[Update in April 2021] The walkthrough and screenshots in this post were from several years ago. Since TaxAct raised its prices in recent years, I stopped updating this post. Please consider switching to TurboTax, H&R Block, or FreeTaxUSA.

By request from a reader, I give a walkthrough for how to report backdoor Roth in TaxACT.

You report on the tax return your contribution to a traditional IRA *for* that year and your converting to Roth *during* that year.

For example when you are doing your tax return for last year, you report the contribution you made *for* last year, whether you actually did it last year or between January 1 and April 15 this year. You also report that you changed your account type to Roth “during” last year, no matter if the contribution was made that year, the year before, or in a previous year. Therefore a contribution made in last year for the year before goes on the year before’s tax return. A change you made this year after putting money in last year shows up on this year’s tax return, which you will file next year.

If you pay your contribution for the current year and finish your conversion in the same year, you will save a lot of time and trouble. Contribute for this year and convert it before December 31. This way everything is clean and neat. See Make Backdoor Roth Easy On Your Tax Return.

The screenshots below are taken from TaxACT desktop software. If you use TaxACT Online, the screens may be similar. Here’s the scenario used in the example:

If your scenario is different, you will have to make some adjustments from the screens shown here. The screenshots were taken for doing a 2014 return in 2015. In a different year you just advance the year. Wherever the screenshot says 2014, think last year. Wherever it says 2015, think this year.

You might feel like you’re trying to solve a Rubik’s cube while blindfolded when you try to figure out how to report your backdoor Roth IRA conversion on your tax return. I’ve been there, and I know the struggle. Which is why I made this complete guide just for TaxAct users who need to correctly report their backdoor Roth conversions.

What Exactly is a Backdoor Roth IRA?

Before we dive into the nitty-gritty of TaxAct reporting, let’s quickly review what a backdoor Roth is:

A backdoor Roth is a way for people who make too much money to directly contribute to a Roth IRA to do so.

- Making a non-deductible contribution to a traditional IRA

- Converting that traditional IRA to a Roth IRA shortly afterward

This two-step process allows high-income earners to still enjoy the tax-free growth benefits of a Roth IRA, even if they exceed the income limits for direct contributions.

Understanding What You Need to Report

When reporting a backdoor Roth, you need to know what gets reported and when:

- You report the contribution to your traditional IRA for that tax year

- You report the conversion to Roth that happened during that tax year

For example, if you’re doing your 2024 tax return, you’ll report:

- Any contributions you made for 2024 (even if you made them between Jan 1-April 15, 2025)

- Any conversions to Roth you did during 2024

This timing distinction is super important and confuses a lot of people!

What You’ll Need Before Starting

Before you dive into TaxAct, make sure you have:

- Your Form 1099-R (if you converted during the tax year)

- Your Form 5498 showing your IRA contribution (though this isn’t strictly necessary for filing)

- Information about any previous non-deductible contributions (your “basis”)

- The value of all your traditional IRAs as of December 31

Step-by-Step Guide for Reporting Backdoor Roth in TaxAct

We will divide this into two main parts: reporting your traditional IRA contribution that is not tax-deductible and reporting your change to a Roth IRA.

Part 1: Reporting Your Non-Deductible Traditional IRA Contribution

- Log into TaxAct and go to the Federal Q&A section

- Look for IRA Contributions in the navigation menu

- Select Yourself Nondeductible traditional IRA contributions

- Enter your contribution amount for the tax year

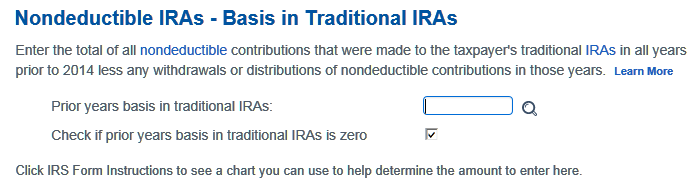

- When asked about prior years’ basis, enter the amount from line 14 of Form 8606 from your previous year’s tax return (or check the box for no basis if this is your first time)

In this first part, you tell the IRS that you put money into a traditional IRA but aren’t deducting it from your income.

