Planning for retirement isn’t just about having enough money saved, it’s about understanding how much you’ll actually spend. Retirees who take the time to estimate their monthly expenses often enjoy more financial peace of mind.

Whether you’re approaching retirement or already there and looking to make the most of your budget, let’s explore the average monthly retirement expenses and how the right living situation can help minimize them.

Do you lie awake at night wondering if you’re saving enough for retirement? You’re not alone! As someone who’s spent countless hours researching retirement planning (and worrying about my own future), I’ve discovered that understanding what makes a “reasonable” retirement budget is crucial for peace of mind

Today I’m gonna break down everything you need to know about retirement spending in 2025, without all the confusing financial jargon. Let’s dive into the real numbers that matter for your golden years!

The Reality of Retirement Spending in 2025

The Bureau of Labor Statistics says that people 65 and older spent an average of $521,112 in 2021. This is about $14,000 less than the average of $66,928 for all people. This means that retirees usually spend around 80% of the money they made before they retired.

There is a catch, though: these numbers can change a lot depending on your situation. To get a better idea, let’s look at some recent survey results:

- 48% of retirees spend less than $2,000 monthly (under $24,000 annually)

- 1 in 3 retirees spend between $2,000-$3,999 monthly

- Only 18% spend more than $3,999 per month

Seeing these numbers was honestly a relief to me. I always thought retirees would need a huge nest egg, but these numbers show that many can live comfortably on much smaller budgets than I thought.

The Income Replacement Ratio: A Starting Point

A lot of financial experts say that the “income replacement ratio” is a good place to start when making a budget for retirement. This is the amount of your pre-retirement income that you’ll need to live the way you did before you retired.

Fidelity suggests starting with 80% as a general guideline, but this can vary based on:

- Your income level – higher earners may need a lower percentage

- Your planned lifestyle – active vs. quiet retirement

- Your health expectations – chronic conditions cost more

Here’s how income affects your replacement ratio according to research:

| Pre-retirement Income | Replacement Ratio Needed |

|---|---|

| Under $50,000 | 80% |

| $100,000 | 65-70% |

| $200,000 | 55% |

I found this super helpful because I always figured I’d need to replace 100% of my income. Knowing that the ratio decreases as income increases gives me a more realistic target!

Breaking Down Major Retirement Expenses

1. Housing (The Big One)

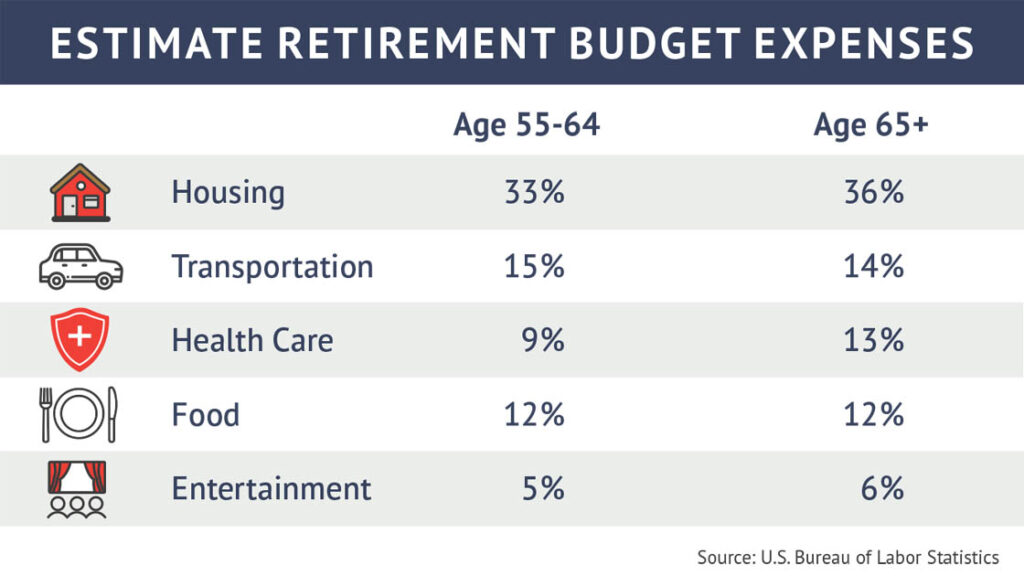

Housing remains the largest expense for retirees, eating up roughly 35% of their budget. In 2021, people 65+ spent an average of $18,872 on housing costs, which includes:

- Owned dwellings: $6,864

- Rented dwellings: $2,759

- Utilities and services: $3,921

- Household operations: $1,442

- Furnishings and equipment: $2,303

The good news? Housing costs tend to decrease as we age, with many retirees downsizing or relocating to less expensive areas. About 80% of retirees own their homes, which can help reduce costs once mortgages are paid off.

