When you think about your plans for retirement, do you wonder what the full retirement age for Social Security is? You’re not the only one.

The answer is important. When preparing for retirement, understanding the timing considerations around claiming your Social Security benefit is essential. Not everyone has the same finances or life expectancy, so it’s also important to know how the rules and benefits of Social Security apply to you.

Are you a baby boomer born in 1954 and want to know when you can start getting your full Social Security benefits? I’ve got good news for you: the answer is pretty simple, and I’ll explain it to you in plain English.

The Quick Answer

If you were born in 1954, your full retirement age is 66.

This is the age at which you can claim 100% of your earned Social Security benefits But there’s much more to understand about this important milestone and how it affects your retirement planning

Understanding Full Retirement Age

When you reach the full retirement age, also known as the normal retirement age, you can start getting all of your Social Security retirement benefits. This age varies depending on when you were born.

For people born between 1943 and 1954 (which includes you!) the full retirement age is 66. This is clearly stated by the Social Security Administration and confirmed across multiple reliable sources.

The concept of full retirement age has evolved over time:

- For those born in 1937 or earlier, it was 65

- For those born between 1943-1954, it’s 66

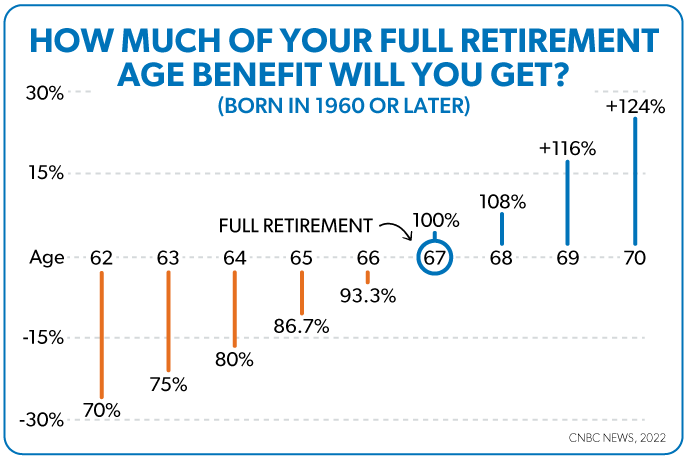

- For those born in 1960 or later, it’s 67

For birth years between these periods, the full retirement age increases gradually by months.

What This Means for You as Someone Born in 1954

Since you were born in 1954, here’s what this means for your Social Security benefits:

-

Full Benefits at 66: You can receive 100% of your earned Social Security benefits when you turn 66.

-

Early Benefits Option: You can start receiving benefits as early as age 62, but your monthly amount will be reduced permanently.

-

Bonus for Delaying Benefits: If you wait until you’re over age 66 to start getting benefits, your monthly amount will go up by 8% every year until you turn 70.

Early Retirement Reduction for Those Born in 1954

If you decide to claim benefits before your full retirement age of 66, here’s how your benefits would be reduced:

| Age When Benefits Start | Percentage of Full Benefits |

|---|---|

| 62 | 75.0% |

| 63 | 80.0% |

| 64 | 86.7% |

| 65 | 93.3% |

| 66 | 100.0% |

For instance, if your full benefit at age 2066 would be $2,000 a month, but you start at age 2062, you would only get $1,500 a month ($2,000 x 3%97%).

Delayed Retirement Credits

On the flip side, waiting beyond your full retirement age can significantly increase your benefits:

- For each year you delay claiming beyond age 66, your benefit increases by 8%

- This continues until age 70, when benefits max out

- That’s a potential 32% increase if you wait from 66 to 70!

So if your full benefit at 66 would be $2,000 monthly, waiting until 70 could increase it to about $2,640 monthly.

Spousal Benefits and Full Retirement Age

If you’re married, your full retirement age also affects spousal benefits. For someone born in 1954:

- At full retirement age (66), a spouse can receive 50% of the worker’s benefit

- If claimed earlier, the spousal benefit is reduced

- At age 62, a spouse would receive only 35% of the worker’s benefit

This is important to consider in your overall household retirement strategy.

Working While Receiving Benefits

Many people don’t realize that working while collecting Social Security before reaching full retirement age can temporarily reduce benefits.

For 2025:

- If you’re under full retirement age for the entire year, $1 in benefits will be deducted for every $2 you earn above $23,400

- In the year you reach full retirement age, $1 in benefits will be deducted for every $3 you earn above $62,160, but only counting earnings before the month you reach full retirement age

- After you reach full retirement age, there’s no reduction in benefits regardless of how much you earn

Since your full retirement age is 66, once you hit that milestone, you can earn unlimited income without affecting your Social Security benefits.

Important Dates and Deadlines for Those Born in 1954

If you were born in 1954:

- You became eligible for reduced benefits at age 62 in 2016

- You reached full retirement age of 66 in 2020

- Your benefits would max out at age 70 in 2024

I know it might be confusing to read this in 2025 when most people born in 1954 have already made their claiming decisions, but this information is still valuable if you haven’t claimed yet or want to understand how your current benefits were calculated.

Medicare Eligibility vs. Full Retirement Age

One common source of confusion is the difference between Medicare eligibility and Social Security full retirement age. For everyone, Medicare eligibility begins at age 65, regardless of when they were born.

So if you were born in 1954:

- You became eligible for Medicare at age 65 in 2019

- Your Social Security full retirement age was 66 in 2020

These are separate programs with different eligibility ages, which is why some people get confused.

