Workplace retirement plans like 401(k)s offer tax benefits for your retirement savings. The tax benefit you receive depends on the type of contributions you make. You should know how your distributions are taxed so that you can decide what to do with your money appropriately.

People who are part of a workplace retirement plan may be able to make three types of contributions: pre-tax contributions, Roth contributions, and after-tax contributions.

Quick Answer: Generally, a direct rollover from a Roth 401(k) to a Roth IRA is NOT taxable. However, there are some important rules and exceptions you need to understand to avoid unexpected tax consequences.

Hey there! I’ve been helping clients navigate retirement account rollovers for years, and lemme tell you – the question of whether rolling over a Roth 401(k) to a Roth IRA is taxable comes up ALL the time. It’s actually one of those financial moves that seems like it should be straightforward but has a bunch of little gotchas that can trip you up if you’re not careful.

So today, I’m breaking down everything you need to know about Roth 401(k) to Roth IRA rollovers and their tax implications. Let’s dive in!

Understanding Roth Accounts: The Basics

It’s important that we both understand how Roth accounts work before we get into the specifics of rollovers:

-

Contributions to a Roth 401(k) are made with money that has already been taxed. Both the contributions and the earnings grow tax-free, and the money can be taken out tax-free in retirement (as long as certain conditions are met).

-

Roth IRA: Like a Roth 401(k), Roth IRA contributions are made with money that has already been taxed and grow tax-free. But Roth IRAs have different rules about how much you can put in, how much income you need to meet, and how you can withdraw your money.

It’s important to remember that the money you put into both types of accounts has already been taxed.

Is a Roth 401(k) to Roth IRA Rollover Taxable?

In most cases no! A direct rollover from a Roth 401(k) to a Roth IRA is generally not taxable. Since both accounts are funded with after-tax money the IRS doesn’t need to tax you again when you move money between them.

However (and this is a big however), there are some important distinctions:

-

The contribution portion of your Roth 401(k) can be rolled over to a Roth IRA tax-free.

-

The earnings portion is where things get a bit more complicated.

Let’s break this down further…

The Key to Tax-Free Rollovers: Understanding Account Components

Your Roth 401(k) has two main components

- After-tax contributions: The money you’ve already paid taxes on

- Earnings: The growth your contributions have generated

When rolling over to a Roth IRA, here’s what happens:

- After-tax contributions: These roll over tax-free because you’ve already paid taxes on this money.

- Earnings on after-tax contributions: If done correctly via direct rollover, earnings also transfer tax-free, but they maintain their “pre-tax” character until you make a qualified withdrawal from the Roth IRA.

As Dave Lowell, a CFP based in the Salt Lake City area, puts it: “You contact your employer’s 401(k) provider and request a rollover. They will then specify how much of the funds are pre-tax and how much are Roth contributions. You then direct them to make the funds transfer payable to the company where you hold your Roth IRA.”

The Three Methods for Tax-Free Rollovers

To avoid taxes on your rollover, use one of these three methods:

-

Direct rollover: Your plan custodian cuts a check made out to the new account custodian (not to you).

-

Trustee-to-trustee transfer: The old and new account custodians handle the transfer for you without you touching the money.

-

60-day rollover: You receive the distribution and then deposit it into a new Roth IRA within 60 days. (WARNING: This method is risky! If you miss the 60-day window, you could face taxes and penalties.)

I always recommend options 1 or 2 to my clients. The 60-day rollover is just too risky – I’ve seen people intend to complete the rollover but then life happens, they miss the deadline, and boom – tax bill!

The Five-Year Rule: A Critical Consideration

One of the most confusing aspects of Roth rollovers is the “five-year rule.” Actually, there are two different five-year rules to be aware of:

-

Five-year rule for Roth 401(k)s: To make qualified (tax-free) withdrawals from a Roth 401(k), you must have had the account for at least five years AND be at least 59½ years old.

-

Five-year rule for Roth IRAs: For Roth IRAs, the five-year clock starts with your first contribution to ANY Roth IRA.

When you roll over a Roth 401(k) to a Roth IRA, here’s what happens:

- If you roll into an existing Roth IRA that’s been open for more than five years, the rollover funds inherit that Roth IRA’s five-year clock.

- If you roll into a new Roth IRA, a new five-year clock starts for those rolled-over funds.

Here’s an example to make this clearer:

Let’s say Andrew is 60 years old, retired, and has $1 million in his 401(k):

- $800,000 (80%) is pre-tax money

- $200,000 (20%) is after-tax contributions

- Of the $800,000 in pre-tax balances, $100,000 is earnings attributable to the after-tax contributions

If Andrew’s plan allows partial withdrawals and tracks source balances separately, he could choose to withdraw just from his after-tax source balance. In this case, with his after-tax balance totaling $300,000 ($200,000 in after-tax contributions and $100,000 in pre-tax earnings), two-thirds of his withdrawal would be after-tax, and one-third would be pre-tax.

Partial Rollovers: More Complex Rules

If you’re doing a partial rollover of your Roth 401(k) to a Roth IRA, things get more complicated. According to IRS guidance:

- For any partial rollovers, nontaxable amounts (your contributions) must be rolled over along with some pre-tax amounts (earnings).

- If your plan allows partial withdrawals and source-specific withdrawals, you could take a rollover of just the after-tax source balance, which includes both after-tax contributions and associated earnings.

- If you choose to roll over only a portion of your after-tax balance, a proportional amount of associated earnings must also be rolled over.

The important thing to remember is that if your plan doesn’t track source balances separately, any partial withdrawal needs to take a proportional amount of both after-tax and pre-tax assets.

Pros of Rolling Over Your Roth 401(k) to a Roth IRA

There are several advantages to rolling your Roth 401(k) into a Roth IRA:

-

More investment choices: Roth IRAs typically offer a wider range of investment options compared to employer-sponsored Roth 401(k)s.

-

No required minimum distributions (RMDs): Roth IRAs don’t require RMDs during your lifetime, allowing your money to continue growing tax-free. (Note: Thanks to the SECURE 2.0 Act, Roth 401(k)s no longer require RMDs either, eliminating one previous advantage of Roth IRA rollovers.)

-

Greater withdrawal flexibility: Roth IRAs allow penalty-free withdrawals for first-time home purchases or qualified education expenses, which Roth 401(k)s don’t offer.

-

Consolidation simplifies management: Having fewer accounts makes it easier to track investments and plan withdrawals.

Cons and Considerations of Rolling Over

Before you rush to roll over your Roth 401(k), consider these potential drawbacks:

-

Five-year rule reset: If you don’t have an existing Roth IRA, you’ll need to start a new five-year clock for qualified distributions.

-

Loss of loan options: Unlike 401(k)s, Roth IRAs don’t offer loan provisions.

-

Investment options and fees: Your 401(k) might offer institutional pricing not available in IRAs.

-

Creditor protection: 401(k)s offer unlimited protection from creditors under federal law, while protection for IRA assets varies by state.

-

Net unrealized appreciation: Any partial withdrawals may affect eligibility for net unrealized appreciation treatment on appreciated employer stock held in the plan.

A Real-World Example

Let’s look at a specific scenario to illustrate how this works:

Jane has worked at her company for 15 years and has accumulated $350,000 in her Roth 401(k). Of this amount, $250,000 is from her contributions, and $100,000 is earnings. She’s changing jobs and wants to roll her Roth 401(k) into a Roth IRA she opened 7 years ago.

In this case:

- Jane can roll over the entire $350,000 to her existing Roth IRA tax-free using a direct rollover or trustee-to-trustee transfer.

- Because her Roth IRA has been open for more than five years, the rolled-over funds inherit this established five-year period.

- When Jane retires and withdraws from her Roth IRA (assuming she’s over 59½), both her contributions and earnings will be tax-free.

How to Avoid Tax Surprises: Best Practices

To ensure your Roth 401(k) to Roth IRA rollover remains tax-free:

-

Use direct transfers: Always opt for direct rollovers or trustee-to-trustee transfers rather than 60-day rollovers.

-

Roll into an existing Roth IRA if possible: If you already have a Roth IRA that’s been open for more than five years, roll your Roth 401(k) funds into that account rather than opening a new one.

-

Consult a tax advisor: Before making any rollover decisions, speak with a tax professional who can evaluate your specific situation.

-

Understand your plan’s rules: Some employer plans have different distribution rules, so check with your HR department or plan administrator.

-

Keep good records: Maintain documentation of your rollover transactions and the composition of your accounts (contributions vs. earnings).

Income Eligibility and Contribution Rules for Roth IRAs

It’s worth noting that Roth IRAs have income eligibility restrictions for contributions. For 2025:

- Single filers with AGI below $150,000 can contribute the full amount

- Single filers with AGI between $150,000-$165,000 can make partial contributions

- Single filers with AGI above $165,000 cannot contribute

For married couples filing jointly:

- AGI below $236,000: full contribution allowed

- AGI between $236,000-$246,000: partial contribution allowed

- AGI above $246,000: no contribution allowed

These income limits only apply to new contributions, not rollovers! You can roll over a Roth 401(k) to a Roth IRA regardless of your income level.

Bottom Line: Is the Rollover Worth It?

In most cases, rolling your Roth 401(k) to a Roth IRA is a smart financial move, especially if:

- You want more investment options

- You prefer not having RMDs (though this benefit is less significant now)

- You value the additional withdrawal flexibility

- You want to consolidate your retirement accounts

However, if you have appreciated company stock in your 401(k) or need to maintain loan options, you might want to reconsider or do a partial rollover.

I personally rolled over my Roth 401(k) from my previous employer to my existing Roth IRA, and it was one of the best financial decisions I’ve made. The process was seamless, and now I have all my retirement funds in one place with more investment choices.

Remember, everyone’s financial situation is unique, so what worked for me might not be the best choice for you. When in doubt, consult with a qualified financial advisor who can help you navigate the complexities of retirement account rollovers.

Rolling over after-tax money to a Roth IRA

If you have after-tax money in your traditional 401(k), 403(b), or other workplace retirement savings account, you can roll over the original contribution amounts to a Roth IRA without paying taxes, as long as certain rules are met. (Note: Your plans terms will determine when and how money is distributable. Please review your plan document or summary plan description for more information about disbursements from the plan. ).

The IRS says you can move money that has already been taxed to a traditional IRA2 and money that has already been taxed to a Roth IRA without making taxable income. When making a choice that could affect your taxes, you should always talk to a tax professional to make sure it’s the right choice for you. The IRS allows for a few different scenarios—but not all may be allowed by your plan.

To make things as simple as possible, you would move the whole balance from your workplace plan to a Roth IRA and put the earnings and contributions made before taxes into a traditional IRA.

The IRS treats plans that track separate source balances differently than plans that do not, allowing for withdrawals from a single source. Additionally, the IRS allows plan participants to take partial withdrawals. The catch is that your plan is not obligated to permit partial distributions or withdrawals of specific contribution types.

If the plan allows partial withdrawals and allows source-specific withdrawals, one could take a rollover of just the after-tax source balance, which includes both the after-tax contributions and all of the associated earnings. Again, the after-tax balance could go to a Roth IRA while earnings would go to a traditional IRA.

In that scenario, one could also choose to roll out only a portion of the after-tax balance. But, to roll over a partial amount of after-tax contributions, a proportional amount of associated earnings must also be rolled over.

Important note: Any partial withdrawals may affect eligibility for net unrealized appreciation treatment on appreciated employer stock held in the plan.

Read Viewpoints on Fidelity.com: Make the most of company stock in your 401(k)

Contributions made before 1987 are treated differently than those made after 1987. Pre-1987 employee contributions may be distributed without taking a taxable disbursement of the associated earnings. If you have contributions from 1986 or before, consult your tax advisor for more information.

Taxes on earnings from after-tax contributions

After-tax contributions to a 401(k) or other workplace retirement plan get a different tax treatment than their earnings. Since youve already paid taxes on the contributions, those withdrawals are tax-free in retirement. But the IRS considers the earnings to be pre-tax—so they would be treated as pre-tax and you would owe income tax when you withdraw the earnings from the plan.

Earnings in Roth IRAs, however, arent subject to income tax as long as all withdrawals from the account are qualified withdrawals.1 So rolling after-tax contributions from a workplace plan to a Roth IRA means you can potentially avoid taxes on any future earnings.

Roth 401k to Roth IRA Rollovers – Tax Explainer

FAQ

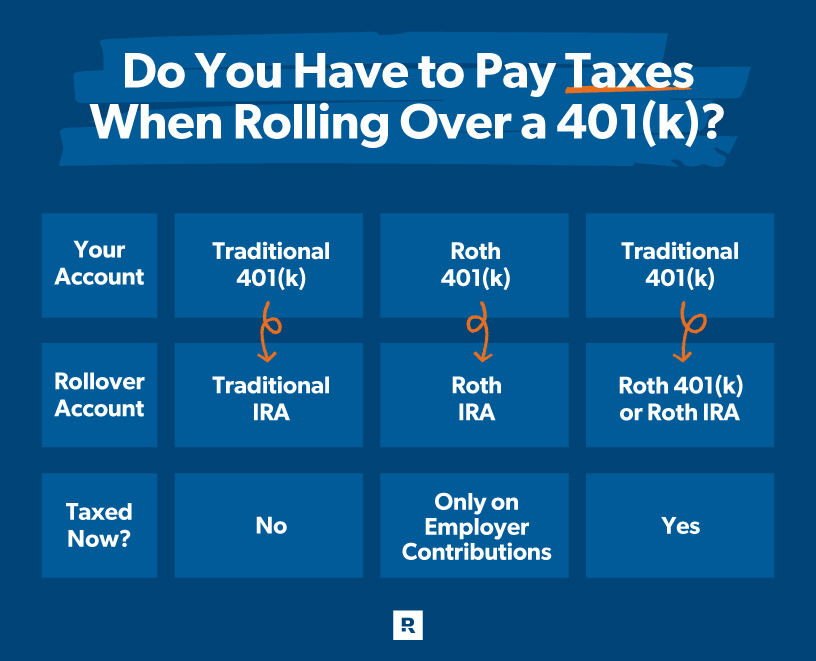

Do you pay taxes when rolling over a 401k to Roth IRA?

Yes, you pay income taxes on the pre-tax portion of your 401(k) when you roll it over into a Roth IRA, as you are converting money from a tax-deferred account to a tax-free account. Your ordinary income tax rate is used to tax the new amount, which is added to your gross income for the year.

Can I rollover a Roth 401k to a Roth IRA?

Yes, you can move money directly from a Roth 401(k) to a Roth IRA. This is often the best way to get a wider range of investments and to combine multiple retirement accounts into one.

What are the disadvantages of rolling over a Roth 401k to a Roth IRA?

ConsLimited opportunity for early withdrawals without paying a 10% early-withdrawal additional tax (early tax is not due for amounts rolled over)Loans are not available. Protection from creditors in bankruptcy only. Additional fees should be considered when moving assets to an IRA (for example, transfer fees may apply).

How do I avoid paying taxes on my 401k rollover?

You can ask your 401(k) plan to send a distribution straight to an IRA or another eligible plan. Under this option, no taxes are withheld. Aug 26, 2025.

Does a 401(k) rollover trigger tax?

Converting to a Roth IRA triggers a tax bill on those pretax funds at the time of rollover. After that, all growth in the Roth IRA is tax-free. Roth 401 (k) to Roth IRA: If your 401 (k) contributions were already Roth (after-tax) within your employer plan, rolling them to a Roth IRA does not trigger taxes.

Can I roll over a 401k to a Roth IRA?

Not if it’s a direct rollover from Traditional 401 (k) to Traditional IRA. You’ll owe tax only if you convert to a Roth IRA. 2. What is the 60-day rule for rollovers? You must deposit the funds into your IRA within 60 days to avoid tax and penalties. 3. Can I roll over a Roth 401 (k) to a Roth IRA?

Does rolling over a Roth 401(k) affect taxes?

The timing and method of your Roth 401 (k) rollover can affect taxes. While rolling over a traditional 401 (k) account has its quirks, rolling over a Roth 401 (k) comes with a unique set of rules. This article highlights some key considerations to keep in mind when rolling over a Roth 401 (k).

What happens if you rollover a Roth 401(k)?

Any earnings from your Roth 401 (k) rollover. Earnings that accrue in your Roth IRA before and after the rollover become tax-free once you reach age 59 ½ or have another qualifying event and meet the Roth IRA’s five-year period. Rollover to Your Roth 401 (k)

What is a direct rollover to a Roth 401(k)?

1) Direct Rollover With a direct rollover to a Roth IRA, the distribution is paid to your Roth IRA custodian for credit to your Roth IRA. With a direct rollover to a Roth 401 (k), the distribution is paid to your Roth 401 (k) plan trustee for credit to your Roth 401 (k).

Can a Roth 401(k) rollover be a five-year rule?

The five-year rule also applies to funds held in a Roth 401 (k) account. So if you’ve had a Roth 401 (k) and a Roth IRA for at least five years and you’ve been actively contributing to both, then the five-year rule shouldn’t be an issue for rollovers. To ensure this goes smoothly, be sure to plan ahead quite a bit.