So you’re about a year away from saying goodbye to that alarm clock, those commutes, and the daily grind. Congrats! But before you pop the champagne and delete all your work emails, there’s some serious prep work to be done.

I’ve helped many folks navigate this transition, and I can tell ya – the year before retirement can be hectic if you don’t have a gameplan Let’s break down exactly what you should do in your final 12 months of work to ensure a smooth transition into your golden years

Why You Need a Pre-Retirement Checklist

It’s not just a long vacation when you retire; it’s a complete lifestyle change that affects almost every part of your life. Think about your schedule, how you make money, what you do every day, and your health care. everything changes!.

Having a structured plan prevents you from forgetting critical steps and helps reduce the anxiety that can come with such a major life transition,

The 20 Essential Steps to Take in Your Final Working Year

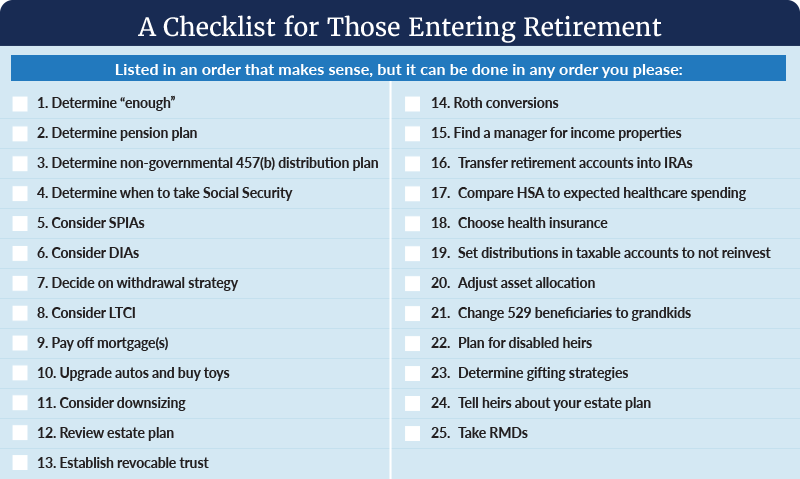

1. Create and Maintain a Detailed Checklist

Seriously, start by making a month-by-month plan of everything you need to do before you retire. I know, it seems silly to have a checklist item about making a checklist!

I recommend listing each month between now and your retirement date, then populating various tasks into each month. Check items off as you complete them to stay on track. This becomes your personalized retirement roadmap!

2. Talk to Your Boss and HR Department

Having open conversations about your retirement plans is crucial. Set up your first meeting with your boss for after one year to be honest and give them time to plan for your replacement.

You’ll also need multiple meetings with HR to discuss:

- COBRA insurance options

- Timing to maximize any bonus payouts

- Transition deadlines

- Non-compete agreements (if applicable)

- Retirement benefit details

Your final HR meeting will likely involve turning in company property like your laptop, credit cards, security badges, etc.

3. Have Heart-to-Heart Talks With Your Spouse

Retirement doesn’t just affect you – it impacts your entire household. If you’re married, make sure you’re planning retirement together and incorporating things important to both of you.

This is especially important if your spouse has been home while you’ve been working, as having you around full-time will be a big adjustment for them too! Studies show that “gray divorce” rates spike during retirement transitions, often because couples didn’t align their expectations beforehand.

4. Migrate Your Personal Files from Work Devices

Start moving any personal photos, documents, or files from your work computer to your home computer. Don’t wait until the last minute—this could take months!

Every time you open a personal file on your work computer, either migrate it immediately or add it to your migration checklist. Consider which platforms you’ll use post-retirement (Google Drive, Microsoft, etc.) and convert files accordingly.

5. Implement a Password Manager

If you’ve been keeping track of passwords in files stored on your work computer or server, it’s time to migrate to a secure password manager. LastPass, 1Password, or Bitwarden are popular options.

For a year before retirement, each time you log into a site requiring your password, make sure it gets captured in your password manager. Don’t forget to save other secure information like loyalty card numbers or credit freeze instructions.

6. Update Your Contact Information Everywhere

Take inventory of all the places where you’ve used your work email or phone number and update them with personal contact information. This includes:

- Newsletters and subscriptions

- Online accounts

- Banking information

- Medical offices

- Insurance policies

- Social media accounts

It’s surprising how many different places you’ve used your work contact info over the years!

7. Design Your Retirement Paycheck System

Establish a system for how you’ll receive regular “income” in retirement. Many retirees create a bucket system where they keep 2-3 years of cash needs in easily accessible accounts.

