If you’re navigating the probate process after the loss of a loved one, working with an experienced Los Angeles probate attorney can help ensure the estate is handled properly and disputes are avoided.

An executor is the person or entity nominated in a will to administer the estate of the deceased person as directed by the will. The executor’s duties include settling the estate’s debts, selling estate property if necessary, and distributing assets to heirs and beneficiaries in accordance with the will.

The executor’s job is potentially a complex job, depending on the size of the estate. The executor is responsible for protecting the interests of the estate as it goes through probate.

It is mostly an administrative job, but the actions of an executor of the estate can impact the livelihood of those who are or should be beneficiaries of the will. When an executor of an estate goes astray, or when someone wants to help an executor protect the estate, they may need to go to court.

The trust and will inheritance lawyers at Albertson have a lot of experience. Here is a look at some issues an executor may face and what is allowed under California law.

The Short Answer: Yes, But There Are Rules

If someone is the beneficiary of a trust, they can also be the executor of an estate or a trustee. This arrangement is actually pretty common, especially in family situations. But before you choose someone to play both roles, you should know what this means legally and in real life.

As someone who has helped many families with their estate planning, I can say that these two roles can work well together if they are done right. But I’ve also seen problems that happen when people don’t fully understand their fiduciary duties.

Understanding the Key Roles

Let’s break down these different roles so we’re all on the same page:

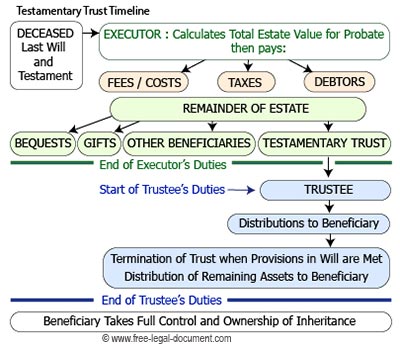

Executor: The person named in a will who manages a deceased person’s estate through the probate process. Their job includes gathering assets, paying debts and taxes, and distributing remaining property to beneficiaries according to the will.

Trustee: The person who administers assets held in a trust. They manage trust assets and make distributions according to the trust document.

Beneficiary Anyone designated to receive assets from a will or trust

Successor Trustee The person who takes over managing a trust after the original trustee (often the grantor) dies or becomes incapacitated

Why People Choose Dual Roles

It’s quite common for a parent to name their adult child as both the executor of their will and a beneficiary of their estate. Similarly many people name the same person as both successor trustee and beneficiary of a trust.

Some compelling reasons for this arrangement include:

- Trust and familiarity – The person knows your wishes and values

- Efficiency – One person handling related responsibilities can streamline the process

- Practicality – In many families, the most responsible person is also a natural beneficiary

The Fiduciary Duty Challenge

Here’s the tricky part – when someone serves as both executor/trustee and beneficiary, they take on what the law calls a “fiduciary duty.” This is the highest standard of care recognized by law.

This fiduciary duty consists of two major components:

- Duty of loyalty – Avoiding “self-dealing” or using their position to benefit themselves at the expense of the estate/trust

- Duty of impartiality – Not favoring themselves over other beneficiaries

Breaking these duties can result in personal financial liability for any losses caused.

Managing Potential Conflicts of Interest

When someone wears both hats (fiduciary and beneficiary), conflicts of interest are inevitable. Here are common examples and how to handle them:

Example 1: Personal Property Valuation

If an executor-beneficiary wants to inherit specific personal property like artwork, they face a conflict when determining its value.

Solution: Obtain a formal, independent appraisal to establish fair market value.

Example 2: Real Estate Purchase

A trustee-beneficiary wanting to purchase a home held by the trust creates another common conflict.

Solution: Be completely honest by telling all other beneficiaries and maybe asking the court to approve your actions. The terms can be looked over by a judge to make sure the sale is fair.

Differences Between Executor and Trustee Roles

While similar in some ways, these roles have distinct differences:

| Executor | Trustee |

|---|---|

| Manages estate through court-supervised probate | Manages trust assets without court supervision |

| Duties conclude once estate is settled | May manage trust for many years |

| Named in a will | Named in a trust document |

| Supervised by probate court | Answerable to trust beneficiaries |

Can the Same Person Be Both Successor Trustee and Executor?

Yes! For many people, appointing the same person to both roles makes sense. This approach can:

- Minimize expenses

- Streamline administration

- Simplify the process if assets were accidentally left outside the trust

However, there can be drawbacks depending on your specific situation and beneficiary dynamics. It’s definitely worth discussing with an estate planning attorney to weigh the pros and cons for your particular circumstances.

How to Make Dual Roles Work Successfully

If you’re considering naming the same person as both beneficiary and executor/trustee, here are some tips to make it work smoothly:

- Choose wisely – Select someone with integrity, organization skills, and good judgment

- Provide clear instructions – Leave detailed guidance about your wishes

- Consider co-fiduciaries – Name a co-executor or co-trustee for additional oversight

- Build in transparency – Require regular reporting to all beneficiaries

- Consider professional help – For complex estates, name a professional fiduciary to work alongside your beneficiary-executor

Practical Considerations for Avoiding Probate

If you set up a living trust to avoid probate, keep in mind that it will only work for assets that were properly transferred into it. Common oversights include:

- Forgetting to retitle real estate in the trust’s name

- Not updating beneficiary designations on financial accounts

- Acquiring new assets and failing to put them in the trust

Even with a trust, having a will with an executor named is still important as a backup for any assets that might have been missed in the trust funding process.

Real-World Example: How This Works in Practice

Let me share a scenario I’ve encountered in my practice:

John names his daughter Sarah as both the successor trustee of his living trust and executor of his will. Sarah is also a beneficiary, set to receive 1/3 of his estate along with her two siblings.

When John passes away, Sarah takes on both roles. As successor trustee, she manages the trust assets and distributes them according to the trust terms. She discovers John acquired a vacation property that wasn’t transferred to the trust. As executor, she handles the probate process for this property, ensuring it follows the same distribution plan as the trust assets.

Throughout this process, Sarah must be careful to:

- Get independent appraisals for assets

- Document all her actions

- Communicate transparently with her siblings

- Avoid giving herself preferential treatment

Common Questions About Dual Roles

Can an executor override a beneficiary?

No, an executor cannot override what’s in a Will. If you’re named as a beneficiary, the executor can’t cut you from the Will after the testator has died.

Do beneficiaries get a copy of the trust?

While the grantors are alive, beneficiaries aren’t legally entitled to see a copy of the trust. However, after one or both grantors die, beneficiaries and heirs generally become entitled to receive a copy of the trust document.

How long does an executor or trustee have to distribute assets?

For a trustee with no complications, the trust should typically be fully distributed within twelve to eighteen months after administration begins. Executors usually have up to one year (the “executor’s year”) before they’re legally required to distribute assets.

Final Thoughts

Having the same person serve as both beneficiary and executor/trustee can work wonderfully in many families. It’s a common arrangement that can simplify estate management and reduce costs. However, it does require careful consideration of potential conflicts and clear communication about fiduciary responsibilities.

The most important factors are choosing someone with integrity who understands their legal obligations and establishing mechanisms for transparency and accountability.

If you’re setting up your estate plan, I recommend working with an experienced attorney who can help you weigh the pros and cons of dual roles for your specific situation and family dynamics.

Remember, the goal of estate planning is to provide peace of mind and ensure your wishes are carried out with minimal complications for your loved ones. Carefully considering who serves in these important roles is a significant part of that process.

Can the executor decide someone doesn’t get what the will says?

No. The executor must abide by the will as written. The executor’s job is to carry out the last wishes of the person who died, which were written in their will and testament.

However, the executor has some flexibility to sell property or assets not designated for disbursal to a specific beneficiary if necessary to pay bills or to meet requirements of the will, such as to split the remaining assets evenly.

An heir or beneficiary who thinks the executor is not doing as the will directs or is not acting in the interest of the estate has the right to appeal to the probate court.

Such a challenge might be based on:

- Undue influence / elder abuse. Under California law, undue influence means taking away an elderly or disabled person’s freedom of choice and getting them to give money, houses, or other property to a bad person.

- Fraud. If a beneficiary lied to the person writing the will to make sure that the words of the will or trust were written in a way that would help them, the will or part of the will can be ruled invalid.

- Mistaken intent. To do this, you must show strong proof that the will doesn’t accurately reflect the wishes of the person who made it at the time it was written. The person who filed the petition must also show what the person’s real intent was.

If you believe a beneficiary has stolen from the estate, you may the seek return of what was taken through a formal complaint or petition filed with the probate court. Most of the time, stealing from an estate is handled as a civil matter. However, if the theft is very valuable or there are other unusual circumstances, the local prosecutor may decide to go after the person who did it.

Instead of filing a formal claim against a family member, people usually get their things or money back through talks or some other informal method. There is a limited amount of time to file to contest a will. If the first request to return items or money taken is turned down, you should talk to an inheritance litigation lawyer right away.

In egregious cases of theft from an estate, the petitioner might seek doubled or tripled damages, punitive damages, disinheritance of the abuser, attorney’s fees and/or costs.