For the latest information about developments related to Pub. 575, such as legislation enacted after it was published, go to IRS. gov/Pub575.

Distributions to victims of domestic abuse. If certain conditions are met, a distribution to a domestic abuse victim made after December 31, 2020, will not be subject to the 2010 additional tax on early distributions. For more information, see Distributions to victims of domestic abuse, later.

Distributions for emergency personal expenses. Beginning with distributions made after December 31, 202023, a distribution to an individual for certain emergency personal expenses is not subject to the 2010 additional tax on early distributions as long as certain conditions are met. For more information, see Distributions for emergency personal expenses, later.

Transfers and rollovers of assets and the substantially equal payment method. Beginning after December 31, 2023, certain transfers and rollovers of assets from qualified plans or annuity contracts using the substantially equal periodic payment method are not considered a modification of the distribution method if certain requirements are met. For more information, see Transfers and Rollovers of Assets, later.

The direct payment requirement for certain distributions for payment of health or long-term care insurance repealed. Distributions from governmental plans to an eligible retired public safety officer made after December 29, 2022, for health and long-term care insurance can be excluded from that employee’s gross income. These distributions are excluded from gross income whether the premiums are paid directly to the provider of the accident or health plan or qualified long-term care insurance contract by deduction from a distribution from the eligible retirement plan or if the distributions are made to the employee. The amount that can be taken out of your gross income for the tax year is limited to either $3,000 or the cost of the insurance.

Form 8915-F replaces Form 8915-E. Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments, replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021, 2022, and 2023, as applicable. In previous years, distributions and repayments would be reported on the applicable Form 8915 for that years disasters. For example, Form 8915-D, Qualified 2019 Disaster Retirement Plan Distributions and Repayments, would be used to report qualified 2019 disaster distributions and repayments.Form 8915-F is a forever form. Beginning in 2021, additional alphabetical Forms 8915 will not be issued. For more information, see the Instructions for Form 8915-F.

Photographs of missing children. The IRS is a proud partner with the National Center for Missing & Exploited Children® (NCMEC). Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. You can help bring these children home by looking at the photographs and calling 1-800-THE-LOST (1-800-843-5678) if you recognize a child.

This publication discusses the tax treatment of distributions you receive from pension and annuity plans and also shows you how to report the income on your federal income tax return. How these distributions are taxed depends on whether they are periodic payments (amounts received as an annuity) that are paid at regular intervals over several years or nonperiodic payments (amounts not received as an annuity).

. For additional information on how to report pension or annuity payments on your federal income tax return, be sure to review the instructions on the back of Copies B, C, and 2 of the Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., that you received and the instructions for Form 1040, lines 5a and 5b, and the instructions for Form 1040-NR, lines 5a and 5b..

For additional information on how to report pension or annuity payments on your federal income tax return, be sure to review the instructions on the back of Copies B, C, and 2 of the Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., that you received and the instructions for Form 1040, lines 5a and 5b, and the instructions for Form 1040-NR, lines 5a and 5b..

. A “corrected” Form 1099-R replaces the corresponding original Form 1099-R if the original Form 1099-R contained an error. Make sure you use the amounts shown on the corrected Form 1099-R when reporting information on your tax return..

A “corrected” Form 1099-R replaces the corresponding original Form 1099-R if the original Form 1099-R contained an error. Make sure you use the amounts shown on the corrected Form 1099-R when reporting information on your tax return..

This is the method generally used to determine the tax treatment of pension and annuity income from nonqualified plans (including commercial annuities). For a qualified plan, you can’t generally use the General Rule unless your annuity starting date is before November 19, 1996. Although this publication will help you determine whether you can use the General Rule, it wont help you use it to determine the tax treatment of your pension or annuity income. For that and other information on the General Rule, see Pub. 939, General Rule for Pensions and Annuities.

Information on the tax treatment of amounts you receive from an IRA is in Pub. 590-B.

If you are retired from the federal government (regular, phased, or disability retirement) or are the survivor or beneficiary of a federal employee or retiree who died, see Pub. 721, Tax Guide to U.S. Civil Service Retirement Benefits. Pub. 721 covers the tax treatment of federal retirement benefits, primarily those paid under the Civil Service Retirement System (CSRS) or the Federal Employees Retirement System (FERS). It also covers benefits paid from the Thrift Savings Plan (TSP).

For information about the tax treatment of these benefits, see Pub. 915, Social Security and Equivalent Railroad Retirement Benefits. However, this publication (575) covers the tax treatment of the non-social security equivalent benefit portion of tier 1 railroad retirement benefits, tier 2 benefits, vested dual benefits, and supplemental annuity benefits paid by the U.S. Railroad Retirement Board.