Part 2: Reporting Your Conversion to Roth IRA

- Navigate back to Federal Q&A

- Look for Retirement Plan Income and select IRA, 401(k), and pension plan distributions (Form 1099-R)

- Click Add to add a new 1099-R

- Use Quick Entry to fill out the form as you received it from your financial institution

- Pay attention to Box 7 distribution code (usually code “2” for Roth conversion)

- Make sure the IRA/SEP/SIMPLE checkbox is marked

- Scroll down until you see the Retirement Plan Income – Roth Conversion screen

- Enter your conversion amount in the field provided

- If you have any prior year non-deductible contributions, check that box and enter the amount

- Continue through the Q&A process until you reach the Form 8606 section

Part 3: Verifying Form 8606 is Correct

After completing the steps above, TaxAct should properly generate Form 8606. To verify:

- Click on Forms at the top of the screen

- Locate and open Form 8606

- Check that the form shows:

- Your non-deductible contribution on Part I

- Your conversion amount on Line 16 (Part II)

- The taxable portion of your conversion on Line 18

Part 4: Confirming on Form 1040

To make sure everything flowed through to your tax return correctly:

- Open Form 1040

- Check Line 4a and 4b (or the equivalent lines for your tax year)

- Line 4a should show your total conversion amount

- Line 4b should show only the taxable portion (if any)

If you did everything right and converted quickly after contributing (before any earnings accrued), Line 4b might be zero or a very small amount!

Common Scenarios and Solutions

Scenario 1: You Contributed for Last Year but Converted This Year

If you made a traditional IRA contribution for 2024 but didn’t convert to Roth until 2025:

- Report the contribution on your 2024 tax return

- The conversion will be reported on your 2025 tax return

- Make sure to carry over your basis from 2024 to 2025

Scenario 2: You Have Existing Traditional IRA Balances (Pro-Rata Rule)

If you have other traditional IRAs with pre-tax money:

- You’ll need to report the total value of all your traditional IRAs as of December 31

- TaxAct will calculate the taxable portion using the pro-rata rule

- This will likely increase the taxable amount of your conversion

Scenario 3: You Made Multiple Conversions in One Year

Simply add each 1099-R separately in TaxAct, and the software should handle the calculations correctly.

Common Mistakes to Avoid

- Not reporting the non-deductible contribution: This step is crucial – skip it and you might pay tax twice!

- Forgetting your basis: Make sure you carry forward your non-deductible basis from previous years.

- Leaving out the December 31 valuation: If you have other traditional IRAs, not reporting their value will mess up your pro-rata calculation.

- Mixing up tax years: Remember that contributions are for a tax year, while conversions are reported based on when they actually happened.

Pro Tips for Backdoor Roth Success

- Keep it simple: Contribute and convert in the same calendar year to make reporting much easier.

- Convert quickly: The less time between contribution and conversion, the less likely you’ll have earnings that will be taxable.

- Clear the decks: If possible, roll over any existing traditional IRA balances to employer plans before doing backdoor Roth to avoid the pro-rata rule.

- Keep good records: Save copies of all your 1099-Rs, 5498s, and past 8606 forms.

TaxAct Quirks to Be Aware Of

Based on my experience and user reports, here are some TaxAct-specific things to watch for:

-

Sometimes TaxAct will leave lines 6-12 on Form 8606 blank, even though they should theoretically have values. This is because TaxAct uses a special worksheet from IRS Publication 590-B that bypasses these lines. Don’t worry – this is normal!

-

In some versions of TaxAct, users have reported the software freezing when entering Roth conversion information. If this happens, try:

- Clearing your browser cache (if using online version)

- Updating to the latest version of the software

- Contacting TaxAct support

-

TaxAct may initially show your tax liability increasing after entering your non-deductible contribution, but before entering your conversion information. Don’t panic – this should resolve once you complete all the steps.

Final Thoughts

Reporting a backdoor Roth in TaxAct isn’t particularly difficult, but it does require attention to detail. The most important thing is making sure you report both the non-deductible contribution AND the conversion properly.

And remember – the simplest approach is to make your contribution and do your conversion in the same calendar year. Future you will thank present you when tax time rolls around!

Disclaimer: While I’ve made every effort to provide accurate information, tax laws change frequently and individual situations vary. This article is for informational purposes only and doesn’t constitute professional tax advice. Always consult with a qualified tax professional regarding your specific situation.

