See how much monthly income an annuity could provide and get objective guidance by calling 866-663-5241.

You can buy a 5-year annuity. In fact, they’re becoming more popular as people look for safer ways to invest their money that are guaranteed to pay off. You’re in the right place if you want to know if a 5-year annuity is right for your finances. In this article, I’ll tell you everything you need to know about them, including their pros and cons and how they might fit into your retirement plans.

What Exactly Is a 5-Year Annuity?

A 5-year annuity is a type of fixed annuity that guarantees a specific interest rate for five years. It’s basically a contract between you and an insurance company where you pay premiums (either as a lump sum or a series of payments), and in return, the insurance company promises to pay you a guaranteed income for a specific period – in this case, five years.

These fixed annuities work a bit like certificates of deposit (CDs), but they have some extra benefits that make them worth adding to your retirement portfolio.

How Does a 5-Year Annuity Work?

When you buy a 5-year fixed annuity, you’re basically giving the insurance company risk instead of yourself.

- You pay premiums to the insurance company (the accumulation phase)

- The insurance company invests your money in high-quality, fixed-income investments like bonds

- After a specified time, you stop paying premiums and start receiving payments (the payout phase)

- The insurance company guarantees your rate of return for the 5-year period

For example, let’s say Amy, age 20, invests $100,000 in a 5-year fixed annuity with a rate higher than 5%. When she turns 67, she could retire with more than $30,000 more in the bank. And there is no market risk. Plus, the growth is tax-deferred until she starts taking withdrawals.

Benefits of Buying a 5-Year Annuity

There are several advantages to considering a 5-year annuity:

- Guaranteed income: You’ll receive a fixed income stream for five years, regardless of what happens in the stock market

- Protection against market volatility: Your principal is protected from market downturns

- Tax-deferred growth: Your money grows tax-free until you withdraw it

- Higher rates than many bank products: Currently, some 5-year fixed annuities are paying upward of 5%

- Additional tax-sheltered retirement savings: Annuities have no contribution limits, making them a good option if you’ve already maxed out your 401(k) and IRA

- Free withdrawal provisions: Many 5-year annuities allow you to withdraw a portion (often 10%) each year without penalties

- Death benefit protection: If you die before the end of the term, payments continue to your beneficiary

Drawbacks to Consider Before Buying

Like any financial product, 5-year annuities aren’t perfect for everyone. Here are some potential drawbacks:

- Lower returns compared to stocks: You might earn less than you would in the stock market during bull markets

- Limited liquidity: You typically can’t access all your money without penalty for five years

- Surrender charges: Early withdrawals beyond the free withdrawal amount may incur penalties

- Inflation risk: The fixed payment may not keep pace with inflation over time

- Tax penalties: Withdrawals before age 59½ may incur a 10% federal tax penalty in addition to regular income tax

- Commissions: All annuities involve commissions, typically built into the policy

5-Year Fixed Annuity vs. 5-Year CD: What’s the Difference?

People often compare 5-year annuities to 5-year CDs since they both offer guaranteed returns for a set period, Here’s how they stack up

| Feature | 5-Year Fixed Annuity | 5-Year CD |

|---|---|---|

| Purpose | Grow money tax-advantaged for retirement | Grow money that’s otherwise sitting in a low-interest savings account |

| Tax Treatment | Tax-deferred until withdrawal | Interest taxed each year as ordinary income |

| Liquidity | Typically can withdraw 10% annually without penalty | Usually no access without penalties |

| Safety | Guaranteed by the issuing insurance company | FDIC-insured up to $250,000 |

| Current Rates | Some offering upward of 5% | Generally lower than competitive annuity rates |

Current 5-Year Annuity Rates (as of 2025)

The market for 5-year fixed annuities is pretty competitive right now. Some of the top providers and their rates include:

- Security Benefit Life Insurance Company: 4.90%

- American Life & Security Corp: 5.40%

- American Freedom Aspire 5: 5.05%

- American Freedom Classic 5: 5.00%

- American Freedom Classic 5 – 2025: 5.00%

Remember that rates change frequently, so it’s always best to check current rates when you’re ready to purchase.

