There was a statistic going around that said 1 in 6 millennials have at least $100,000 saved. The reactions were mostly confusion and indignation. They were along the lines of, “I don’t know a single millennial with $1,000, much less $100,000. ” Or, “Maybe $100,000 of debt, amirite. ”.

The 1 in 6 figure comes from a report (pdf) commissioned by Bank of America in 2017. They defined a millennial as someone who was 23 to 37 years old. This is slightly older than the more standard definition set by the Pew Research Center: born from 1981 to 1996, or 21 to 36 during the survey year.

I don’t have access to the Bank of America survey, but the Survey of Consumer Finances (SCF) from the Federal Reserve Board provides more detailed information. I calculated the +$100k percentages for millennials using both millennial definitions:

The Reality Behind When Americans Reach $100K

One study said that one in six millennials have saved at least $100,000. When I read this, I thought, “No way! I don’t know anyone my age who has saved even $10,000.” But looking more closely at the Survey of Consumer Finances data shows some interesting facts about this important event.

Looking at net worth data by age group tells a much clearer story than blanket statements about millennials. By our mid-40s, more Americans have a net worth exceeding $100K than those who don’t. This makes a lot more sense than the misleading “1 in 6 millennials” claim.

Here’s what the data actually shows:

- Only about 0.4% of young adults (21-36) have $100K+ in actual savings accounts

- Around 7.5% have $100K+ in financial assets (including retirement accounts, stocks)

- About 17.7% have a $100K+ net worth when including all assets minus debt

The “1 in 6” number isn’t completely wrong; it’s just a way to measure net worth (assets minus debts), not the amount of money saved in a bank account.

My Personal Journey to $100K

When I turned 28, I had saved my first $100,000, which felt amazing after years of not being able to save anything worthwhile. For the first five years after college, I was only able to save about $300 to $500 a month while paying off student loans. That $100,000 goal seemed so far away.

What changed? I landed a better-paying job, slashed my expenses by moving to a cheaper apartment with roommates, and got serious about investing instead of leaving everything in a savings account earning basically nothing. The last part made a HUGE difference.

The Age Factor: When Do Most People Hit $100K?

Based on data from the Federal Reserve’s Survey of Consumer Finances, here’s when Americans typically reach the $100K net worth milestone:

| Age Group | % with $100K+ Net Worth |

|---|---|

| Under 25 | Less than 5% |

| 25-34 | About 20% |

| 35-44 | About 50% |

| 45-54 | About 65% |

| 55-64 | About 75% |

| 65+ | About 70% |

Remember, net worth includes everything – your house equity, retirement accounts, savings, minus any debts. That’s why the percentages jump so dramatically in the 35-44 range, when many people have built some home equity and been contributing to retirement for a decade or more.

Why Your First $100K Is the Hardest (The Math Proves It!)

There’s an old saying that “the first $100K is a b*tch” (attributed to investor Charlie Munger), and the math actually proves this is true!

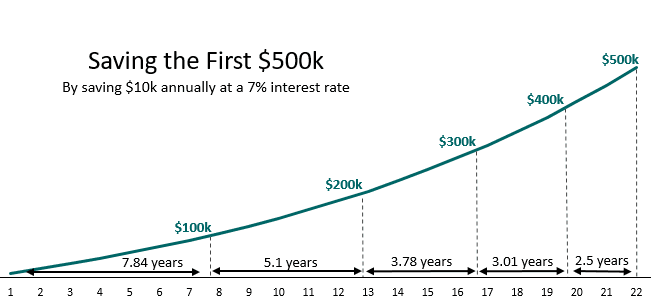

Consider someone who saves $10,000 per year and invests it with a 7% average annual return:

- It takes nearly 8 years to reach the first $100K

- But reaching $200K from $100K only takes about 5 more years

- Getting from $600K to $1 million only takes about 6.4 years

This happens because compound interest starts working in your favor in a major way after you’ve built that initial nest egg. Your money starts making significant money on its own.

The brutal truth is that in the beginning, your savings rate matters WAY more than your investment returns. When you have $10K invested, even a fantastic 10% return only gives you $1,000. But once you have $100K, that same 10% return gives you $10,000 – as much as many people save in an entire year!