If you work for a public school or certain tax-exempt organizations, you may be eligible to participate in a 403(b) retirement plan offered by your employer. Although this publication covers the treatment of benefits under 403(b) plans and discusses in-plan Roth rollovers from 403(b) plans to designated Roth accounts, it doesnt cover other tax provisions that apply to these plans. For that and other information on 403(b) plans, see Pub. 571.

You can send us comments through IRS.gov/FormComments. Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications. Don’t send tax questions, tax returns, or payments to the above address.

If you have a tax question not answered by this publication or the How To Get Tax Help section at the end of this publication, go to the IRS Interactive Tax Assistant page at IRS.gov/Help/ITA where you can find topics by using the search feature or viewing the categories listed.

Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

A pension is generally a series of definitely determinable payments made to you after you retire from work. Pension payments are made regularly and are based on such factors as years of service and prior compensation.

An annuity is a series of payments under a contract made at regular intervals over a period of more than 1 full year. They can be either fixed (under which you receive a definite amount) or variable (not fixed). You can buy the contract alone or with the help of your employer.

A qualified employee plan is an employers stock bonus, pension, or profit-sharing plan that is for the exclusive benefit of employees or their beneficiaries and that meets Internal Revenue Code requirements. It qualifies for special tax benefits, such as tax deferral for employer contributions and capital gain treatment or the 10-year tax option for lump-sum distributions (if participants qualify). To determine whether your plan is a qualified plan, check with your employer or the plan administrator.

A qualified employee annuity is a retirement annuity purchased by an employer for an employee under a plan that meets Internal Revenue Code requirements.

A designated Roth account is a separate account created under a qualified Roth contribution program to which participants may elect to have part or all of their elective deferrals to a 401(k), 403(b), or 457(b) plan designated as Roth contributions. In addition, a designated Roth account may include certain nonelective contributions or matching contributions that a participant designates as Roth contributions.

Designated Roth contributions, designated Roth nonelective contributions, and designated Roth matching contributions are included in your income. However, qualified distributions (explained later) arent included in your income.

You should check with your plan administrator to determine if your plan will accept designated Roth contributions.

A tax-sheltered annuity plan (often referred to as a “403(b) plan” or a “tax-deferred annuity plan)” is a retirement plan for employees of public schools and certain tax-exempt organizations. Generally, a tax-sheltered annuity plan provides retirement benefits by purchasing annuity contracts for its participants.

The first annuitant receives a definite amount at regular intervals for life. After they die, a second annuitant receives a definite amount at regular intervals for life. The amount paid to the second annuitant may or may not differ from the amount paid to the first annuitant.

You receive payments that may vary in amount for a specified length of time or for life. The amounts you receive may depend upon such variables as profits earned by the pension or annuity funds, cost-of-living indexes, or earnings from a mutual fund.

You may receive employee plan benefits from more than one program under a single trust or plan of your employer. If you participate in more than one program, you may have to treat each as a separate pension or annuity contract, depending upon the facts in each case. Also, you may be considered to have received more than one pension or annuity. Your former employer or the plan administrator should be able to tell you if you have more than one contract.

Your employer set up a noncontributory profit-sharing plan for its employees. The plan provides that the amount held in the account of each participant will be paid when that participant retires. Your employer also set up a contributory defined benefit pension plan for its employees providing for the payment of a lifetime pension to each participant after retirement.

The amount of any distribution from the profit-sharing plan depends on the contributions (including allocated forfeitures) made for the participant and the earnings from those contributions. Under the pension plan, however, a formula determines the amount of the pension benefits. The amount of contributions is the amount necessary to provide that pension.

Each plan is a separate program and a separate contract. If you get benefits from these plans, you must account for each separately, even though the benefits from both may be included in the same check.

. Distributions from a designated Roth account are treated separately from other distributions from the plan..

Distributions from a designated Roth account are treated separately from other distributions from the plan..

A QDRO is a judgment, decree, or order relating to payment of child support, alimony, or marital property rights to a spouse, former spouse, child, or other dependent of a participant in a retirement plan. The QDRO must contain certain specific information, such as the name and last known mailing address of the participant and each alternate payee, and the amount or percentage of the participants benefits to be paid to each alternate payee. A QDRO may not award an amount or form of benefit that isnt available under the plan.

