Important information – the value of investments and the income from them, can go down as well as up, so you may get back less than you invest.

Most of us know we need to save for our future – but how much is enough?

There are several ways you can answer that question. You may want to know how much you need to save now in order to be financially stable in the future. You could also find it helpful to know how much you need to save based on how much you make. Some people want to know how their savings compare to other people their age.

All of these can be useful in understanding how your saving is progressing. Here we lay out that information so you can see the savings landmarks you might need to hit as you move through life.

Remember – targets like these can sometimes appear hard to reach, particularly if you’ve delayed your savings to prioritise other things. That’s OK – it’s still useful to understand them and gauge your progress. Even if you feel you’re behind on your saving there is almost always something your can do to improve the picture.

Hitting the big 4-0 often triggers some serious life reflection. If you’re anything like me, you’ve probably asked yourself: “Am I on track financially?” or “Have I saved enough by now?” These questions kept me up at night as I approached this milestone birthday, so I’ve done some digging into what financial experts suggest about savings at age 40 in the UK.

The Magic Number: How Much Should You Have Saved by 40?

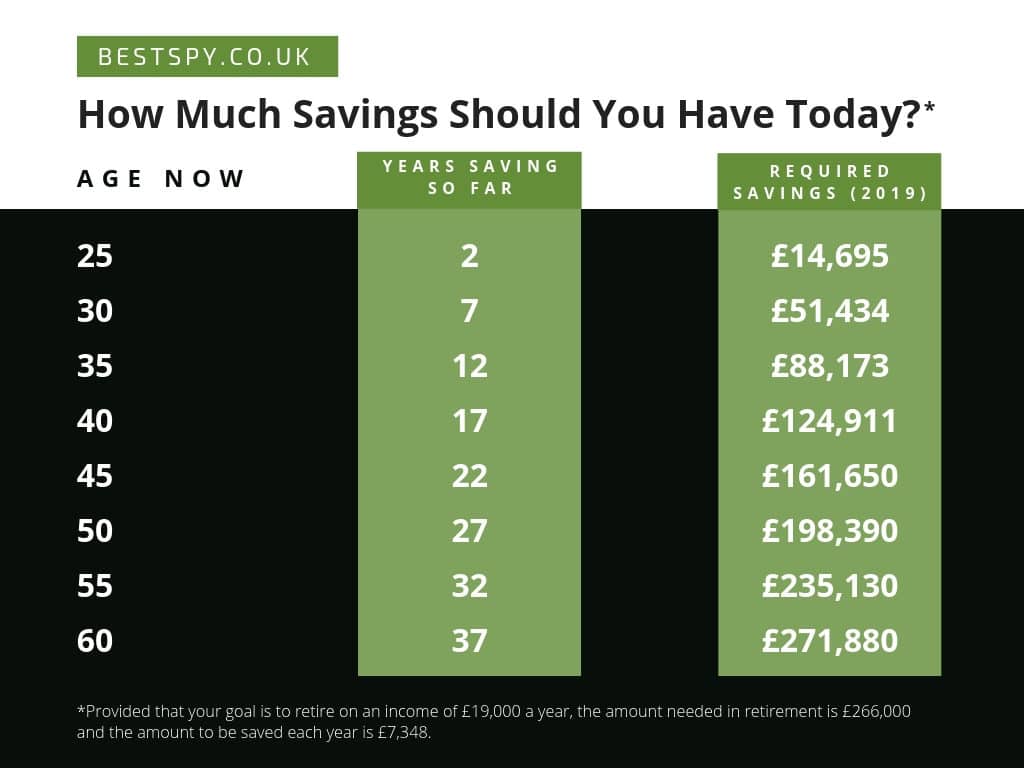

Several financial institutions have found that the average savings goal for a 40-year-old in the UK is around £124,911. As a general rule, you should have saved about three times your income before retirement by this age.

But here’s the kicker – the reality is often quite different from this ideal target.

The Reality: What Do 40-Year-Olds Actually Have Saved?

Recent data paints a more sobering picture of what Brits in their late 30s and early 40s actually have tucked away:

| Age Group | Average Savings | Percentage with Less Than £1,000 |

|---|---|---|

| 35-44 | £6,751 – £7,434 | Nearly 49% |

A 2025 Finder poll found that people aged 35 to 44 have saved an average of £7,434 The number from Unbiased is a little lower, at £6,751 for the same age group.

Even scarier is the fact that nearly half of people in this age group have less than £1,000 saved. If this sounds like you, don’t worry—you’re not the only one!

Types of Savings to Consider at 40

When we talk about “savings.” we’re actually referring to two different financial pots

- Emergency Funds: Money you can access immediately for unexpected expenses

- Pension Savings: Long-term savings for retirement that you can’t access until at least age 55

Emergency Savings

Financial experts typically recommend having 3-6 months’ worth of essential expenses saved in an easily accessible account. This safety net protects you if you lose your job or face an unexpected large bill.

