While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferral contributions all in Roth dollars and forgo the immediate tax deduction.

As a financial advisor who’s been working with high-income clients for years, I’ve noticed a surprising trend: while over 80% of employer plans now offer Roth 401(k) options, only about 1 in 5 savers actually use them. The gap is even wider among high-earners who often stick with traditional pre-tax contributions without considering alternatives.

Many wealthy professionals automatically assume that because they’re in a high tax bracket today, traditional 401(k) contributions must be the better choice But is that really true? Let’s dive into whether high-income earners should use Roth 401(k)s and the factors that might make this an excellent strategy despite conventional wisdom

The Quick Answer: Is a Roth 401(k) Right for High Earners?

For many high-income earners, a Roth 401(k) can be an extremely powerful tool, but it’s definitely not a one-size-fits-all solution. The decision ultimately boils down to taxes whether it’s better to pay taxes now or later.

In simple terms, a Roth 401(k) is generally worth it if you believe your current tax rate is low compared to what you’ll face in the future.

If your current tax rate is extremely high and you expect a much lower rate in retirement, sticking with pre-tax (traditional) contributions could save you more. Many experts actually recommend a mix – contributing some money to Roth and some to traditional – as a hedge against future uncertainty.

Roth vs. Traditional 401(k): Understanding the Key Differences

Before we get into specific strategies, let’s clarify how these accounts differ:

Traditional 401(k):

- Contributions reduce your taxable income today

- Money grows tax-deferred (no taxes on growth until withdrawal)

- All withdrawals in retirement are taxed as ordinary income

- Required Minimum Distributions (RMDs) start at age 73

Roth 401(k):

- Contributions are made with after-tax dollars (no immediate tax break)

- Money grows completely tax-free

- Qualified withdrawals in retirement are 100% tax-free

- No RMDs during your lifetime (as of 2024 thanks to SECURE Act 2.0)

The fundamental difference is when you pay taxes. Traditional gives you a tax break now but taxes later, while Roth demands taxes upfront but offers tax-free money in retirement.

5 Compelling Reasons High-Income Earners Should Consider Using Roth 401(k)

1. Tax Rates Are Eventually Going Up

Take a look at this sobering fact: compared to the past, we currently have a very low income tax rate, especially for people in higher tax brackets. Our national debt keeps going up and up with no sign of stopping, and entitlement programs like Medicare and Social Security are severely underfunded.

The current tax environment simply can’t continue indefinitely. Tax rates are eventually going to rise. It’s not a matter of if but when.

By using a Roth 401(k), high-income earners essentially “lock in” today’s tax rates. Even if you’re paying 32% or 35% now, that might actually be a bargain compared to what tax rates could be decades from now when you’re withdrawing funds.

2. You Expect Your Income to Grow Throughout Your Career

Despite earning a lot now, if you’re on an upward career trajectory, you might actually be in a lower tax bracket today than you’ll be in future working years. Many professionals and executives see their income continue climbing throughout their 40s and 50s.

If you expect continued income growth over your career, it’s very possible that you should realistically anticipate graduating into even higher tax brackets in future years. Using a Roth 401(k) early in your high-income years could prove advantageous if you expect your tax rate to rise later.

3. You Already Have Large Traditional Retirement Account Balances

This is a point many financial advisors miss! If you already have substantial balances in Traditional IRAs and 401(k)s, those accounts will continue growing until retirement.

By the time you reach age 73 (when RMDs begin), the magic of compounding might result in your balance being considerably higher. These RMDs often push retirees into higher tax brackets than they anticipated.

The sooner you can divert investment dollars into Roth accounts, the lower your taxable RMDs will be in retirement, which may allow you to remain in lower tax brackets. This benefit is especially valuable for younger high-income earners with decades of growth ahead.

4. RMDs and Other Taxable Income Will Determine the Taxability of Social Security and Medicare Costs

A lot of people with high incomes don’t know that the amount of money they make in retirement can cause their Social Security benefits to be taxed and their Medicare premiums to go up.

For married couples filing jointly with taxable income over $44,000, up to 85% of Social Security benefits become taxable. Additionally, higher-income retirees face Medicare’s Income-Related Monthly Adjustment Amount (IRMAA) surcharges that can add thousands to annual healthcare costs.

Since qualified Roth withdrawals aren’t counted as taxable income, they don’t contribute to these thresholds. Using Roth accounts strategically can help you reduce how much of your Social Security benefits are subject to taxation and potentially avoid Medicare premium surcharges.

