These reviewers are experts in their fields and professional writers who often work for reputable newspapers and magazines like The New York Times and The Wall Street Journal.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

Set your retirement goals with an annuity. Annuities can help protect your savings from changes in the market and give you a steady stream of income for life.

Do you know how you’ll fund your retirement? Do you know how much you’ll need to live comfortably during your non-working years? These are tough questions that many people don’t spend enough time considering.

According to a three-part poll by CNBC, more than 70% of Americans got a serious financial wake-up call during the COVID-19 pandemic. Now, people all over the nation are thinking more about their long-term financial goals and paying closer to their progress in achieving them.

One popular way to refine your goals and gauge your progress is to review the average retiree income levels in the U.S., along with other key retirement statistics. Your situation may be different than that of the average person, but a benchmark can be informative, especially when you can dial into specific categories of data, such as age groups.

According to the latest data from the United States Census Bureau, the median annual income for individuals aged 65 and older is $47,620, while the mean annual income is $75,254. A few other income data points for people of retirement age are illustrated below.

Retirement That golden period we all dream about. feet up, seeing the world, or just doing the things we love without having to work from 9 to 5. But let’s be honest: all of those picture-perfect retirement posts hide a big question: how much do retired people really live on each month?

As someone who’s spent years researching retirement finances (and worrying about my own) I’ve discovered some eye-opening facts about retiree income that might make you rethink your retirement plans.

The Reality of Retirement Income in 2025

Here’s the thing – there’s no “one-size-fits-all” answer. Some retirees live comfortably on $2,000 monthly while others struggle with $5,000. As financial advisor Joe Conroy from Harford Retirement Planners puts it, “You can have a great retirement on $5,000 a month, and you can have a great retirement on $50,000 a month.”

But numbers help, so let’s look at what the average retiree is actually bringing in.

The Average Retiree’s Monthly Income

According to recent data, most American retirees are living on considerably less than what financial experts recommend. Here’s the breakdown:

- Monthly spending needs: The average retired household spends approximately $5,000 per month ($60,000 annually)

- Reality check: 68% of retirees spend less than $40,000 per year (or about $3,333 monthly)

- Most common range: About 53% of retirees live on $1,000-$2,999 per month

The Employee Benefit Research Institute’s 2022 Spending in Retirement Survey revealed this interesting distribution:

| Monthly Spending | Percentage of Retirees |

|---|---|

| Less than $1,000 | 15% |

| $1,000 – $1,999 | 33% |

| $2,000 – $2,999 | 20% |

| $3,000 – $3,999 | 13% |

| $4,000 – $4,999 | 8% |

| $5,000 – $5,999 | 5% |

| $6,000 – $6,999 | 2% |

| $7,000 or more | 3% |

I was surprised to learn that almost half of retirees live on less than $2,000 a month. That’s tight!.

Where Does Retirement Money Come From?

Most retirees rely on a combination of these five main income sources:

- Social Security – The foundation for most (nearly 90% of people 65+ receive it)

- Investment portfolios – 401(k)s, IRAs, and other retirement accounts

- Pensions – Becoming increasingly rare for newer retirees

- Part-time employment – Many continue working in some capacity

- Annuities – Providing guaranteed income streams

Social Security Reality Check

The average monthly Social Security benefit as of December 2024 was $1,975, or about $23,700 annually. That’s… not a lot to live on by itself.

“Most people just think, ‘I can use part-time work as a stop-gap,'” says Ashley Weeks, VP of wealth strategies at TD Wealth. Every one of us will not be able to go to work at some point. “.

The Gap Between Expectations and Reality

Here’s where things get concerning. Empower data shows that the average 401(k) balance for people 60 to 69 years old is only $210,724 If you use the standard 4% withdrawal rule, that’s only $702 a month taken out of your savings.

Do the math:

- $702 (401k withdrawal) + $1,975 (Social Security) = $2,677 monthly income

That’s well below the $5,000 monthly average spending need. This gap explains why many retirees are cutting back on expenses or continuing to work part-time.

