Learn more about claiming your Social Security benefits and forward-looking tax planning with our downloadable guides: the Social Security Decisions Guide and Tax Reduction Strategies. Click below to download:

It’s been years of hard work, and now you’re getting closer to that magical $1 million mark in your retirement accounts. First off congrats! That’s no small achievement. But the question that probably keeps you up at night is: “Is a million dollars really enough for my spouse and me to retire comfortably?”

I’ve been researching this topic extensively and the answer isn’t as straightforward as we’d all like. Let’s dive into the real factors that determine if $1 million is your golden ticket to a worry-free retirement or just a good start.

The Million-Dollar Question: Is It Enough?

The short answer? It depends. (I know, I know – not what you wanted to hear!)

According to a recent Northwestern Mutual study, many Americans actually think they need around $1.26 million for a comfortable retirement. But honestly, whether $1 million is enough varies wildly depending on several key factors.

One money expert says, “Yes, no, and maybe so.” Evan Patzer is a retirement expert at LifeWealth Solutions. He says that your unique situation is very important, not just your Social Security income but also your living costs and lifestyle choices.

What Factors Determine If $1M Is Enough?

For those who want to know if their million dollars will last, here are the main details:

1. Where You Live Matters… A LOT

Where you live has a HUGE effect on how far your money goes. Living in Manhattan versus rural Michigan? Yeah, completely different scenarios.

According to the experts, downsizing or relocating to more affordable areas can make that $1 million last much longer. Some couples find moving from high-cost coastal cities to more moderately priced areas gives their retirement savings a serious boost.

2. Your Health and Longevity

Nobody has a crystal ball, but family history and your current health can give you some clues. If you and your spouse might live well into your 90s (which is increasingly common), that million needs to stretch further.

The 2024 Fidelity Retiree Health Care Cost Estimate found that an average 65-year-old retiring last year could need $165,000 in after-tax savings JUST for healthcare costs! And that doesn’t even include long-term care, which could cost more than $127,000 a year for a private nursing home room.

3. Your Lifestyle Choices

This is where you have the most control. As Tyler Ozanne, a certified financial planner, points out: “How much you spend is a huge factor.”

Do you plan to:

- Travel extensively in retirement?

- Maintain multiple homes?

- Help support adult children or grandchildren?

- Pursue expensive hobbies?

Your spending habits will make or break your retirement budget, no matter how much you’ve saved.

4. Other Income Sources

Most retirees don’t rely solely on their savings. Social Security, pensions, part-time work, rental income, or other sources can supplement your nest egg.

For example, let’s look at a real scenario: If a couple has $1 million saved but also receives $40,000 annually from Social Security and only needs $55,000 per year to live comfortably, they’d only need to withdraw $15,000 annually from their savings – a withdrawal rate of just 1.5%! At that rate, their million could last for decades.

How Long Will $1 Million Actually Last?

Let’s get practical. Here’s a rough estimate of how long $1 million might last for a couple with different annual expenses (assuming a conservative 4% annual return on investments):

| Annual Withdrawal | How Long $1M Lasts |

|---|---|

| $40,000 (4%) | 30+ years |

| $50,000 (5%) | 20-25 years |

| $60,000 (6%) | 15-20 years |

| $80,000 (8%) | 12-15 years |

This table is just a starting point – it doesn’t account for inflation, market fluctuations, or unexpected expenses. But it gives you a general idea.

Smart Withdrawal Strategies for Couples

If you’re a couple with $1 million saved, how you withdraw your money matters almost as much as how much you’ve saved. Here are three popular strategies:

The 4% Rule

This is the classic approach: withdraw 4% of your starting portfolio in your first retirement year (that’s $40,000 from $1 million), then adjust that amount for inflation each year afterward.

The upside? It’s simple and predictable. The downside? It’s not very flexible when markets get rocky.

Dynamic Spending

With this approach, you adjust your withdrawals based on how your investments perform. If your portfolio earns 10% one year, you might increase your withdrawal. If it drops 10% the next year, you’d tighten your belt.