A spouse or former spouse who receives part of the benefits from a retirement plan under a QDRO reports the payments received as if they were a plan participant. The spouse or former spouse is allocated a share of the participants cost (investment in the contract) equal to the cost times a fraction. The numerator of the fraction is the present value of the benefits payable to the spouse or former spouse. The denominator is the present value of all benefits payable to the participant.

A distribution that is paid to a child or other dependent under a QDRO is taxed to the plan participant.

The tax rules in this publication apply both to annuities that provide fixed payments and to annuities that provide payments that vary in amount based on investment results or other factors. For example, they apply to commercial variable annuity contracts, whether bought by an employee retirement plan for its participants or bought directly from the issuer by an individual investor. Under these contracts, the owner can generally allocate the purchase payments among several types of investment portfolios or mutual funds and the contract value is determined by the performance of those investments. The earnings arent taxed until distributed either in a withdrawal or in annuity payments. The taxable part of a distribution is treated as ordinary income.

For information on the tax treatment of a transfer or exchange of a variable annuity contract, see Transfers of Annuity Contracts under Taxation of Nonperiodic Payments, later.

Annuities under a nonqualified plan are included in calculating your net investment income for the NIIT. See Form 8960, Net Investment Income Tax—Individuals, Estates, and Trusts, and its instructions for more information.

If you withdraw funds before your annuity starting date and your annuity is under a qualified retirement plan, a ratable part of the amount withdrawn is tax free. The tax-free part is based on the ratio of your cost (investment in the contract) to your account balance under the plan.

If your annuity is under a nonqualified plan (including a contract you bought directly from the issuer), the amount withdrawn is allocated first to earnings (the taxable part) and then to your cost (the tax-free part). However, if you bought your annuity contract before August 14, 1982, a different allocation applies to the investment before that date and the earnings on that investment. To the extent the amount withdrawn doesnt exceed that investment and earnings, it is allocated first to your cost (the tax-free part) and then to earnings (the taxable part).

If you withdraw funds (other than as an annuity) on or after your annuity starting date, the entire amount withdrawn is generally taxable.

The amount you receive in a full surrender of your annuity contract at any time is tax free to the extent of any cost that you havent previously recovered tax free. The rest is taxable.

For more information on the tax treatment of withdrawals, see Taxation of Nonperiodic Payments, later. If you withdraw funds from your annuity before you reach age 59½, also see Tax on Early Distributions under Special Additional Taxes, later.

If you receive annuity payments under a variable annuity plan or contract, you recover your cost tax free under either the Simplified Method or the General Rule, as explained under Taxation of Periodic Payments, later. For a variable annuity paid under a qualified plan, you must generally use the Simplified Method. For a variable annuity paid under a nonqualified plan (including a contract you bought directly from the issuer), you must use a special computation under the General Rule. For more information, see Variable annuities under Computation Under the General Rule in Pub. 939.

If you receive a single-sum distribution from a variable annuity contract because of the death of the owner or annuitant, the distribution is generally taxable only to the extent it is more than the unrecovered cost of the contract. If you choose to receive an annuity, the payments are subject to tax as described above. If the contract provides a joint and survivor annuity and the primary annuitant had received annuity payments before death, you figure the tax-free part of annuity payments you receive as the survivor in the same way the primary annuitant did. See Survivors and Beneficiaries, later.

When planning for retirement, many folks turn to annuities as a reliable income stream for their golden years. But what happens when you need to cash out that annuity early? Is that money considered income? And how will Uncle Sam treat those funds come tax time?

I’ve researched this topic extensively to help you understand the tax consequences of cashing out an annuity. The short answer is yes cashing out an annuity is generally considered income for tax purposes – but there’s more to the story than that simple answer.

Understanding Annuities: The Basics

Let’s make sure we all agree on what annuities are before we talk about all the tax implications.

Annuities are financial contracts between you and an insurance company. You make either a lump-sum payment or a series of payments and in return the insurer promises to provide you with income payments in the future – typically during retirement.

The main benefits of annuities include:

- Tax-deferred growth – your earnings grow without being taxed until withdrawal

- Guaranteed income stream – predictable payments that can last your lifetime

- Principal protection – some annuities ensure you won’t lose your initial investment

However, annuities also come with some drawbacks:

- Taxation upon withdrawal – earnings are taxed as ordinary income when you take money out

- Early withdrawal penalties – taking money before age 59½ often results in a 10% penalty

- Limited liquidity – surrender charges may apply if you withdraw early

Qualified vs. Non-Qualified Annuities: A Critical Distinction

When it comes to taxation, whether your annuity is qualified or non-qualified makes a huge difference.

