A $300,000 annuity pays about $1,924/month for a 65-year-old male or $1,834 for a woman with an immediate lifetime annuity. Payments vary based on age, type and customizations. Heres how to estimate monthly payouts for your unique needs and long-term financial goals.

Looking to secure your retirement with a steady income stream? You’re not alone! Many of us worry about outliving our savings. I’ve been researching annuities lately and the question on everyone’s mind seems to be how much does a $300000 annuity pay per month?

The short answer A $300,000 annuity could pay anywhere from about $1,255 to $2,820 per month, depending on several factors But don’t click away yet! There’s much more to understand if you want to make a smart decision with your hard-earned $300K

What Exactly Is an Annuity, Anyway?

Before diving into the numbers, let’s make sure we’re on the same page. An annuity is basically a contract between you and an insurance company. You give them a chunk of money, and they promise to pay you back in regular installments, often for the rest of your life.

Think of it as creating your own personal pension plan You’re essentially trading a lump sum for guaranteed income Pretty neat, right?

$300,000 Annuity Monthly Payouts: The Real Numbers

So how much monthly income can you expect from a $300,000 annuity? The answer isn’t simple because several factors affect your payout amount:

- Your age when payments begin

- Your gender (yes, this matters!)

- The type of annuity you choose

- Whether you want payments for just yourself or for you and your spouse

- Current interest rates

- Any additional features or riders you select

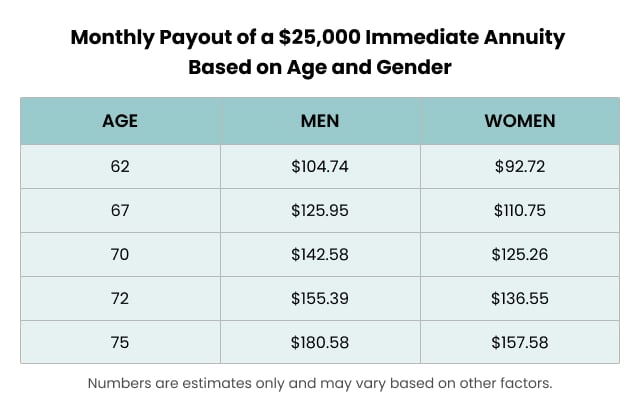

Let’s look at some actual numbers based on recent data from March 2025:

Monthly Payouts for a $300,000 Annuity (Single Life)

| Age | Male | Female | Joint Life |

|---|---|---|---|

| 50 | $1,362 | $1,335 | $1,255 |

| 55 | $1,471 | $1,420 | $1,317 |

| 60 | $1,599 | $1,510 | $1,376 |

| 65 | $1,763 | $1,646 | $1,470 |

| 70 | $1,992 | $1,835 | $1,601 |

| 75 | $2,290 | $2,013 | $1,697 |

| 80 | $2,820 | $2,472 | $2,014 |

Source: LifeAnnuities.com, BMO Insurance rates as of March 2025

Did you notice that the payouts go up as you get older? That’s because the insurance company thinks it will have to pay out less often if you start getting money later in life. Makes sense when you think about it!.

Why Do Men Get Higher Payouts Than Women?

It’s not sexism—it’s statistics! Women generally live longer than men (lucky ladies!), so insurance companies expect to make payments to women for more years. This means slightly lower monthly amounts for the same investment.

For example, at age 65, a $300,000 annuity pays about $1,763 monthly to a man but only $1,646 to a woman. That’s a difference of $117 per month or $1,404 per year!

Different Types of Annuities Affect Your Monthly Income

When I first started researching annuities, I was confused by all the different types. But understanding the basics can help you make better choices:

Immediate vs. Deferred Annuities

With an immediate annuity, you start receiving payments almost right away (usually within 12 months of purchase).

A deferred annuity delays payments until a future date. For example, you might buy one at 55 but not start receiving income until you’re 65. This gives your money more time to grow, potentially resulting in higher monthly payments.

Fixed vs. Variable Annuities

Fixed annuities guarantee a specific rate of return and predictable payments. They’re the “sleep well at night” option.

Variable annuities have payments that fluctuate based on investment performance. Higher potential rewards, but also higher risks.

Case Study: How Age Affects Payout Amounts

Let’s look at a real-world example to understand how timing affects your monthly income:

Carmen, who is 65 years old, puts $300,000 into an immediate annuity that will pay out for life. She receives about $1,798 per month, guaranteed for life.

Richard is 75 years old and invests the same $300,000. He receives about $2,501 per month—that’s $703 more each month than Carmen, simply because he’s 10 years older!

Factors That Impact Your Monthly Payout

Aside from your age and gender, the monthly payment on your $300,000 annuity will depend on the following:

1. Payout Period Selection

You can choose different payout structures:

- Life only (highest monthly amount, but payments stop when you die)

- Life with 10-year certain (slightly lower payments, but guaranteed for at least 10 years even if you die sooner)

- Life with 20-year certain (even lower payments, but guaranteed for at least 20 years)

- Life with cash refund (guarantees your beneficiaries receive at least your initial investment amount)

2. Joint Life vs. Single Life

If you want your spouse to continue receiving payments after your death, you’ll get less each month than with a single life option.

