Though pensions come in two types—defined-contribution and defined-benefit—the most common type of traditional pension is the defined-benefit plan. During an employees working years, the employer contributes to the plan. (With a defined-contribution plan, the employee does, too. ) After the employee retires, they receive monthly benefits for the rest of their life from the plan. Their benefits are based on a percentage of their average salary over their highest-earning years of employment. The formula also takes into account how many years they worked for their employer.

Have you ever wondered who actually owns all that money sitting in pension plans? If you’re like me you’ve probably assumed that the money you’ve earned in your pension belongs to you. But the reality is much more complicated than that. Let’s dive into this confusing yet fascinating topic of pension asset ownership.

The Basic Structure of Defined-Benefit Pension Plans

One of the most common traditional ways to save for retirement, especially in the public sector, is through defined-benefit pension plans. When people retire under these plans, they get monthly benefits based on

- A percentage of their average salary (usually from their final working years)

- The length of time they worked for the organization

- A predetermined formula

For example, a pension might pay 1% of an employee’s annual salary for each year of service, multiplied by their average salary from their last five years of employment. So if someone worked at a company for 35 years with a final average salary of $50,000, they’d receive about $17,500 per year in retirement.

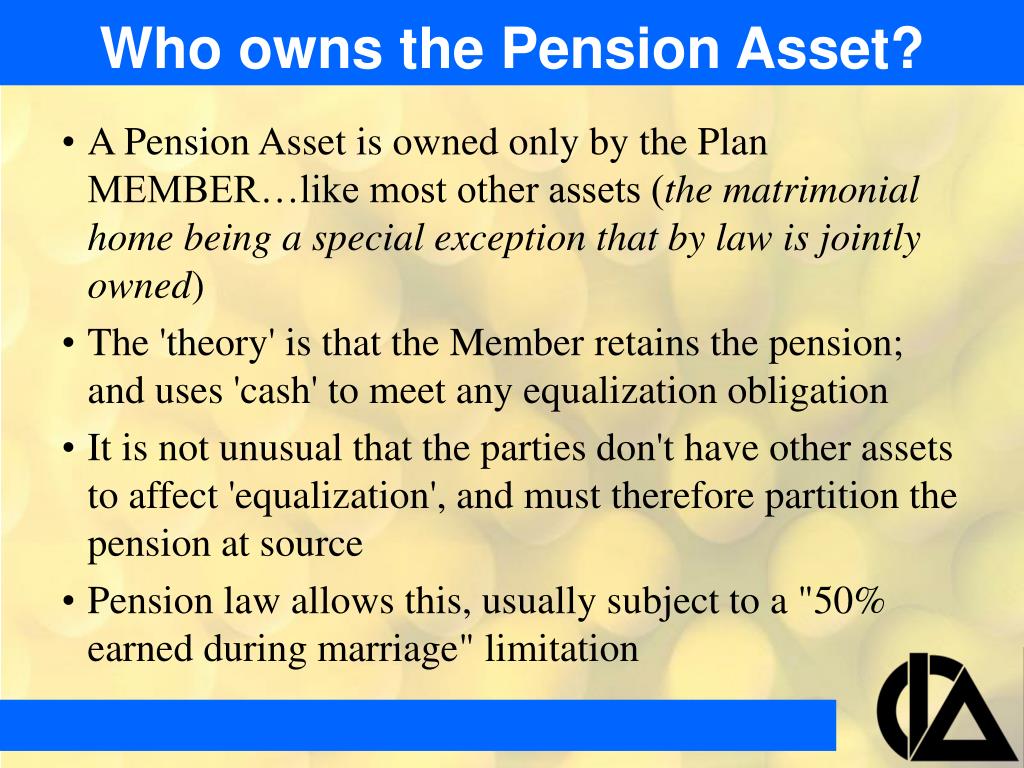

But here’s where things get tricky: who owns the assets that are being used to pay for these payments?

The Ownership Question: It’s Complicated

The answer to who owns pension assets isn’t straightforward. There are two main perspectives:

1. The Augmented Balance Sheet Model

According to this model, stockholders own the assets in the pension plan. The pension is viewed as part of the company’s overall financial picture, despite being a separate legal entity from the corporation itself.

2. The Group Model

This different point of view says that pension assets are owned by both employees and stockholders. The ownership is mostly up for discussion between these people.

