If the thought of playing golf or taking care of your garden all day sounds like your ideal life, you’re not the only one. Most people your age are still decades away from retirement.

Retiring well ahead of the norm is a topic that dominates online forums and many millennial-managed websites. But figuring out how to retire at 45 — and reaching that goal — isnt for the faint of heart.

A typical adult in good health may go on to live more than three decades after theyve reached their mid-40s, and quite a few will reach age 85 or 90. 1. It goes without saying that if you want to retire early, you’ll need a strong investment account to make sure you don’t run out of money during your lifetime.

Dreaming of ditching the 9-to-5 grind two decades before the typical retirement age? You’re not alone! Early retirement at 45 is the ultimate financial goal for many folks who want to reclaim their time and live life on their terms, But let’s be honest – figuring out exactly how much cash you’ll need stashed away can feel overwhelming,

I’ve done the research and crunched the numbers to help you understand what it really takes to retire at 45. Spoiler alert: it’s gonna take some serious saving and planning, but it’s totally achievable with dedication!

The Big Number: How Much You Really Need

According to financial experts the magic formula for early retirement centers around the 4% rule. This rule suggests you should withdraw no more than 4% of your retirement savings in your first year of retirement then adjust that amount for inflation in subsequent years.

So what does that mean in actual dollars? Let’s break it down:

If you need $50,000 annually to cover your expenses in retirement you’ll need about $1.25 million saved by age 45. This calculation uses the 4% withdrawal rule (25 times your annual expenses).

For many early retirees, the actual number might be significantly higher, especially when factoring in:

- Healthcare costs before Medicare eligibility

- Potential long-term care needs

- Inflation over a potentially 40+ year retirement

- Market volatility

- Taxes and account fees

Why Early Retirement Requires More Savings

When you retire at 45, your retirement savings need to last potentially 40+ years, compared to the 20-30 years for someone retiring at the traditional age of 65. This extended timeframe creates unique challenges:

- Longer exposure to inflation – Even modest inflation compounds dramatically over four decades

- Healthcare coverage gap – You’ll need to fund 20 years of health insurance before Medicare eligibility

- No Social Security yet – Benefits typically don’t kick in until at least age 62

- Sequence of returns risk – Market downturns early in retirement can devastate your nest egg

The Current Retirement Savings Reality Check

First, let’s take a look at how much most people have saved by the time they are in their mid-40s:

The Federal Reserve says that in 2022, Americans aged 45 to 54 had saved an average of $313,220 for retirement. Vanguard’s “How America Saves 2023” report also found that employees aged 45 to 54 had average 401(k) balances of $91,281 to $168,646.

These figures fall significantly short of the $1. 25+ million needed for early retirement. This isn’t meant to put you off, but to stress that retiring at 45 requires a lot of money management and planning.

Calculating Your Personal Retirement Number

Your specific retirement number depends on several personal factors:

1. Estimate Your Annual Expenses

Start by determining how much you’ll spend annually in retirement. A good starting point is 70-80% of your current income, but early retirees often need more. Here’s a breakdown of average expenses for retirees according to the U.S. Bureau of Labor Statistics:

| Expense Category | Average Annual Cost |

|---|---|

| Housing | $21,445 |

| Healthcare | $8,027 |

| Transportation | $9,033 |

| Food (at home) | $4,973 |

| Food (dining out) | $2,741 |

| Utilities | $4,307 |

| Entertainment | $2,898 |

| Personal insurance | $3,277 |

| Clothing | $1,287 |

| Reading materials | $164 |

While these figures reflect costs for people 65+, early retirees should expect higher expenses, especially for healthcare.

2. Account for Healthcare Costs

Healthcare deserves special attention for early retirees. Without employer-sponsored coverage or Medicare, you’ll need to budget for:

- Health insurance premiums (potentially $12,000+ annually for a couple)

- Out-of-pocket costs like deductibles and coinsurance

- Potential long-term care expenses later in life

A home health aide costs about $27 an hour on average, while a private room in a nursing home costs about $9,034 a month on average. Yikes!.

