Have you ever worried about losing your hard-earned pension to creditors? You’re not alone. As retirement approaches, many folks start to wonder if their nest egg is truly secure. Let’s dive into this important topic and clear up some confusion.

The Basic Protection: ERISA as Your Shield

Good news! Your pension benefits are generally protected from creditors. A federal law called the Employee Retirement Income Security Act of 1974 (ERISA) is a big reason for this.

ERISA says that pension plans must have “spendthrift” protections that keep your benefits from being taken away. These rules against alienation are strong; they stop creditors from going straight to your retirement plan and demanding money.

As Robert Melson from Calfee, Halter

The US Supreme Court confirmed that creditors can’t take away ERISA-covered retirement benefits during bankruptcy. This means that your pension isn’t just another asset that can be taken to pay off debts.

When Protection Requirements Are Met

For your pension to receive full protection, three key requirements must be satisfied:

- The pension plan must be subject to ERISA

- It must be tax-qualified under IRS rules

- The plan must contain a written anti-alienation provision

Most traditional employer pension plans meet these requirements, giving you solid protection. But be aware that a pension plan covering only an owner or an owner and spouse might not be considered an ERISA plan, which could impact protection levels.

The Exceptions: When Creditors Can Reach Your Pension

Like most legal protections, there are exceptions. Here’s when your pension might be vulnerable:

1. Qualified Domestic Relations Orders (QDROs)

If you’re going through a divorce, your spouse might claim part of your pension. A 1984 federal law allows for assignments of pension benefits through a qualified domestic relations order (QDRO) This means a court can order that some of your pension go to your ex-spouse or children for

- Divorce settlements

- Alimony payments

- Child support

2. Federal Tax Liens

The IRS has special powers. Federal tax liens can attach to ERISA pension plans, allowing the government to collect unpaid taxes. Courts have generally sided with the IRS in allowing immediate seizure of pension benefits to satisfy tax debts. However, state tax authorities don’t have this same power – state tax liens cannot attach to ERISA pension plans.

3. Federal Criminal Fines and Restitution

If you’ve been convicted of a federal crime, courts can order your pension assets be used to pay criminal fines or make restitution to victims. The Mandatory Victims Restitution Act (MVRA) can override ERISA’s protections in these cases.

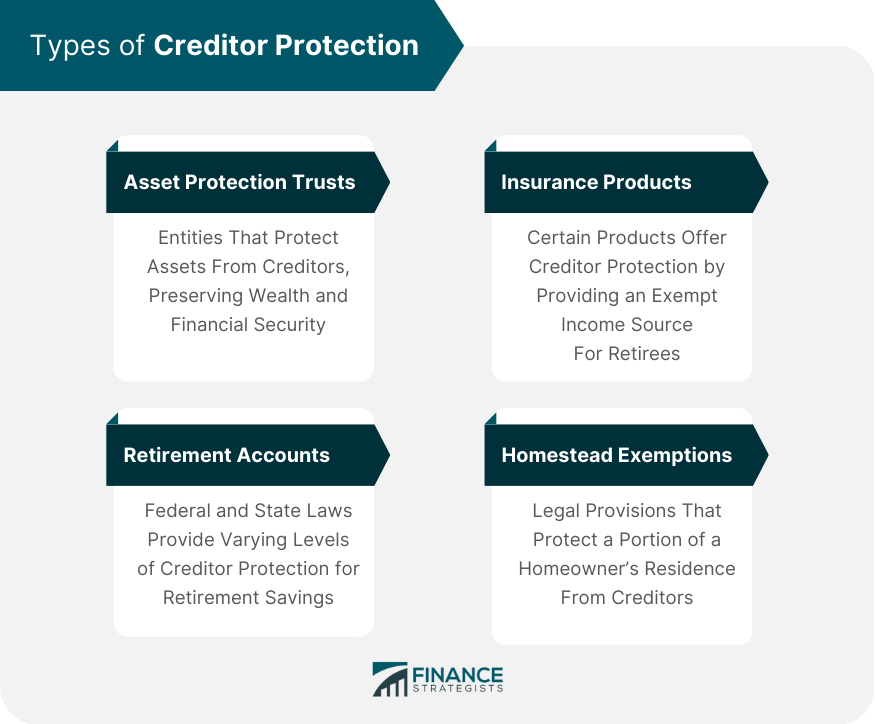

Different Types of Retirement Accounts: Different Levels of Protection

Not all retirement accounts have the same level of protection. Let’s break it down:

ERISA-Covered Plans (Most Company 401(k)s and Traditional Pensions)

These have the strongest protection from creditors thanks to the federal anti-alienation provisions.

Individual Retirement Accounts (IRAs) and SEPs

These aren’t governed by ERISA, so they don’t enjoy the same level of federal protection. Protection for these accounts varies by state law. For example, Ohio law currently protects IRAs only “to the extent reasonably necessary for the support of the participant.”

Non-Qualified Plans

Executive compensation plans and other non-qualified retirement plans typically don’t have ERISA’s anti-alienation protection. The assets in these plans are considered part of the sponsoring corporation’s general assets and could be vulnerable to that company’s creditors.

What Happens After You Receive Your Pension Money?

Here’s a critical point many people miss: ERISA’s protection stops once the money leaves the retirement plan.

When your pension benefit is distributed and deposited into your personal bank account, it becomes more vulnerable to creditors with court judgments against you. This is where things get tricky.

