Generally, pension and annuity payments are subject to Federal income tax withholding. The withholding rules apply to the taxable part of payments or distributions from an employer pension, annuity, profit-sharing, stock bonus, or other deferred compensation plan. You must also follow these rules when getting money from an individual retirement account (IRA), an annuity, an endowment, or a life insurance contract from a life insurance company. There is no withholding on any part of a distribution or payment that is not reasonably believed to be includible in the payee’s gross income. For this purpose, any distribution or payment from or under an IRA (other than a Roth IRA) is treated as includible in gross income.

People who receive “periodic payments” and “nonperiodic payments” (see below) can usually choose not to have withholding applied to their pensions or annuities. However, see below for information on Mandatory Withholding on Payments to be Delivered Outside the United States. The election remains in effect until the payee revokes it. The payer must notify the payee that this election is available. Except where explicitly noted, the discussion below applies to payments to U. S. persons.

Periodic payments, like monthly pension or annuity payments, are usually made in installments at regular times over a period of more than one year. These payments are not eligible for rollover distributions. Periodic payments are payments that are about the same amount made at least once a year for at least 10 years or as long as the employee or beneficiaries live.

Payees of periodic payments can give payers a Form W-4P in order to make or change a withholding election, or elect not to have withholding apply, for their periodic payments. Refer to Form W-4P for more information (including how withholding will be determined if a payee does not give a Form W-4P to the payer).

Unless a payee chooses another withholding rate, the default withholding rate for a nonperiodic distribution (a payment other than a periodic payment) that is not an eligible rollover distribution, is 10% of the distribution. A payee can ask the payer to withhold at any rate (from 0% to 100%) using Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions. Distributions from an IRA that are payable on demand are treated as nonperiodic payments.

A payer must withhold 20% of an eligible rollover distribution unless the payee elected to have the distribution paid in a direct rollover to an eligible retirement plan, including an IRA. In the case of a payee who does not elect such a direct rollover, the payee cannot elect no withholding on the distribution. With certain exceptions, the taxable part of any distribution from a qualified plan, section 401(k) plan, governmental section 457(b) plan, section 403(a) annuity plan, or section 403(b) plan that can be rolled over to an IRA or other eligible retirement plan is an eligible rollover distribution. In general, qualifying “hardship” distributions, and distributions required by federal law such as required minimum distributions, are not eligible rollover distributions.

Note, a payee may request a higher rate of withholding than the 20% default withholding rate on an eligible rollover distribution by filing a 2021 or earlier Form W-4P or a 2022 or later Form W-4R. Although the Form W-4R was available for use in 2022, the IRS postponed the requirement to begin using the new form until Jan. 1, 2023. For more information, see Chapter 8 in Publication 15-A, Employer’s Supplemental Tax Guide.

Are you approaching retirement and wondering about the tax bite on your hard-earned pension? You’re not alone! As someone who’s helped many retirees navigate this confusing landscape, I’ve seen firsthand how understanding pension taxation can make a huge difference in your retirement cashflow.

Let’s dive into everything you need to know about pension taxation without the confusing jargon!

The Basics: Is My Pension Taxable?

The short answer is: probably yes, but it depends on how your pension was funded.

Most pensions are taxable because they’re funded with pre-tax dollars. That means you didn’t pay taxes on that money when you put it into the pension plan, so when you take it out, Uncle Sam wants his cut.

Here’s the simple breakdown

- Fully taxable pensions: If you made NO after-tax contributions to your pension

- Partially taxable pensions: If you contributed after-tax dollars to your pension

Guy Baker, founder of Wealth Teams Alliance, says, “Most pensions are paid for with money that has already been taxed. This means that you will be taxed when you get money from them.” “.

How the IRS Determines Your Pension Tax

There are two main ways for the IRS to figure out how much of your pension is taxed.

- The General Rule: Complex calculation for pensions starting before November 18, 1996

- The Simplified Method: Used for most pension payments starting after November 18, 1996

For most of us, the Simplified Method applies. This spreads your after-tax contributions (if any) over your expected payment period, making a portion of each payment tax-free.

Federal Tax Rates on Pension Income

When it comes to taxes, your pension is taxed at the same rates as your wages and other regular income. If you are a citizen of the United States and file your taxes electronically, your federal tax brackets will be between 2010 and 2037 in 2020.

For example:

- A single retiree with $50,000 in taxable pension income falls into the 22% marginal tax bracket

- A married couple filing jointly with that same $50,000 might stay in the 12% bracket

Remember, our tax system is progressive. If you’re single with $60,000 in taxable pension income:

- The first $11,600 is taxed at 10%

- The next portion up to $47,150 is taxed at 12%

- Only the remaining amount gets hit with the 22% rate

This means your effective tax rate (what you actually pay overall) is lower than your marginal rate.

State Taxation of Pensions: It Varies Wildly!

