In the battle for retirement supremacy, pensions and 401(k)s duke it out as the two heavyweight champions of retirement planning. But which one truly deserves the championship belt? If you’re scratching your head wondering whether a pension is better than a 401(k), you’re not alone. I’ve spent countless hours researching this topic to bring you the definitive answer.

TL;DR Pensions are generally considered better than 401(k)s because they guarantee income for life, removing investment risk from your shoulders However, 401(k)s offer more control and portability for today’s mobile workforce.

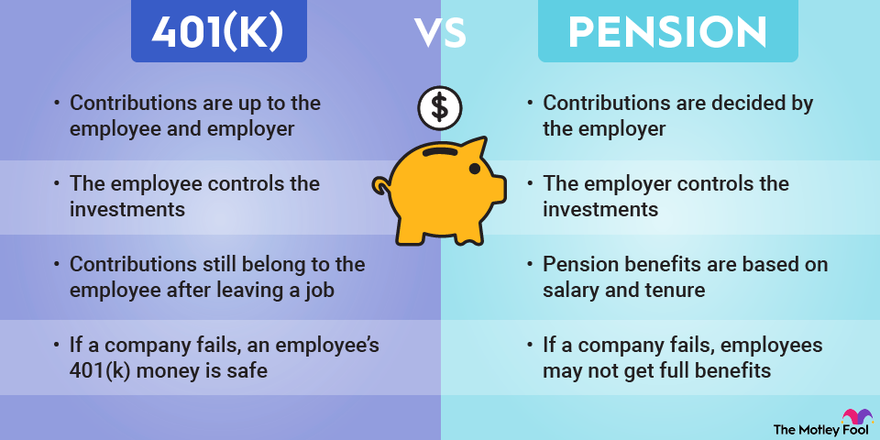

The Pension vs. 401(k) Fundamentals

Before we pick a winner, let’s take a look at what each of these retirement vehicles is:

What is a Pension?

A pension is a type of defined benefit plan in which your employer agrees to give you a set amount of money every month after you retire. The amount of money you get depends on

- Your salary history

- Years of service

- Age at retirement

The company that pays for your pension also takes on all the investment risk. No matter how the market does, you’ll get a check every month until you die.

What is a 401(k)?

There is a type of retirement plan called a 401(k) where you and sometimes your employer put money into your account. With a 401(k):

- You decide how much to contribute (up to IRS limits)

- You choose your investments

- Your retirement income depends on how well those investments perform

- You bear the investment risk

In 2024, employees can contribute up to $23,000 to a 401(k), with an additional $7,500 in catch-up contributions for those 50 or older.

The 5 Key Differences That Matter Most

When comparing pensions and 401(k)s, these five factors make all the difference

1. Who Bears the Risk?

Pensions: Your employer bears all the investment risk. If the market crashes, your benefits remain the same.

401(k)s: You bear all the investment risk. If the market crashes right before retirement, your nest egg could shrink dramatically.

2. Guaranteed Income

Pensions: Provide guaranteed income for life. Once you retire, you know exactly how much you’ll get each month until you die.

401(k)s: No guarantees. Your income depends on how much you’ve saved and how you manage withdrawals. The money could run out.

3. Portability

Pensions: Limited portability. If you leave a job before being fully vested, you might lose some or all of your pension benefits.

401(k)s: Highly portable. If you change jobs, you can roll over your 401(k) to a new employer’s plan or an IRA, keeping your retirement savings intact.

4. Control and Flexibility

Pensions: Limited control. Your employer makes all the investment decisions, and you have few choices about how to receive your benefits.

401(k)s: High level of control. You decide how much to contribute, where to invest, and how to withdraw the money in retirement.

5. Availability

Pensions: Increasingly rare in the private sector. According to the U.S. Bureau of Labor Statistics, only 15% of private industry workers had access to a pension in 2022.

401(k)s: Widely available. About two-thirds of workers have access to a 401(k) plan.

The Undeniable Advantages of Pensions

Let’s be honest – pensions come with some serious perks that make them the envy of many workers:

Guaranteed Income for Life

The biggest advantage of a pension is the security it provides. You’ll receive regular, predictable payments for as long as you live, eliminating the fear of outliving your money.

No Investment Decisions Required

With a pension, you don’t have to worry about choosing investments, rebalancing portfolios, or timing the market. Your employer handles all that stress.

Protection Against Market Volatility

Market crashes? No problem. Your pension benefit remains the same regardless of market conditions.

Potential Spousal Benefits

Many pension plans offer survivor benefits, ensuring your spouse continues receiving a portion of your pension after you die.

The Compelling Case for 401(k)s

Despite pensions’ apparent advantages, 401(k)s offer some compelling benefits that shouldn’t be overlooked:

Portability and Flexibility

In today’s job-hopping economy, 401(k)s shine because they move with you. I’ve changed jobs 3 times in the past decade, and being able to roll over my retirement savings has been invaluable.