What You Actually Need vs. What People Have

The University of Massachusetts Boston created an “Elder Index” showing what retirees need annually to live independently:

| Expense | Average Annual Cost |

|---|---|

| Housing | $13,824 (renter)<br>$22,020 (homeowner with mortgage)<br>$8,220 (homeowner without mortgage) |

| Food | $3,888 |

| Transportation | $3,240 |

| Healthcare | $4,452 (excellent health)<br>$5,640 (good health)<br>$8,196 (poor health) |

| Miscellaneous | $4,200 |

Depending on your situation, your annual needs could range from $24,000 (no mortgage, excellent health) to over $41,500 (with mortgage, poor health). That’s a monthly range of $2,000 to $3,460.

How To Determine Your Own Retirement Number

I always tell my friends that rules of thumb only get you so far. Here’s a better approach:

- Start with the 80% rule – Financial experts often suggest aiming for 80% of your pre-retirement income

- Adjust for your lifestyle – Do you want to travel extensively? Move to a cheaper area? These choices dramatically impact your needs

- Factor in your health – Healthcare costs can vary by thousands depending on your condition

- Consider your housing situation – Owning your home outright can reduce monthly expenses by $1,000+

- Be honest about discretionary spending – How much do you truly need for hobbies, entertainment, etc.?

Christopher Abts, a financial advisor with Prime Capital Financial, observes: “No one wants to retire to a lower lifestyle.” But many retirees are forced to do exactly that due to insufficient savings.

The Hard Truth About Retirement Savings

Here’s a reality check. If you want that comfortable $5,000 monthly retirement ($60,000 annually), and assuming about $24,000 coming from Social Security, you’d need to generate $36,000 annually from your savings.

Using the 4% rule, that means you need:

$36,000 ÷ 0.04 = $900,000 in retirement savings

Yet the median 60-something has only about $210,724 saved. That’s a massive shortfall!

How Are Retirees Actually Managing?

From what I’ve seen, retirees are adapting in several ways:

- Cutting discretionary expenses – Less travel, dining out, entertainment

- Downsizing homes – Moving to smaller, more affordable housing

- Relocating to lower-cost areas – Leaving expensive coastal cities for affordable regions

- Working part-time – Supplementing retirement income with employment

- Delaying full retirement – Working longer to increase Social Security benefits

- Multi-generational living – Sharing housing costs with family members

5 Strategies to Boost Your Retirement Income

If you’re still working toward retirement, here are some moves to consider:

- Maximize retirement contributions – For 2025, those 50+ can contribute up to $31,000 to a 401(k) and $7,000 to an IRA

- Delay Social Security – Each year you wait past full retirement age increases your benefit by 8% (up to age 70)

- Develop passive income streams – Rental properties, dividends, etc.

- Reduce tax burden – Consider Roth conversions to minimize taxes in retirement

- Pay off debt before retiring – Eliminating mortgage and other debts significantly lowers monthly expenses

Final Thoughts: Facing Reality

I’m not gonna sugarcoat it – many Americans are facing a retirement income gap. The data shows most retirees are living on less than what experts recommend for a comfortable lifestyle.

As Nick Hughes, a certified financial planner, points out: “It’s all relative. What could be sufficient retirement income for one household could fall far short in another.”

The most important thing? Start planning NOW. Review your retirement strategy annually, make adjustments, and be realistic about your future needs. And seriously consider talking to a financial advisor – as Christopher Abts says, “My hope is that they seek professional guidance before they pull the trigger.”

What about you? Are you on track to have enough monthly income in retirement? I’d love to hear your thoughts and strategies in the comments below!

Note: All figures in this article are based on data as of 2025. Your personal retirement needs may vary significantly based on your location, health, and lifestyle choices.

Where Does Retirement Income Come from?

Many people have various sources of retirement income, which can include pension plan distributions, Social Security benefits and investment account distributions. Ideally, you should have a lot of different sources of income to make sure you have enough to live on, pay the least amount of taxes possible, and protect yourself from inflation. Let’s take a closer look at the most prominent sources of retirement income.

According to a recent study by Schroders, 62% of working Americans plan to continue working during retirement in some capacity. Fortunately, there does not appear to be a shortage of work. In fact, there are a wide variety of opportunities for retirees to make money and grow their skills — from keeping a blog to becoming a life coach.

How to maximize this income:

- Use the skills you’ve learned over the course of your career to start your own freelance consulting business.

- Get a part-time job.

- Use the gig economy to find something flexible that fits your schedule.