This is more realistic for most of us – we naturally spend more when times are good and cut back when they’re not.

The Bucket Strategy

I personally like this one. You divide your savings into different “buckets” based on when you’ll need the money:

- Bucket 1: Cash and short-term bonds for the next 1-3 years of expenses

- Bucket 2: Intermediate investments for years 4-10

- Bucket 3: Growth investments for 10+ years down the road

This helps you avoid selling stocks during market downturns, which can devastate your retirement savings.

Real-Life Examples: When $1M Works (and When It Doesn’t)

The Comfortable Couple

Meet Bob and Linda. They own their home outright in a moderate-cost area, receive $40,000 yearly from Social Security, and spend about $55,000 annually. They only need to withdraw $15,000 from their $1 million savings each year – a super-sustainable 1.5% withdrawal rate. Their million will likely last their entire retirement, maybe even with money left for their kids!

The Stretched-Thin Couple

Now consider Mike and Sarah. They live in an expensive coastal city, rent their apartment, and need $90,000 annually to maintain their lifestyle. Even with $50,000 from Social Security, they need to withdraw $40,000 yearly from their savings – a 4% withdrawal rate from day one. Add in inflation and potential healthcare costs, and they might run out of money in their late 80s.

Inflation: The Silent Retirement Killer

We can’t ignore inflation – it’s like termites quietly eating away at your purchasing power. After years of near-zero inflation, we’ve seen prices skyrocket recently. While experts say the high inflation of 2022 isn’t sustainable long-term, even modest inflation of 3% per year can seriously erode your purchasing power over a 25-30 year retirement.

What cost $50,000 in your first year of retirement might cost $90,000 twenty years later with just 3% annual inflation!

How to Tell If $1M Is Right for YOUR Retirement

Instead of relying on a generic rule of thumb, try this personalized approach:

- Calculate your guaranteed retirement income (Social Security, pensions, etc.)

- Estimate your realistic retirement expenses (including healthcare, housing, travel, gifts)

- Determine the gap that needs to be filled by your savings

If you’re withdrawing more than 4-5% of your savings annually, you might need to save more, reduce expenses, or consider working longer.

It’s Not Just About the Million – It’s How You Invest It

“You can’t have $1 million in cash and expect that to get you through retirement,” warns Barbara Taibi, a tax partner with Eisner Advisory Group. Your money needs to be invested wisely to keep up with inflation.

Having $1 million invested in a diversified portfolio is very different from having $800,000 in home equity and $200,000 in investments. The money in your home isn’t easily accessible for day-to-day expenses.

How to Save a Million Dollars (If You Haven’t Yet)

If you’re not at the million-dollar mark yet, don’t despair! The power of compound interest makes this goal achievable even for those with modest incomes.

For young workers, it’s quite doable. A 20-year-old would need to save approximately $330 a month to reach $1.26 million by age 65 (assuming a 7% annual return). That’s WAY better than the $1,547 monthly savings a 40-year-old with no previous savings would need!

But if you’re already in your 50s and just starting? As one advisor bluntly puts it: “It’s probably not as doable if they have waited until their 50s to start saving. My advice for someone who hasn’t started earlier is to temper your expectations.”

My Final Thoughts

So can a couple retire on one million dollars in 2025? For many couples, especially those with modest spending habits and additional income sources like Social Security, the answer is YES. But it requires careful planning, smart withdrawal strategies, and realistic expectations.

The most important thing I’ve learned from all this research? There’s no one-size-fits-all answer. Your retirement needs are as unique as your fingerprint. Working with a financial advisor who specializes in retirement planning can help you create a personalized strategy.

What matters most isn’t hitting some arbitrary number like $1 million – it’s having enough to support the lifestyle you want without the constant fear of running out of money.

For me and my wife, we’re aiming for that million-dollar mark, but we’re also focusing on paying off our mortgage before retirement and keeping our everyday expenses reasonable. We figure if we can enter retirement debt-free with $1 million invested, plus our Social Security benefits, we’ll be in pretty good shape.

What about you? Do you think a million dollars would be enough for your retirement dreams? What strategies are you using to get there?