Who Should Consider Buying a 5-Year Annuity?

A 5-year annuity might be right for you if:

- You’re nearing retirement and want to reduce market risk

- You’ve already maxed out your 401(k) and IRA contributions

- You want guaranteed income for a specific period

- You have a lump sum of money that you don’t need immediate access to

- You’re looking for tax-deferred growth

- You want higher guaranteed returns than what banks are offering

On the flip side, this might not be the right choice if:

- You might need access to all your money soon

- You’re far from retirement and can take more market risk

- You’re under 59½ and might need the money before then

- You’re already struggling with liquidity in your portfolio

How to Choose a 5-Year Annuity Provider

If you’ve decided a 5-year annuity might be right for you, here’s how to choose a provider:

- Check financial strength ratings: Stick to insurers highly rated by A.M. Best, Moody’s, Fitch and Standard & Poor’s

- Compare rates: Shop around for the best rates available

- Review surrender charges: Understand the penalties for early withdrawal

- Look for carriers with low fees: There are plenty that keep annual fees to 1.5% or less

- Consider carriers offering upfront bonuses: Some top-rated carriers offer bonuses in the 10% to 15% range

- Read the contract carefully: Understand all terms and conditions before signing

Tips for Buying a 5-Year Annuity

Here are some practical tips if you’re considering a 5-year annuity:

- Diversify your annuity investments: Consider spreading your money across annuities from different insurance companies to reduce risk

- Consider annuitizing gradually: Rather than investing all at once, you could start with part of your money and add more later

- Consult a financial advisor: An annuity is a significant financial decision that should align with your overall financial plan

- Ask about the commission: All annuities include commissions – make sure you know what they are

- Know your free-look period: All annuities come with a free-look period (usually 10-30 days) during which you can cancel for a full refund

- Get everything in writing: Have your agent sign and date your understanding of the sales pitch

Final Thoughts: Is a 5-Year Annuity Right for You?

A 5-year fixed annuity can be a valuable part of your retirement planning strategy, especially if you’re looking for guaranteed income and protection against market volatility. The current economic environment makes these products particularly attractive, with some offering rates around 5% for five years.

However, like any financial product, it’s important to consider how a 5-year annuity fits into your overall financial plan. These aren’t one-size-fits-all solutions, and the right choice depends on your specific goals, risk tolerance, and time horizon.

If you’re interested in exploring 5-year annuity options, I recommend speaking with a qualified financial advisor who can help you evaluate whether this type of annuity makes sense for your particular situation.

Remember, retirement and uncertainty go together about as well as mustard and chocolate (not well at all!). A 5-year annuity might just be the ingredient that helps bring some stability to your financial recipe.

Why consider an income annuity?

Income annuities can provide the confidence that you will have guaranteed retirement income for life or a set period of time. *.

Annuities can also play a key role in your overall retirement strategy—helping reduce portfolio risk, increase savings potential, offer tax advantages, and even provide legacy protection.

Answer a few simple questions to estimate how much monthly income an annuity might provide.

Ready to explore annuities or get guidance tailored to your goals?

Call us today at 866-663-5241 to speak with a Schwab Annuity Specialist for objective, non-commissioned guidance.

Schwab requires all annuity contracts to have a minimum value of $100,000. This is to make sure that we provide the best service possible.

Dave, Can You Clarify What A Fixed Index Annuity Is?

FAQ

Is a 5-year annuity a good idea?

A 5-year fixed annuity may be a good choice if you’re nearing retirement and want a low-risk investment that offers predictable returns. It is especially suited for those who don’t need immediate access to their funds and anticipate being in a lower tax bracket after retirement.

What is the 5-year annuity rule?