3. Apply the 4% Rule (or Less)

Once you’ve determined your annual expenses:

- Multiply your annual expense amount by 25 (assuming 4% withdrawal rate)

- Consider using a more conservative 3% rate for early retirement (multiply by 33.3)

For example:

- If you need $60,000 annually: $60,000 × 25 = $1.5 million (using 4% rule)

- Using a more conservative 3% rule: $60,000 × 33.3 = $2 million

4. Factor in Other Income Sources

Your retirement savings goal may be adjusted based on additional income sources:

- Rental properties

- Side businesses

- Part-time work

- Future pension or Social Security benefits

How to Achieve Your Early Retirement Savings Goal

Reaching the 7-figure savings needed for early retirement requires aggressive strategies:

1. Maximize Retirement Contributions

- Max out your 401(k) ($23,000 in 2024, plus catch-up contributions after 50)

- Fully fund IRAs ($7,000 in 2024)

- Consider additional tax-advantaged accounts like HSAs

2. Create a Bridge Account

Since you typically can’t withdraw from retirement accounts until age 59½ without penalties, you’ll need accessible money to bridge the gap:

- Taxable brokerage accounts

- High-yield savings

- Real estate investments

3. Drastically Increase Your Savings Rate

Most early retirees save 50%+ of their income. This requires:

- Downsizing housing

- Eliminating debt

- Reducing discretionary spending

- Increasing income through side hustles or career advancement

4. Optimize Your Investment Strategy

- Focus on low-fee, diversified investments

- Consider a slightly more aggressive asset allocation during accumulation

- Gradually shift to a more conservative portfolio as you approach your retirement date

Real-World Considerations for Early Retirement

Inflation’s Impact

$50,000 today won’t have the same purchasing power in 20 or 30 years. If we assume 3% annual inflation:

- $50,000 today = $90,306 in 20 years

- $50,000 today = $121,363 in 30 years

Your withdrawal strategy must account for this ever-increasing cost of living.

Tax Efficiency Matters

How you withdraw money in early retirement can significantly impact your tax bill:

- Roth conversion ladders

- Tax-loss harvesting

- Strategic withdrawal sequencing from different account types

Potential for Part-Time Work

Many early retirees continue earning income through:

- Consulting

- Freelancing

- Passion projects

- Seasonal work

Even modest income of $10,000-$20,000 annually can reduce withdrawal needs dramatically.

Is Early Retirement at 45 Realistic for You?

Let’s be real – retiring at 45 isn’t for everyone. It requires:

- High income relative to expenses during working years

- Exceptional savings discipline (often 50%+ savings rates)

- Strategic investment management

- Flexibility to adjust spending in retirement

- Willingness to potentially return to work if needed

My Personal Take on Early Retirement Planning

I think the biggest mistake people make when planning for early retirement is focusing solely on the total savings number without considering the lifestyle implications. The journey to early retirement often involves significant sacrifices during your prime earning years.

Consider whether you want to:

- Live extremely frugally for 20+ years to retire early

- Work longer but enjoy more lifestyle flexibility along the way

- Find a career you genuinely enjoy that doesn’t feel like “work”

There’s no one-size-fits-all answer, and the “right” approach depends on your personal values and priorities.

Steps to Take Right Now Toward Early Retirement

Regardless of where you currently stand, these steps will move you closer to your early retirement goal:

- Calculate your target number using the guidelines above

- Track your current spending to identify savings opportunities

- Increase retirement contributions by at least 1% annually

- Eliminate high-interest debt

- Develop additional income streams

- Consult with a financial advisor who specializes in early retirement planning

Final Thoughts: Is It Worth It?

Retiring at 45 requires extraordinary commitment to saving and investing, but the reward is extraordinary too – potentially decades of freedom to pursue your passions without financial stress.

The key question isn’t just “How much do I need?” but rather “What kind of life do I want to live?” Balance your desire for early retirement with enjoying the journey along the way.

Remember that even if full retirement at 45 proves challenging, financial independence that allows greater flexibility in your work and lifestyle is an achievable goal worth pursuing. The planning and habits you develop will benefit you regardless of when you ultimately retire.

What’s your early retirement number? And more importantly, what would you do with that freedom if you achieved it? I’d love to hear your thoughts!