2. Healthcare (The Unpredictable One)

This is the expense that keeps me up at night! Healthcare costs average about $7,030 annually for retirees 65+, representing approximately 13% of total spending.

Important healthcare stats to keep in mind:

- A 65-year-old retired couple needs about $330,000 set aside for healthcare through their retirement

- 20% of adults 65+ report out-of-pocket medical expenses exceeding $2,000 annually

- Medicare Part B premiums start at $164.90 monthly (2023 figures)

- 15% of your retirement budget should be allocated to healthcare expenses

3. Food (The Fastest Growing Expense)

Food was reported as the fastest-growing expense by 44% of seniors in 2021! On average, retirees report that 25% of their monthly spending goes toward food.

The average food costs for adults 65+ in 2021 were:

- Food at home: $4,497 annually

- Dining out: $1,994 annually

I was shocked to see food costs rising so dramatically for retirees. This definitely makes me rethink my own retirement budget planning!

4. Transportation

Even though many retirees drive less, transportation still accounts for about 14% of retiree budgets. In 2021, people 65+ spent an average of $7,160 on transportation, including:

- Vehicle purchases: $2,777

- Gasoline: $1,396

- Other vehicle expenses: $2,707

- Public transportation: $279

5. Entertainment & Other Discretionary Spending

Don’t forget the fun stuff! Retirees 65+ spent an average of $2,889 on entertainment in 2021 (about 8% of their budget). Clothing and apparel accounted for about 7% of monthly spending ($986 annually).

What’s a Reasonable Budget? Three Tiers of Retirement Spending

Based on all this data, I’ve created three tiers of what might be considered “reasonable” retirement budgets in 2025:

Basic Retirement Budget: $24,000-$36,000 annually

This aligns with the 48% of retirees spending less than $2,000 monthly. This level typically covers:

- Modest housing (paid-off home or affordable rental)

- Basic healthcare costs with Medicare

- Limited travel and entertainment

- No major debts

Comfortable Retirement Budget: $36,000-$60,000 annually

This middle tier covers the 1 in 3 retirees spending $2,000-$3,999 monthly and provides:

- Comfortable housing with some luxuries

- Comprehensive healthcare coverage

- Regular local travel and entertainment

- Some dining out

Luxurious Retirement Budget: $60,000+ annually

For the 18% spending over $4,000 monthly, this budget allows:

- Upscale housing (possibly multiple homes)

- Premium healthcare and insurance

- Extensive travel

- Generous spending on hobbies and entertainment

- Financial help for family members

Tips for Creating Your Own Reasonable Retirement Budget

-

Use the 80% rule as a starting point, then adjust based on your income level and lifestyle plans.

-

Add 15 percentage points to your replacement ratio if you plan an active retirement lifestyle with lots of travel.

-

Allocate at least 15% of your budget for healthcare expenses – and more if you have chronic conditions.

-

Consider your housing strategy carefully – will you pay off your mortgage before retiring? Downsize? Relocate?

-

Track your current spending for 3-6 months to understand your personal spending patterns.

-

Build in flexibility for rising costs – especially for food and healthcare, which are increasing faster than other categories.

-

Plan for decreasing expenses as you age – many retirees spend less on discretionary items in their 80s than in their 60s.

Watch Out for Debt in Retirement!

One thing that really surprised me was how common debt is among retirees. In 2022, a shocking 96% of retirees reported having some form of debt:

- 40% had credit card debt

- 30% had mortgage debt

- 23% had car loans

- 11% had medical debt

- 7% had home equity loans

- 4% had student loan debt

While 89% described their debt as “easily manageable” or “manageable,” 11% considered their debt “unmanageable” or “crushing.” This definitely reinforces the importance of entering retirement as debt-free as possible!

My Final Thoughts

What’s reasonable for your retirement budget ultimately depends on your personal circumstances, income history, and retirement dreams. The most important thing is to start planning early and be realistic about what you can afford.

For me, seeing that almost half of retirees live on less than $24,000 annually was eye-opening. While I’d prefer a bit more cushion in my golden years, it’s comforting to know that many people find contentment without extravagant retirement budgets.

