Annuities can provide people with a guaranteed stream of income when they need it most. Experts say that between the ages of 70 and 75 is the best time to start getting payments from an annuity, but you don’t have to wait until then to buy one.

Your decision about when to buy should take into account things like your retirement income needs, financial goals, tolerance for market fluctuations, life expectancy, and the amount of savings that you have.

Are you scratching your head about when to pull the trigger on an annuity? You’re not alone! I’ve been researching this topic for weeks, and the answer isn’t as straightforward as you might hope. The truth is the “right” age depends on your personal situation financial goals, and retirement plans.

Many financial advisors suggest 70 to 75 as the best age to start taking annuity payments But that doesn’t mean you should wait until then to purchase one! Let me break this down for you in simple terms so you can make an informed decision

Understanding Annuities: The Basics

Before diving into the age question let’s make sure we’re on the same page about what annuities actually are.

Basically, an annuity is a deal between you and an insurance company. You give them a large amount of money, either all at once or over time, and they promise to give you a steady income, either right away or in the future. This money can keep coming in for a set amount of time or for the rest of your life.

The main appeal? Guaranteed income that you can’t outlive. That’s pretty strong in a world where people are living longer than ever!

Age Breakdown: When Should YOU Consider an Annuity?

Let’s look at different age ranges to understand when annuities might make sense:

Ages 18-34: Generally a No-Go

If you’re in this age bracket, I’ll be blunt: stay away from annuities!

At this stage of life, you need:

- Growth potential from investments

- Flexibility with your money

- Time to weather market ups and downs

In addition, the IRS has a rule that says you’ll have to pay a penalty if you take money out of a lot of annuities before you turn 70 1/2. Not ideal when you’re decades away from retirement!.

As Stan the Annuity Man puts it quite colorfully: “18 to 34-year-olds should never, ever, ever, ever, ever buy an annuity of any type.” He suggests that if someone this age is pitched an annuity, they should metaphorically “punch them in the face.” (Though he quickly walks that back—violence is never the answer, folks!)

Ages 35-49: Still Probably Too Early

For most people in this age range, annuities still aren’t a great fit. You’ve got:

- Many working years ahead

- Time to recover from market fluctuations

- Need for growth to combat inflation

- That same 59½ rule to worry about

There are a few rare exceptions, like if you inherited an annuity or are a very rich business owner who wants to keep your assets safe from lawsuits. But for the average person aged 35 to 49, it might be better to put their money into other things.

Ages 50-64: Start Learning and Maybe Dipping Your Toe In

Now we’re getting somewhere! Once you hit 50, it’s time to start educating yourself about annuities. You’re approaching retirement and may want to:

- Create income floors

- Protect some principal

- Transfer certain risks to insurance companies

This doesn’t mean you should rush out and buy an annuity at 50, but it’s a good time to start exploring how they might fit into your overall retirement strategy.

If you’re planning to retire early (say, 54 or 55), annuities could be part of your income bridge strategy before Social Security kicks in. But remember that 59½ rule—you’ll need to structure things carefully to avoid penalties.

Ages 65 and Older: Prime Annuity Territory

This is when annuities start to make the most sense for many people. At this stage:

- You’re in or approaching retirement

- Income security becomes more important

- Protection against market volatility matters more

- You may have a better sense of your longevity prospects

Many financial advisors suggest 70 to 75 as the optimal age to start taking annuity payments. The monthly payout tends to be higher when you start later because of shorter life expectancy.

Factors Beyond Age That Matter

Your date of birth isn’t the only thing that should influence your annuity decision. Consider:

1. Your Retirement Income Needs

Do a thorough assessment of your expected income from:

- Social Security

- Pensions (if applicable)

- 401(k), IRA, and other savings

- Other investments

If there’s a gap between guaranteed income and essential expenses, an annuity might help fill it.

2. Your Life Expectancy and Health

Be honest with yourself about your health and family history. If longevity runs in your family and you’re in good health, annuities can provide valuable protection against outliving your money.

3. Your Risk Tolerance

How do you feel about market volatility? If watching your portfolio drop 20% would keep you up at night, especially in retirement, an annuity could provide peace of mind.

4. Your Other Financial Goals

Do you want to leave money to heirs? Travel extensively in early retirement? These goals should factor into your annuity decision.

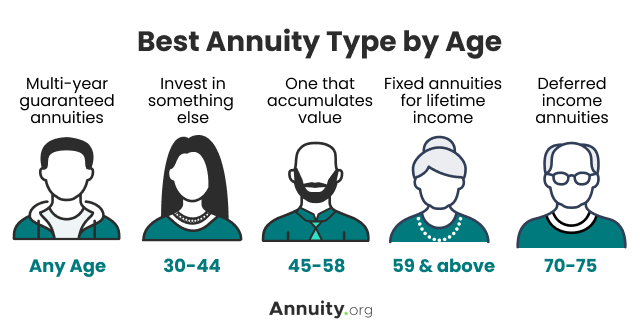

Types of Annuities and Age Considerations

Different types of annuities may be appropriate at different ages:

Immediate Annuities (SPIAs)

These start paying income right away and are typically purchased by older individuals who are in or near retirement.

Deferred Annuities

These allow your money to grow tax-deferred and start payments years later. They might be appropriate for people in their 50s or early 60s who want to secure income for their later years.