As one pension expert explained to me, “Think of pension ownership as being similar to the ownership of a house with a mortgage – technically the bank has a claim on the property, but you also have ownership rights. Pension ownership has similar overlapping claims.”

Factors Affecting Pension Asset Ownership

Several elements complicate the ownership question:

Separate Legal Entity Status

Pension plans are structured as separate legal entities from the sponsoring company. This separation creates a legal distinction between the company and the pension fund.

Corporate Responsibility

Despite this separation, the corporation remains ultimately responsible for ensuring that promised benefits get paid to employees. If the pension fund runs short, the company must make up the difference.

ERISA Protection

The Employee Retirement Income Security Act (ERISA) of 1974 governs private pension plans and provides some protection through the Pension Benefit Guaranty Corporation (PBGC). This federal agency ensures workers receive at least some retirement benefits if their employer goes bankrupt or terminates its pension plan.

Public vs. Private Pensions

It’s not ERISA that governs public pension plans for government workers. Instead, it’s state laws and sometimes even state constitutions. Since the PBGC doesn’t cover public plans, taxpayers usually pay if a public employee plan doesn’t do what it’s supposed to do.

How Pension Asset Valuation Works

Understanding pension ownership also requires understanding how these assets are valued:

Present Value Method

The most accurate way to value a defined-benefit pension plan is based on the present value of benefits promised to employees – not just what’s been accrued to date. This reflects the true long-term obligations.

Complicating Factors in Valuation

Several factors make valuing pension assets challenging:

- Vesting schedules: Employees may not be fully vested in their benefits until they’ve worked a certain number of years

- Early retirement provisions: Options for retiring early with reduced benefits affect valuation

- Lump sum distributions: Some plans allow employees to take benefits as a lump sum rather than monthly payments

- Ad hoc benefit increases: Companies may occasionally increase benefits for retirees, changing the valuation

The Bargaining Power Dynamic

The ownership of pension assets ultimately comes down to a negotiation between employees and the firm:

- Employees have bargaining power due to their firm-specific human capital (the specialized skills and knowledge they’ve developed within the company)

- The firm has bargaining power because it controls the pension plan assets

This negotiation dynamic means that ownership is rarely absolute but instead exists on a spectrum depending on the specific agreement between the company and its workers.

Practical Implications of Pension Asset Ownership

So what does all this mean for actual pension participants and companies?

For Pension Participants

- You don’t technically “own” your pension in the same way you own your personal bank account

- Your benefits are protected by laws and regulations, but the actual assets remain under the control of the pension fund

- In case of company bankruptcy, PBGC insurance provides some protection for private pension participants (with limits)

For Companies

- Pension assets are considered in the company’s overall financial position

- Companies must ensure pension funds remain solvent to meet obligations

- Pension underfunding can become a significant financial liability

Types of Pension Plans and Their Ownership Structures

Different pension plans have varying ownership structures:

Single-Employer Plans

These are pension plans maintained by one employer. The company has more direct control over the assets, though they’re still legally separate from corporate assets.

Multi-Employer Plans

These plans typically include unionized employees who may work for multiple employers. Ownership is even more complex here as multiple companies contribute to a shared pool of assets.

Public Pension Plans

Government pension plans like CalPERS (California Public Employees Retirement System) are typically larger than private plans and offer more generous benefits. The assets are owned by the government entity but held in trust for employees.

How Pension Funds Invest Their Assets

Pension funds are major players in global financial markets. They invest in:

- Private equity

- Real estate

- Infrastructure

- Securities like gold (as inflation hedges)

- Traditional stocks and bonds

These investment decisions affect both the security of promised benefits and the ultimate question of who truly controls and benefits from the assets.

The Bottom Line: Shared Ownership with Protections

If I had to give a simple answer to the question of pension asset ownership, I’d say this: Pension assets exist in a state of shared ownership with legal protections. The company, the pension plan itself, and the beneficiaries all have certain rights and claims to the assets, but none has absolute ownership.

Think of it as a trust relationship – the assets are held in trust for the benefit of participants but managed by the pension plan administrators with corporate oversight.

Final Thoughts

Understanding who owns pension assets is more than an academic question – it affects retirement security for millions of workers. As defined-benefit pensions become increasingly rare in the private sector, these ownership questions remain relevant primarily for public sector employees and those fortunate enough to still have traditional pension coverage.

