Have you ever felt like all the fancy investment terms and strategies were too much to handle? I know I did! When I first started investing, I was flooded with terms like “derivatives,” “leveraged ETFs,” and “technical analysis patterns.” It was enough to make my head spin!.

That’s when I discovered the KISS Rule of Investing – a principle that completely changed my approach to growing wealth In this article, I’ll break down this powerful concept in simple terms so you can apply it to your own financial journey

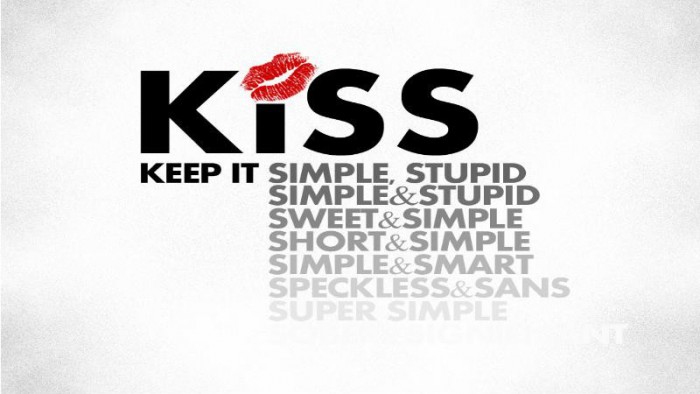

Understanding the KISS Rule: Keep It Simple, Stupid!

The KISS Rule of Investing stands for “Keep It Simple, Stupid.” Now, don’t be offended by the name! This principle wasn’t created to insult anyone but to emphasize an important truth: simplicity often beats complexity when it comes to investing.

The KISS principle actually originated back in the 1960s with the U.S. Navy. They used it to remind engineers that most systems work best when kept simple rather than complicated. The core idea is that unnecessary complexity should be avoided whenever possible.

When applied to investing, the KISS rule encourages us to:

- Focus on investments we truly understand

- Avoid unnecessarily complex financial products

- Create straightforward investment strategies

- Make decisions based on clear, fundamental principles

Why the KISS Rule Matters in Today’s Complex Investment World

Investment options have grown increasingly complex over time. We’ve gone from basic stocks and bonds to:

- Mutual funds

- Fixed annuities

- Variable annuities

- Fixed index annuities

- Exchange-traded funds (ETFs)

- Smart ETFs

- Alternative investments

With so many choices, it’s easy to feel pressured to chase the newest, shiniest investment vehicle. But here’s the thing – complexity often leads to confusion, higher fees, and sometimes even devastating mistakes.

The KISS rule reminds us that we don’t need exotic investments to build wealth. In fact, some of the most successful investors in history, like Warren Buffett, have succeeded by keeping things remarkably simple.

The Major Benefits of Following the KISS Rule

1. Easier Understanding

You only put money into things you understand when you follow the KISS rule. In simple terms, this means you can talk about your investments with anybody. If you can’t explain it, it’s probably not worth your money.

As Warren Buffett wisely says, “Risk comes from not knowing what you’re doing.”

2. Lower Costs

Simple investment strategies typically come with lower fees than complex ones. You’re not paying expensive fund managers to implement complicated strategies. These fee savings might seem small, but they compound dramatically over time.

According to one example, an extra 1% in annual fees can lower your retirement nest egg by more than 5% over a 10-year period!

3. Reduced Risk

Complex investments often carry hidden risks that aren’t immediately obvious. When you keep things simple, these risks are easier to identify and manage.

Alternative investments (sometimes called structured products or non-conventional investments) are usually riskier than traditional investments. Unfortunately, many people purchase these products without fully understanding them, which can lead to unpleasant surprises.

4. Time-Saving

Let’s be honest – most of us don’t want to spend hours analyzing investments every week. With a simple strategy, you can spend less time worrying about your portfolio and more time enjoying life.

5. Better Long-Term Results

Surprisingly, simple investment strategies often outperform complex ones over long periods. This is partly because complex strategies:

- Have higher costs that eat into returns

- Are harder to stick with during market volatility

- Tempt investors to chase performance and time the market

How to Implement the KISS Rule in Your Investment Strategy

So how do you actually apply this principle to your investments? Here’s my step-by-step approach:

1. Identify Your Investment Goals

Before investing a single dollar, get clear on your goals. Are you saving for:

- Retirement?

- A home purchase?

- Your children’s education?

- Building wealth generally?

Your goals will determine your time horizon and risk tolerance, which should shape your investment strategy.

2. Stick to Investments You Understand

This is crucial! If you can’t explain an investment to someone else in simple terms, it’s probably too complex for your portfolio.

For beginners, this might mean focusing on:

- Index funds that track broad markets

- Blue-chip dividend stocks of companies whose products you use

- Government bonds

- Simple ETFs

3. Diversify Without Overcomplicating

Diversification is important, but you don’t need 50 different investments to achieve it. A simple portfolio might include:

- A total stock market index fund

- An international stock index fund

- A bond index fund

- Perhaps a few individual stocks of companies you understand well

4. Focus on the Long Term

The KISS rule emphasizes long-term investing rather than short-term trading. Trading frequently increases costs and taxes while often reducing returns.

Set up a regular investment schedule (sometimes called dollar-cost averaging) and stick with it through market ups and downs.

5. Regular Monitoring (But Not Obsessing)

Check your investments periodically to ensure they still align with your goals, but avoid the temptation to constantly tinker with your portfolio based on market movements or the latest “hot tip.”