Fixed vs. Variable Annuities

Fixed annuities guarantee a minimum interest rate, while variable annuities’ returns fluctuate with the market. Your age and risk tolerance will influence which is more appropriate.

Common Myths About Annuity Age

Let me clear up some misconceptions:

Myth 1: “You should always wait until you’re 70+ to buy an annuity.”

Truth: While 70-75 may be optimal for starting payments, you might purchase the contract earlier, especially with deferred annuities.

Myth 2: “Younger people should never consider annuities.”

Truth: While rare, there are specific situations where younger individuals might use annuities (like protecting wealth from lawsuits).

Myth 3: “It’s too late to buy an annuity if you’re already in your 80s.”

Truth: Even at advanced ages, certain annuity products might make sense for specific goals.

My Personal Take

I think annuities are like specialized tools – they’re perfect for certain jobs and terrible for others. The right age is really about where you are in your financial journey rather than just the number of candles on your birthday cake.

If you’re approaching retirement and worried about income security, annuities deserve serious consideration. But if you’re young with decades ahead of you, your money probably belongs elsewhere.

When Should You Definitely NOT Buy an Annuity?

Regardless of age, some situations make annuities a poor choice:

- If you don’t have an emergency fund

- If you’re struggling with high-interest debt

- If you haven’t maxed out tax-advantaged retirement accounts

- If you need short-term liquidity for upcoming expenses

- If all your other income sources are already secure

Tips for Buying an Annuity at Any Age

If you do decide an annuity is right for you, here are some pointers:

- Shop around – Payout rates vary significantly between companies

- Consider laddering – Buy multiple smaller annuities over time rather than one big one

- Understand the fees – Some annuities (especially variable ones) can be expensive

- Check the insurer’s rating – You want a financially sound company that’ll be around for decades

- Get expert help – Work with a fiduciary advisor who puts your interests first

The ideal age for purchasing an annuity depends on your personal circumstances, but here’s a general guideline:

- Under 50: Probably not, focus on growth investments

- 50-64: Start learning and potentially planning for future annuity purchases

- 65-70: Consider immediate annuities if you need income now

- 70-75: Often considered the sweet spot for maximizing annuity income

- 75+: Still an option, but be careful about surrender periods and fees

Remember, an annuity shouldn’t be your entire retirement strategy, but rather one piece of a diversified approach to secure income.

Have you considered buying an annuity? At what age do you think would be right for you? I’d love to hear your thoughts in the comments!

The Monthly Payout

The amount of money you get each month from an annuity depends on your age and gender, interest rates, and the amount of money you invested.

Annuities pay out the full amount of principal and interest by the end of a certain period. If you want payments made for a 10-year period, for example, the payment amount will be based on the principal and total interest to be earned during that period, divided into 120 monthly payments.

If you want a payment for life, the amount is based on how many months you have left until you reach your life expectancy age. If you are 65 and your life expectancy age is 80, the payment amount is based on 180 months. Even if you live beyond your life expectancy, the monthly payments will continue.

People between the ages of 50 and 70 are frequently buyers of annuities because theyre approaching retirement (or have already stopped working) and probably have the savings for an upfront lump sum payment for an immediate annuity.

Consider Your Life Expectancy

Developing an idea of how long you may live can inform your annuity purchase decision. First, if you think you’ll live a long time, the monthly payments from an annuity may help you if you lose your other sources of income.

In that case, buying a deferred annuity earlier in life may be a good choice. The longer the period of time you have before you start annuity payments, the greater the monthly payout can be. (But bear in mind, it will involve substantial fees given the length of time its administered.)

However, annuity payment amounts get larger the older one is because life expectancy grows shorter. So theres also the case for buying an immediate annuity later in life.

How to Buy an Annuity: What Age Is Too Old or Too Young?

FAQ

What is the best age to get an annuity?

Financial advisors recommend starting annuity payments between the ages of 70 and 75. When you are close to or already retired is a better time to buy an immediate annuity because the payments start right away.

How much will a $100,000 annuity pay monthly?

Should a 40 year old buy an annuity?

Bottom line. Buying an annuity in your 40s is uncommon — and for most people, it’s not the best move. You’ll likely get better long-term results from lower-cost, higher-growth investments. In your 40s, growth and flexibility are usually more important than guarantees.

What is the average age to buy an annuity?

The age has other significances however and marks an important financial planning milestone for many today. Standard Life, which is part of Phoenix Groups, says that the average age at which people buy lifetime annuities is 64 and the average age at which they buy fixed term annuities is 63.

How old do you have to be to buy an annuity?

This means that if you enter NPS at the age of 60, you have to buy the annuity at the age of 63 which stops nearly 40% of your income from compounding in a tax-free manner to a sizeable amount, even as the remaining 60% can compound and grow.

What if I’m Too Young to buy an annuity?

That means if you’re 18 to 34, in that age range, or too young to buy an annuity. You buy this index annuity that the person said, “Dude, you’re going to the market upside with no downside,” which is a lie, and you take money out of that before your age 59 1/2, there is a 10% IRS penalty because you’re taking it out before age 59 1/2.

When is the best time to buy an annuity?

One of the best times to buy an annuity can be when you’re retiring. That’s when you’ll be thinking about changing your RRSPs and other registered savings into retirement income. An annuity can provide guaranteed lifetime income to cover basic living expenses during your retirement.