Qualified Annuities

These are bought with money that hasn’t been taxed yet, usually from a 401(k) or traditional IRA. The key tax implications:

- The entire withdrawal amount is taxable as ordinary income

- Your tax rate for the year in which you receive the distribution determines how much tax you’ll owe

- Early withdrawals before age 59½ typically incur a 10% penalty on top of regular income tax

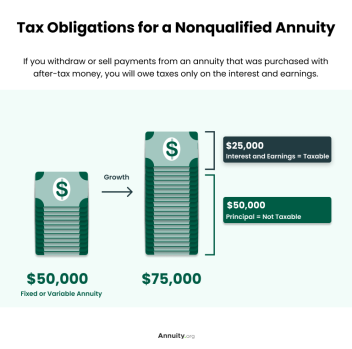

Non-Qualified Annuities

These are purchased with after-tax dollars (money you’ve already paid taxes on). The tax implications:

- Only the earnings portion is taxed as ordinary income

- Your initial investment (the principal) isn’t taxed again

- Early withdrawal penalties still apply to the earnings portion

So, Is Cashing Out an Annuity Considered Income?

Yes, cashing out an annuity is considered income – but exactly how much of it is taxable depends on the type of annuity and how it was funded.

The IRS counts the earnings part of an annuity as taxable income when you take the money out. If you take money out of a qualified annuity, the whole amount is taxed. Only the earnings on a non-qualified annuity are taxed if you have one.

Think of it this way:

- For qualified annuities: 100% of withdrawal = taxable income

- For non-qualified annuities: Only earnings = taxable income

Early Withdrawal Penalties: The Double Whammy

If you’re under 59½ when you cash out your annuity, be prepared for a double hit:

- You’ll pay ordinary income tax on the taxable portion

- You’ll likely owe an additional 10% early withdrawal penalty

This may cut the amount you get to keep by a large amount. In this case, if you take $50,000 out of a qualified annuity before age 55 and are in the 2024 tax bracket, you may have to pay the following:

- $12,000 in federal income tax (24% of $50,000)

- $5,000 in early withdrawal penalty (10% of $50,000)

That’s $17,000 gone to taxes and penalties – leaving you with just $33,000!

Strategies to Minimize the Tax Impact

Nobody wants to pay more taxes than necessary. Here are some strategies that might help reduce the tax bite when cashing out an annuity:

1. Wait Until Age 59½ If Possible

This simple strategy helps you avoid the 10% early withdrawal penalty. While you’ll still pay income tax on the earnings, at least you won’t face the additional penalty.

2. Take Only What You Need

Instead of cashing out the entire annuity, consider taking only what you absolutely need. This can keep you in a lower tax bracket and spread the tax impact over multiple years.

3. Consider a Roth Conversion

If you have a qualified annuity in a traditional IRA, you might consider converting it to a Roth IRA. You’ll pay taxes on the conversion, but future withdrawals could be tax-free.

4. Use the Exclusion Ratio for Annuitization

If you annuitize a non-qualified annuity (convert it to a stream of payments), part of each payment is considered a return of your principal and isn’t taxed. This is determined by something called the “exclusion ratio.”

5. Get Professional Tax Advice

A qualified financial advisor or tax professional can help you develop a tax-efficient strategy tailored to your specific situation.

Calculating the Taxable Portion of Your Withdrawal

For qualified annuities, it’s simple – the entire withdrawal is taxable.

For non-qualified annuities, it gets a bit more complicated. The IRS uses what’s called the “last-in, first-out” (LIFO) method:

- Withdrawals are considered to come from earnings first (taxable)

- Only after all earnings have been withdrawn does the principal come out tax-free

You can find information about your annuity’s earnings on your annuity statement, or by contacting your insurance company.

Special Exceptions to Early Withdrawal Penalties

There are some situations where you might avoid the 10% early withdrawal penalty, even if you’re under 59½:

- You become disabled

- You need the money for medical expenses exceeding 7.5% of your adjusted gross income

- You set up “substantially equal periodic payments” (SEPPs) under IRS Rule 72(t)

- The distribution is made to a beneficiary after your death

Real-World Example: The Tax Impact of Cashing Out

Let’s look at a couple examples to see how this works in practice:

Example 1: Qualified Annuity

John, age 55, cashes out his qualified annuity worth $100,000 (initial investment of $60,000 plus $40,000 in earnings).