5. You Want Greater Control of Your Taxes in Retirement

This could be the best thing about having both traditional and Roth money: it gives you a lot of tax options when you retire.

When most of your retirement funds are in traditional accounts, you’re at the mercy of RMDs and tax brackets. But with a mix of both, you can strategically decide each year which accounts to tap based on your tax situation.

For example, in a year with high medical expenses or other deductions, you might take more from traditional accounts. In years with higher income from other sources, you can lean on tax-free Roth withdrawals to avoid bumping into higher brackets.

This tax diversification gives you control over your tax rate each year in retirement—something most retirees would love to have!

State Tax Considerations: Where You Live Matters

Don’t forget that state taxes can significantly impact your Roth vs. traditional decision. Where you live now and where you plan to retire should factor into your strategy:

High-Tax State Now → Low/No-Tax State Later:

If you currently live in California, New York, or New Jersey but plan to retire in Florida, Texas, or Nevada, traditional contributions might make more sense. You avoid the high state tax now and won’t pay state tax on withdrawals in your new tax-free home state.

Low/No-Tax State Now → High-Tax State Later:

If you currently live in a no-income-tax state but might relocate to a high-tax state in retirement, Roth contributions become even more attractive. You pay no state tax on contributions now and won’t owe state tax on qualified withdrawals later.

The state tax impact can be substantial—potentially a swing of 10% or more in certain scenarios—so don’t overlook this factor in your planning.

Common Misconceptions About Roth 401(k)s for High Earners

There’s a lot of confusion about Roth accounts for wealthy individuals. Let me clear up some misconceptions:

-

“High earners can’t use Roth accounts” – While there are income limits for Roth IRAs, there are NO income limits for Roth 401(k) contributions. Even if you earn $500,000+ annually, you can contribute to a Roth 401(k) if your employer offers one.

-

“The employer match goes into my Roth too” – Traditionally, employer contributions go into the pre-tax portion of your account (though some plans now allow Roth matching if you elect it and pay tax on the match).

-

“I’ll have to take RMDs from my Roth 401(k)” – As of 2024, this is no longer true! Roth 401(k)s no longer require lifetime RMDs, which is a significant advantage for high-income earners who want to maximize tax-free growth.

-

“I should choose either all Roth or all traditional” – Many high earners benefit from a mixed approach, contributing to both types of accounts to create tax diversity.

When Traditional 401(k) Still Makes More Sense

Despite the advantages of Roth contributions, there are situations where traditional pre-tax contributions remain the better choice for high-income earners:

- You’re at your absolute peak earning years (late career) and expect a significantly lower tax bracket in retirement

- You live in a high-tax state now but plan to retire in a no-income-tax state

- You need the immediate tax deduction to meet other financial goals

- You’re confident that tax rates will be lower when you retire

The Bottom Line: Tax Diversification Is Key

For most high-income earners, the ideal strategy isn’t all-or-nothing but rather creating tax diversity with both traditional and Roth accounts. This hedges against future tax uncertainty and provides maximum flexibility.

If you’re truly unsure, consider splitting your contributions—perhaps 50% traditional and 50% Roth—as a balanced approach. You’ll get some tax benefits now while building a tax-free nest egg for the future.

Remember, the goal isn’t to minimize taxes in any single year but to minimize taxes over your lifetime. For many successful professionals, that strategy increasingly includes Roth 401(k) contributions despite their high current tax bracket.

I’ve seen too many high-income clients regret not building Roth balances earlier in their careers. Don’t make that same mistake—take time to assess whether Roth 401(k) contributions should be part of your retirement strategy!

Disclaimer: This article provides general information for educational purposes only. Please consult with a qualified financial advisor or tax professional for advice tailored to your specific situation.

401(k) Deferral Aggregation Limits

In 2025, the employee deferral limits are $23,500 for individuals under the age of 50, $31,000 for individuals aged 50-59 and 64 and older and $34,750 for individuals age 60-63. If your 401(k) plan allows Roth deferrals, the annual limit is the aggregate between both pre-tax and Roth deferrals, meaning you are not allowed to contribute $23,500 pre-tax and then turn around and contribute $23,500 Roth in the same year. It’s a combined limit between the pre-tax and Roth employee deferral sources in the plan.

The Value of Roth Compounding

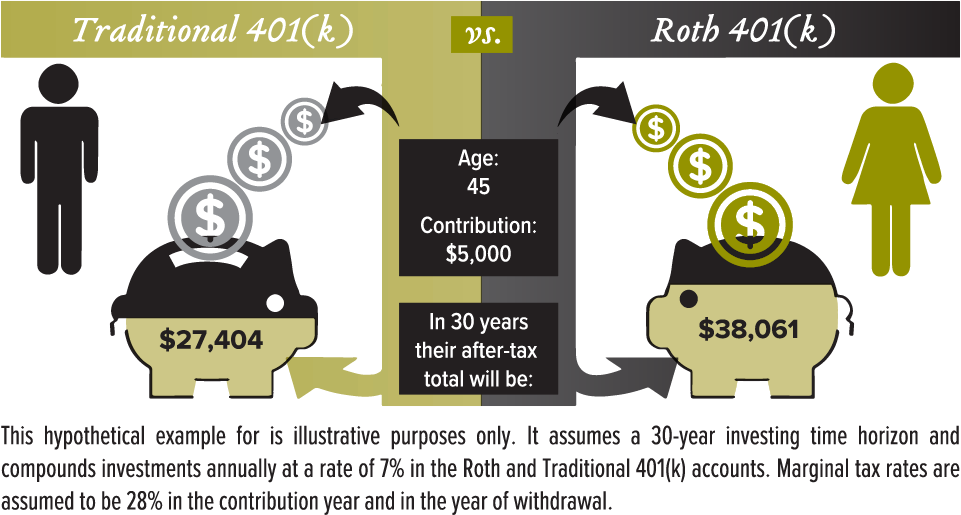

I’ll pause for a second to remind readers of the big value of Roth. With pre-tax deferrals, you get a tax break right away because you don’t have to pay federal or state income taxes on the money your employees put into their 401(k) plan. However, you must pay tax on those contributions AND the earnings when you take distributions from that account in retirement. The tax liability is not eliminated, just deferred.

Should You Use a Roth 401(k) If You Have a High Income?

FAQ

Is there a downside to a Roth 401k?

Roth 401(k) cons: There aren’t many bad things about Roth 401(k)s, but one big one is that you can’t put off paying taxes. When faced with a choice of paying more tax now or later, most people choose to pay later, hence the low participation rates for Roth 401(k)s.

Should high income earners max out their 401k?

If you’re in a high tax bracket, maxing out the $23,500 annual IRS limit ($31,000 if over 50) is often smart to get tax savings. Aim for contribution benchmarks like: 10% of your salary, rising by 1% to 2% each year as you get a raise, and finally working up to the IRS maximum.

Who benefits most from a Roth 401k?

That being said, younger workers may benefit more from Roth contributions because they tend to be in the lowest tax bracket of their career when just starting ….

Can I contribute to a Roth 401k if I make over 150k?

If you file as a single person and your MAGI is $150,000 or more but less than $165,000, you can contribute some of the full amount. For those married filing jointly, the income range to contribute a portion of the full amount is $236,000 or more, but less than $246,000.

Should high-income earners consider a Roth 401(k)?

Flexibility in Financial Planning: With no tax hit on withdrawals, high-income earners can be more flexible in managing income streams in retirement, reducing their total tax burden. Withdrawal rules are an essential consideration when considering a Roth 401 (k) vs. traditional 401 (k) for high-income earners.

Can a high income earner make a Roth 401(k) deferral?

It’s common for high income earners to think they are not eligible to make Roth deferrals to their 401 (k) because their income is too high. However, unlike Roth IRAs that have income limitations for making contributions, Roth 401 (k) contributions have no income limitation.

Is a Roth 401(k) a good investment?

A Roth 401 (k) allows for tax-free withdrawals, which can be a major advantage if you are in a higher tax bracket at retirement. In contrast, regular 401 (k) withdrawals are taxed as ordinary income, which could result in a higher tax burden during retirement. Can High-income Earners Roll Over a Traditional 401 (k) into a Roth 401 (k)?

Should you defer 401(k) contributions if you have a high income?

While pre-tax contributions are typically the 401 (k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

Can high-income earners roll over funds from a 401k to a Roth 401(k)?

Yes, high-income earners can roll over funds from a traditional 401 (k) to a Roth 401 (k), subject to certain conditions. This conversion requires paying taxes on the transferred amount as it moves from a pre-tax to an after-tax account.

Do Roth 401(k) contributions reduce taxable income?

No, contributions to a high-income Roth 401 (k) don’t reduce your taxable income in the year made. This differs from traditional 401 (k) contributions, which lower your taxable income and provide immediate tax relief.