Factors That Affect When You’ll Hit $100K

After talking with dozens of friends and readers about their financial journeys, I’ve noticed these major factors determine when someone hits their first $100K:

- Income level – Obviously, higher earners can potentially save more

- Savings rate – Someone earning $50K who saves 30% will outpace someone earning $100K who saves 5%

- Investment strategy – Keeping everything in cash vs. investing in growth assets

- Debt burden – Student loans and high-interest debt create major headwinds

- Housing costs – Rent or mortgage payments that consume 40%+ of income make saving difficult

- Educational path – Those who spent years in graduate school often start saving later but may catch up quickly

- Inheritance or gifts – Some receive financial boosts from family

Real People, Real Stories

I surveyed my newsletter readers about when they hit $100K, and here are some real responses:

“After paying off $87K in student loans, I made $100,000 at age 34.” The first $100K took 12 years. The second $100K took just 2. 5 years. ” – Maria, teacher.

“Hit $100K at 29 after living with my parents for 3 years after college. Saved almost 80% of my income during that time.” – Jason, engineer

“Didn’t reach $100K until 42. Single mom, started from negative net worth after divorce. Now at $350K at age 48.” – Laura, nurse practitioner

“Hit $100K at 26 thanks to tech job and stock options. But many friends from college still have negative net worths due to student loans.” – Raj, software developer

The diversity of experiences shows there’s no “right” age to hit this milestone.

Strategies to Reach $100K Faster

If you’re still working toward your first $100K, here are strategies that have worked for me and many others:

1. Make It Automatic

Set up automatic transfers to savings/investment accounts on payday. You’ll adapt to living without that money.

2. Increase Savings Rate With Raises

When you get a raise, immediately divert half of the increase to savings before lifestyle inflation sets in.

3. Focus on Big Housing Decisions

Housing typically consumes 30-50% of income. Choosing a modest home or living with roommates can accelerate savings dramatically.

4. Invest, Don’t Just Save

A high-yield savings account might give you 1-2%. A diversified investment portfolio has historically returned 7-10% annually over long periods. The difference is massive.

5. Side Income Goes Straight to Savings

I saved 100% of my side hustle income for two years, which added about $15K to my investments annually.

The Psychological Impact of Hitting $100K

Reaching $100K was a game-changer for me mentally. Before hitting this milestone, saving felt like a constant uphill battle with little to show for it. After crossing $100K, watching my net worth grow became exciting as I could literally see compound interest working for me.

Many people report similar psychological shifts:

- Less financial anxiety

- More confidence in making career decisions

- Greater sense of control over their future

- Motivation to continue good financial habits

Don’t Get Discouraged By Others’ Progress

Remember that survey showing 1 in 6 millennials having $100K? That means 5 out of 6 DON’T have $100K yet. You’re not behind – this is a marathon, not a sprint.

Social media makes it easy to feel like everyone is doing better financially than you are. They’re not. Many people with impressive lifestyles have impressive debts to match.

Whether you’re 22 or 52, working toward your first $100K follows the same mathematical principles. It will likely be the hardest financial milestone you’ll ever reach, but once you get there, the path to $200K, $500K and beyond gets progressively easier thanks to the magic of compound interest.

I’d love to hear from you – what age did you reach $100K, or what age are you targeting? What strategies are working for you? Share your story in the comments below!

Note: All data in this article comes from the Federal Reserve’s Survey of Consumer Finances and personal research. Your individual financial journey may vary based on numerous personal factors.

Passing $100k in Savings

If you only look at transaction accounts like checking and savings, the 1% in 2016 number, or 2017, seems high.

| More than $100k in… | Age 21 to 36 (Pew) | 23 to 37 (BofA) |

|---|---|---|

| Savings | 0.4% | 0.9% |

| Checking | 0.2% | 0.3% |

| All Transaction Accounts | 1.2% | 1.8% |

The older ages for the BofA definition pushes the percentages up, but none are close to 17 percent.

Although, the report never defines “savings. ” It reads like money in a savings account, but maybe they also mean other sources, like a retirement account, stocks, and bonds. When you have that much money, I think most people don’t just leave it laying around in a low-interest bank account.