- Taxable amount: $100,000 (entire amount)

- Income tax (24% bracket): $24,000

- Early withdrawal penalty (10%): $10,000

- Total tax and penalties: $34,000

- Net amount John receives: $66,000

Example 2: Non-Qualified Annuity

Mary, age 65, cashes out her non-qualified annuity worth $100,000 (initial investment of $60,000 plus $40,000 in earnings).

- Taxable amount: $40,000 (earnings only)

- Income tax (24% bracket): $9,600

- Early withdrawal penalty: $0 (she’s over 59½)

- Total tax and penalties: $9,600

- Net amount Mary receives: $90,400

As you can see, the type of annuity and your age at withdrawal make a huge difference in how much you get to keep!

Frequently Asked Questions

Can I avoid paying taxes on my annuity withdrawal?

You generally can’t completely avoid taxes on annuity earnings, but you can minimize them through careful planning. With non-qualified annuities, your principal comes back tax-free, but earnings will be taxed eventually.

What if I inherit an annuity?

Inherited annuities have special tax rules. Beneficiaries must generally take distributions and pay taxes on them, but the 10% early withdrawal penalty typically doesn’t apply, regardless of the beneficiary’s age.

Can I exchange one annuity for another without triggering taxes?

Yes, through what’s called a 1035 exchange. This allows you to transfer funds from one annuity to another without triggering immediate taxation. However, surrender charges might still apply.

How do I report annuity withdrawals on my tax return?

Your insurance company will send you a Form 1099-R showing the taxable amount of your withdrawal. You’ll report this on your federal income tax return.

Final Thoughts: Is Cashing Out Your Annuity Worth It?

Cashing out an annuity is a major financial decision that shouldn’t be taken lightly. While it provides immediate access to funds, the tax consequences can be significant.

Before making a decision, ask yourself:

- Do I really need the money now?

- Can I wait until age 59½ to avoid penalties?

- Have I explored other sources of funds with fewer tax consequences?

- Have I consulted with a financial advisor about my options?

We all want financial security in retirement, and annuities can be a valuable tool in that journey. But understanding the tax implications of cashing out is crucial to making informed decisions that align with your long-term financial goals.

Remember, while this article provides general guidance, tax laws are complex and constantly changing. It’s always wise to consult with a qualified financial advisor or tax professional before making significant decisions about your annuity.

What’s your experience with annuities? Have you had to cash one out early? I’d love to hear your thoughts and experiences in the comments below!

Useful ItemsYou may want to see:

Publication

- 505 Tax Withholding and Estimated Tax

- 525 Taxable and Nontaxable Income

- 560 Small Business Retirement Plans (SEP, SIMPLE, and Qualified Plans)

- 571 Tax-Sheltered Annuity Plans (403(b) Plans)

- 590-A Contributions to Individual Retirement Arrangements (IRAs)

- 590-B Distributions from Individual Retirement Arrangements (IRAs)

- 721 Tax Guide to U.S. Civil Service Retirement Benefits

- 907 Tax Highlights for Persons With Disabilities

- 915 Social Security and Equivalent Railroad Retirement Benefits

- 939 General Rule for Pensions and Annuities

- 976 Disaster Relief

Form (and Instructions)

- W-4P Withholding Certificate for Pension or Annuity Payments

- W-4R Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions

- 1099-R tax forms for money coming out of pension plans, annuities, IRAs, insurance contracts, and other retirement or profit-sharing plans

- 4972 Tax on Lump-Sum Distributions

- 5329: More taxes on qualified plans (like IRAs) and other tax-advantaged accounts

- 8915-D Qualified 2019 Disaster Retirement Plan Distributions and Repayments

- 8915-F Qualified Disaster Retirement Plan Distributions and Repayments

See How To Get Tax Help for information about getting publications and forms.

Definitions.

Some of the terms used in this publication are defined in the following paragraphs.

Pension.

A pension is generally a series of definitely determinable payments made to you after you retire from work. Pension payments are made regularly and are based on such factors as years of service and prior compensation.

Annuity.

In a contract, an annuity is a set of payments that are made at regular times over a period of more than one full year. They can be either fixed (under which you receive a definite amount) or variable (not fixed). You can buy the contract alone or with the help of your employer.

Qualified employee plan.

Employers can set up a qualified employee plan, which can be a stock bonus, pension, or profit-sharing plan that only helps employees or their beneficiaries and meets the requirements of the Internal Revenue Code. It qualifies for special tax benefits, such as tax deferral for employer contributions and capital gain treatment or the 10-year tax option for lump-sum distributions (if participants qualify). To determine whether your plan is a qualified plan, check with your employer or the plan administrator.