Making the Right Decision for Your Situation

When deciding when to claim Social Security, consider these factors:

- Your health and family longevity: If you expect to live a long time, delaying benefits might be advantageous

- Your financial needs: If you need the income now, claiming earlier might be necessary

- Your employment status: If you’re still working, it might make sense to delay

- Your spouse’s benefits: Coordinating with your spouse can maximize household benefits

- Other retirement savings: Your other income sources might influence when you should claim

Calculating Your Specific Benefit Amount

To get a precise estimate of your benefit amounts at different ages:

- Create a my Social Security account at ssa.gov

- Review your earnings history for accuracy

- Use the benefit calculators to see how different claiming ages affect your payment

- Consider consulting with a financial advisor who specializes in retirement planning

Examples for Someone Born in 1954

Let me show you a few scenarios for someone born in 1954 with a full retirement benefit of $2,000 at age 66:

Example 1: Early Claiming

Maria claims at 62 (in 2016):

- Receives 75% of full benefit

- Monthly payment: $1,500

- Lifetime payment by age 85: $414,000

Example 2: Full Retirement Age

John claims at 66 (in 2020):

- Receives 100% of full benefit

- Monthly payment: $2,000

- Lifetime payment by age 85: $456,000

Example 3: Delayed Claiming

Robert claims at 70 (in 2024):

- Receives 132% of full benefit

- Monthly payment: $2,640

- Lifetime payment by age 85: $475,200

These examples show how claiming age can affect total lifetime benefits. The break-even point where delaying benefits starts to pay off is usually in your early 80s.

Special Considerations for People Born in 1954

If you were born in 1954, you were the last birth year eligible for some special claiming strategies that have since been phased out:

- File and Suspend: This strategy was eliminated in 2016

- Restricted Application: People born in 1954 or earlier could still file a restricted application for spousal benefits while allowing their own benefit to grow

Since most people born in 1954 have already reached age 70 by 2025, these strategies may no longer be relevant, but they were important options during your decision-making years.

If you were born in 1954, your full retirement age for Social Security is 66. This is the age at which you can claim 100% of your earned benefits. You could have started claiming reduced benefits as early as age 62, or increased benefits by delaying until age 70.

The decision of when to claim is personal and depends on your individual circumstances. There’s no one-size-fits-all answer, and what works for one person might not work for another.

Have you already claimed your benefits, or are you still deciding? What factors influenced your decision? I’d love to hear your thoughts in the comments below!

What Is the Full Retirement Age for Social Security?

The age to receive full Social Security retirement benefits depends on the year you were born. 1 For those born before 1943, the full retirement age is 65. But for people born from 1943 to 1954, the full retirement age is 66. Full retirement age goes up from 66 to almost 67 if you were born between 1955 and 1959. For anyone born in 1960 or after, full retirement benefits are payable at age 67.

When Can You Claim Social Security Benefits?

The longer you wait to claim benefits, the more they can increase. There are three general options for claiming retirement benefits from Social Security:

- Early retirement age. Starting as early as age 62, you can start getting Social Security during retirement. But if you start getting benefits before you reach full retirement age, they will be less.

- Full retirement age. Depending on the year you were born, this is the age at which you can start getting your full retirement benefit.

- Delayed retirement age. Your retirement benefit amount will go up by 8% every year after you reach full retirement age until you reach age 70. After age 70, there is no reason to delay benefits any longer.

Were You Born After 1954? Learn Your Full Retirement Age in this Video

FAQ

Can you collect Social Security at 66 and still work full time?

When can I draw Social Security if I was born in 1954?

Your full retirement age is 66 if you were born between 1943 and 1954. You can start getting Social Security retirement benefits as early as age 62, but the amount you get will be less than your full retirement benefit amount.

What is the best age to retire for Social Security?

There isn’t a single “best” age to retire for Social Security; it depends on your personal situation, but for most people, waiting until age 70 provides the highest monthly benefit for the rest of your life. You can claim benefits as early as 62, but this results in a permanently reduced monthly payment.

At what age do you get 100% of your Social Security benefits?

You receive 100% of your Social Security benefits when you reach your full retirement age, which is 67 for people born in 1960 or later. The full retirement age varies based on your birth year, falling between 66 and 67 years old.

What is a full retirement age?

Full Retirement Age Your full retirement age varies depending on the year you were born. The full retirement age for receiving full Social Security benefits varies by birth year, ranging from 65 to 67. Claiming Social Security before your full retirement age reduces your monthly benefit, but delaying benefits until age 70 increases them.

What is the retirement age if you were born in 1959?

People born in 1959 can now get full benefits at age 66 years and 10 months. Starting in 2026, people born in 1960 or later will be able to retire at age 67. This marks the conclusion of a phased increase initiated under the 1983 amendments.

When is the full retirement age for Social Security?

People born in 1959 reach their full retirement age at 66 years and 10 months, while those born in 1960 or later will reach full retirement age at 67. This change is important for anyone nearing retirement and considering when to begin collecting benefits. In 2025, the full retirement age for Social Security reached a significant milestone.

When can I start collecting my retirement benefits?

Claiming at 62: You can start collecting as early as 62, but your monthly benefit is permanently reduced. The reduction can be up to 30% depending on your full retirement age. Claiming at FRA: Waiting until your full retirement age ensures you receive 100% of your earned benefit. For people born in 1960 or later, this means waiting until age 67.

How much is a spouse’s retirement benefit at full retirement age?

This example is based on an estimated monthly benefit of $1000 at full retirement age. Year of Birth 1. Months between age 62 and full retirement age 2. At Age 62 3. The retirement benefit is reduced by 4. The spouse’s benefit is reduced by 5. If you were born on January 1 st, you should refer to the previous year.

How does the full retirement age (Fra) calculator work?

The Full Retirement Age (FRA) varies depending on your birth year, and claiming benefits too early or too late affects the amount you receive. The calculator works by analyzing: Birth Year – Social Security FRA is determined by your year of birth. Current Age – Helps estimate how many years remain until FRA.