There are a lot of seniors and the number is growing. Some estimates say that seniors hold two-thirds of all the personal wealth in the United States. By the year 2050, the number of seniors is projected to be nearly twice as large as it was in 2012. Since many seniors have been able to save up a nest egg for their retirement years, they are often targeted with fraud in a way that younger people with no savings are not.

With billions of dollars in sales to be made, insurance companies may offer commissions as high as 10 percent to agents to sell products like long-term deferred annuities to senior citizens. In this environment, consumers should arm themselves with information to protect their interests. The Attorney General provides the following tips to consider before purchasing an annuity:

Are you or someone you care about in their mid-80s thinking about buying an annuity? Maybe you’ve been to one of those “free dinner” financial seminars or an advisor has told you that it could be a good way to make sure you have money in your later years. Let’s take a close look at whether annuities make sense for you at this point in your life before you sign anything.

I’ve researched this topic extensively, and what I’ve found might surprise you. The truth is, most annuities are NOT a good fit for people over 85 – but there are some exceptions worth considering.

Understanding Life Expectancy and Annuity Returns

Let’s start with a critical fact according to the Center for Disease Control, an 85-year-old male will live, on average, an additional 6.5 years (to age 915) This life expectancy statistic is absolutely crucial when evaluating annuities.

Why? Because most annuities need time to provide value, and at 85, time is limited.

For example, if an 85-year-old invests $100,000 in an immediate annuity with lifetime income guarantees, they might receive about $12,000 per year. If they live the average 6.5 years, they’ll only receive $78,000 back – a terrible return on investment!

Someone who invests $100,000 would get $180,000, even if they live to be 100 years old and come from a family with genes that make people live long. That’s better, but is the risk worth it? Most money experts say no.

Types of Annuities and Their Suitability for 85+ Investors

Not all annuities are created equal. Let’s look at the main types and see if they make sense for an 80-year-old person:

1. Immediate Annuities with Lifetime Income Guarantees

Recommendation: Generally NOT suitable for 85+ investors

- Pros: Guaranteed income for life

- Cons: Poor return on investment unless you live well beyond average life expectancy

- Bottom line: The math simply doesn’t work out unless you’re extremely confident about living into your late 90s or beyond

2. Period Certain/Cash Refund Immediate Annuities

Recommendation: Potentially suitable in specific situations

- Period Certain: For example, a 15-year period certain annuity might pay about $7,800 annually for 15 years on a $100,000 investment. If the investor dies before the period ends, beneficiaries receive the remaining payments.

- Cash Refund Option: Guarantees about $8,500 annually with a promise that beneficiaries receive the difference between initial investment and amount paid if the investor dies before recouping their initial investment.

- Bottom line: Cash refund immediate annuities can be viable if you want income plus ensuring money passes to heirs

3. CD-Type Fixed Annuities

Recommendation: Potentially suitable with cautions

- Pros: Guaranteed capital and fixed returns

- Important considerations: Only consider those that waive surrender penalties upon death and avoid those with market value adjustments

- Bottom line: Can be viable for 85+ investors, but read the fine print carefully

4. Variable Annuities with Lifetime Income Benefits

Recommendation: Generally NOT suitable for 85+ investors

- Very few insurance companies will issue these to someone 85+

- A typical 5% withdrawal rate would mean just $5,000 annually on a $100,000 investment

- By average life expectancy (91.5), you’d receive only about $32,500

- Bottom line: Doesn’t provide enough income and remaining balance is typically lost upon death

5. Variable Annuities with Return of Premium Death Benefits

Recommendation: Potentially suitable for specific goals

- These allow market participation while guaranteeing heirs receive at least initial premium amount (less withdrawals) upon death

- Offers protection against market downturns for estate planning purposes

- Bottom line: May be viable for those who want market participation with principal protection for heirs

Red Flags and Warning Signs to Watch Out For

The Minnesota Attorney General’s office warns seniors about several questionable practices in the annuity industry:

Beware of High-Pressure Sales Tactics

- “Free” dinner seminars that are actually sales pitches

- Agents who cold call or show up unannounced

- “Limited time offers” designed to rush decisions

- Salespeople who don’t want family members present

Watch Out for Excessive Surrender Charges

- Some annuities charge penalties as high as 17-25% for early withdrawals

- One Minnesota senior faced an annuity with surrender charges lasting until age 95!

- Another retired farmer was charged $6,800 in penalties when he needed to access his $24,000 investment

Questionable Marketing Practices

- “Bonuses” that are offset by higher fees

- Claims that annuities are “just like CDs but better”

- Agents encouraging switching from one annuity to another (“churning”)

- Misrepresentations about tax benefits

The Smart Approach: What Should an 85-Year-Old Consider Instead?

In the end, should an 85-year-old buy an annuity? Most of the time, NO. But there are exceptions:

-

CD-type fixed annuities with no surrender penalties upon death and no market value adjustment might be appropriate in some cases.

-

Cash refund immediate annuities could make sense if guaranteed income plus return of premium to heirs is important.

-

Variable annuities with return of premium death benefits might work for those wanting market participation with principal protection for heirs.