Estimating Your Savings Goal

Suppose you add up your potential expenses and figure you can live off $50,000 a year from your investments in your first year of retirement. (Our Retirement Cost of Living Calculator can help you do the math. ) If you use the 4% withdrawal rule, youll need 25 times your annual expenditures to avoid over-withdrawing your accounts over time, although this does not take into consideration market volatility, inflation or any taxes and fees on the account.

So, even with that modest budget, youd have to save a hefty $1. 25 million to stay afloat. As you typically cant pull money out of a 401(k) until you reach age 59½ without incurring penalties, saving aggressively is a necessity.

Regardless of your projected retirement budget, youll want to calculate the necessary amount of funds youll need using the withdrawal rate with which youre comfortable.

Understanding What It Takes to Retire Early

The general rule of thumb in retirement is to withdraw no more than 4% of your savings in the first year, and then adjust your income for inflation after that. But those planning a prolonged retirement may want to err on the cautious side with a slightly smaller withdrawal rate.

To figure out the amount of savings youd need at retirement, youll need to determine your expected annual expenses in retirement. That can be daunting for someone whos still relatively young, but a retirement calculator can help you tally your projected living costs, including housing expenses, food, utilities, loan payments and hobbies.

You should definitely remember to plan for health care costs, which are likely to be one of your biggest costs even when you’re in your late 40s or early 50s. In the near term, that includes things such as health care insurance premiums and out-of-pocket costs, such as deductibles and coinsurance. You may also have to shop for health insurance plans on an exchange since most people arent eligible for Medicare until 65.

Long-term medical costs are another factor to consider. You may need to hire a caregiver or enter an assisted living facility later in life. The average cost of a home health aide is currently about $27 an hour. 2 Meanwhile, care at a nursing facility is even pricier, with a private room averaging $9,034 per month. 3 If you plan to eventually take out long-term care insurance to help cover those contingencies, youll want to factor that into your living expenses and account for inflation.

I’m 45 with $2 Million Can I Retire Early?

FAQ

How much net worth do you need to retire at 45?

Many factors affect how much you should be able to retire on at age 45, but the average range is between $2 and $5 million or more, depending on your desired lifestyle, annual expenses, and willingness to follow an aggressive withdrawal strategy like the 4 percent rule.

Can I retire at 45 with $500,000?

Retiring at 45 with $500,000 is possible but challenging, requiring aggressive planning, a low-cost lifestyle, and careful consideration of future expenses and income sources. You’ll need to understand your desired annual spending and use the 4% Rule as a guideline, though you may need to withdraw less to make your money last for a longer retirement.

Is $3 million enough to retire at 45?

You can probably retire at age 45 if you have $3 million, but to be successful in the long run, you need to carefully plan your spending and withdrawals, account for inflation and health care costs, and think about how you want to live and how much you need to spend.

Can I retire at 45 with $1 million dollars?

Retiring at 45 with $1 million is possible but requires careful planning and depends heavily on your spending, lifestyle, and the longevity of your portfolio.

What is a good retirement age?

Retirement age of 67 (when most people will receive full Social Security benefits). 6 percent rate of return before retirement and 5 percent rate of return during retirement (assuming a more conservative portfolio). A 3% average annual inflation rate. Salary increases of 2% per year. Life expectancy of 95.

Should you retire at 45?

Retiring at 45 is an attractive proposition. It likely means you’ll have more time to enjoy relationships, leisure and travel. For those with other passions such as volunteering and working on social impact initiatives, quitting work early can allow you to devote more time to these fulfilling endeavors. How to Retire at 45 with $3 Million

How much money do I need to retire at 45?

If you plan to retire at 45, you’ll need to plan and save for a retirement that could last 40 years or even longer.Many financial advisors suggest multiplying the annual retirement income you would like to receive by how many years you have until you reach the age of 85.