Common Misconceptions About the KISS Rule

Let me clear up some misunderstandings about this investing approach:

Myth 1: KISS Investing Means No Research Needed

Not true! While the strategy itself is simple, you still need to do your homework. Research is essential – just focus it on understanding fundamental aspects of your investments rather than trying to predict short-term price movements.

Myth 2: KISS Investing is Only for Beginners

Many experienced investors, including billionaires, follow simple strategies. Warren Buffett himself has instructed the trustee of his estate to invest 90% of his wife’s inheritance in low-cost S&P 500 index funds after his death. That’s KISS investing at its finest!

Myth 3: KISS Investing Means Lower Returns

Simple doesn’t mean less profitable. In fact, studies repeatedly show that simple index-based strategies outperform the majority of actively managed, complex investment approaches over long periods.

Myth 4: KISS Investing is Risk-Free

All investing involves risk. The KISS rule doesn’t eliminate risk – it just makes those risks more transparent and easier to understand.

Real-World Examples of KISS Investing Success

Warren Buffett’s Coca-Cola Investment

Warren Buffett, arguably the world’s greatest investor, has always followed KISS principles. In 1988, he invested in Coca-Cola – a company with a simple business model that he thoroughly understood. That investment has multiplied many times over.

Buffett said, “We haven’t succeeded because we use some amazing, intricate system, magic formulas, or anything similar. What we have is just simplicity itself.”

The Average Investor’s Index Fund Journey

Consider the case of an average investor who consistently invested in a low-cost S&P 500 index fund for 20 years. Despite market crashes, recessions, and pandemics, their investment would have grown substantially through the power of compounding and market growth.

This strategy required no complex analysis, no market timing, and minimal fees – just consistency and patience.

A Tale of Two Investment Approaches

Imagine two friends:

Friend 1: Invests in a simple portfolio of index funds and a few blue-chip stocks of companies whose products they use daily. They spend minimal time managing their investments.

Friend 2: Constantly trades in and out of positions, uses complex derivatives, and follows complicated technical analysis systems. They spend hours each week analyzing charts and reading financial news.

In most cases, Friend 1 will outperform Friend 2 over long periods, with far less stress and time commitment.

My Uncle’s KISS Investing Success Story

I’d like to share a personal example that really illustrates the power of KISS investing. My uncle, a business owner in his fifties, has been investing since the early 1990s. Despite having no formal education in finance, he’s built impressive wealth through simple principles.

His strategy? He simply buys stocks in companies whose products he uses daily. If he owns a Hero bike and wears a Titan watch, he buys stock in those companies. Over the years, he’s accumulated positions in companies like Asian Paints, Pidilite, ITC, Dabur, Colgate Palmolive, and others – all companies with products he personally uses and understands.

What I find most admirable is his discipline. From the beginning of his career, he’s invested a set amount each month. And his holding period? As Warren Buffett says, “Our favorite holding period is forever.”

This real-world example shows that investing isn’t rocket science. The most important qualities are discipline and patience, not complex formulas or advanced degrees.

The KISS Rule of Investing reminds us that often, the simplest approach is the most effective. By focusing on investments we understand, keeping costs low, and maintaining a long-term perspective, we can build wealth without unnecessary complexity or stress.

As Charlie Munger, Warren Buffett’s long-time partner, wisely said, “People think too little and calculate too much. We have a passion for keeping things simple. We move on to something else if it’s too difficult. What could be more simple than that?”

So, when it comes to your investment strategy, remember to KISS – Keep It Simple, Stupid! Your future self (and your stress levels) will thank you.

FAQs About the KISS Rule of Investing

What does KISS stand for in investing?

KISS stands for “Keep It Simple, Stupid.” It’s a principle encouraging investors to simplify their investment strategies rather than pursuing overly complex approaches.

Is the KISS method suitable for all investors?

Yes, investors of all experience levels can benefit from the KISS approach. In fact, many seasoned investors gravitate toward simpler strategies as they gain experience.

What are the best investments for a KISS portfolio?

Index funds, blue-chip stocks, government and high-quality corporate bonds, and ETFs that track major market indexes are all excellent choices for a KISS portfolio.

Does the KISS rule mean I shouldn’t diversify?

Not at all! Diversification is important, but it should be done thoughtfully. You don’t need hundreds of different investments to be well-diversified.

How often should I check my investments when following the KISS rule?

Quarterly reviews are usually sufficient. Checking too frequently can lead to emotional decision-making and unnecessary trading.

Remember, building wealth through investing isn’t about finding the most complex strategy or the hottest stock tip. It’s about consistency, patience, and keeping things simple enough that you can stick with your plan through market ups and downs.

As they say in investing circles: K.I.S.S. – Keep Investing Simple, Stupid!

What is the KISS rule of investing?

The phrase has changed over time. It used to be called “Keep it Simple, Stupid” (KISS), but now some people see it as “Keep it Super Simple” or “Keep it Simple and Short.” However, the essence remains the same regardless of the variation.

This rule can be applied in any sphere of work. The idea is to keep things simple and prioritise decision-making. Though it originated in the engineering world, the concept can also be applied to investment. This principle advocates a simple investment process to help avoid unnecessary risks.

‘Keep it Simple, Stupid’ (KISS) is an investing strategy that helps manage finance as one age.

![]()

With many choices of investment instruments, modes of investments, service providers, etc. , available today, it’s easy to get confused. For instance, mutual funds, insurance, stocks, and fixed deposits offer many investment options but often create a dilemma of the best suitable option. Managing large documents and keeping records updated becomes more challenging as one ages, and even for younger investors, it can be overwhelming. Here, the KISS strategy can offer relief.