Have you ever laid awake at night, staring at the ceiling, with the weight of your loans and credit card statements pressing down on you? You’re definitely not alone! The question of when we should aim to be debt-free has become a hot topic in personal finance circles, and for good reason. With Americans carrying an average of $90,460 in debt according to recent CNBC data, it’s something most of us need to think about.

So what’s the magic number? At what age should you finally break the chains of debt and breathe that sweet sigh of financial freedom? Let’s dive into what experts say and what realistic goals might look like for you.

The Ideal Debt-Free Timeline: What Experts Recommend

According to financial experts, a good target is to be debt-free by retirement age – around 65 or earlier if possible This makes sense when you think about it – you don’t want to be making loan payments when your income drops significantly!

But the recent Empower survey reported by USA Today gives us a more ambitious target: Americans believe the ideal age to become debt-free is 41. That’s nearly 25 years earlier than retirement! Is this realistic? Well, that depends on several factors.

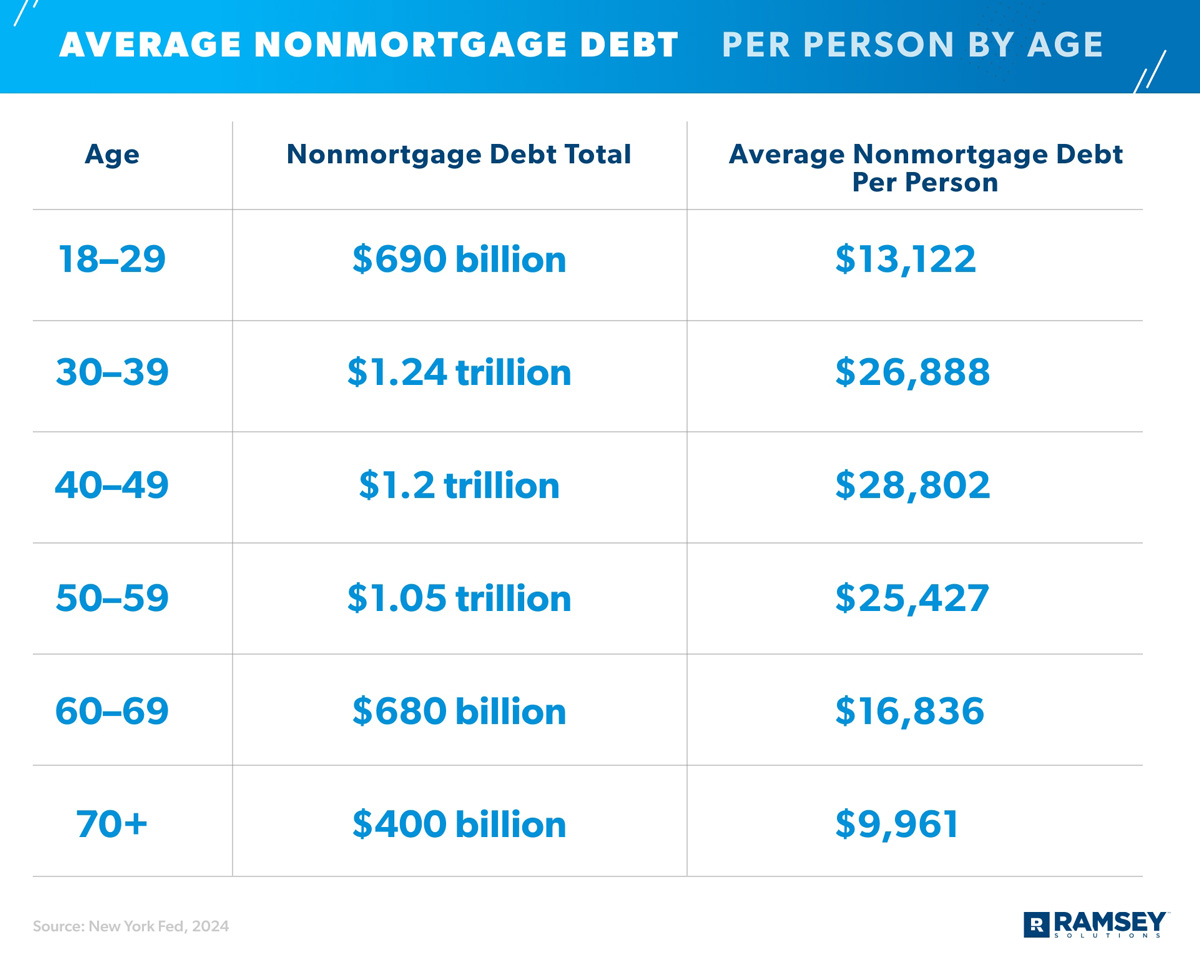

The Reality of American Debt by Age Group

Now that we know what our own goals are, let’s see what’s really happening with debt across different generations.

- Gen Z (18-23 years old): Average debt of $9,593

- Millennials (24-39 years old): Average debt of $78,396

- Gen X (40-55 years old): Average debt of $135,841

- Baby Boomers (56-74 years old): Average debt of $96,984

- Silent Generation (75+ years old): Average debt of $40,925

Gen X has the most debt in almost every category, which is interesting. They owe the most on their credit cards ($8,215), cars ($21,570) mortgages ($238,344), and school loans ($39,981). It’s only when it comes to personal loans that Baby Boomers are ahead, with an average of $19,253.

The Different Types of Debt Matter

Not all debt is created equal, and this is something I really need to emphasize! Some debt is actually considered “good” because it helps build wealth over time.

“Bad” Debt to Eliminate ASAP:

- High-interest credit card balances

- Payday loans

- High-interest personal loans

“Good” Debt That Might Be Strategic to Keep:

- Low-interest mortgages (especially those locked in at 3-4%)