To maintain maximum protection:

- Consider keeping pension deposits in a separate account

- Avoid “commingling” these funds with other money

- Be aware that mixing pension payments with other money can make it difficult to prove which funds should remain protected

For certain federal benefits that are directly deposited, banks must protect either the sum of federal benefit payments from the previous two months or the current account balance (whichever is less). But this limited protection isn’t as comprehensive as what you had while the money was still in the pension plan.

Government and Military Pensions: Special Rules

If you have a government or military pension, different rules apply. These pensions aren’t covered by ERISA but have their own protective laws:

- Federal employees covered by Civil Service Retirement System (CSRS) or Federal Employees Retirement System (FERS) have similar protections

- Military retirement pay is shielded by separate federal laws

- These pensions are generally protected from most creditors but still subject to exceptions for federal tax debts, alimony, and child support

Practical Tips to Protect Your Pension

Based on the information we’ve covered, here are some practical steps you can take:

- Know your plan type: Understand whether your plan is ERISA-protected or not

- Stay current on taxes: Prevent IRS liens by keeping up with tax obligations

- Separate accounts: Consider using a dedicated account for pension deposits

- State protection: Research your state’s specific protections for IRAs and other non-ERISA plans

- Consult professionals: For significant debts, talk to a financial advisor or attorney about protecting your retirement assets

The Bottom Line on Pension Protection

Your pension benefits are a crucial part of your financial security in retirement. The good news is that federal law provides substantial protection for these assets against most creditors, especially while the money remains within the pension plan.

As Melson points out, “Not only do retirement plans provide one of the few remaining tax deferral mechanisms, but in most cases, retirement plan benefits are given safe haven from creditor action.”

However, no protection is absolute. Certain types of debts—particularly those related to federal taxes, family support obligations, and criminal restitution—can penetrate these protections under specific circumstances.

The key is understanding exactly what type of retirement assets you have, what laws protect them, and how to maintain that protection throughout your retirement years. With this knowledge, you can better safeguard your financial future and enjoy the retirement security you’ve worked so hard to build.

Remember that while your pension has significant built-in protections, staying informed and making smart decisions will help ensure those protections remain effective throughout your retirement years.

Final Thoughts

We all work hard our entire lives to build up our retirement savings. Knowing that these funds have substantial legal protection gives peace of mind as we plan for the future. While no system is perfect, the current legal framework does prioritize protecting retirement benefits from most creditors, recognizing the importance of financial security in our later years.

By understanding both the protections and their limitations, you can take appropriate steps to maximize the security of your retirement assets and enjoy the fruits of your labor without unnecessary worry about creditor claims.

Have you taken steps to protect your pension or other retirement assets? Do you have additional questions about how these protections work in practice? Let us know in the comments below!

Are Retirement Accounts Protected from Creditors and Lawsuits

FAQ

How do I protect my pension from creditors?

ERISA requires pension plans to have “spendthrift” provisions which prevent benefits from being alienated from the participant. This means that you are safe from both your creditors and your own urge to spend the money before you retire or can do so in another way allowed by the plan.

Can my pension be garnished for credit card debt?

… employer-sponsored retirement plans are protected by the Employee Retirement Income Security Act (ERISA), which prevents creditors from accessing those …Mar 7, 2025.

Are pensions 100% protected?

Defined benefit pension schemes You’re usually protected by the Pension Protection Fund if your employer goes bust and cannot pay your pension. The Pension Protection Fund usually pays: 100% compensation if you’ve reached the scheme’s pension age. 90% compensation if you’re below the scheme’s pension age.

Is a pension exempt from creditors?

Under the Employee Retirement Income Security Act (ERISA), creditors are generally not able to seize funds from pensions and employer-sponsored retirement accounts.

Are pension plans protected from creditors?

Many assume their retirement funds are protected from creditors, but depending on the type of retirement account you have—and the state where you live—this is not necessarily the case. The good news is that many employer-sponsored plans generally have the best protection. Can creditors get access to my pension plan?.

Can a creditor access my pension?

Creditors and courts will not be given access to your personal pension plan for any reason. Your pension money is safe in that account under the ERISA, but you should be aware of some scenarios in which it might become legal for creditors or courts to obtain some of your pension funds. Can a creditor remove pension funds from a personal account?.

Can creditors seize pension funds under ERISA?

Under the Employee Retirement Income Security Act (ERISA), creditors are generally not able to seize funds from pensions and employer-sponsored retirement accounts. People who owe money can go after funds in traditional and Roth IRAs as well as some 403(b) plans, which are not usually protected by ERISA.

What protection does federal pension law offer against creditor action?

First, one must understand the protection that federal pension law offers against creditor action. Most private employer retirement plans are governed and protected by a federal pension law known as the Employee Retirement Income Security Act of 1974 (“ERISA”).

Can a creditor remove pension funds from a personal account?

Basically, your pension account itself is its own protected entity. Creditors and authorities cannot dip into your personal account to remove retirement savings from you. However, funds in your personal bank account are a different story. Pension funds that have been added to your account may be subject to removal.

Can a retirement plan be protected from judgment creditors?

If you set up your retirement plan under the Employee Retirement Income Security Act (ERISA), most creditors won’t be able to take it away. To be protected, your pension must be a qualified retirement plan. What Is A Qualified Retirement Plan?.