If you inherit a nonqualified annuity and fail to act, the IRS may impose the five-year rule. You will be required to withdraw the entire balance within five years of the original owner’s death. Understand the rules, act early and talk to a financial advisor if you’re not sure what to do.

Can you purchase a 5-year annuity?

A 5-year fixed annuity may be a good choice for you if you want to keep your money safe and put off paying taxes for a while. These products, which include a minimum guaranteed rate, can help you add padding to your retirement savings without risking your principal.

How much does a $100k annuity pay per month?

Should you buy a 5 year fixed annuity?

A 5-year fixed annuity may be a good choice for you if you want to keep your money safe and put off paying taxes for a while. These products, which include a minimum guaranteed rate, can help you add padding to your retirement savings without risking your principal.

Should you invest in a 5-year certain annuity?

If you’re a conservative investor looking for guaranteed returns and stability, a 5-year certain annuity could be an appealing option. If you’re approaching retirement or already retired, a 5-year certain annuity can play a significant role in your retirement plan.

What is a 5 year fixed annuity?

Five-year fixed annuities are often compared to 5-year certificates of deposit (CDs). Both offer the safety and protection of your principal and can grow your money in a predictable, guaranteed way. One big difference is the purpose of each.

Is a 5-year fixed annuity tax-deferred?

She finds out about a 5-year fixed annuity offering a rate that exceeds 5%. Additionally, the product is tax-deferred. She is interested in this for two reasons: the interest on the annuity may grow faster than a 5-year CD because it won’t be taxed every year, and when she retires, her tax rate will be lower.

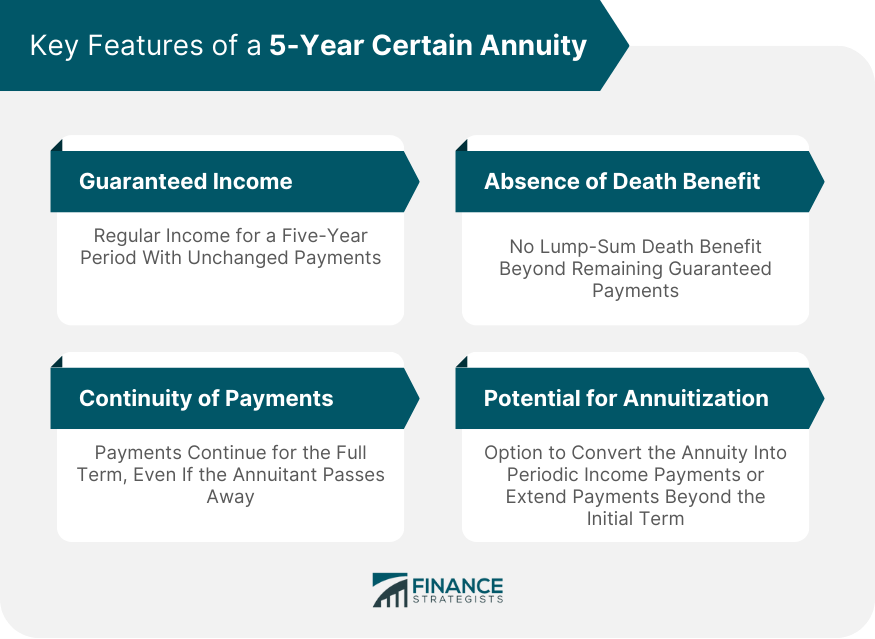

What is a 5-year certain annuity?

In essence, a 5-Year Certain Annuity offers security, predictability, and peace of mind in the financial planning landscape. The most fundamental feature of a certain 5-year annuity is its guarantee of regular income for a five-year period.

Does a 5 year annuity provide lifelong income?

If you’re approaching retirement or already retired, a 5-year certain annuity can play a significant role in your retirement plan. While it will not provide lifelong income, it can supplement other retirement income sources for a short period.