This article is based on financial information available as of October 2025. Remember that retirement planning is personal, and what works for one couple might not work for another. Consider consulting with a financial advisor to create a plan tailored to your specific needs and goals.

Setting the Stage for Retiring with $1 Million

Jason, welcome. Matt, welcome. I feel old here in the middle of two young CERTIFIED FINANCIAL PLANNER™ professionals, but you guys got some great talents. You’ve done great things for many of our clients and continue to do so.

We see it happen all the time that somebody has X-amount of dollars saved. In this example, we’re going to show $1 million. Let me set the scene for what we’re going to do. Then you two can talk about the specifics.

GRAPHIC 1

We’re going to make some assumptions here.

We’re going to show you four different couples. All four couples have saved exactly $1 million and have the exact same earnings history, so their Social Security is going to be the same. On the surface, you would assume that every single couple will have the same spendable income throughout their retirement years, but nothing could be further from the truth. That’s why financial planning is so critical.

Lifetime Income with Different Tax Strategies When Retiring with $1 Million

Matt Kasper: Absolutely. When we look at these, the lifetime benefit, what might surprise even with making what happens to be many cases, wrong decision claiming at 62, not universally, by the way, sometimes that can make sense.

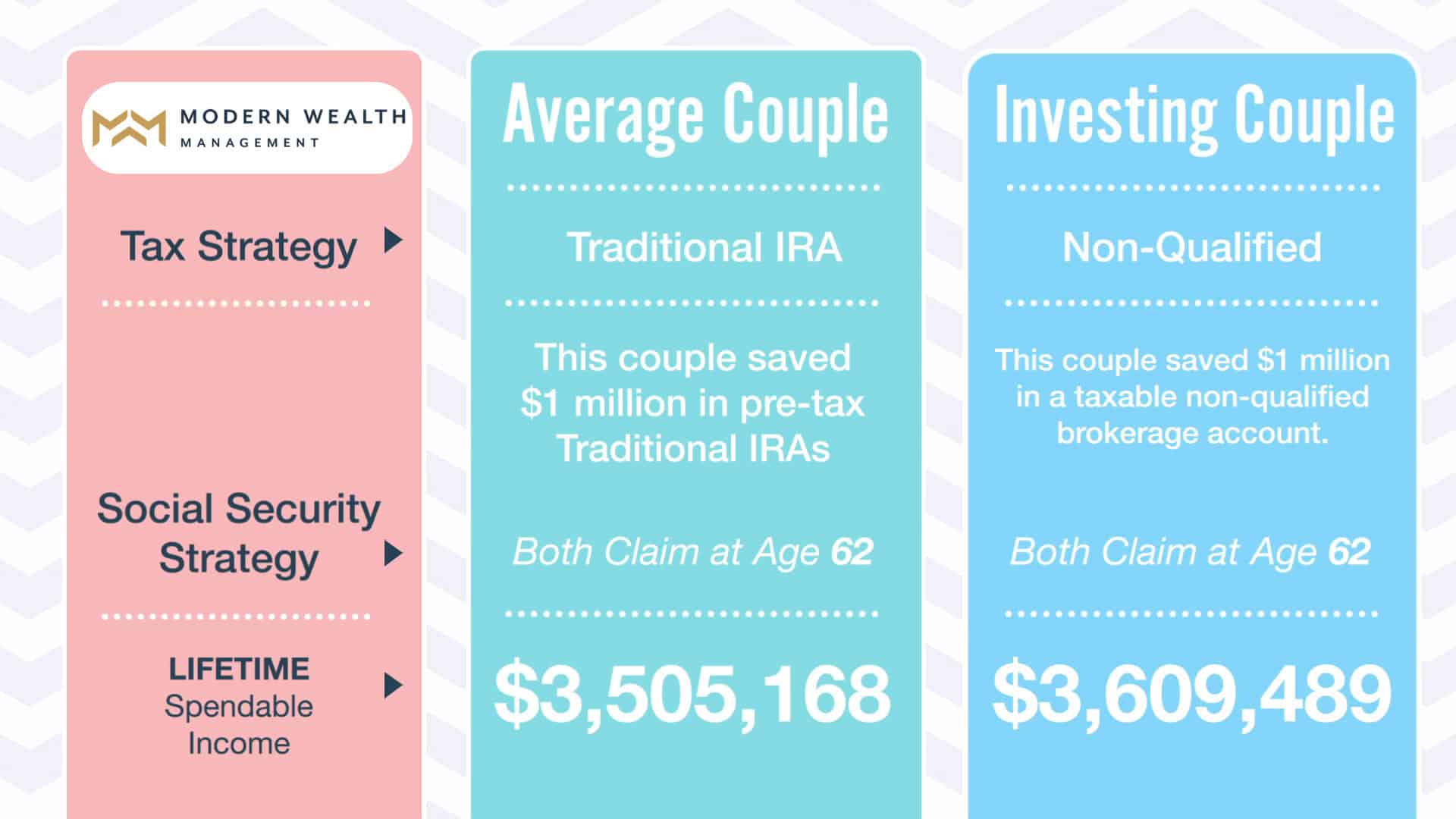

GRAPHIC 11

When we look at the investing couple filing at 62, they’re aware they accumulated their assets throughout retirement and captured another $104,321 of spendable income throughout the retirement.