3. Current Interest Rates

Higher interest rates generally mean higher annuity payouts. The current rate environment has a big impact on what you’ll receive.

Is $300,000 Enough for a Decent Monthly Income?

This is where you need to be honest with yourself about your expenses and lifestyle. Is a monthly income of $1,600-$2,000 (approximate range for a 65-year-old) enough for you?

Remember, you might have other income sources too:

- Social Security benefits

- 401(k) or IRA withdrawals

- Other investments

- Part-time work

- Rental income

I always tell friends to create a retirement budget BEFORE deciding on annuity amounts. Know what you need before committing!

The Pros and Cons of Putting $300,000 into an Annuity

Pros:

- Guaranteed lifetime income (no more worrying about outliving your savings)

- Predictable payments (especially with fixed annuities)

- Peace of mind (knowing exactly how much you’ll receive each month)

- Protection from market volatility (with fixed annuities)

Cons:

- Limited access to your principal (your money is typically locked up)

- Potential inflation concerns (unless you choose an indexed option)

- Fees and commissions (can be high with certain products)

- Complexity (some annuity contracts are difficult to understand)

Should You Get an Annuity? My Two Cents

I’m not a financial advisor, but I’ve done my homework on this topic. Here’s my take: annuities can be a valuable part of your retirement strategy, but I wouldn’t put ALL my retirement savings into one.

Many financial experts suggest using annuities to cover your essential expenses (housing, food, healthcare, utilities) while keeping other investments more flexible for discretionary spending and emergencies.

A $300,000 annuity could provide a solid foundation of guaranteed income, but whether it’s enough depends on your individual situation and other resources.

Ready to Take the Next Step?

If you’re seriously considering a $300,000 annuity, here’s what I’d suggest:

- Shop around! Rates vary significantly between insurance companies

- Consider working with a financial advisor who understands annuities (preferably a fiduciary who must put your interests first)

- Read the fine print carefully before signing anything

- Ask about fees and surrender charges (what happens if you need to access your money early)

- Check the financial strength of any insurance company you’re considering

Final Thoughts

A $300,000 annuity can provide between $1,255 to $2,820 in monthly income, depending primarily on your age, gender, and the type of annuity you choose. For many retirees, this could form a valuable part of their retirement income strategy.

Remember, there’s no one-size-fits-all answer. Your retirement needs are unique, and what works for someone else might not be right for you.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Annuity rates change frequently, and the figures provided are based on rates available as of March 2025. Always consult with a qualified financial professional before making investment decisions.

Factors That Affect Monthly Annuity Payouts

Annuities are easy to customize to your needs and specifications. Here are a few ways to set them up to see how payments could work for you.

Mary is a 65-year-old retiree who buys a $300,000 immediate, fixed annuity with a 20-year payout period. Payments stop once Mary reaches 85.

For her $300,000 annuity, Mary gets $1,672 every month for 20 years.

Mark is 55 years old and buys a $300,000 deferred lifetime annuity. Payments are set to start 10 years after the initial investment, which means Mark won’t get his first payout until he’s 65.

For Mark, a $300,000 annuity pays out $3,073 per month when he starts to receive payments. His payout is much larger than Mary’s, thanks to the accrued interest built up over 10 years from deferring payments.

Mack and Martha are both 50 years old. They are buying a $300,000 joint lifetime annuity and deferring payments for 10 years. At 60, they will get $2,376 per month from their annuity.

Deferring their annuity sets them up for larger payments down the road. If Mack and Martha opted for immediate payouts, they would get $1,378 per month — about $1,000 less than they would get a decade later.

The payouts from a $300,000 annuity depend on when you start receiving payments, making each plan unique. Avoid comparing your payouts to others, as they vary based on individual factors.

Given the complexity of annuities, consulting a financial advisor is wise. A fiduciary advisor who prioritizes your best interests can guide you toward the most suitable plan. Remember, everyone’s financial goals are different, and seeking expert advice can help you make the best choice for your future.

Editor Norah Layne contributed to this article. Advertisement

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

How Are Annuity Payouts Calculated?

Annuity payments depend on several factors, including your age, gender, life expectancy, interest rates, annuity type, lump-sum investment, single or joint policies, immediate or deferred payouts and term limits.

Any guarantees within your annuity can also affect monthly payouts. Like, if you have a cost-of-living adjustment rider, your payments might go up over time to keep up with inflation and rising costs of living.

Annuities offer a variety of payout options tailored to your financial goals and needs. Whether you like fixed, variable, index, immediate, or deferred payments, knowing about them all helps you plan for a steady income in retirement.

A fixed annuity has a fixed interest rate and fixed payout terms. This means you’ll get the same monthly payment for your payout period, whether for a few years or the rest of your life.