Consider setting up automated transfers from your retirement accounts to your checking account on a regular schedule that mimics a paycheck. This creates both financial discipline and psychological comfort.

8. Establish a Personal Calendar System

If you’ve been using your work calendar for everything, create and start using a personal calendar system now. Begin putting all personal items on your new calendar and especially enter anything scheduled for after your retirement date.

Google Calendar, Apple Calendar, or other personal options work well. Get comfortable with your new system before you lose access to your work calendar.

9. Save Your Address Book/Contacts

Don’t lose years of contact information when you leave your job! Export your work contacts and import them to your personal contact management system.

Social media platforms like LinkedIn can also help maintain professional relationships after retirement, so make sure your profile is updated before you leave.

10. Develop a Health Insurance Plan

Healthcare is often one of the biggest retirement expenses, especially if you’re retiring before Medicare eligibility at 65. Research your options thoroughly:

- COBRA continuation (typically available for 18 months)

- Healthcare marketplace plans

- Spouse’s insurance

- Retirement health benefits from your employer

- Health sharing ministries

Avoid scheduling doctor appointments for the first month after retirement to ensure a smooth transition to your new coverage.

11. Make Decisions About Pension Details

If you’re fortunate enough to have a pension, understand all your options:

- Lump sum vs. monthly payments

- Single life vs. joint and survivor benefits

- Early retirement reductions

- Deferral options

- COLA adjustments

These decisions can have lifelong implications, so take the time to understand them fully and consider consulting a financial advisor.

12. Shift Your Mindset from Work to Retirement

Start mentally preparing for retirement by spending more time dreaming about and planning your post-work life. Build a retirement bucket list that goes beyond just travel.

Research shows that those who mentally prepare for retirement have a much smoother transition and experience less depression or anxiety about this major life change.

13. Start Exploring New Hobbies and Activities

Don’t wait until retirement to figure out what you’ll do with your time. Use your final working year to explore potential interests and activities.

Join local groups, take classes, or volunteer to start building your post-retirement social network outside of work colleagues. This helps create continuity between your working and retired life.

14. Buy Your Retirement “Toys” While Still Working

If you’ve been dreaming of an RV, boat, motorcycle, or other retirement “toys,” consider purchasing them while you still have a steady paycheck.

Many retirees find it psychologically difficult to make larger purchases after the regular paychecks stop. Create a spreadsheet to track these pre-retirement purchases to ensure you don’t overspend.

15. Address Your Retirement Housing Situation

Don’t wait until retirement to decide where you’ll live. Whether you’re:

- Staying in your current home

- Downsizing

- Moving to a retirement community

- Relocating to a different state or country

Make these decisions and start implementing them before retirement. If you’re planning home renovations or modifications for aging in place, it’s easier to finance these while still employed.

16. Replace Work-Provided Technology and Services

Take inventory of the technology and services currently provided by your employer that you’ll need to replace:

- Cell phone and service plan

- Laptop or computer

- Software subscriptions

- Internet service

- Professional subscriptions

Research options and costs, and start the transition process well before your retirement date.

17. Create and Test Your Retirement Budget

By the one-year mark, you should have a good estimate of your retirement expenses. Try living on this budget for several months to test its viability.

Look for expenses you can reduce before retirement and practice living within your projected retirement means. This also helps build your retirement savings in the final stretch.

18. Use a Countdown App for Motivation

Install a retirement countdown app on your phone to stay motivated during your final year. Watching those days tick down can help you stay focused on preparing for retirement rather than getting caught up in workplace drama or stress.

19. Take Time to Say Proper Goodbyes

In your final month or two, be intentional about saying goodbye to colleagues and mentoring your successor. Plan some business trips to visit important contacts, write personal notes, and have lunch with coworkers you value.

While we all think we’ll keep in touch after retirement, that rarely happens. Take time now to express your appreciation and say proper goodbyes.

20. Enjoy the Ride!

Your final year of work represents the culmination of decades of effort. Take time to enjoy and appreciate this transition period.

Smile through those final budget meetings, laugh during your last performance review, and savor the knowledge that you’ve earned what’s coming next. This is a unique time in life – try to enjoy it!

Financial Considerations for Your Last Working Year

Don’t forget these important financial steps:

- Max out retirement contributions: This is your last chance to take advantage of employer matches and tax benefits

- Consider Roth conversions: Plan for any conversions you might want to do in early retirement

- Review and update beneficiaries: Check all accounts have current beneficiary designations

- Consolidate accounts: Consider streamlining multiple retirement accounts

- Adjust your asset allocation: Most retirees need a less aggressive portfolio as they approach retirement

- Update your estate plan: Review wills, powers of attorney, and other legal documents

Common Mistakes to Avoid in Your Pre-Retirement Year

I’ve seen folks make these errors – don’t be one of them!