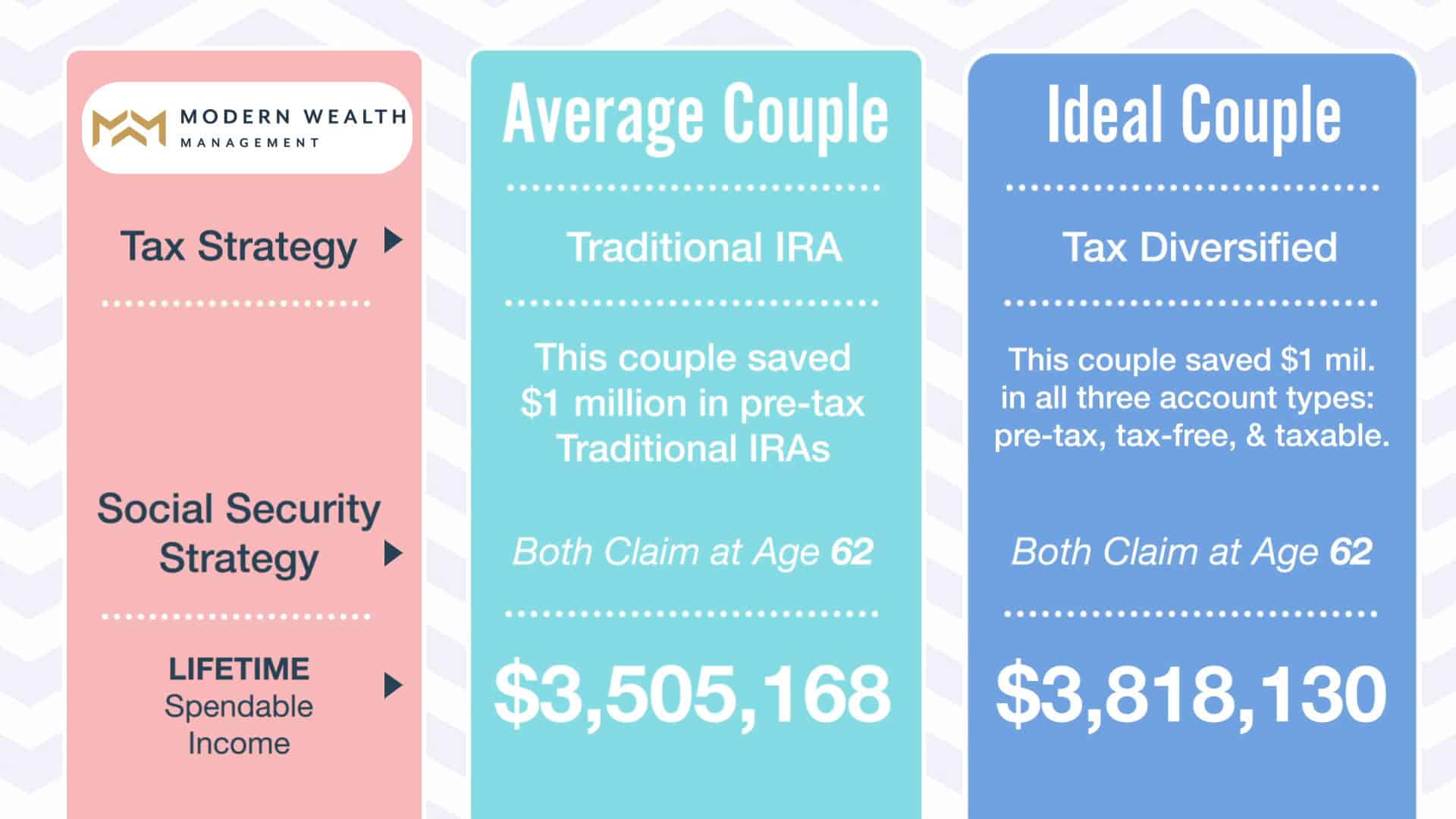

GRAPHIC 12

When you look at the ideal couple, this is where it just becomes more and more shocking. The ideal couple ended with $312,962 more in spendable income over a lifetime.