Some folks prefer fixed annuities because they know exactly how much they’ll get every month, which can help them set a budget based on what they’re getting from their payout. If you’re short from your annuity, you may need to look into other income opportunities, like Social Security, an IRA, your 401(k) or something else.

A $300,000 immediate lifetime annuity for a relatively healthy, 65-year-old male will pay between $1,800 and $2,000 monthly. For women of the same age, payments are between $1,700 and $1,900 monthly.

While a fixed annuity has a fixed interest rate, a variable annuity has a variable interest rate. That means payments can change from month to month. There’s a chance you could earn more on any given month with a variable interest rate, but you could also stand to earn less since it fluctuates.

In a premium account, your money is invested in stocks, bonds, and other assets. In a fixed account, your money is guaranteed to earn at least a certain amount of interest when the payments start.

Because of fluctuation, predicting your return for variable annuities is not as easy for fixed annuities. In the last 30 years, stock market returns have averaged anywhere between 7% and 10%, depending on the type of investments you have. With a $300,000 variable annuity, you can expect similar returns based on market performance.

If you have an index annuity, it’s invested in an index, like the S&P 500 or NASDAQ. Your insurance company invests your funds in stocks, bonds, mutual funds or other securities. While your funds could earn money and generate a higher monthly payout, they could also lose money and mean a lower monthly payout.

In the last 50 years, the S&P 500 averaged about 10% to 12% returns, depending on what you invest in. You can expect similar returns if you have a $300,000 index annuity.

An immediate annuity is when you get annuity payments right away. Once you make your lump-sum annuity payment, you’ll start receiving annuity payouts about a month after you’ve purchased your annuity.

Immediate annuities might be an option if you want an instant source of income during retirement. However, payments start right away, so there isn’t much time for interest to build up.

For a 65-year-old retired male, a $300,000 immediate lifetime annuity would pay between $1,800 and $2,000 monthly. For women of the same age, you can expect around $1,700 and $1,900 monthly, depending on your annuity factors.

Rather than take payments immediately, deferred annuities let you put off payments for months or years. You can have a fixed, variable, or index deferred annuity. The longer your money accumulates, the larger your monthly payments will be.

For a 45-year-old male with a $300,000 deferred lifetime annuity with income set to start in 20 years — or at 65 — that’s about $5,182 monthly. For a 55-year-old male beginning in 10 years, those payments would be $3,073.

What does a $300,000 annuity pay per month?

FAQ

How much cash can a $300,000 annuity generate for me each month?

If you get a $300,000 annuity, it will pay you about $1,924 a month as a man aged 65 or $1,834 a month as a woman aged 65. Dec 12, 2024.

Should a 70 year old buy an annuity?

Financial advisors recommend starting annuity payments between the ages of 70 and 75.

What annuity can I buy with $300,000?

A $300,000 annuity could provide monthly income, but the exact payout varies significantly based on factors like your age, the type of annuity (immediate vs. deferred), the payment options chosen (e. g. , lifetime or period certain), and the current interest rates.

How much do you need in an annuity to get $1000 a month?

We’ll also guess that you’ll live about 18 years longer than the average male life expectancy, which is 83 years. In order to withdraw $1,000 each month you would need roughly $192,000. If you exceeed your life expectancy and make it to the ripe old age of 90 you would need approximately $240,000.

How much does a $100,000 annuity pay per month?

A $100,000 annuity provides monthly payouts that depend on your age and payment structure. As of January 2025: At age 60, you’ll receive $600 per month. At age 65, this increases to $660 per month. At age 70, monthly payouts rise to $713.

How much do fixed annuities pay per month?

The Annuity Calculator says that if you choose a $300,000 fixed annuity, the insurance company will usually give you four payout options, each with its own benefits and income amounts: $3,517 per month: Single life only (lifetime income, no death benefit);

How much do annuities pay per month?

For larger annuities, payouts follow a similar pattern of growth with age. For example, a 60-year-old male with a $750,000 annuity receives $4,286 per month, while at age 80, the payout jumps to $7,682 per month, which is a 79% increase. Similarly, for females, payouts rise from $4,128 at age 60 to $7,042 at age 80, reflecting a 70% increase.

How much money can you get from a deferred income annuity?

For example, a 65-year-old man who invests $300,000 in a deferred income annuity with income starting at age 80 could receive around $4,000 per month for life, while a woman of the same age could receive about $3,500 per month.

How much does a 10 year period certain annuity pay a month?

With a 10-year period certain annuity, Sydney receives $2,206 a month. If she dies within 10 years of purchasing the annuity, the remaining payments for that 10-year period will go to her beneficiary. The 10-year period certain guarantee means that the minimum payout from Sydney’s annuity is $263,280.

Should you buy an annuity?

When you need another stream of income for retirement, you might consider an annuity. You purchase the annuity from an insurance company and receive payments back at a later date. Before buying an annuity, you’ll want to consider how much monthly income it might generate. For example, how much does a $300,000 annuity pay per month?