If your wages have risen this year, thats good news. But along with the additional cash, its possible you may be in for an unpleasant tax surprise too.

Although wage increases may have helped your income keep pace with rising costs for everything from food to housing and auto repairs, a bigger paycheck may also bump you into a higher marginal tax bracket, in a phenomenon called tax-bracket creep.

Tax-bracket creep can be particularly pronounced during periods of high inflation when wages rise, pushing people into higher tax brackets. It can be hard on your wallet in two ways: the rising prices of many everyday items can make it hard to stick to a budget, and your extra pay could mean a bigger tax bill.

While the federal government adjusts marginal tax brackets for inflation each year, it does not make adjustments to numerous credits, deductions, exemptions, and surcharges, which can mean your effective tax rate could go up, whether you take the standard deduction or itemize.

One example is that the net investment income tax (NIIT) on interest, dividends, and capital gains has not been changed since it was put in place in 2013. Its an added 3. 8% surtax on everything from home sales to interest paid on CDs, taxable bonds, and dividend payouts if those things bring your income over $250,000 for a married couple or $200,000 for a single person. The NIIT is particularly worth paying attention to as house prices continue to rise and as interest rates have pushed yields up for both bonds and CDs.

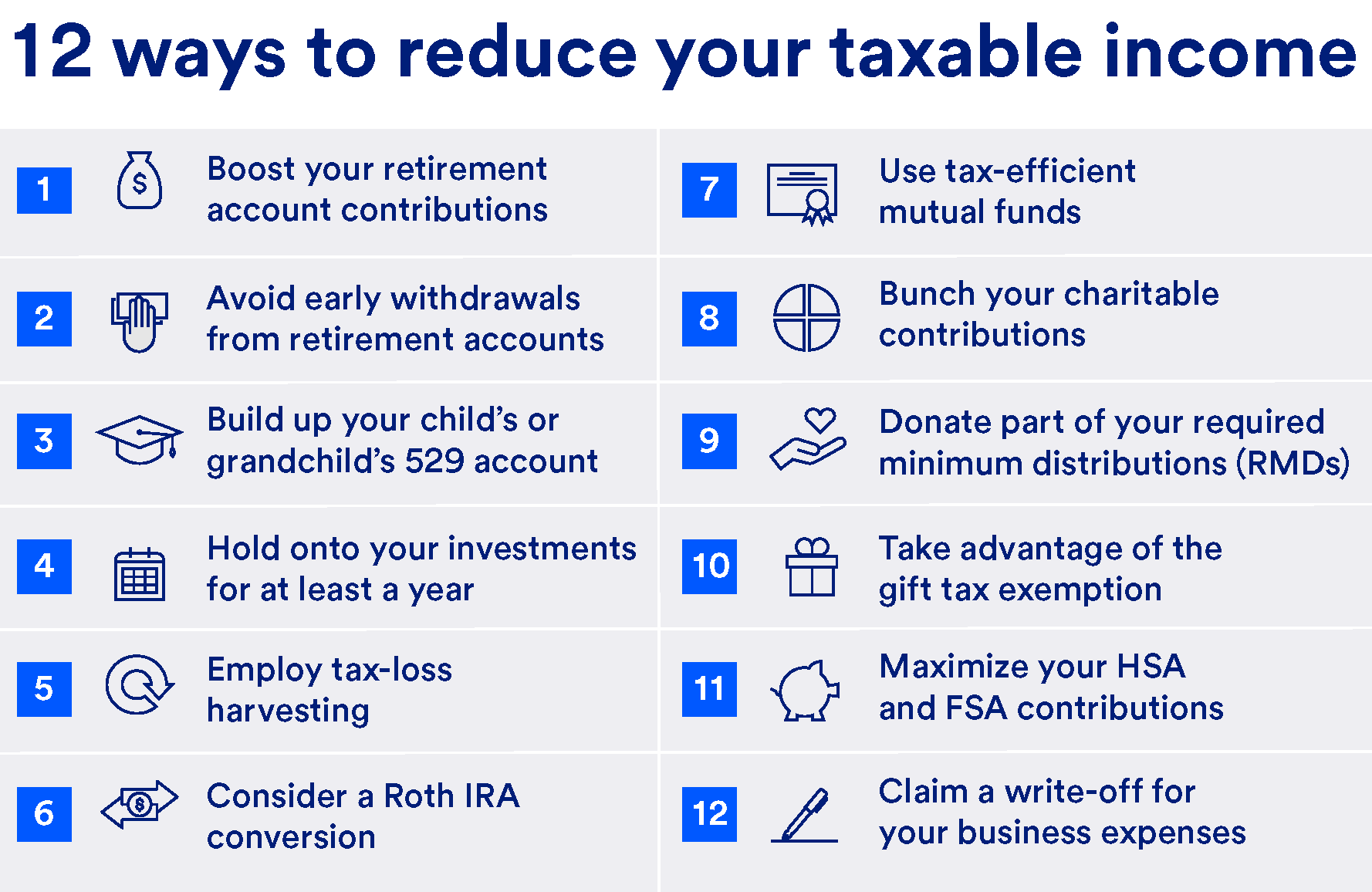

Here are 8 steps to consider now to help you reduce your tax bill and reduce tax-bracket creep.