Convert Traditional IRA to Roth

Now we enter the Roth conversion.

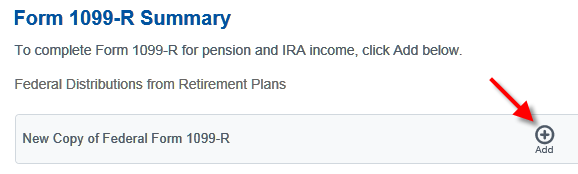

Go back to Federal Q&A. Browse to the left column and click on Retirement Plan Income. Next, click on IRA, 401(k), and pension plan distributions (Form 1099-R).

Click on Add to add a 1099-R.

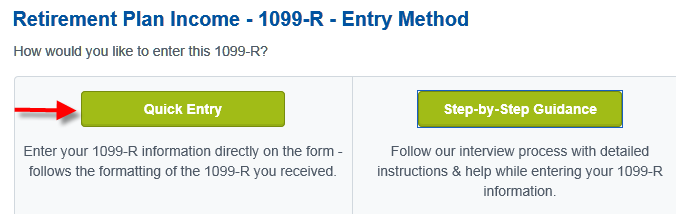

Click on Quick Entry.

Fill out the 1099-R as you received it. Pay attention to box 2b, box 7, and the IRA/SEP/SIMPLE checkbox.

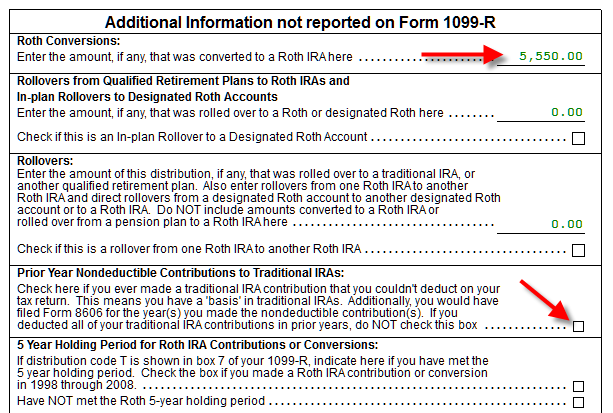

Scroll down. Fill in your conversion amount. Leave the Prior Year Nondeductible Contributions box blank if you don’t have any carryover basis. Check it and enter the amount if you do.

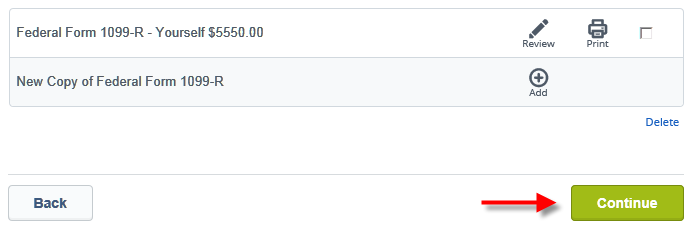

You are done with one 1099-R. Repeat if you have another one. Click on Continue when you are done.

Just some general info about Form 8606.

It asks about your prior years basis again. Enter it or check the box.

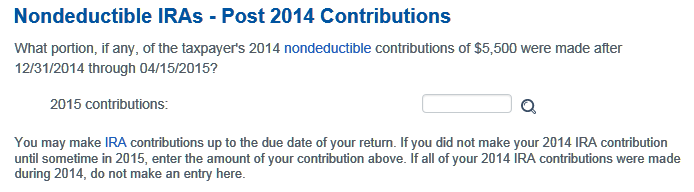

Enter how much you contributed for last year between January 1 and April 15 this year. In our example it’s zero because we contributed before December 31 last year.

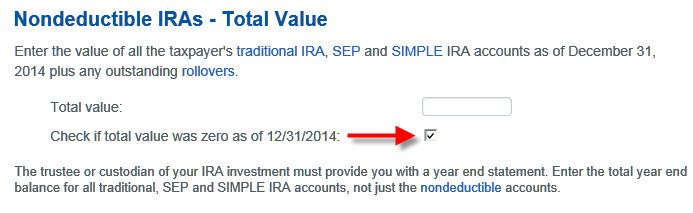

As of December 31, 2017, we had no money in any of our traditional, SEP, or SIMPLE IRAs.

