This information comes from the National Academy of Social Insurance to help people learn more about Social Security, which is still a big part of how Americans and their families can plan for their retirement. We encourage you to use the information on our site to increase your familiarity with social insurance programs as they currently exist and to envision how they could evolve to meet the needs of a changing world.

Understanding Your Rights to Survivor Benefits After Losing a Spouse

It’s very hard to lose a spouse, and having to deal with money issues can make things even worse. One question that widows and widowers often ask is, “Do I get my spouse’s Social Security when he dies?” The answer is “yes”—in most cases—but there are some important details you need to know.

As someone who’s researched this topic extensively, I’m gonna share everything you need to know about collecting your deceased spouse’s Social Security benefits. Let’s dive into the specifics of survivor benefits, eligibility requirements, and how to make sure you receive what you’re entitled to

Who Can Receive Survivor Benefits?

Nearly 3.7 million widows and widowers were receiving survivor benefits as of February 2025, according to AARP. You may qualify for these benefits if you fall into one of these categories

- Surviving spouse – If you were married to the deceased at the time of their death

- Divorced spouse – Even if you weren’t married at the time of death

- Children of the deceased

- Dependent parents of the deceased who relied on them financially

Basic Eligibility Requirements for Spouses

In most cases, you need to meet these requirements to get your spouse’s Social Security after they die:

- You must be at least 60 years old (or 50 if you have a qualifying disability)

- You must have been married to the deceased for at least 9 months at the time of death

- You haven’t remarried before age 60 (or age 50 if disabled)

However, there are some exceptions to these rules:

- If your spouse’s death was accidental or occurred while on U.S. military duty, the 9-month marriage requirement is waived

- If you’re caring for a child from the marriage who is under 16 or has a disability, you can apply at any age

- If you remarry after turning 60 (or 50 if disabled), you can still collect survivor benefits based on your late spouse’s record

How Much Will You Receive in Survivor Benefits?

The amount you’ll receive depends on several factors, including your age when you claim and what your spouse was receiving (or eligible to receive) from Social Security. Here’s a breakdown:

- 100% of your spouse’s benefit – If you’ve reached full retirement age

- 71.5% to 99% of your spouse’s benefit – If you claim between age 60 and full retirement age (higher percentage the older you are)

- 71.5% of your spouse’s benefit – If you claim in your 50s due to disability

- 75% of your spouse’s benefit – If you’re caring for a child under 16 or with a disability

It’s important to note that full retirement age for survivor benefits is different than for regular retirement benefits. For survivors born in 1958, it’s 66 and 4 months, for those born in 1959, it’s 66 and 6 months, and it’s gradually increasing to 67 over the next few years.

What If I Have My Own Social Security Benefits?

Many people wonder if they can collect both their own retirement benefits and survivor benefits. Here’s the deal:

- You won’t receive both benefits simultaneously

- Social Security will pay whichever amount is higher

- You can strategize by taking one benefit earlier and switching to the other later if it would result in a higher payment

For example, you might claim survivor benefits at 60 and then switch to your own retirement benefits at 70 if they would be higher due to delayed retirement credits.

How to Apply for Survivor Benefits

Unlike some other Social Security benefits, survivor benefits aren’t automatically granted—you must apply for them. Here’s what to do:

- Report the death – In most cases, the funeral home will report the death to Social Security

- Contact Social Security – Call 800-772-1213 to schedule an appointment

- Gather documents – You’ll need proof of death, marriage certificate, Social Security numbers, and more

- Complete the application – This can be done during your appointment

If you were already getting spousal benefits because of your partner’s work, Social Security will usually switch you to survivor benefits when they find out about the death.

Important Considerations and Limitations

There are several factors that might affect your survivor benefits:

Working While Receiving Benefits

If you’re working and getting survivor benefits but are under the full retirement age, you should know that Social Security’s earnings limit could temporarily lower your benefits.

Remarriage

As mentioned earlier, remarriage before age 60 (or 50 if disabled) will prevent you from collecting survivor benefits based on your late spouse’s record. However, if that marriage ends, you can again become eligible for survivor benefits from your former spouse.

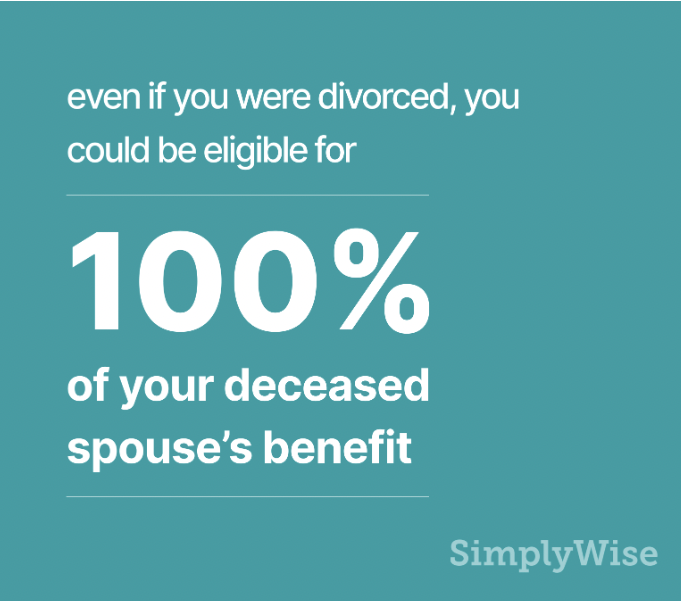

Divorced Spouse Benefits

Even if you were divorced from the deceased, you may still qualify for survivor benefits if:

- Your marriage lasted at least 10 years

- You haven’t remarried before age 60 (or 50 if disabled)

- You aren’t entitled to a higher benefit on your own record

Common Questions About Survivor Benefits

How long do survivor benefits last?

For spouses and divorced spouses, survivor benefits can last for the rest of your life. For children, benefits typically stop at age 18 (or 19 if still in high school), unless the child has a disability that began before age 22.

What happens to my survivor benefits if I remarry?

If you remarry before age 60 (or 50 if disabled), you cannot receive survivor benefits. If you remarry after reaching those age thresholds, you can continue receiving survivor benefits based on your deceased spouse’s record.

Can I collect survivor benefits and then switch to my own retirement benefits later?

Yes! This is actually a smart strategy for many people. You could claim survivor benefits as early as age 60, then switch to your own retirement benefits later (up to age 70) if they would be higher.

Real-Life Example

Let’s look at how this might work in practice:

Maria’s husband John passed away at age 68. He was receiving $2,000 monthly in Social Security benefits. Maria is now 62 and eligible for $1,500 in retirement benefits on her own record. Because she’s not yet at full retirement age for survivors (which is 66 and 6 months for her birth year), she would receive about 81.5% of John’s benefit, or $1,630 if she claims now. She decides to take the survivor benefit now and will switch to her own benefit at age 70 when it will have grown to approximately $2,160 due to delayed retirement credits.

Steps to Take Now

If your spouse has recently passed away or if you’re planning ahead, here are some steps to consider:

- Contact Social Security promptly – Call 800-772-1213 to report the death and schedule an appointment about survivor benefits

- Gather important documents – Death certificate, marriage certificate, Social Security numbers, birth certificates, tax returns, etc.

- Consider your claiming strategy – Decide when to claim based on your age, financial needs, and whether you have your own retirement benefits

- Get professional advice – A financial advisor familiar with Social Security rules can help maximize your benefits

Final Thoughts

Navigating Social Security after losing a spouse is complex, but understanding your rights to survivor benefits is crucial for your financial wellbeing. In most cases, yes—you will get your spouse’s Social Security when they die, but the amount and eligibility depend on various factors.

Remember that Social Security is just one piece of your financial picture after losing a spouse. It’s important to consider other sources of income and support during this difficult transition.

Have you had experience with survivor benefits? What challenges did you face? Share your thoughts in the comments below!

Who is entitled to survivors’ benefits from Social Security?

Social Security is a key source of financial security to widowed spouses. About 7. Social Security benefits are given to 8 million people aged 60 and up based in part on the work record of a deceased spouse. These surviving spouse beneficiaries are overwhelmingly women.

These beneficiaries include 3. 6 million people who are eligible only as widowed spouses. Another 4. 2 million people who are eligible for benefits based on their own work records but whose deceased spouses were entitled to higher benefits than them will get higher benefits as individuals (but, as we’ll talk about below, lower total benefits for their households).

How much do widowed spouses receive?

Social Security survivor benefits are mostly important to women (95% of survivors are women), since wives usually make less than their husbands and usually live longer than their husbands. When a retired worker dies, the surviving spouse receives a benefit equal to the deceased worker’s full retirement benefit.

Depending on the widow’s or widower’s circumstances, however, this benefit may substantially reduce her (his) monthly household income because only one Social Security benefit is now arriving (whichever is higher), not the two benefits that the couple received before the spouse’s death. Women who had worked and earned their own Social Security benefits, in particular, may find themselves struggling to meet the rising fixed expenses that come with aging.

For more information on Social Security and survivor benefits, please visit the Social Security Administration at ssa.gov/benefits/survivors/.

- Every year, the latest Trustees’ Report is added to this important Academy resource: Social Security Benefits, Finances, and Policy Options: A Primer.

- This brief looks at four ways to help elderly widows who are poor because of a Social Security formula that hurts women who used to make more money: Widows, Poverty, and Social Security Options, Social Security Brief No. 9.

- The lack of social insurance support for caregiving hurts women, especially women of color, more than it hurts men. This paper suggests a way to fix this problem: Crediting Care in Social Security: A Proposal for an Income Tested Care Credit.