Control Over Investments

With a 401(k), you’re in the driver’s seat. If you’re knowledgeable about investing or work with a good financial advisor, you could potentially outperform a pension fund.

Employer Matching = Free Money

Many employers offer matching contributions – effectively free money for your retirement. If your employer matches 50 cents on the dollar up to 6% of your salary, that’s a guaranteed 50% return on your investment!

Estate Planning Benefits

When you die, any remaining 401(k) funds go to your beneficiaries. With most pensions, the payments stop when you (and potentially your spouse) die.

Making the Choice: Which is Better for You?

The answer to whether a pension is better than a 401(k) isn’t one-size-fits-all. Here’s how to determine which might be better for your situation:

A Pension Might Be Better If:

- You plan to stay with one employer for many years

- You prefer guaranteed income over potentially higher but uncertain returns

- You don’t want the responsibility of managing investments

- You’re risk-averse and value security over flexibility

A 401(k) Might Be Better If:

- You change jobs frequently

- You enjoy managing investments and have the knowledge to do so effectively

- You value flexibility and control over your retirement assets

- You want to leave remaining retirement funds to heirs

The Reality: You Might Not Have a Choice

The truth is, most workers don’t get to choose between a pension and a 401(k) – your employer makes that decision for you. Pensions have become increasingly rare, especially in the private sector, due to their cost and unpredictability for employers.

If you’re lucky enough to have access to both (which some public sector and unionized jobs offer), taking advantage of both gives you the best of both worlds – the security of a pension and the growth potential of a 401(k).

Making Your 401(k) More Pension-Like

If you only have access to a 401(k), here are some strategies to make it function more like a pension:

1. Max Out Your Contributions

Try to contribute the annual maximum if possible. In 2024, that’s $23,000 (plus $7,500 in catch-up contributions if you’re 50+).

2. Don’t Miss Out on Employer Matching

At minimum, contribute enough to get the full employer match – that’s essentially free money.

3. Consider an Annuity

Once you’re near retirement, you might convert part of your 401(k) savings into an annuity that provides guaranteed income for life, similar to a pension.

4. Create a Withdrawal Strategy

Develop a sustainable withdrawal strategy (like the 4% rule) to make your savings last throughout retirement.

The Bottom Line: Security vs. Control

So, is a pension better than a 401(k)? If guaranteed lifetime income is your priority, then yes, a pension generally wins. The security of knowing exactly how much money will arrive each month for the rest of your life is invaluable for many retirees.

However, if you value flexibility, control, and the potential for higher returns – and you’re comfortable managing investments – a 401(k) might be the better choice for you.

In an ideal world, you’d have both: the security of a pension providing your basic retirement needs, plus a 401(k) to provide growth potential and flexibility.

FAQs About Pensions vs. 401(k)s

Can I have both a pension and a 401(k)?

Yes! Some employers offer both, and having both provides excellent diversification in your retirement strategy.

What happens to my pension if my company goes bankrupt?

Most pensions are insured by the Pension Benefit Guaranty Corporation (PBGC), which will pay benefits up to certain limits if your plan fails.

What happens to my 401(k) when I change jobs?

You can roll it over to your new employer’s plan, convert it to an IRA, or sometimes leave it with your former employer (though this isn’t usually recommended).

Which provides better tax advantages?

Both offer tax advantages. Traditional 401(k)s provide upfront tax breaks, while Roth 401(k)s offer tax-free withdrawals in retirement. Pensions are generally taxed as ordinary income when received.

What if my employer doesn’t offer either?

You can still save for retirement through an Individual Retirement Account (IRA), although contribution limits are lower ($7,000 in 2024, plus $1,000 catch-up for those 50+).

The retirement landscape has changed dramatically over the past few decades, with responsibility shifting from employers to employees. Whether you have a pension, a 401(k), or both, the most important factor in retirement success is consistent, adequate saving throughout your working years. Start early, save often, and make the most of whatever retirement vehicles are available to you!

How Does a 401(k) Work?

Employees contribute a portion of their salary to their 401(k), and many employers offer matching contributions, making it an excellent way to build retirement savings. With a 401(k), you can decide how much to contribute up to the annual IRS limit.

You decide which investments to make and how to put your money to work, usually in mutual funds, stocks, and bonds.

The value of your 401(k) at retirement depends on your contributions, employer matches, and the performance of your investments. There is no guaranteed income like with pensions; the amount you get depends on how the market is doing.

What is a 401(k)?

A 401(k) plan is a defined contribution plan employers offer to help employees save for retirement. In contrast to a pension, the 401(k) plan gives the employee a lot of control over how the money is invested and managed.