- Student loans with manageable interest rates

- Business loans that fund income-generating activities

As financial planner Andrew Herzog puts it, “Debt can serve a good purpose, depending on its use. If you can strategically use your debt, there’s no problem with carrying it.”

Setting Realistic Debt-Freedom Goals By Age

Instead of giving you a one-size-fits-all age, let me break this down into more manageable milestones:

In Your 20s:

- Focus on building an emergency fund

- Start retirement savings (ideally by age 27 or earlier)

- Work on paying off high-interest debt like credit cards

- Begin tackling student loans

In Your 30s:

- Aim to be free of consumer debt (credit cards, personal loans)

- Make significant progress on student loans

- If you’ve purchased a home, focus on building equity

In Your 40s:

- This is when many Americans aim to be completely debt-free (except perhaps mortgage)

- Accelerate mortgage payments if it makes financial sense

- Ensure retirement savings are on track

By Retirement (65 or earlier):

- Be completely debt-free, including mortgage

- Have sufficient retirement savings to maintain your lifestyle

Is Being Debt-Free at 41 Realistic?

The poll that said Americans want to be debt-free by age 41 seems too optimistic when we look at the numbers. With $135,841, Gen X (40–55) has the most debt of any generation, suggesting that many don’t reach this goal.

But that doesn’t mean it’s impossible! It depends on:

- Your income trajectory

- How much debt you accumulated in your 20s

- Whether you’ve experienced major life setbacks

- If you’ve inherited money or received other windfalls

- Your commitment to debt repayment vs. other financial goals

The Benefits of Being Debt-Free (At Any Age)

Whatever age you manage to shed your debt, the benefits are substantial:

- Increased financial security – less worry about job loss or income changes

- More disposable income for savings, investments, or experiences

- Improved mental health with reduced financial stress

- Greater flexibility to pursue passion projects or change careers

- Ability to help others financially when needed

The numbers show that about 23% of Americans are currently debt-free, showing that it is a goal that can be reached, though not for everyone.

Is Being Debt-Free the New Definition of Wealth?