Qualified employee annuity.

A qualified employee annuity is a retirement annuity purchased by an employer for an employee under a plan that meets Internal Revenue Code requirements.

Designated Roth account.

A designated Roth account is a separate account created under a qualified Roth contribution program to which participants may elect to have part or all of their elective deferrals to a 401(k), 403(b), or 457(b) plan designated as Roth contributions. In addition, a designated Roth account may include certain nonelective contributions or matching contributions that a participant designates as Roth contributions.

Designated Roth contributions, designated Roth nonelective contributions, and designated Roth matching contributions are included in your income. However, qualified distributions (explained later) arent included in your income.

You should check with your plan administrator to determine if your plan will accept designated Roth contributions.

Tax-sheltered annuity plan.

A tax-sheltered annuity plan (often referred to as a “403(b) plan” or a “tax-deferred annuity plan)” is a retirement plan for employees of public schools and certain tax-exempt organizations. Generally, a tax-sheltered annuity plan provides retirement benefits by purchasing annuity contracts for its participants.

Types of pensions and annuities.

Pensions and annuities include the following types.

Fixed-period annuities.

You receive definite amounts at regular intervals for a specified length of time.

Annuities for a single life.

You receive definite amounts at regular intervals for life. The payments end at death.

Joint and survivor annuities.

The first annuitant receives a definite amount at regular intervals for life. After they die, a second annuitant receives a definite amount at regular intervals for life. The amount paid to the second annuitant may or may not differ from the amount paid to the first annuitant.

Variable annuities.

You receive payments that may vary in amount for a specified length of time or for life. The amount you get may change based on things like cost-of-living indexes, the profits made by the pension or annuity funds, or the profits made by a mutual fund.

Disability pensions.

You receive disability payments because you retired on disability and havent reached minimum retirement age.

More than one program.

You may receive employee plan benefits from more than one program under a single trust or plan of your employer. If you participate in more than one program, you may have to treat each as a separate pension or annuity contract, depending upon the facts in each case. Also, you may be considered to have received more than one pension or annuity. Your former employer or the plan administrator should be able to tell you if you have more than one contract.

Example.

Your employer set up a noncontributory profit-sharing plan for its employees. The plan provides that the amount held in the account of each participant will be paid when that participant retires. Your employer also set up a contributory defined benefit pension plan for its employees providing for the payment of a lifetime pension to each participant after retirement.

The amount of any distribution from the profit-sharing plan depends on the contributions (including allocated forfeitures) made for the participant and the earnings from those contributions. Under the pension plan, however, a formula determines the amount of the pension benefits. The amount of contributions is the amount necessary to provide that pension.

Each plan is a separate program and a separate contract. If you get benefits from these plans, you must account for each separately, even though the benefits from both may be included in the same check.

. Distributions from a designated Roth account are treated separately from other distributions from the plan..

Distributions from a designated Roth account are treated separately from other distributions from the plan..

Qualified domestic relations order (QDRO).

A QDRO is a judgment, decree, or order relating to payment of child support, alimony, or marital property rights to a spouse, former spouse, child, or other dependent of a participant in a retirement plan. The QDRO must contain certain specific information, such as the name and last known mailing address of the participant and each alternate payee, and the amount or percentage of the participants benefits to be paid to each alternate payee. A QDRO may not award an amount or form of benefit that isnt available under the plan.

A spouse or former spouse who receives part of the benefits from a retirement plan under a QDRO reports the payments received as if they were a plan participant. The spouse or former spouse is allocated a share of the participants cost (investment in the contract) equal to the cost times a fraction. The numerator of the fraction is the present value of the benefits payable to the spouse or former spouse. The denominator is the present value of all benefits payable to the participant.

A distribution that is paid to a child or other dependent under a QDRO is taxed to the plan participant.

The tax rules in this publication apply both to annuities that provide fixed payments and to annuities that provide payments that vary in amount based on investment results or other factors. For example, they apply to commercial variable annuity contracts, whether bought by an employee retirement plan for its participants or bought directly from the issuer by an individual investor. Under these contracts, the owner can generally allocate the purchase payments among several types of investment portfolios or mutual funds and the contract value is determined by the performance of those investments. The earnings arent taxed until distributed either in a withdrawal or in annuity payments. The taxable part of a distribution is treated as ordinary income.

For information on the tax treatment of a transfer or exchange of a variable annuity contract, see Transfers of Annuity Contracts under Taxation of Nonperiodic Payments, later.