For example, if your monthly essential expenses (mortgage/rent, utilities, food, transport) total £2,000, you should aim to have £6,000-£12,000 in emergency savings.

Pension Savings

According to Fidelity, you should have saved about three times your yearly salary in a pension by the time you are 40. That is, if you make £35,000 a year, your pension fund should be around £105,000.

Factors That Impact Your Savings at 40

There’s no one-size-fits-all approach to savings. Several factors influence how much you realistically might have saved by 40:

- Income levels: Higher earners typically have more disposable income to save

- Housing costs: Those who’ve been paying expensive rents or large mortgages may have saved less

- Family circumstances: Having children or caring responsibilities often reduces saving capacity

- Career breaks: Taking time out for childcare, education, or health reasons impacts savings

- Debt levels: Paying off student loans or other debts can limit saving ability

- Financial education: Understanding investing and compound interest gives some people a head start

Why Many of Us Are Falling Short

If you’re looking at these figures and feeling a bit queasy, you’re not alone. Several societal factors explain why our generation might be saving less:

- Housing costs have increased dramatically compared to our parents’ generation

- Student loan debt is a reality for many 40-year-olds

- The gig economy and less stable employment make consistent saving harder

- The cost-of-living crisis has forced many to dip into savings

- Lower wage growth relative to inflation over the past decade

Getting Back on Track: It’s Not Too Late!

Good news! At 40, you still have plenty of time to boost your savings before retirement. Here’s how:

1. Make a Realistic Plan

First, calculate how much you need to save for the retirement you want. Use online pension calculators to help with this.

2. Create a Budget That Prioritises Saving

Try the 50/30/20 rule:

- 50% on needs (housing, food, utilities)

- 30% on wants (eating out, entertainment)

- 20% on saving and debt repayment

If 20% feels impossible right now, start with what you can – even 5% is better than nothing!

3. Maximise Your Pension Contributions

- Check your employer’s scheme – many companies match contributions, which is essentially free money

- Increase contributions when you get a pay rise

- Track down old pension pots from previous employers – you might have forgotten funds!

4. Optimise Your Savings Strategy

- Review your pension fund choices – switching to funds with better performance could boost returns

- Consider stocks and shares ISAs for medium-term goals

- Look for higher interest rates on your emergency fund

5. Reduce Expenses Where Possible

- Review subscriptions – cancel those you don’t use

- Shop around for better deals on insurance, utilities, and mobile contracts

- Consider downsizing if housing costs are eating too much of your income

Real Talk: My Personal Experience

When I hit 40 last year, I’d saved nowhere near the “ideal” amount. After paying off student loans, helping with ageing parents, and dealing with a career change, my savings were pretty pathetic compared to the benchmarks.

But instead of panicking, I created a plan. I increased my pension contribution by 2% (barely noticed it in my monthly take-home), tracked down two old pension pots worth about £12,000 combined, and set up a direct debit of £100 into an emergency fund on payday.

Six months later, I’m feeling more confident. I’m not where the experts say I “should” be, but I’m moving in the right direction.

How Do You Compare to Your Peers?

If you’re curious about how your savings stack up against other UK adults in different age brackets:

| Age Group | Average Savings | % with Less Than £1,000 |

|---|---|---|

| 18-24 | £4,759 | 57.1% |

| 25-34 | £9,357 | 47.8% |

| 35-44 | £7,434 | 48.8% |

| 45-54 | £13,318 | 38.6% |

| 55+ | £27,949 | 26.9% |

Interestingly, the average savings for 25-34-year-olds is actually higher than for the 35-44 group. This could be because those in their late 30s and early 40s often face peak expenses with young families, mortgages, and career transitions.

Generations and Their Savings Habits

Different generations face unique financial challenges:

| Generation | Average Savings | Change Since 2023 |

|---|---|---|

| Silent Generation | £54,110 | -£4,496 |

| Baby Boomers | £39,880 | -£1,924 |

| Gen X | £11,204 | -£1,735 |

| Millennials | £5,384 | -£559 |

| Gen Z | £3,106 | +£643 |

Gen X (which includes most 40-year-olds today) has been squeezed between expensive housing, caring for both children and ageing parents, and economic uncertainties.

Planning for Retirement: How Much Will You Need?

The Pensions and Lifetime Savings Association (PLSA) provides helpful guidelines on annual retirement income needs:

| Retirement Lifestyle | Single Person | Couple |

|---|---|---|

| Minimum | £13,400 | £21,600 |

| Moderate | £31,700 | £43,900 |

| Comfortable | £43,900 | £60,600 |

Working backwards from these figures can help you set realistic pension saving goals.

Safety of Your Savings

It’s worth noting that cash deposits held in UK regulated banks, building societies and credit unions are protected up to £85,000 per person per financial institution under the Financial Services Compensation Scheme (FSCS).

This means your money is protected if the institution goes bust, but remember that some banking brands are owned by the same financial institution. In such cases, your funds are only protected up to £85,000 in total across all accounts with that financial group.