The most important thing for pension participants to understand is that while you may not directly “own” your pension assets, legal frameworks exist to protect your interests and ensure you receive the benefits you’ve earned through your years of service.

Have you ever considered how pension ownership might affect your retirement planning? I’d love to hear your thoughts in the comments below!

How Pension Plans Are Regulated and Insured

Private pension plans come in two main types: single-employer plans and multi-employer plans. Multi-employer plans usually cover unionized workers who may work for more than one company.

Both types of private plans are subject to the Employee Retirement Income Security Act (ERISA) of 1974. It aimed to put pensions on a more solid financial footing and also established the Pension Benefit Guaranty Corporation (PBGC).

The PBGC acts as a pension insurance fund: Employers pay the PBGC an annual premium for each participant, and the PBGC guarantees that employees will receive retirement and other benefits if the pension fails and cannot be paid.

However, the PBGC wont necessarily pay the full amount retirees would have received had their plans continued to operate. Instead, it pays up to certain maximums, which can change from year to year.

The most that a 65-year-old retiree in a single-employer plan will get in 2024 if they take their benefit as a straight life annuity is $7,107. 95 per month. Multi-employer plans have different ways of figuring out benefits. For example, someone with 30 years of service can get up to $12,870 a year.

ERISA does not cover public pension funds, which instead follow the rules established by state governments and sometimes state constitutions. The federal government also operates pensions for its employees which are regulated as well. Nor does the PBGC insure public plans. In most states, taxpayers are responsible for picking up the bill if a public employee plan is unable to meet its obligations.

What Is a Pension?

A pension is a type of defined-benefit plan. An employer guarantees a set payout in retirement based on a formula that typically takes the employees years of service and highest-earning years into account.

What Percentage Of The Stock Market Is Owned By Pension Funds? – AssetsandOpportunity.org

FAQ

Who owns the assets of a pension scheme?

A trustee is a person or business that holds assets in trust for the scheme’s beneficiaries and does not work for the employer. Trustees are responsible for ensuring that the pension scheme is run properly and that members’ benefits are secure.

Who gets the pension if someone dies?

When a member of a retirement plan dies, the benefits that person would have been entitled to are usually paid to the person who was named as the beneficiary in a way that is allowed by the plan’s rules, such as a lump sum or an annuity.

Who are the owners of a pension fund?

In the augmented balance sheet model of pension finance, the stockholders own the assets in the pension plan. In the group model, the employees and the stockholders share ownership of these assets.

Who holds pension funds?

Pension funds are owned by the employees (beneficiaries) for whom the funds are set up, though actual ownership is represented by legal structures managed by fiduciaries like pension fund trustees, employers, or professional asset managers.

How much money does a pension fund own?

As highlighted in Exhibit 1, pension funds, insurers and sovereign wealth funds represent total assets of approximately $33. 9 trillion, $24. 1 trillion, and $5. 2 trillion, respectively. Each asset owner has a choice of managing their assets directly, outsourcing to asset.

Who pays for a pension plan?

Pension plans are funded by contributions from employers and occasionally from employees. Public employee pension plans tend to be more generous than ones from private employers. Private pension plans are subject to federal regulation and eligible for coverage by the Pension Benefit Guaranty Corporation. Who is a pension fund manager?.

What is a pension fund?

Pension funds’ assets are things that were bought with money that people put into a pension plan so that the benefits of the plan can be paid. The pension fund is a pool of assets forming an independent legal entity. This indicator is measured in millions of USD or as a percentage of GDP. Can you lose your pension?.

Who owns a retirement account?

Men were slightly more likely (47.8%) than women (43.5%) to own a retirement account in 2020. There were also differences in ownership by race and Hispanic origin. About 54% of non-Hispanic White individuals owned a retirement account, and 46.8% of non-Hispanic Asian individuals owned a retirement account.

How do asset owners manage their assets?

In practice, asset owners such as pension plans, sovereign wealth funds, and insurance companies have legal ownership of their assets and make asset allocation decisions. Many asset owners manage their money directly, while others outsource management of all or a portion of their assets to external asset managers.

How are pension plans funded?

Pension plans are funded by contributions from employers and occasionally from employees. Public employee pension plans tend to be more generous than ones from private employers. Private pension plans are subject to federal regulation and eligible for coverage by the Pension Benefit Guaranty Corporation.