Every time someone gets paid, a 6. 2% Social Security tax is withdrawn from the gross amount. For the self-employed, this percentage doubles to 12. 4%. Then, the Social Security program pays this money to qualifying retirees, including you. The amount you receive is based on how much you earn during your working years and the age you elect to start your benefit. Interesting Fact.

A study conducted by the National Institute on Retirement Security shows that 40% of Americans rely solely on Social Security benefits to fund their retirement.

According to the Social Security Administration, for 2022, the maximum Social Security benefit you can receive each month is $3,345 for those at full retirement age. The estimated monthly average Social Security income is $1,657, after a 5. 9% cost-of-living adjustment.

How to maximize this income: Delay receiving your Social Security benefit until full retirement age, which is between 66 and 67, depending on when you were born. Claiming the benefit prior to full retirement age will result in a reduced monthly payment. Brian Fry, a CERTIFIED FINANCIAL PLANNER™ and founder of Safe Landing Financial, offers the following guidance:

“To receive 100% of your Social Security benefit, you must wait until full retirement age. Each year that you claim before full retirement age, you give up between 5% and 6. 67% of your full benefit. Benefits increase by approximately 8% for each year that you delay claiming Social Security after full retirement age. ”.

Get Your Free Guide to Annuities: Learn from the pros by getting our free guide, Annuities Explained, sent straight to your inbox.

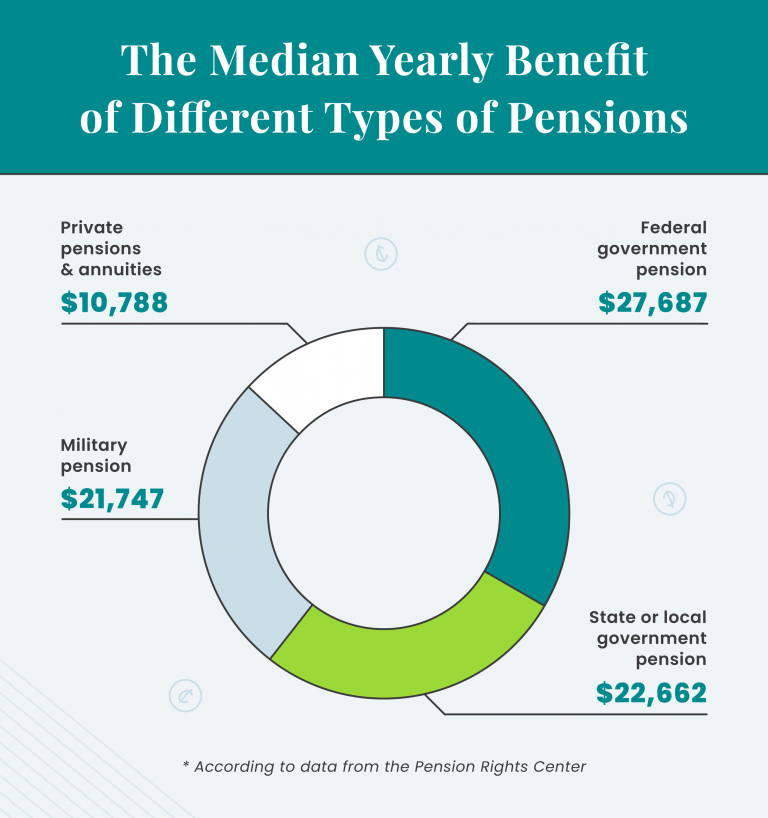

According to the Pension Rights Center, only about one-third of American retirees receive income from defined benefit retirement plans, which reflects the steady decline in pension plans. According to the United States Department of Labor, there were 113,062 pension plans in 1990, but only 46,869 in 2018.

The median private pension in the United States pays out $10,606 per beneficiary annually, according to the latest data from the Pensions Rights Center. On average, other types of pensions, including government and military pensions, pay out higher benefits.

How to maximize this income: Generally, by working as long as possible for a pension plan sponsor, you can increase your benefit. Usually, the benefit will also increase as you earn more money.

According to the Transamerica Center for Retirement Studies, 48% of American workers expect their main form of retirement income to be from personal financial assets, some of which, are tax-advantaged.