There’s an interesting perspective gaining traction: “Is being debt-free the new rich?”

The answer seems to be yes – as long as you have money and assets in addition to having no debts. Living completely loan-free provides a level of financial security that many high-income but debt-burdened individuals lack.

Strategies to Become Debt-Free Faster

If you’re inspired to accelerate your journey to debt freedom, here are some practical steps:

1. The Debt Snowball Method

- List all debts from smallest to largest

- Pay minimum payments on all debts

- Put any extra money toward the smallest debt

- Once smallest debt is paid, roll that payment to the next smallest

- This gives psychological wins that keep you motivated

2. The Debt Avalanche Method

- List all debts by interest rate (highest to lowest)

- Pay minimum payments on all debts

- Put any extra money toward the highest-interest debt

- Mathematically more efficient than the snowball method

3. Income Boosting

- Take on side gigs temporarily

- Sell unused items

- Request a salary review at work

- Use windfalls (tax returns, bonuses) exclusively for debt repayment

4. Lifestyle Adjustments

- Temporarily reduce entertainment spending

- Cook at home more often

- Consider downsizing housing if your space exceeds your needs

- Use public transportation when feasible

Finding the Balance: Debt Freedom vs. Other Financial Goals

This is where I think many financial experts miss the mark. Becoming debt-free shouldn’t necessarily be your ONLY financial goal. Sometimes it makes more sense to:

- Build an emergency fund before accelerating debt payments

- Contribute enough to get your employer’s 401(k) match before extra debt payments

- Keep low-interest mortgage debt while investing for potentially higher returns

The key is balance and making intentional choices rather than just following conventional wisdom.

Real Talk: My Personal Take

Look, I’m not gonna pretend becoming debt-free is easy or that there’s a perfect age when everyone should achieve this. Life happens – medical emergencies come up, cars break down unexpectedly, housing markets shift, and careers take unexpected turns.

The “ideal age” of 41 mentioned in the Empower survey might work for some, but it’s just not realistic for many Americans. What’s more important than the specific age is having a thoughtful plan and making consistent progress.

I believe the best approach is to:

- Eliminate high-interest debt as quickly as possible

- Be strategic about low-interest debt

- Balance debt repayment with other important financial goals

- Celebrate progress along the way

The Bottom Line: When Should YOU Be Debt-Free?

Rather than fixating on a specific age, consider these guidelines:

- High-interest consumer debt: Eliminate ASAP, regardless of age

- Student loans: Aim to pay off before age 45

- Mortgage: Try to pay off by retirement (earlier if possible)

- Overall debt-free goal: Before retirement, with earlier being better

Remember that your financial journey is unique. While statistics and averages can provide benchmarks, your personal situation, values, and goals should ultimately guide your debt-freedom timeline.

What’s your take? Do you have a specific age in mind for becoming debt-free? Have you already achieved this milestone? I’d love to hear your thoughts and experiences in the comments below!

Note: Financial situations vary widely. Consider consulting with a financial advisor to create a personalized plan for your debt-freedom journey.

Why not everyone should pay off all debt in their 40s

If being debt-free in your mid-40s sounds like a dream, thats understandable. Debt can often feel weighty, especially when its in the five- and six-figures. For many consumers who graduate with student loan debt in their early 20s, the thought of carrying that debt around for decades can be anxiety-inducing. Not to mention, you might be concerned that your debt can disqualify you from homeownership or other financial milestones (which is often not the case).

But mathematically, theres not always an incentive to be debt-free so soon, argues Sanborn Lawrence. If the interest rates on your debt are below 5% to 10%, it often makes most sense to invest your extra cash in the stock market, which has historically earned at above this rate, rather than rushing to pay off debt.

Mortgages, for instance, are at historic lows right now, so someone with an interest rate at 3% or below shouldnt feel pressed to pay off their home quickly and instead let their money grow in the market.

“If you are borrowing money at a lower rate than youre able to make on that money, youre going to end up net positive,” says Sanborn Lawrence.