Are you tired of watching a big chunk of your hard-earned money disappear every tax season? Me too! I’ve spent years researching the best (and totally legal) ways to keep more money in my pocket instead of sending it to Uncle Sam.

The truth is that most Americans are not investing their money. Do you know that after the 2018 tax law changes, only about 10% of taxpayers itemize their deductions, down from nearly 20% of taxpayers before the changes? Even worse, Americans leave over $1 billion in unclaimed tax refunds every year!

I’m going to share my favorite strategies that can help you slash your taxable income without getting into hot water with the IRS These aren’t shady tax schemes – they’re completely legitimate methods that the tax code actually encourages you to use

Understanding Taxable Income: The Basics

Before we dive in, let’s quickly cover what “taxable income” actually means:

- Gross Income: All the money you earned during the year (wages, freelance work, business income, interest, dividends, etc.)

- Adjusted Gross Income (AGI): Your gross income minus certain “above-the-line” adjustments

- Taxable Income: Your AGI minus deductions (standard or itemized) – this is what determines your tax brackets

The goal is simple: legally reduce that final “taxable income” number as much as possible!

1. Max Out Your Retirement Accounts

Without a doubt, this is one of the best and easiest ways to lower your taxable income:

- Traditional 401(k): Contributions are pre-tax, directly lowering your taxable income. For 2025, you can contribute up to $23,500 (even more if you’re over 50).

- Traditional IRA: Contributions may be tax-deductible depending on your income and whether you have a workplace retirement plan. The limit is around $7,000 per year for those under 50.

Here’s a real example: If you earn $80,000 and contribute $19,000 to your 401(k), the IRS only taxes you on $61,000. If you’re in the 22% tax bracket, that’s an immediate savings of $4,180!

Craig Ferrantino, president of Craig James Financial Services, calls retirement contributions “an excellent opportunity to reduce taxable income” – and I completely agree.

Don’t forget that you can still put money into an IRA for the previous tax year until the tax filing deadline, which is usually April 15.

2. Open a Health Savings Account (HSA)

If your health plan has a high deductible, an HSA is a triple tax break that you can’t miss:

- Contributions are tax-deductible (lowering your current taxable income)

- Money grows tax-free

- Withdrawals for qualified medical expenses are tax-free

For 2025, you can contribute up to $4,300 (single) or $8,550 (family) to an HSA. Those over 55 can add an extra $1,000.

As Tatiana Tsoir, CPA and business coach, puts it: “That’s money that never gets taxed if you spend it on medical expenses.” Even better? Unlike FSAs, the money rolls over year after year if you don’t use it.

3. Claim All Eligible Business Deductions

If you have any self-employment income – even from a side hustle – you’ve got a golden opportunity to reduce your taxable income.

“You can save a ton of money if you do it right,” says Tsoir, who encourages people to start side gigs specifically for the tax advantages.

Common business deductions include:

- Home office (if used exclusively for business)

- Business travel and mileage

- Professional services and subscriptions

- Office supplies and equipment

- Internet and phone (business portion)

Let’s say your side business earned $10,000 and you had $3,000 in legitimate expenses. You’d only pay tax on $7,000 – saving over $600 in federal tax if you’re in the 22% bracket!

Here’s a pro tip: if you’re a business owner, consider the Section 179 expensing option and bonus depreciation for major purchases. This allows you to deduct the full cost of equipment in the year of purchase rather than depreciating it over several years.

4. Take Advantage of Tax Credits

Unlike deductions (which reduce your taxable income), tax credits directly reduce your tax bill dollar-for-dollar. Here are some valuable credits to look for:

- Child Tax Credit: Worth up to $2,000 per qualifying child under 17

- Earned Income Tax Credit (EITC): For low-to-moderate income workers (can be worth several thousand dollars)

- American Opportunity Tax Credit: Up to $2,500 per student for college expenses

- Lifetime Learning Credit: Up to $2,000 for tuition or courses

- Saver’s Credit: Rewards low and middle-income people for retirement contributions

Don’t overlook these! Even if a credit isn’t refundable, it can reduce your tax to zero, which frees up cash.