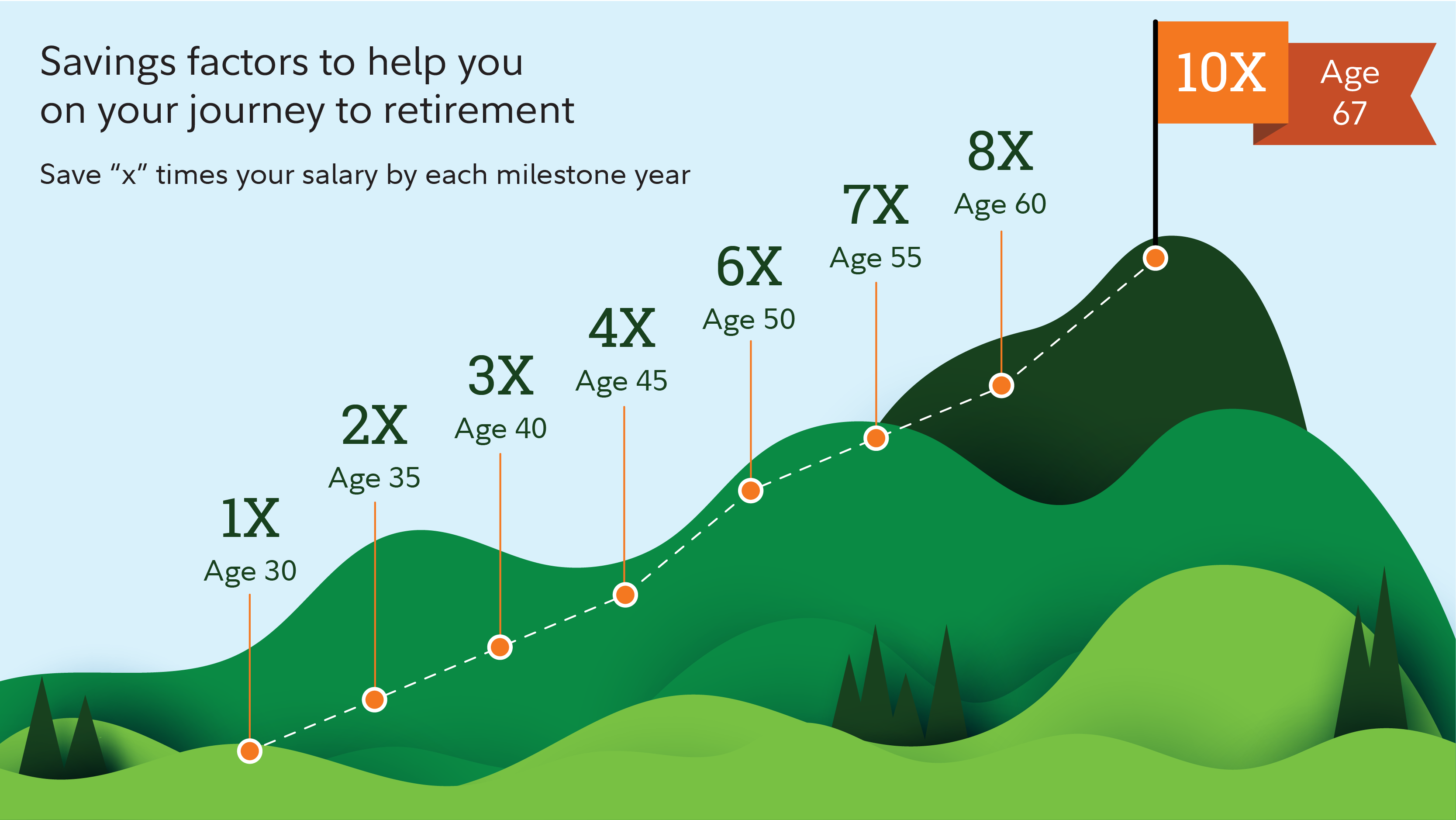

How much money should you have saved by age 45?

By age 45, financial experts typically recommend having saved 3-6 times your annual salary for retirement. However, determining how much you should have saved by age 45 depends on your unique circumstances and goals.

How much money should you spend in retirement?

Monthly budget in retirement ($2,561) If you’re unsure, start with the recommended 70% of your projected income at retirement age (67). Other retirement income This is the monthly total of any other income you expect to receive in retirement, such as pension benefits or Social Security.

Should you plan for retirement?

Planning for retirement takes time and focus to get right. The sooner you start making a retirement plan, the more money you can save and invest for the long term. Use Forbes Advisor’s retirement calculator to help you understand where you are on the road to a well-funded, secure retirement.