Final Thoughts

Remember, these figures are averages and guidelines – not judgements. Life throws curveballs, and everyone’s journey is different. The most important thing is not how your savings compare to others, but whether you have a plan to improve your financial situation going forward.

At 40, you still have around 25 years until retirement age, which gives compound interest plenty of time to work its magic if you can increase your savings now.

Don’t let perfect be the enemy of good. Any improvements you make to your saving habits today will benefit your future self, regardless of where you’re starting from.

What savings goals have you set for yourself at 40? Have you found any clever ways to boost your savings rate? I’d love to hear your experiences in the comments below!

How do you compare?

The government publishes statistics of levels of saving by age. Specifically, these cover the money held by individuals in ISAs and pensions. The most recent figures cover the period up to 2022.

The statistics group people in age bands. For the 25-34 age group, the average held in ISAs is £9,4772, while the median amount held in pensions is £18,8003.

Note that these numbers are the averages for people who have savings in an ISA or a pension. There are a lot of people who don’t have these, so the averages for those people would be much lower.

What do you need to generate £50k a year in retirement?

Sometimes, big, round targets work best. Lots of people will have a figure in mind for the income they hope for in retirement. For example – how much would you have to save in order to generate a £50,000 a year income when you retire?.

To be clear – this is a very challenging target that requires some serious saving. In reality, only a small proportion of people are likely to generate this kind of retirement income. Nonetheless, knowing what it would take gives your something to work towards.

Your Fidelity Retirement Pension Drawdown Calculator can help you figure out what kind of retirement account you need to get that income, assuming you want your income to rise by 2% a year.

If you are 65 and seeking annual income of £50,000, the pot you need climbs to just over £1m – another big target. This is the pot that would be invested to generate income – therefore after any tax-free cash has been taken.

At those levels, your pot would run dry by age 95 with average investment performance, but just 86 if investment performance is poor. 4.

For someone aged 30, let’s assume they have begun saving from age 25. To reach $20.2 million by age 65, they would need to have saved $234,826 and been contributing $354 a month, with this amount going up by 2% every year. This assumes they achieve 5% investment growth after all fees. 5.

I’m 40 and just starting to INVEST | Can I make up for time?

FAQ

How much does the average 40 year old have in savings in the UK?

| Age | Average Savings |

|---|---|

| 25 – 34 | £9,357 |

| 35 – 44 | £7,434 |

| 45 – 54 | £13,318 |

| above 55 | £27,949 |

How much money should a 40 year old have saved?

A 40-year-old should aim to have three times their annual salary saved for retirement, according to financial guidelines from Fidelity and other experts. For example, a 40-year-old with an average full-time salary of $70,000 would target saving between $210,000 and $420,000.

How many Americans have $100,000 in savings?

While specific, up-to-date figures are elusive, surveys from early 2025 and late 2023 indicate around 12-22% of American households have at least $100,000 in savings, though this figure varies significantly by age group and often includes retirement assets like checking accounts, savings accounts, and retirement accounts, rather than just liquid savings.

Can you retire at 40 with $500,000?

Retiring at age 40 with $500,000 is possible, but it will likely require a frugal lifestyle, careful financial planning, and potentially additional income streams, as $500,000 generally provides a modest income. You’ll need to significantly reduce your living expenses, possibly by relocating to a lower-cost area or owning a home outright.

What is the average savings for a 40-year-old in the UK?

The average savings for a 40-year-old in the UK is around £6,751. This figure is a general estimate and individual savings can vary widely due to factors like income, expenses, and financial habits. It’s important to note that this is an average and not necessarily indicative of what every 20-year-old in the UK has saved.

How much should you save at 40?

How much should you save at 40 The average savings by age goes up to £124,911 by the age of 40. The general rule for the average saved by age 40 is to have three times your pre retirement income. How much should you save at 50 and 60.

What is the average savings amount in the UK?

For example, the average amount held in savings by those aged 18 to 24 is £4,759, according to the Finder survey. This compares to an average of £27,949 for those aged over 55. Total average cash savings are below £10,000 in all age groups until age 45 and over. Average savings by age in the UK What factors affect average savings?.

How much savings should you have by age 30?

But as a general rule, the amount of money you should have saved by age 30 should be equal to your year-end salary. The average savings by age goes up to £124,911 by the age of 40. The general rule for the average savings by age 40 is to have three times your preretirement income.

How much money should you save in the UK?

It is suggested by experts that people save enough money to cover their living costs for three months. However, most people in the UK do not have this much saved. There can be multiple reasons for not saving enough, but insufficient earnings are consistently among the top reasons. Overall, the data on average savings in the UK is worrisome.

How much money should a 40 year old have in retirement?

For people aged 40, Fidelity’s retirement savings guidelines recommend an amount in savings worth two times your salary1 in order that you have enough to maintain your standard of living in retirement. So, someone earning £50,000 would need £100,000 in savings – which can mean money both inside and outside of pensions. How do you compare?.