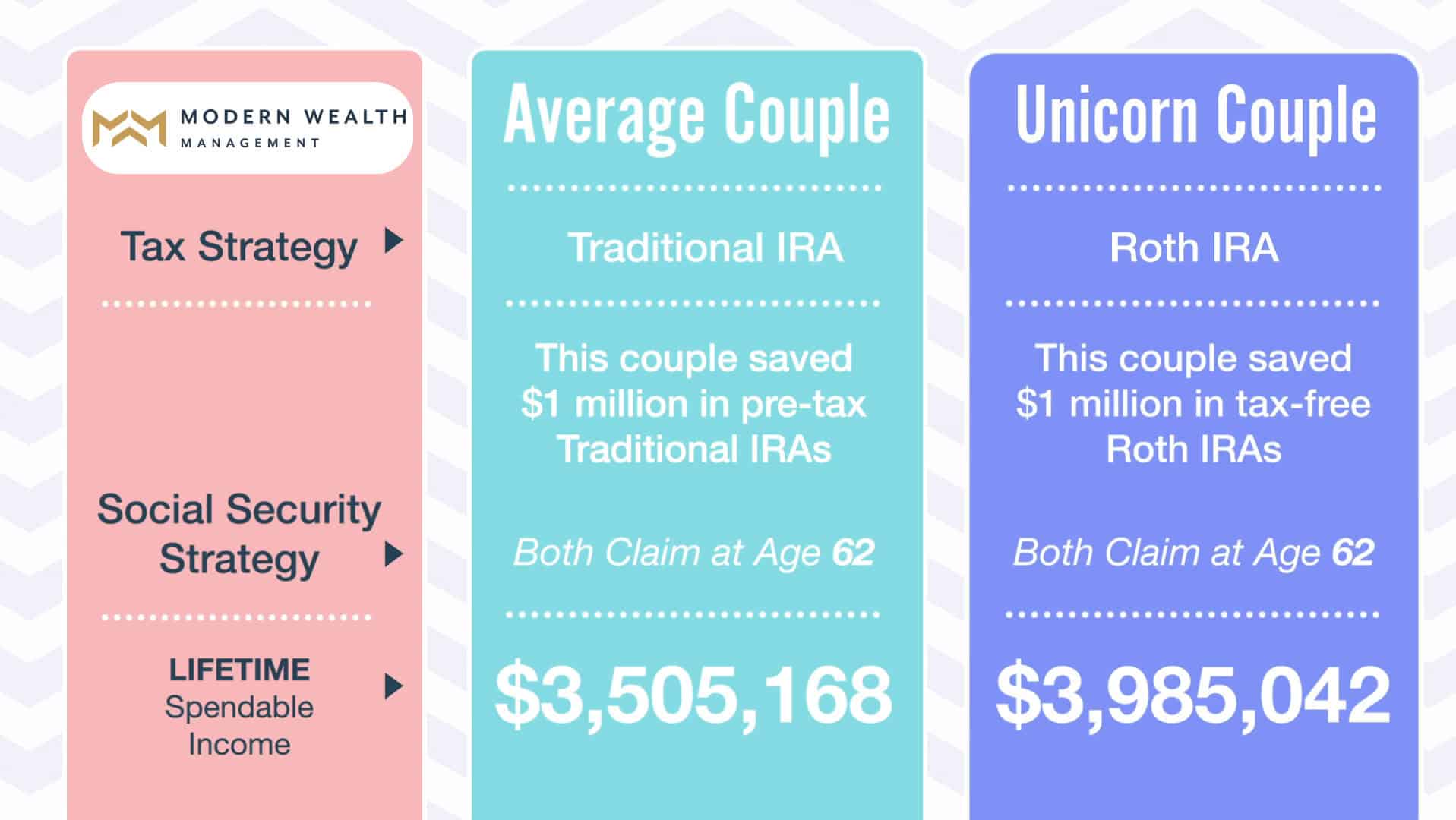

GRAPHIC 13

Of course, the unicorn couple added $479,874 to their lifetime spendable income compared to the average couple. It seems like everyone would agree that their retirement would be more meaningful if they had an extra $500,000.

Dean Barber: There’s no question about it.

Can a couple retire at 60 with $1 million?

FAQ

Is 1 million enough for a married couple to retire?

If you can keep your costs between $30,000 and $40,000 a year, $1 million has historically been more than enough for an endless retirement. This has always been the standard FI mentality.

At what age can you retire with $1 million?

You can retire at 50 if you have saved $1 million. You will get a guaranteed income of $62,500 annually, utilizing an annuity, starting immediately for the rest of your life. The income amount will stay the same and never decrease.

Can you live off interest of 1 million dollars?

If you have $1 million in assets, you might be able to live off the profits from your investments. After all, the S&P 500 alone averages 10% returns per year. Setting aside taxes and down-year investment portfolio management, a $1 million index fund could provide $100,000 annually.

What is a good monthly retirement income for a couple?

The median retirement income, which is typically a better indicator of what the average retiree has saved, is closer to $47,000 annually, or around $3,900 per month, however. For married couples, the numbers are higher. The average retirement income is about $100,000 a year, or $8,300 a month.

Can you retire on 1 million?

Can You Retire on $1 Million? Yes, it’s possible to retire on $1 million today. In fact, with careful planning and a solid investment strategy, you could possibly live off the returns from a $1 million nest egg.