Remember that your spending will likely change throughout retirement – typically higher in the early “active” years, lower in the middle years, and potentially higher again in later years if healthcare needs increase.

The key is finding that sweet spot where your retirement income and spending align to create the lifestyle you want without the stress of financial instability.

What do you think is a reasonable retirement budget for your situation? Have you started planning yet? I’d love to hear your thoughts in the comments!

Note: All figures cited are based on 2021-2025 data. Always consult with a financial advisor for personalized retirement planning advice.

How Retirement Communities Help Manage These Costs

Estimating your retirement expenses is step one. Managing them effectively is where the real challenge begins. While you could cut costs here and there, there’s one solution that helps manage all your expenses in one go: moving to a continuing care retirement community (CCRC).

Here’s how CCRCs help with each major expense:

In a CCRC, your housing costs are streamlined into a single monthly fee. That typically includes:

- Maintenance and repairs

- Landscaping and snow removal

- Utilities

- Property taxes (which disappear entirely!)

This flat-fee structure makes budgeting much easier and eliminates surprise costs like needing a new roof or furnace.

Healthcare is where CCRCs really shine. With Type A Life Care, your medical costs won’t change over time, even if you need more care. That means no financial surprises if you ever require assisted living, skilled nursing, or rehabilitation services.

You can get all the care you need on one campus, and you can rest easy knowing that your costs won’t go up all of a sudden. The alternative can be an increase in monthly costs of thousands of dollars for a higher level of care.

Many CCRCs offer shuttle services to nearby destinations like:

- Doctor’s appointments

- Grocery stores and pharmacies

- Local attractions

In this case, you won’t need your own car as much, which saves you money on car ownership costs and brings many benefits right to your door.

Food and Entertainment

Food is a constant expense, whether youre cooking at home or dining out more often now that your schedule is open. And with more time for hobbies and outings, entertainment expenses can also increase:

- Dining out

- Movies and concerts

- Hobbies and clubs

- Cultural events or day trips

It’s smart to allocate a portion of your budget toward enjoyment. You’ve earned it!

Retirement Budget Tips (2 Ways to Estimate Accurately)

FAQ

What is a typical budget for a retired person?

Estimating the Average Retirement Expenses in a Year According to the U. S. Bureau of Labor Statistics, the average retiree household spent around $50,000 per year in 2021. While this is less than the national average of $63,000 across all households, it’s still a significant amount.

How many Americans have $1,000,000 in retirement savings?

Approximately 2. 5% to 4. 7% of Americans have $1 million or more in retirement savings, with slightly higher percentages among retirees (around 3. 2%) and households with any retirement accounts.

Can you retire at 70 with $400,000?

It is 100% possible to retire with $400,000, provided you’re not looking to enjoy a particularly expensive retirement lifestyle or hoping to leave the workforce notably early.

Is $5000 a month enough to retire on?

Whether $5,000 a month is enough to retire on depends on your individual lifestyle, location, and the cost of healthcare and housing. For some, especially those in lower-cost areas with low or no mortgage payments, $5,000 per month can be a comfortable retirement income.

How much should a retirement budget be?

Commonly recommended percentages range from 55% on the low end to 80% on the high end as an estimate for your expenses in retirement. Using this percentage of pre-retirement income suggests that if your annual income immediately before retiring is $100,000, for example, a retirement budget of between $55,000 and $80,000 is likely to be realistic.

Do you need a retirement budget?

You’ll need a retirement budget. BlackRock guides you through several expenses to consider when estimating your retirement spending.

How do you budget for retirement?

Keep an eye on your expenses and adjust your budget as needed over time to reflect changes in your spending habits. Budgeting your spending in retirement looks and works similarly to the way it does in your working years.

What is included in a retirement budget?

In a retirement budget, income from Social Security and retirement accounts are added to costs like housing and health care. Factor in potential lifestyle changes, such as reduced work-related expenses or increased travel spending. Many people fear they’ll run out of money during retirement.

How much money should you spend in retirement?

Expect to spend 55%–80% of your current income annually in retirement. Assuming you know your yearly income while you’re working, you can expect to spend between 20% and 80% of that amount every year after retirement, depending on your income, how you live in retirement, and the cost of your health care.

What is a realistic retirement budget?

Using this percentage of pre-retirement income suggests that if your annual income immediately before retiring is $100,000, for example, a retirement budget of between $55,000 and $80,000 is likely to be realistic. BLS survey results indicate this is similar to many retirees’ experiences.