5. Bundle Your Charitable Donations

Charitable contributions can reduce your taxable income, but only if you itemize deductions (which fewer people do since the standard deduction increased).

A smart strategy is to “bunch” your donations. Instead of giving $5,000 to charity annually, consider giving $10,000 every other year. This might push you over the standard deduction threshold in those years, allowing you to itemize and get the tax benefit.

For those with significant funds to donate, a Donor-Advised Fund (DAF) can be powerful. Donald Hoffman, CPA and partner at Eisner Advisory Group, calls it “a phenomenal opportunity for people who are charitable in nature.”

With a DAF, you can contribute a lump sum now (getting the immediate tax deduction) while distributing the money to charities over several years.

6. Utilize Tax-Loss Harvesting

If you have investments that have decreased in value, you can use tax-loss harvesting to offset capital gains and even reduce your ordinary income.

Here’s how it works:

- Sell investments that have lost value

- Use those losses to offset any capital gains you’ve realized

- If your losses exceed your gains, you can deduct up to $3,000 against your ordinary income

- Carry forward any additional losses to future years

This strategy can be particularly effective during market downturns. Just be aware of the “wash-sale rule” – don’t repurchase the same or substantially identical securities within 30 days.

7. Contribute to a 529 Plan

While there’s no federal tax deduction for 529 plan contributions, many states offer tax breaks on your state return. The real benefit comes from tax-free growth and withdrawals for qualified education expenses.

Plus, recent changes allow you to:

- Use up to $10,000 to repay student loans

- Transfer up to $35,000 to a Roth IRA (under certain conditions)

“The Secure Act 2.0 made it very attractive in that you can convert some of the 529 savings to a Roth account,” notes Ferrantino.

8. Defer Income When Possible

If you’re self-employed or run a business, you have some flexibility on when you recognize income:

- Consider delaying billing clients until January if you’re near the end of the tax year

- For businesses, purchase needed supplies or equipment before December 31 to claim the expense this year

- Be strategic about when you sell investments to control when capital gains are realized

Remember, this isn’t about hiding income – it’s about timing when that income is taxed.

9. Consider an S Corporation

If you’re self-employed with significant income, forming an S Corporation might reduce your overall tax burden.

“Owner-operators should look hard at their mix of compensation,” advises Anthony Scinto, CPA and partner at accounting firm MMB + CO.

With an S Corp, you can pay yourself a reasonable salary (subject to payroll taxes) and take the rest as distributions (which aren’t subject to self-employment tax). This strategy requires careful planning and professional guidance, but can save thousands in taxes.

10. Qualified Charitable Distributions (QCDs)

If you’re over 70½, you can make charitable donations directly from your IRA using qualified charitable distributions.

The amount of the QCD is excluded from your taxable income and can count toward your required minimum distribution. This is particularly valuable since it works whether you take the standard deduction or itemize.

11. Maximize Your FSA

If your employer offers a Flexible Spending Account (FSA), take advantage of it! Contributions are made with pre-tax dollars, reducing your taxable income.

FSAs can be used for healthcare expenses or dependent care costs. Just remember these are generally “use-it-or-lose-it” within the plan year.

12. Invest in Municipal Bonds

Interest from municipal bonds is tax-free at the federal level (and often at the state level if issued by your home state). This makes them especially attractive for high-income investors in top tax brackets.

While municipal bonds typically yield less than corporate bonds, the after-tax return can be higher.

13. Take Advantage of the Home Office Deduction

If you’re self-employed and use part of your home exclusively for business, don’t hesitate to claim the home office deduction.

“The only caveat is that you are supposed to use that room exclusively for business,” explains Hoffman. If that extra bedroom constitutes one-fifth of your living space, you can deduct one-fifth of rent and utilities.

14. Adjust Your W-4

If you’re a W-2 employee, properly adjusting your withholding ensures you don’t give the government an interest-free loan throughout the year.

While this doesn’t reduce your overall tax liability, it improves your cash flow so you can invest that money yourself throughout the year.

15. Qualified Business Income (QBI) Deduction

If you own a pass-through business (sole proprietorship, LLC, S-Corp), you might qualify for the QBI deduction, which allows you to deduct up to 20% of your qualified business income.

This deduction is subject to limitations for high earners and certain service industries, but it can significantly reduce your taxable income if you qualify.

The Bottom Line

Reducing your taxable income isn’t about avoiding taxes illegally – it’s about taking advantage of the deductions, credits, and strategies that the tax code specifically allows.

I’ve found that combining several of these strategies yields the best results. For example, maxing out my 401(k), contributing to an HSA, and carefully tracking business expenses has saved me thousands each year.