Is 1 million enough savings for retirement?

Many people think $1 million is sufficient savings for retirement. How long $1 million will last depends on how much a retiree spends on housing, health care and other expenses. Retirement savings can be supplemented with other income, such as Social Security and pensions, to make them last longer.

Is $1 million enough for a comfortable retirement?

It’s not until you reach adulthood that you realize that not only is $1 million in savings possible for you, but it may also be necessary. One of the most common questions people ask about retirement is whether $1 million is enough. Many people consider it a benchmark for a comfortable retirement, but it’s not necessarily enough for everyone.

Will $1 million buy you in retirement?

Assuming things get back to normal sometime soon, $1 million today will have the same purchasing power as $1.8 million two decades from now. 4 That means if you plan to retire in 20 years, you might need an extra $800,000 in your nest egg to live the kind of lifestyle $1 million would buy you in retirement now.

How much money do you need for retirement?

$1 million should be enough to see you through your retirement. You can retire at 50 with $1 million in savings and receive a guaranteed annual income of $62,400. Your tax bracket and how much you pay should also be considered when planning how much money you’ll need for retirement. Retiring at 60 with $1 million is feasible.

How much money do retirees have in their retirement accounts?

According to estimates based on the Federal Reserve Survey of Consumer Finances, only 3.2% of retirees have over $1 million in their retirement accounts. This percentage drops even further when considering those with $5 million or more, accounting for a mere 0.1% of retirees.