Here’s where things get interesting – and potentially beneficial! State tax treatment of pensions varies dramatically:

States with NO income tax (so no pension tax):

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

- New Hampshire (only taxes dividend income and capital gains)

States that don’t tax pension income:

- Alabama

- Illinois

- Hawaii

- Mississippi

- Pennsylvania

As CPA Dennis Duban notes: “If you contributed to your pension while living in a high tax rate state and you happen to move to a state with low or no income tax taxes, then you will avoid state tax on your pension income.”

This geographic tax arbitrage is why so many retirees pack up and move to tax-friendly states!

The 10% Early Withdrawal Penalty Trap

Taking pension payments before age 59½? Watch out! You might get hit with an additional 10% tax penalty on early distributions.

However, several exceptions exist:

- Distributions made as part of substantially equal periodic payments after separation from service

- Distributions due to total and permanent disability

- Payments made because you’re terminally ill

- Distributions made after the death of the plan participant

Required Minimum Distributions (RMDs)

While traditional pensions typically provide monthly payments, some pension plans offer lump-sum options. If you roll a lump sum into a traditional IRA, you’ll eventually face Required Minimum Distributions (RMDs).

Currently, RMDs must begin at age 73. The amount is calculated annually using the IRS Uniform Lifetime Table, dividing your prior year-end account balance by a life expectancy factor.

Failing to take your RMD results in a hefty penalty – 25% of the amount you should have withdrawn! (This can be reduced to 10% if corrected within two years.)

Tax Withholding on Pension Payments

Thankfully, managing tax payments on pension income is straightforward. Most pension providers will withhold federal income tax from your payments.

You have options:

- Submit Form W-4P to your pension provider to specify withholding amounts

- Use the IRS Tax Withholding Estimator tool to calculate the right amount

- Choose not to have income tax withheld (but beware of underpayment penalties!)

If you don’t submit Form W-4P, the payer will withhold as if your filing status is single with no adjustments.

For many retirees, withholding isn’t enough – especially with multiple income sources. You might need to make quarterly estimated tax payments to avoid underpayment penalties.

Strategies to Reduce Your Pension Tax Burden

We’ve covered the rules, now let’s talk strategy! Here are ways to potentially lower your tax bill:

Take Advantage of Additional Deductions and Credits

- Age-Based Deduction: In 2024, taxpayers 65+ get an additional standard deduction of $1,950 (single) or $1,550 per spouse (married filing jointly)

- Credit for the Elderly or Disabled: A potential tax break for low-income seniors