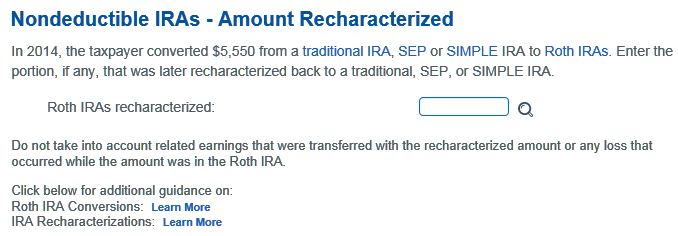

We didn’t recharacterize our conversion.

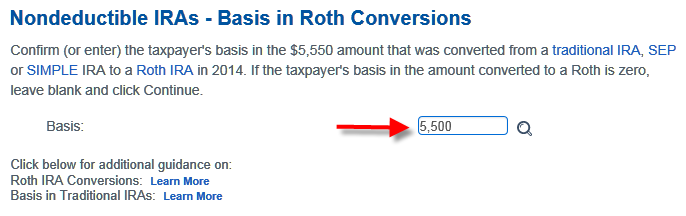

Confirm the basis for our conversion.

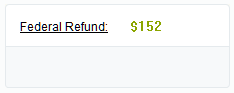

That’s it. Our refund came down a little due to the earnings in our conversion.

Taxable Income from Backdoor Roth

After going through all these, let’s confirm how you are taxed on the backdoor Roth.

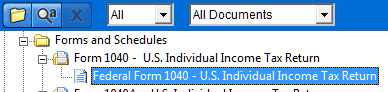

Click on Forms on the top and open Form 1040.

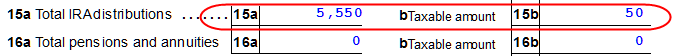

Scroll down on the right hand side to find line 15. It shows $5,550 in Roth conversion, $50 of which is taxable.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount of earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

How Do You Report a Backdoor Roth IRA on a Tax Return?

FAQ

How do I report Backdoor Roth on my tax return?

Form 8606 is the key to reporting backdoor Roth IRAs successfully.

Do you get a 1099 when you do a Roth conversion?

So, here is some general information that might help you: When you convert your pre-tax IRA to a Roth IRA, you’ll get a Form 1099-R showing the distribution and a Form 5498 showing the conversion.

Do I need to file 8606 for Roth conversion?

The full distribution does not need to be converted to a Roth IRA. Conversions must be reported on Form 8606, Part II.

Are backdoor Roth contributions taxable?

If you execute the backdoor Roth IRA rules correctly, the process shouldn’t cause any additional current-year taxes, and if you follow the Roth IRA withdrawal ….

How do I report a backdoor Roth IRA?

Form 8606 is the key to reporting backdoor Roth IRAs successfully. The tax form, which is filed as part of your overall return, reports to the IRS that the Traditional IRA contribution you made to start the process of the backdoor Roth IRA was not deductible. In other words, you are not taking a tax deduction for the Traditional IRA contribution.

Will I receive a backdoor Roth IRA tax form?

A backdoor Roth IRA tax form might not get to you by the due date if the transaction did not happen in the same calendar year as your tax return (between January 1, 2024, and December 31, 2024 for 2024 taxes). However, you can still report your Roth IRA conversion without the tax forms.

What is a backdoor Roth IRA?

A Backdoor Roth IRA lets people with high incomes get around income limits and put money into a Roth IRA by first putting money into a traditional IRA that isn’t tax-deductible and then converting the money to a Roth IRA. This strategy provides tax-free growth and withdrawals in retirement but requires careful tax reporting to avoid unnecessary taxes or IRS scrutiny.

What happens if you get money into a Roth IRA through a backdoor?

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount of earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

Are backdoor Roth IRAs a good investment?

Backdoor Roth IRAs can be great for physicians, dentists, business executives, and other high-income earners planning for retirement. However, they can be tricky. Therefore, it is essential to report them properly on your tax return to avoid unnecessary taxes.

How much is taxed on a backdoor Roth conversion?

After going through all these, let’s confirm how you are taxed on the backdoor Roth. Click on Forms on the top and open Form 1040. Scroll down on the right hand side to find line 15. It shows $5,550 in Roth conversion, $50 of which is taxable. Tah-Dah!