- Failing to plan for healthcare costs – These can be much higher than expected, especially before Medicare

- Not practicing retirement living – Test your retirement lifestyle and budget while still working

- Forgetting to migrate digital assets – Don’t lose access to important files, contacts, or accounts

- Neglecting emotional preparation – Retirement is a huge identity shift, especially for career-focused individuals

- Making major financial decisions too quickly – Avoid hasty moves with long-term impacts

Wrapping Up

The transition from decades of work to retirement is one of life’s biggest changes. Being methodical about your preparation can make all the difference between a stressful adjustment and a smooth, enjoyable transition.

By following these 20 steps in your final year, you’ll be well-positioned to enter retirement with confidence and excitement rather than anxiety. Remember, you’ve worked hard to get to this point – now it’s time to reap the rewards!

What steps are you taking to prepare for retirement? Have you started your pre-retirement checklist? I’d love to hear about your journey in the comments below!

#3: Plan ahead for Social Security

| If you were born in… | Your full retirement age is… |

|---|---|

| 1957 or earlier | Youve already hit full retirement age |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 or later | 67 |

#1: Find out where you stand

| Type of account | 2025 contribution limit | 2025 catch-up contribution | Total allowed for 2025 with catch-up contribution |

|---|---|---|---|

| Employer retirement plan—401(k), 403(b), 457(b), or Thrift Savings Plan | $23,500 | $7,500 (or $11,250 for employees 60-63) | $30,500 (or $34,750 for employees 60-63) |

| Traditional IRA, Roth IRA | $7,000 | $1,000 | $8,000 |

| Health Savings Account (HSA) | $4,300 (self-only)$8,550 (families) | $1,000 | $5,300 (self-only)$9,550 (families*) |

8 Things You MUST DO One Year BEFORE Retirement

FAQ

What is the first thing to do before retiring?

The very first thing to do when you retire is to relax and savor your achievement with loved ones before diving into new plans.

What is the $1000 a month rule for retirement?

The “$1,000 a month rule for retirement” is a simple guideline to help you estimate the savings needed to generate consistent monthly income in retirement, typically requiring $240,000 in savings for every $1,000 of desired monthly income. This rule, based on a 5% annual withdrawal and 5% annual return, suggests that withdrawing $1,000 a month from a $240,000 portfolio would provide that amount of income without depleting your savings.

What is the biggest mistake most people make regarding retirement?

The top ten financial mistakes most people make after retirement are:1) Not Changing Lifestyle After Retirement. 2) Failing to Move to More Conservative Investments. 3) Applying for Social Security Too Early. 4) Spending Too Much Money Too Soon. 5) Failure To Be Aware Of Frauds and Scams. 6) Cashing Out Pension Too Soon.

What are the 3 R’s of retirement?

Rediscover, Relearn, Relive—embrace the journey. If you are still looking for an active lifestyle with a community at the heart of it, a retirement community may be the best option for you. In the past, they were places where elderly people could move when they could no longer live in their own home.

When should I start getting serious about retirement?

For most folks, I’d encourage you to start getting serious about retirement when you’re ~5 years away.

Should you have a retirement plan before leaving a day job?

Here’s how it works. Having your income, health care and tax plans in place before you exit the day job can make it more likely that you’ll have a happy retirement. Meet Steve. He is a partner with a big law firm in Washington, D. C. He is facing a mandatory retirement in just under a year, at age 65.

What is the ultimate retirement planning guide?

I created The Ultimate Retirement Planning Guide to assist folks as they plan for retirement, with specific steps for folks at various stages in their retirement journey (from mid-career, 5+ years out, 2-3 years out, 1 year out and post-retirement). Today, we’ll look in detail at the final year.

How often should you check your retirement plan?

If you do have one, check it at least once a year to make sure it still matches your needs and goals. A lot of things could change, like when you retire, how much you save, how much you invest, and how much money you could make in the future. You can use a retirement calculator to see if you’re saving enough.

How do I maintain a checklist 18 months before retirement?

Maintain A Checklist 18 months before retirement, I started a checklist with everything I had to address before retirement. The 20 items in this post are a good place to start. You can add to them as you think of more tasks. It was a lifesaver for me and became the roadmap that led my tasks as I made my final preparations for retirement.

What should you do if you retire?

Plan some business trips to say goodbye to the folks who have meant the most to you through your career, and start letting your successor run the day-to-day business. After you retire, you’ll no longer have an opportunity to say goodbye the “right” way, so prioritize it while you’re still working.