Most investors hold some combination of the following assets:

Depending on how they’re structured, the first three vehicles offer the potential for either tax-deferred or tax-exempt growth. The latter two asset types do not receive favorable tax treatment.

Regardless of the personal financial assets you own, strive to maintain a holistic perspective. The success of your retirement plan is dependent on how the various assets complement each other and your other sources of income, not on standalone performance. Along those lines, be sure to strive to maintain an appropriate degree of diversification. This can help to improve the risk-adjusted performance of your retirement portfolio and extend the longevity of your savings.

How to maximize this income:

- Invest the maximum amount into your retirement accounts each year.

- You might want to buy an annuity to protect your savings and let your money grow tax-free. When you do this, make sure you look around for reputable annuity providers.

- Put your money into passive investment funds that hold bonds, stocks that pay dividends, and commercial real estate to make money.

Will You Be Able To Maintain Your Retirement Lifestyle?

Learn how annuities can:

- Help protect your savings from market volatility

- Guarantee income for life

- Safeguard your family

- Help you plan for long-term care

Speak with a licensed agent about top providers and how much you need to invest.

Understanding Median and Mean

The median and mean are two statistics that everyone should know, especially if they are going to be used to make a retirement plan.

Because retirees with higher incomes tend to skew the mean retirement income, the median income is a more accurate measure of the national average.

Generally, the median is more useful than the mean for assessing average retirement income. This is because the mean is skewed by individuals with very large incomes. These outliers can easily pull the metric up into unrealistic territory for average people.

Is An Annuity Right For You?Answer a few simple questions to discover if an annuity is the right financial choice for you.

What Is The AVERAGE Monthly Retirement INCOME?

FAQ

What is a good monthly income for a retired person?

There is a wide range of what makes a good monthly retirement income, but a common guideline is to keep your lifestyle at the same level of income you had before you retired. For 2025, U. S. Census Bureau data shows the average retirement income for an individual is about $5,000 per month, and for a couple, it is around $8,300 per month, though median incomes are lower.

How much do most retirees live on a month?

Key Takeaways. About $5,000 is spent each month by the average retired couple, with housing, health care, and food being the biggest categories. With a median 401(k) balance of $210,724, retirees relying on the 4% withdrawal rule and Social Security benefits often face a shortfall in covering monthly costs.

Can you live on $3,000 a month in retirement?

Yes, you can live on $3,000 a month in retirement by carefully selecting a location with a low cost of living, especially in areas with affordable housing, and by creating a strict budget.

Is $5000 a month enough to retire on?

Whether $5,000 a month is enough to retire on depends on how you live, where you live, and how much your housing and health care costs. For some, especially those in lower-cost areas with low or no mortgage payments, $5,000 per month can be a comfortable retirement income.

What is the average retirement income?

While it’s difficult to pinpoint an average retirement income, the most recent Census Bureau data indicates that people 65 and older have a median annual income of approximately $54,700 or nearly $4,560 per month. A financial advisor can help you create a retirement plan for the future that meets your long-term needs.

How much money does a retiree make a year?

Cambridge, Massachusetts, follows with a total average retirement income of $82,979, which includes $25,665 from Social Security and $57,314 from other retirement savings. Sunnyvale, California, ranks third, where retirees have an average total income of $79,442, including $25,327 from Social Security and $54,115 from additional retirement funds.

How much does a retired person spend a month?

The average retired person spends about $4,345 per month. However, this is just an average, and your individual needs may be higher or lower. What are the biggest expenses in retirement? The biggest expenses in retirement are typically housing, healthcare, and food. How can I save for retirement?

How much money do you need to live comfortably in retirement?

This means that the average retired person lives on about $4,345 per month. However, this is just an average, and your individual needs may be higher or lower. Several factors can affect how much you need to live comfortably in retirement, including:

What is the average retirement budget?

When it comes to the average retirement budget, studies report a wide range of responses. A 2022 survey by the Employee Benefit and Retirement Institute (EBRI) found that half of individuals around retirement age spend less than $2,000 per month, equal to less than $24,000 per year.

What is a good retirement income?

“You can have a great retirement on $5,000 a month, and you can have a great retirement on $50,000 a month,” says Joe Conroy, financial advisor and owner of Harford Retirement Planners in Bel Air, Maryland. However, before you retire, understand what defines a good retirement income for you and where that money will come from.