Plan for Multiple Income Sources

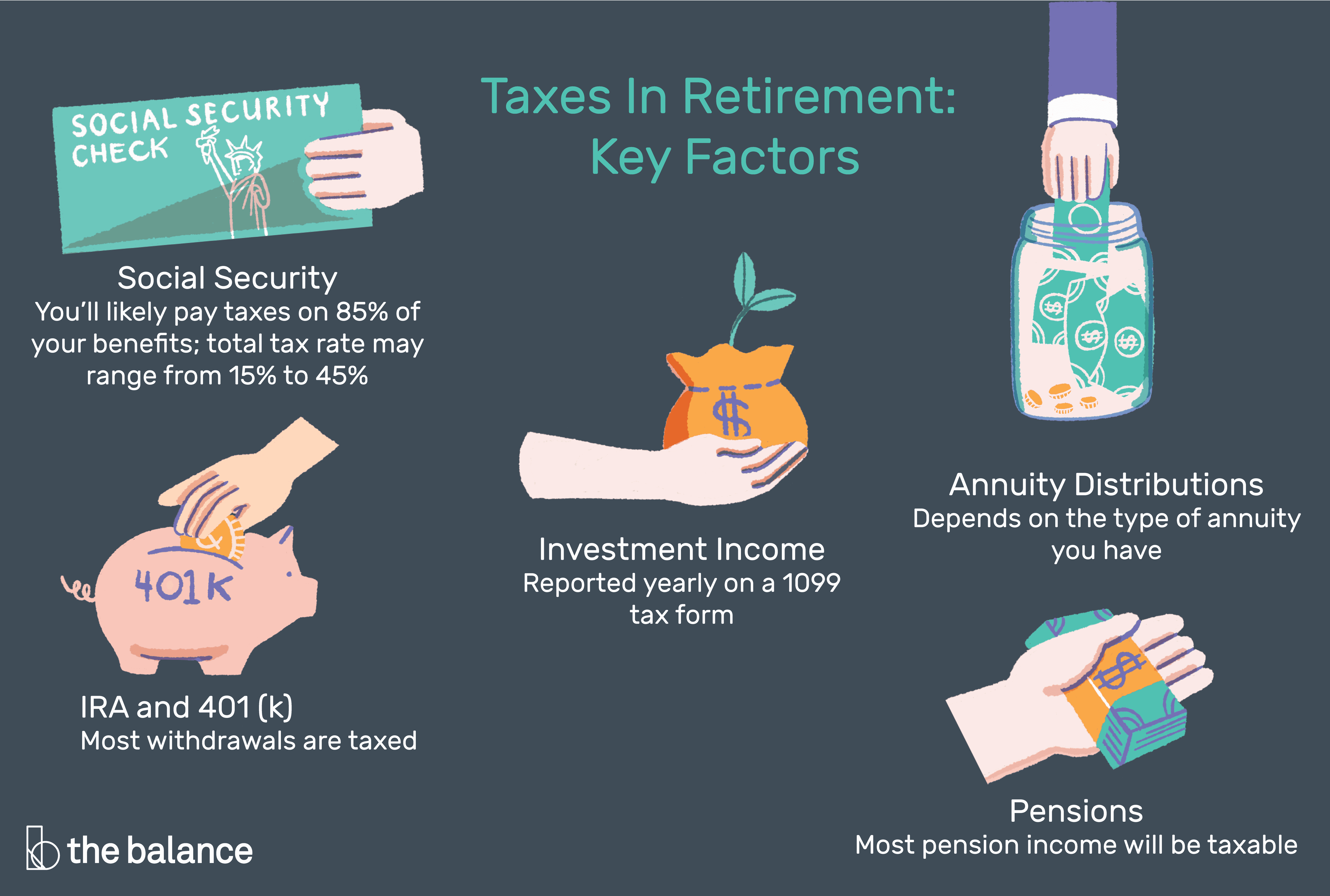

Receiving Social Security along with your pension? Be strategic! Up to 85% of your Social Security benefits may become taxable if your combined income exceeds certain thresholds ($25,000 for singles, $32,000 for joint filers).

Consider a Lump Sum Rollover

If your pension offers a lump-sum option, rolling it into an IRA gives you more control over the timing of your withdrawals and potentially your tax situation.

Roth Conversions

As Baker explains: “In some cases, the pension can be converted to a lump sum and rolled to an IRA.” By converting some funds to a Roth IRA, you pay taxes upfront but can make tax-free withdrawals later.

Real-World Examples

Let’s look at a couple examples to see how this works in practice:

Example 1: John, Single Filer

- $45,000 annual pension (fully taxable)

- $20,000 Social Security benefits

- Standard deduction: $14,600 + $1,950 (over 65) = $16,550

- Taxable income: $45,000 – $16,550 + portion of Social Security = varies based on combined income

Example 2: Mary and Bob, Married Filing Jointly

- $60,000 combined pension income (fully taxable)

- $30,000 combined Social Security benefits

- Standard deduction: $29,200 + $3,100 (both over 65) = $32,300

- Taxable income: $60,000 – $32,300 + portion of Social Security = varies based on combined income

Common Mistakes to Avoid

- Forgetting about state taxes: Moving to a tax-friendly state can save thousands

- Ignoring RMDs: The 25% penalty hurts!

- Insufficient withholding: Quarterly estimated payments may be necessary

- Not planning for Social Security taxation: Your pension can make more of your Social Security taxable

Wrapping It Up

Navigating pension taxation isn’t exactly fun, but understanding the rules can save you serious money in retirement. The most important things to remember:

- Most pensions are fully or partially taxable at ordinary income rates

- Your filing status, total income, and state residence all impact your tax bill

- Proper withholding or estimated payments helps avoid penalties

- Strategic planning can reduce your overall tax burden

I always tell my clients: don’t let taxes dictate your retirement, but don’t ignore them either! With proper planning, you can keep more of your hard-earned pension and enjoy the retirement you deserve.

Have questions about your specific situation? Consider consulting with a tax professional who specializes in retirement income planning. They can help you create a personalized strategy that minimizes your tax burden while maximizing your retirement income.

Mandatory withholding on payments to be delivered outside the United States

A payee who is a U. S. If a citizen or resident alien wants a regular or one-time payment sent outside of the United States or its territories, they cannot choose not to have any taxes withheld. See Publication 505, Tax Withholding and Estimated Tax, and Form W-4P or Form W-4R for more information.

What is the tax rate for retirement pension income?

FAQ

How much of my pension is taxable?

If you did not put money into your pension, all of your pension income will be taxed at your normal income tax rate. Feb 6, 2025.

Does Arkansas tax retirement income?

Arkansas is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 3. 40%.

How much of my pension can I take tax free?

How much can I take from my pension tax-free? From age 55 (57 from April 2028), you can usually take up to 25% from each of your pensions without paying any tax, provided you: take the money as one or more lump sums (rather than regular income) and.

At what age do you stop paying taxes on your pension?

In the United States, there is no specific age at which seniors automatically stop paying taxes.

Is my pension income taxable?

Because there are 14 states that do not tax your pension income. Under federal law, a pension is considered income. So, your pension income is either fully taxable or partially taxable depending on whether you have contributed after-tax dollars to your pension or not. But state income tax is different from federal income tax.

Are pension checks taxable?

This means that everything you get when you retire is taxed if you didn’t put money into your pension or if your employer didn’t take money out of your paycheck for it. If your monthly pension check is $1,000 per month, you’ll pay ordinary income taxes on $1,000 per month.

Do I owe taxes if I take a pension?

You won’t owe taxes on the amount you contributed in after-tax dollars. If you take distributions from your pension before age 59 1/2, you may owe a 10% penalty on top of your regular income taxes. The only way you can get out of this early withdrawal penalty is: