In today’s uncertain world, protecting what you’ve worked hard to build isn’t just smart—it’s essential Whether you’re a business owner, medical professional, or simply someone with significant assets, understanding how to legally shield your wealth from potential creditors could save you from financial devastation

I’ve looked into the best ways to protect your assets, and I’ll tell you what really works. Come with me as I talk about ways to protect your property and hard-earned money from lawsuits and creditor claims.

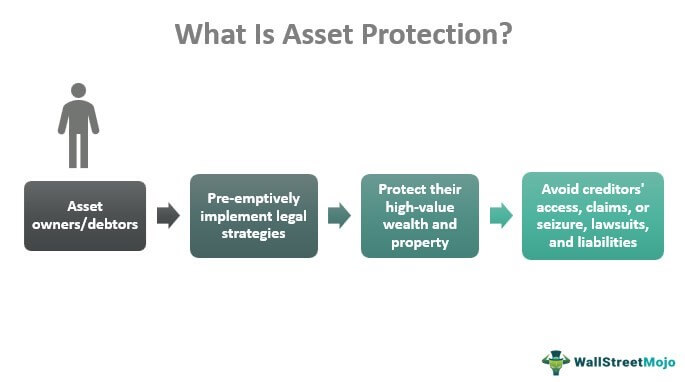

What is Asset Protection?

Asset protection is the use of legal strategies and techniques to keep your money safe from creditors, legal judgments, seizure, and people you don’t want to get it. It’s about putting up walls between your property and people who might try to take it.

Blake Harris, an asset protection lawyer in Florida, says, “There’s more than one way to skin a cat, and there are a lot of different tools that are being used to protect assets.”

The key principle to remember is that timing matters Protection strategies work best when implemented before problems arise,

“Really, the key with asset protection planning is doing it in advance, and the longer you can do it in advance of a lawsuit, the safer your assets will be,” Harris advises.

Top Asset Protection Strategies

Let’s look at the most effective ways to shield your assets:

1. Insurance Policies

One of the simplest yet most effective first lines of defense is proper insurance coverage:

-

Umbrella Coverage: This provides additional liability protection beyond your regular homeowners or auto insurance. If you’re hit with a $1 million judgment but your auto policy caps at $300,000 for injuries, an umbrella policy could cover the remaining $600,000.

-

Malpractice Insurance: Essential for medical professionals and others at risk of professional liability claims.

-

Life Insurance: Many life insurance policies are exempt from creditor claims in many states, making them a safe haven for assets.

2. Retirement Accounts

Under the Employee Retirement Income Security Act (ERISA), most creditor claims can’t hurt employer-sponsored retirement plans like 401(k)s.

IRAs offer protection too, though the level varies by state law. In most situations, creditors cannot access your retirement funds, with exceptions for things like back taxes or past-due alimony.

3. Asset Protection Trusts

There are two main types:

-

Domestic Asset Protection Trusts (DAPTs): Available in 17 states including Nevada, Alaska, and Delaware, these irrevocable trusts can shield assets from future creditors. Attorney Mark J. Kohler calls them “the most affordable asset protection tool” available in the U.S.

-

Offshore Trusts: For higher-level protection, trusts in places like the Cook Islands offer significant security. Harris explains, “This is an offshore trust which allows clients to keep beneficial ownership of their assets so they can still use and enjoy their property. But the control of the trust is held outside the United States, so that clients are not subject to losing their assets due to U.S. court orders.”

4. Limited Liability Companies (LLCs)

LLCs create separation between personal and business assets. If your business faces claims, your personal property typically remains protected.

Harris describes an LLC as “like a financial manhole cover. You can put it on top of your assets, and if something toxic occurs with those assets, that liability is not going to bubble up and affect your other assets.”

5. Asset Titling Strategies

Simply changing how assets are titled can provide significant protection:

-

Spouse’s Name: Transferring assets to a spouse’s name removes them from your creditors’ reach (though they become subject to your spouse’s creditors).

-

Tenancy by the Entirety: A special form of joint ownership for married couples that protects assets from creditors of either spouse (available in many states).

6. Homestead Exemptions

Many states offer homestead exemptions that protect your primary residence from creditors:

- Unlimited Exemption States: Places like Florida and Texas offer unlimited homestead protection.

- Limited Exemption States: Others like Massachusetts cap protection at specific amounts (e.g., $300,000).

7. Prenuptial Agreements

While primarily associated with divorce protection, prenups can also shield assets from creditors by clearly defining separate property.

8. Alternative Dispute Resolution

Including arbitration clauses in contracts can reduce lawsuit risks. A business might require employees to resolve disputes through mandatory arbitration rather than through lawsuits.

What’s the BEST Strategy?

There’s no one-size-fits-all answer, but I can tell you this: layered protection works best.

Most experts recommend combining multiple strategies based on your specific situation. For example, you might use:

- Umbrella insurance as your first line of defense

- An LLC for business assets

- A domestic asset protection trust for personal wealth

- Maximizing retirement account contributions for additional protection

As Adam Frank, Managing Director at J.P. Morgan Wealth Management, notes: “Often, people are able to achieve sufficient asset protection by employing very simple strategies.” But he adds, “You may be willing to assume the added complexity of the more sophisticated techniques for the additional creditor protection benefits that these techniques offer.”

Protection by Asset Type

Different assets require different protection strategies:

| Asset Type | Protection Strategies |

|---|---|

| Primary Residence | Homestead exemption, tenancy by the entirety |

| Investment Properties | LLC ownership, asset protection trust |

| Business Assets | LLC, corporation structure |

| Cash/Investments | Domestic or offshore trusts, retirement accounts |

| Professional Practice | Malpractice insurance, LLC structure |

Important Considerations and Warnings

Before implementing any asset protection strategy, be aware of these critical points:

Timing Matters

If you try to protect assets after a lawsuit has been filed, courts may consider it fraudulent. Protection must be established well before creditor claims arise.

Legitimate Purpose Required

Asset protection must have legitimate purposes beyond avoiding creditors. Courts can “pierce” protection structures if they appear designed purely to hinder creditors.

Not About Tax Avoidance

As Harris emphasizes regarding offshore trusts: “This is not about tax dodging; it’s not about avoiding your debts to the IRS.” Proper asset protection strategies maintain tax compliance.

State Laws Vary

Protection levels differ dramatically between states. Florida offers unlimited homestead protection, while other states provide much less. Know your local laws.

When to Start Planning

The best time to implement asset protection? NOW.

The longer your protection strategies are in place before any claims arise, the stronger they’ll be. Once creditors are at your door, many options disappear.

Who Needs Asset Protection Most?

While everyone can benefit from some level of asset protection, those at highest risk include:

- Medical professionals and others vulnerable to malpractice claims

- Business owners with personal liability exposure

- Real estate investors

- High-net-worth individuals

- Anyone in a high-risk profession

Getting Professional Help

DIY asset protection is risky. Working with qualified professionals ensures your strategy is both legal and effective.

Consider consulting with:

- An attorney specializing in asset protection

- A financial advisor with expertise in wealth preservation

- A tax professional to ensure compliance

As J.P. Morgan advises, “Talk to a professional to review your options if you have concerns about your or your children’s creditors, and always engage independent legal counsel before undertaking any sophisticated planning.”

The Bottom Line

The best way to protect your assets from creditors is to create multiple layers of protection tailored to your specific situation. Start with simple strategies like insurance and proper asset titling, then consider more sophisticated approaches like trusts and business structures as needed.

Remember that timing is critical—protection must be established before problems arise. With proper planning, you can significantly reduce the risk of losing your hard-earned assets to creditors, lawsuits, or other claims.

Have you implemented any asset protection strategies? What’s worked for you? I’d love to hear about your experiences in the comments below!

FAQs About Asset Protection

Can I protect my assets after a lawsuit is filed?

Generally no. If you attempt to protect assets after being sued, courts may rule that you’re attempting to commit fraud.

Will one protection method be enough?

Rarely. Most effective protection plans use multiple layers of protection for different assets.

Are offshore trusts only for the ultra-wealthy?

While commonly associated with high-net-worth individuals, offshore protection has become more accessible and might be appropriate depending on your situation and risk level.

Is asset protection only for the rich?

No! Even modest assets deserve protection. Simple strategies like insurance and retirement accounts can protect anyone’s wealth.

Will asset protection help avoid taxes?

No. Proper asset protection maintains tax compliance while shielding assets from creditors.

Don’t wait until it’s too late—start protecting your assets today!