopedia explains:

“Technically, a company that has more debts and other liabilities than assets is worth a negative amount. Shares of its stock, however, would only fall to zero and would not turn negative.”

What Happens If a Stock Price Goes to Zero?

If your stock hits zero, your holdings become worthless. The stock exchange will typically delist shares that fall below certain thresholds, though they might continue trading over-the-counter (OTC) for a while.

Even in bankruptcy, there’s sometimes a small chance of recovery, which is why you might see bankrupt companies’ shares trading for pennies as speculators make high-risk bets.

Can You Lose All Your Money in Stocks?

Technically yes, but it’s rare if you’re diversified. Even if one company completely fails, it should only represent a portion of your overall portfolio. The only way to lose everything would be if every single company you invested in went bankrupt.

The Bottom Line: Losses Are Part of Investing

Let’s be real – if you’re gonna invest in stocks, you WILL experience losses at some point. It’s not a matter of if, but when and how much. What separates successful investors from unsuccessful ones isn’t avoiding losses entirely, but managing risk appropriately and responding wisely when losses occur.

Remember that historically, despite short-term volatility and occasional severe downturns, the overall stock market has trended upward over long time periods. This doesn’t guarantee future returns, of course, but provides some context for viewing temporary losses.

As an investor who’s had my share of winners and losers, I can tell you that stock losses feel terrible in the moment but often look different with the perspective of time. Some of my best investment decisions came after painful losses taught me valuable lessons.

So next time you see red in your portfolio, take a deep breath, assess the situation rationally, and make decisions based on your long-term financial goals rather than short-term emotions. Your future self will thank you.

How Low Can a Stock Go?

Stock prices can fall all the way down to zero. That means the stock loses all of its value and a shareholder’s earnings are typically worthless. In this case, the investor loses what they invested in the stock.

Companies With Weak Business Models

Even if a stock is currently performing well, it may fall in the future if the business model is fundamentally flawed. For this reason, many investors prefer to research a company’s practices, team composition, and business model before investing in its stock.

Stocks that trade below $5 are known as penny stocks. These low price stocks tend to be very volatile, as the companies that issue them have low or no profit.

Sometimes penny stocks can even turn out to be scams.

Rather than selling stocks when the market declines, some investors believe it can be a good idea to buy while the market is low. By buying the dip, as it’s known, investors pay less for stocks.

And, since these stocks still have the potential to go up in value as the market recovers after the decline, they can be preferred by long-term investors who may have more time to let their portfolio go back up in value.

However, if a company is going bankrupt or otherwise likely to fall to zero, it’s unlikely to offer a strong return on investment.

It’s also very difficult to time the market, so a trader might buy in when they think the market has hit bottom, only to watch it continue to go down.

Generally, building a diversified portfolio can offer higher returns on average over time than trying to time the market based on shorter-term trends or dips.