Want to invest in the stock market?: This 3-question checklist will help you determine when youre ready to invest your money.

Follow Select © 2025 CNBC.COM

“Shark Tank” investor Kevin OLeary has said the ideal age to be debt-free is 45, especially if you want to retire by age 60.

Being debt-free — including paying off your mortgage — by your mid-40s puts you on the early path toward success, OLeary argued. It helps you free yourself from financial obligations at a time when your income is presumably stable and potentially even growing. You can ramp up your savings so you can ensure a comfortable life in retirement.

“Most careers start in early 20s and end in the mid-60s,” OLeary said in the 2018 interview with CNBC Make It. “So, when youre 45 years old, the game is more than half over, and you better be out of debt, because youre going to use the rest of the innings in that game to accrue capital. “.

While OLearys advice may resonate with some, Rachel Sanborn Lawrence, advisory services director and certified financial planner at Ellevest, says that aiming to be debt-free by 45 may be ill-advised. Not only is it unrealistic for many — it might also mean you leave money on the table.

Before, CNBC Select talked to Sanborn Lawrence about who should be the most careful about following O’Leary’s advice and why.

The #1 Rule For Getting Out Of Debt

FAQ

At what age should I be debt-free?

You should not have any debt by age 50, and your savings should be enough to live a nice life in retirement.

How much debt is normal at 35?

The average total debt for a 35-year-old can vary significantly, but a 2023 Federal Reserve report found households with a head of household aged 35-44 (an age group including most 35-year-olds) with debt had an average debt of approximately $188,680, with mortgage debt being a significant portion of this.

How many 40 year olds are mortgage-free?

In 2023, two-thirds of the mortgage-free homeowners are baby boomers aged 60 years and over. In contrast, only 5% of mortgage-free homeowners are under 35 years old, 8% are between 35 and 44 years old, 11. 9% are aged 45 to 55, and 8. 9% are between 55 and 59.

How much debt does the average 70 year old have?

97. 1% of U. S. The average amount of non-mortgage debt held by adults aged 66 to 71 is $11,349. Auto loans, credit cards, and student loans make up the majority of this debt. Texas and Florida metros report the highest median retirement-age debt, with San Antonio leading at $18,107.

What is the ideal age to be debt-free?

Investing on “Shark Tank” and writing about money, Kevin O’Leary, said in 2018 that 45 is the best age to be debt-free. O’Leary said that this is the age when you start the second half of your career, so you should start saving more for retirement to make sure you have a good time when you get old.

How old do you have to be to get out of debt?

People 18-24 are the most optimistic, predicting debt freedom at about age 33; but the prediction keeps advancing, as 25-34 year olds predict age 38; 35-49 year olds predict age 56; 50-64 year olds predict age 62; and at age 65-plus, debt freedom is expected at age 77.

What is the best age to pay off debt?

It’s not all that surprising that consumers in their 30s and 40s — who are growing families, buying homes and generally facing more expenses — would have more debt. But if taking on debt in your younger years is considered the status-quo, what’s the best age to pay it off by? The answer, CNBC Select found, depends on a few things.

What is the age of predicted debt freedom?

The age of predicted debt freedom was 53 on average. People 18-24 are the most optimistic, predicting debt freedom at about age 33; but the prediction keeps advancing, as 25-34 year olds predict age 38; 35-49 year olds predict age 56; 50-64 year olds predict age 62; and at age 65-plus,

When should you pay off your debt?

So start planning as early as possible for how to pay off that debt throughout your life, O’Leary suggests. That way, you can be financially secure by the time you retire. When should you aim to have it all paid off? Age 45, O’Leary says.

Should a 45 year old be out of debt?

“So, when you’re 45 years old, the game is more than half over, and you better be out of debt, because you’re going to use the rest of the innings in that game to accrue capital.” To plan for retirement and pay down debt, O’Leary and other experts offer these tips. 1. Save and invest for the long term