Remember that tax laws change regularly, so it’s always worth consulting with a tax professional to customize these strategies to your specific situation. The small cost of professional advice can result in significant tax savings!

What strategies have you used to reduce your taxable income? I’d love to hear what’s worked for you in the comments!

Make the best use of a Roth conversion

While Roth conversions from a traditional IRA are typically fully taxable, you arent required to take money out of a Roth once the funds are in the account, as you would need to do with a traditional IRA, where required minimum distributions (RMDs) must begin at age 73. After that, payouts arent subject to taxes when you do withdraw funds, assuming youve met all conditions for the account, including the 5-year aging rule and are 59½ years old or older or have met some other exemption. 1. A conversion may also lower the value of the traditional IRA from which the money was moved, which could cause RMDs from the traditional IRA to be lower.

You could also use realized losses to offset realized gains elsewhere, plus up to $3,000 of ordinary income, depending on your filing status. This is called year-round tax loss harvesting. If youve got investments that are below their cost basis, and theres another investment thats similar (but not a substantially identical security), you could use it to replace the sold asset without a material impact to your investment plan. Consult your tax advisor about your situation and beware of the wash-sale rule.

Remember your health savings account (HSA)

You can put money into an HSA if you have a high-deductible health plan. For 2025, the most you can put into an HSA is $4,300 for an individual and $8,550 for a family. People over 55 who are not on Medicare can put in an extra $1,000. If both partners are in a family high-deductible health plan and have an HSA, one of them can make a $1,000 catch-up contribution if they are 55 or older and not on Medicare. They must each make a catch-up contribution in a separate HSA if they are both 55 or older and not on Medicare and want to make one. This means that the total amount they can contribute is limited to $10,550.

How Can I Reduce What I Pay in Taxes?

FAQ

How do I minimize my taxable income?

In this articlelinkPlan throughout the year for taxes. Contribute to your retirement accounts. Contribute to your HSA. If you’re older than 70. 5 years, consider a QCD. If you’re itemizing, maximize deductions. Look for opportunities to leverage available tax credits. Consider tax-loss harvesting. Consider tax-gains harvesting.

What is the most overlooked tax break?

The 10 Most Overlooked Tax DeductionsState sales taxes. Reinvested dividends. Out-of-pocket charitable contributions. Student loan interest paid by you or someone else. Moving expenses. Child and Dependent Care Credit. Earned Income Tax Credit (EITC)State tax you paid last spring.

How can I reduce my taxable salary?

Section 80CCD(1B) This special deduction is over and above the standard Rs. 1. 5 lakh limit offered under Section 80CCD(1), allowing individuals to further reduce their taxable income by investing more in their retirement savings through the National Pension System (NPS).

What lowers the amount of taxable income?

A deduction is an amount you subtract from your income when you file so you don’t pay tax on it. By lowering your income, deductions lower your tax. Jul 31, 2025.

How can I reduce my taxes?

Immediate tax deferral: Lower your current taxable income. Tax bracket arbitrage: Withdraw income later, when you’re in a lower tax bracket. Flexible distributions: Choose lump sums or installments to suit retirement cash flow needs. State tax planning: Defer income until after moving to a lower- or no-tax state.

How can I reduce my taxable income in the short term?

When looking to reduce your taxable income in the short term (for the tax year at hand), focus on moves you can make before filing your return that directly lower the income on which you’ll be taxed. Here are key strategies: Every taxpayer can subtract a standard deduction from their income, no questions asked.

How can tax deductions reduce your tax liability?

Therefore, managing your taxable income within certain brackets can reduce your tax liability. This is where smart planning and utilizing deductions come in handy to keep you in the lower brackets. Tax deductions serve as essential tools in lowering taxable income. They directly reduce the amount of income that’s subject to taxes.

How can I reduce my tax liability?

To help manage these challenges, here are 10 effective strategies to reduce your tax liability: 1. Retirement Account Maximization: One of the best and most immediate ways for high-income earners to save on taxes is to put as much money as possible into tax-advantaged retirement accounts.

How can a high-income person reduce income tax?

Employ advanced strategies: charitable trusts, donor-advised funds, and gifting assets to reduce taxable income and future estate taxes. – High-income individuals may face the Net Investment Income Tax (3. 8%) on investment and business income – plan to minimize it (through income timing or exempt investments).

How do you reduce taxes on a retirement plan?

Max out retirement plans and consider a Defined Benefit pension plan for extra-large contributions if income allows. – Employ advanced strategies: charitable trusts, donor-advised funds, and gifting assets to reduce taxable income and future estate taxes.