Here’s what you get when you include other assets:

When looking at all assets, the percentages rise a lot.

| More than $100k in… | Age 21 to 36 (Pew) | 23 to 37 (BofA) |

|---|---|---|

| Financial Assets | 7.5% | 9.8% |

| All Assets | 35.1% | 39.9% |

Remember that a house counts as an asset, and based on the SCF, almost 40 percent of millennials have over $100,000 in assets.

However, with that house usually comes debt. Factor that into the equation and you get net worth:

All the Age Groups

Okay, maybe a net worth of more than $100,000 still seems a little out there. But I think there are two main factors here to consider.

First, 1 in 6 is about 17 percent. That’s a small fraction of millennials. The remaining 83 percent do not have $100,000. That’s high. If there’s an 83 percent chance it’s going to rain, you bring an umbrella.

Second, the definition of millennial is a wide age range. It includes people still in school and just out of college, up to people who have been working for more than 15 years.

So looking at savings for just millennials is not so useful.

It’s a lot more useful to look at the data linearly. The charts that follow show assets, debt, and net worth by age group, in five-year increments instead of using a dumb age classification.

The BRUTAL Truth About Saving Your First $100K

FAQ

At what age should I have 100K saved up?

Kevin O’Leary: By Age 33, You Should Have $100K in Savings — How To Get Started. If you’re just starting out in your career, $100,000 might seem like a lot of money. After all, the Bureau of Labor Statistics says that the average salary for a 20- to 24-year-old is only $37,024 a year.

How long will it take you to save your first $100,000?

Being disciplined in your mindset and sticking to your plan will also be key. The dollars and cents will add up. You might be able to reach your $100,000 goal in as little as six years—which would allow you to move on to saving the next $100,000 that much sooner.

Is $500,000 enough to retire at age 65?

Yes, retiring comfortably with $500,000 is achievable. This amount can support an annual withdrawal of up to $34,000, covering a 25-year period from age 60 to 85. If your lifestyle can be maintained at $30,000 per year or about $2,500 per month, then $500,000 should be sufficient for a secure retirement.

Is saving your first 100K the hardest?

Yes, your first $100,000 really is the toughest retirement saving milestone to reach. Plus, two more important things to remember: (1) You’re probably paving the way for more growth in the future than you realize, and (2) You could be, and maybe should be, doing more to build your nest egg.

How long does it take to save $100K?

As you can see from the chart above, it takes between 7 and 8 years to save $100,000. This is true no matter what interest rate your savings earn each year. This is because the amount you save matters far more than your investment returns when you’re just starting out.

How long does it take to get the first $100k?

As Charlie Munger said, getting the first $100k is a b*tch, but once you cross that threshold, your savings begin to do the heavy lifting for you. Notice in the chart above that it takes 7 – 8 years to save the first $100k no matter what annual interest rate your savings grows at.

How much money should a 33 year old save?

“By the time you hit 33 years old, you should have $100,000 saved somewhere. Make that your goal. Thirty-three [and] $100,000,” O’Leary tells CNBC Make It. Why 33? O’Leary says it’s the “tipping point” in a person’s life when they have to focus on saving money and if they don’t, they fall “behind the eight-ball.”

How much money can you make if you save 11 years?

Even if you keep the same salary and assume no interest, saving that amount for 11 years gets you $106,480 by the age of 33. By investing the same money, and assuming O’Leary’s 5% growth, that gives you $144,397 in the same amount of time. (The S&P 500 Index has averaged annual returns of approximately 10% since its inception in 1926.)

Are there age based savings milestones?

Still, there are some basic age-based savings milestones that will help you figure out how you’re doing (including compared to your peers), or if you need to do more. To this end, a recently posted Reddit question is one that many young investors are probably regularly asking themselves. How long does it too you to reach your first 100k?

Is your first $100,000 really the toughest retirement saving milestone?

Yes, your first $100,000 really is the toughest retirement saving milestone to reach. Now here are a couple of other important takeaways on the matter: (1) You’re probably setting the stage for more future growth than you realize, and (2) you also could be — and arguably should be — doing more to grow your nest egg.