Net Investment Income Tax (NIIT).

Annuities under a nonqualified plan are included in calculating your net investment income for the NIIT. See Form 8960, Net Investment Income Tax—Individuals, Estates, and Trusts, and its instructions for more information.

Withdrawals.

If you withdraw funds before your annuity starting date and your annuity is under a qualified retirement plan, a ratable part of the amount withdrawn is tax free. The tax-free part is based on the ratio of your cost (investment in the contract) to your account balance under the plan.

If your annuity is under a nonqualified plan (including a contract you bought directly from the issuer), the amount withdrawn is allocated first to earnings (the taxable part) and then to your cost (the tax-free part). However, if you bought your annuity contract before August 14, 1982, a different allocation applies to the investment before that date and the earnings on that investment. To the extent the amount withdrawn doesnt exceed that investment and earnings, it is allocated first to your cost (the tax-free part) and then to earnings (the taxable part).

If you withdraw funds (other than as an annuity) on or after your annuity starting date, the entire amount withdrawn is generally taxable.

The amount you receive in a full surrender of your annuity contract at any time is tax free to the extent of any cost that you havent previously recovered tax free. The rest is taxable.

For more information on the tax treatment of withdrawals, see Taxation of Nonperiodic Payments, later. If you withdraw funds from your annuity before you reach age 59½, also see Tax on Early Distributions under Special Additional Taxes, later.

Annuity payments.

If you receive annuity payments under a variable annuity plan or contract, you recover your cost tax free under either the Simplified Method or the General Rule, as explained under Taxation of Periodic Payments, later. For a variable annuity paid under a qualified plan, you must generally use the Simplified Method. For a variable annuity paid under a nonqualified plan (including a contract you bought directly from the issuer), you must use a special computation under the General Rule. For more information, see Variable annuities under Computation Under the General Rule in Pub. 939.

Death benefits.

If you receive a single-sum distribution from a variable annuity contract because of the death of the owner or annuitant, the distribution is generally taxable only to the extent it is more than the unrecovered cost of the contract. If you choose to receive an annuity, the payments are subject to tax as described above. If the contract provides a joint and survivor annuity and the primary annuitant had received annuity payments before death, you figure the tax-free part of annuity payments you receive as the survivor in the same way the primary annuitant did. See Survivors and Beneficiaries, later.

If you work for a state or local government or for a tax-exempt organization, you may be able to participate in a section 457 deferred compensation plan. If your plan is an eligible plan, you arent taxed currently on pay that is deferred under the plan or on any earnings from the plans investment of the deferred pay. You are generally taxed on amounts deferred in an eligible state or local government plan only when they are distributed from the plan. You are taxed on amounts deferred in an eligible tax-exempt organization plan when they are distributed or otherwise made available to you.

Your 457(b) plan may have a designated Roth account option. If so, you may be able to roll over amounts to the designated Roth account or make contributions. Contributions to a designated Roth account are included in your income. Qualified distributions (explained later) arent included in your income. See Designated Roth accounts under Taxation of Periodic Payments, later.

This publication covers the tax treatment of benefits under eligible section 457 plans, but it doesnt cover the treatment of deferrals. For information on deferrals under section 457 plans, see Retirement Plan Contributions under Employee Compensation in Pub. 525.

Is your plan eligible?

To find out if your plan is an eligible plan, check with your employer. Plans that aren’t eligible section 457 plans include the following.

- valid plans for paid time off, severance pay, disability pay, death benefits, vacation pay, or sick leave

- Nonelective deferred compensation plans for nonemployees (independent contractors).

- Deferred compensation plans maintained by churches.

- Plans for length of service awards for real volunteer firefighters and emergency medical workers If the total amount paid to a volunteer for any year of service is more than $7,500, there is an exception.

If you retired on disability, you must generally include in income any disability pension you receive under a plan that is paid for by your employer. You must report your taxable disability payments as wages on Form 1040, 1040-SR, or 1040-NR, line 1h, until you reach minimum retirement age. Minimum retirement age is generally the age at which you can first receive a pension or annuity if you arent disabled.

. You may be entitled to a tax credit if you were permanently and totally disabled when you retired. For information on this credit, see the Instructions for Schedule R (Form 1040)..

You may be entitled to a tax credit if you were permanently and totally disabled when you retired. For information on this credit, see the Instructions for Schedule R (Form 1040)..