However, for most 85-year-old investors, other options are likely more suitable:

- Certificates of Deposit (CDs) provide guaranteed returns without complicated contracts

- Treasury bills or bonds offer government-backed security

- High-yield savings accounts maintain liquidity for healthcare or living expenses

- Simple investment portfolios designed for income and preservation of capital

A Checklist Before Making Any Decision

If you or a loved one is still considering an annuity at 85+, please take these steps:

- Consult with a fee-only financial advisor who isn’t compensated for selling products

- Involve trusted family members in all discussions

- Get a second (and third) opinion

- Read ALL the fine print, especially about surrender charges

- Consider how much access to capital might be needed for healthcare or living situation changes

- Understand exactly how beneficiaries will be treated

- Compare with simpler alternatives like CDs or Treasury securities

Real Talk: The Sales Pressure Problem

Let’s be real for a minute. Insurance companies sometimes offer commissions as high as 10% to agents who sell long-term deferred annuities to seniors. That creates a powerful incentive for them to sell products that may not be in your best interest.

As one expert says, “Always tell yourself to swallow the food rather than the sales pitch” if you attend one of those free dinner seminars!

The Bottom Line

At 85, most annuities simply don’t make mathematical sense. The combination of limited life expectancy and the structure of most annuity products means you’re unlikely to receive a good value.

The exceptions might be certain cash refund immediate annuities, carefully selected CD-type fixed annuities, or variable annuities with return of premium death benefits – but ONLY after careful consideration with trusted advisors.

Remember that simplicity, flexibility, and liquidity become increasingly important as we age. Any financial product that ties up money with surrender penalties or complex terms deserves extreme scrutiny.

Have you or a family member dealt with annuity decisions late in life? I’d love to hear your experiences in the comments below!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial professional before making investment decisions.

Beware High-pressure Sales Tactics and Seminars

Some unscrupulous sellers use high-pressure sales pitches, seminars, and telemarketing. Agents who “cold call” you, call you more than once, offer “limited time offers,” show up without an appointment, or won’t meet with you if your family is there should be avoided. Beware of estate planning “seminars” that are actually designed to sell annuities. Beware of seminars that offer free meals or gifts. In the end, they are rarely free. Beware of agents who give themselves fake titles to enhance their credibility.

Beware of High Surrender Charges

The most significant fee associated with annuities is often the surrender charge. This is the percentage that a consumer is charged if he or she withdraws funds early. For instance, one of the insurance companies that the Attorney General’s Office sued charged a retired farmer on a fixed income $6,800 in surrender penalties when he needed access to his $24,000 (most of his net worth) placed in annuities. Another woman from Minnesota was sold an annuity that had surrender charges that would last for 16 years, or until she was 95 years old. The penalty for giving up the annuity was 17% of her investment.

The HUGE Mistake That 99% of Annuity Owners Make

FAQ

At what age should you not buy an annuity?

Annuities come with various costs, including administrative fees and surrender charges. For adults over 80, these expenses become more problematic because there’s less time for the guaranteed income to offset the costs. Experts say annuities may not make sense in these scenarios: You have your basic needs covered.

Can you buy an annuity at age 85?

There generally isn’t a strict age limit to buying an annuity.Aug 18, 2025

How much will a $100,000 annuity pay monthly?

How much can annuities pay out at age 85?

At age 85, it’s your remaining life expectancy that allows the insurance company to provide this high payout. If you invested $100,000 in the annuity product, the company could make payments of $8,500 per year for almost 12 years just with the money you invested.

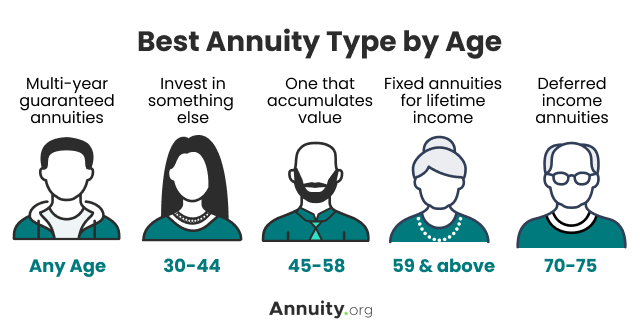

What is the best age to buy an annuity?

Annuities can provide people with a guaranteed stream of income when they need it most. While some financial advisors suggest that the best age to begin taking payments from an annuity is between 70 and 75, you don’t have to wait until then to buy it. You can purchase one from age 18 on up to your retirement years. 1.

Should seniors buy annuities?

Seniors can supplement their income with annuities in order to manage increased medical costs, living expenses and maintaining their lifestyle. Additionally, certain annuities have guarantees which prevent seniors from outliving their income, and provide a death benefit for the beneficiary. How Many Seniors Buy Annuities?.

What percentage of annuities are owned by seniors?

Seniors make up a significant portion of the annuity owning and purchasing population. Around half of annuity owners purchased their annuity between the ages of 50 and 64. About 14 percent of annuity purchasers are age 65 or older, according to the 2013 Gallup Survey of Individual Annuity Contracts.

Should you buy an annuity if you live beyond your life expectancy?

Even if you live beyond your life expectancy, the monthly payments will continue. People between the ages of 50 and 70 are frequently buyers of annuities because they’re approaching retirement (or have already stopped working) and probably have the savings for an upfront lump sum payment for an immediate annuity.

Who can buy an annuity?

Anyone 18 years and older can buy an annuity. However, it is relatively uncommon among younger people. Annuities typically come with higher fees than other investment vehicles, and some financial advisors recommend maxing out other options—such as a 401 (k)—before turning to annuities.