Beginning on the day after you reach minimum retirement age, payments you receive are taxable as a pension or annuity. When you receive pension or annuity payments, you are able to recover your cost or investment. Your cost is generally your net investment in the plan as of your annuity starting date. It doesnt include pre-tax contributions. For more information, see Cost (Investment in the Contract) and Taxation of Periodic Payments, later.

Report the payments on Form 1040, 1040-SR, or 1040-NR, lines 5a and 5b.

. Disability payments for injuries incurred as a direct result of a terrorist attack directed against the United States (or its allies) arent included in income. For more information about payments to survivors of terrorist attacks, see Pub. 3920, Tax Relief for Victims of Terrorist Attacks, and Pub. 907..

Disability payments for injuries incurred as a direct result of a terrorist attack directed against the United States (or its allies) arent included in income. For more information about payments to survivors of terrorist attacks, see Pub. 3920, Tax Relief for Victims of Terrorist Attacks, and Pub. 907..

Military and government disability pensions.

Certain military and government disability pensions aren’t taxable.

Service-connected disability.

You may be able to exclude from income amounts you receive as a pension, annuity, or similar allowance for personal injury or sickness resulting from active service in one of the following government services.

- The armed forces of any country.

- The National Oceanic and Atmospheric Administration.

- The Public Health Service.

- The Foreign Service.

If you are an eligible retired public safety officer (law enforcement officer, firefighter, chaplain, or member of a rescue squad or ambulance crew who is retired because of disability or because you reached normal retirement age), you can elect to exclude from income distributions made from your eligible retirement plan that are used to pay the premiums for coverage by an accident or health plan or a long-term care insurance contract. The premiums can be for coverage for you, your spouse, or dependents.

The distribution must be from the plan maintained by the employer from which you retired as a public safety officer. The distribution can be made directly from the plan to the provider of the accident or health plan or long-term care insurance contract, or the distribution can be made to you to pay to the provider of the accident or health plan or long-term care insurance contract.

You can exclude from income the smaller of the amount of the insurance premiums or $3,000. You can make this election only for amounts that would otherwise be included in your income. The amount excluded from your income cant be used to claim a medical expense deduction.

An eligible retirement plan is a governmental plan that is a:

- Qualified trust,

- Section 403(a) plan,

- Section 403(b) annuity, or

- Section 457(b) plan.

If you make this election, reduce the otherwise taxable amount of your pension or annuity by the amount excluded. The amount shown in box 2a of Form 1099-R doesnt reflect this exclusion. Report your total distributions on Form 1040, 1040-SR, or 1040-NR, line 5a. Report the taxable amount on Form 1040, 1040-SR, or 1040-NR, line 5b. Enter “PSO” next to the appropriate line on which you report the taxable amount.

If you are retired on disability and reporting your disability pension on Form 1040, 1040-SR, or 1040-NR, line 1h, include only the taxable amount on that line and enter “PSO” and the amount excluded on the dotted line next to the applicable line.

Benefits paid under the Railroad Retirement Act fall into two categories. These categories are treated differently for income tax purposes.

The first category is the amount of tier 1 railroad retirement benefits that equals the social security benefit that a railroad employee or beneficiary would have been entitled to receive under the social security system. This part of the tier 1 benefit is the social security equivalent benefit (SSEB) and you treat it for tax purposes as social security benefits. If you received, repaid, or had tax withheld from the SSEB portion of tier 1 benefits during 2024, you will receive Form RRB-1099, Payments by the Railroad Retirement Board (or Form RRB-1042S, Statement for Nonresident Alien Recipients of Payments by the Railroad Retirement Board, if you are a nonresident alien), from the U.S. Railroad Retirement Board (RRB).

For more information about the tax treatment of the SSEB portion of tier 1 benefits and Forms RRB-1099 and RRB-1042S, see Pub. 915.

The second category contains the rest of the tier 1 railroad retirement benefits called the non-social security equivalent benefit (NSSEB). It also contains any tier 2 benefit, vested dual benefit (VDB), and supplemental annuity benefit. Treat this category of benefits, shown on Form RRB-1099-R, as an amount received from a qualified employee plan. This allows for the tax-free (nontaxable) recovery of employee contributions from the tier 2 benefits and the NSSEB part of the tier 1 benefits. (The NSSEB and tier 2 benefits, less certain repayments, are combined into one amount called the Contributory Amount Paid on Form RRB-1099-R.) VDBs and supplemental annuity benefits are non-contributory pensions and are fully taxable. See Taxation of Periodic Payments, later, for information on how to report your benefits and how to recover the employee contributions tax free. Form RRB-1099-R is used for U.S. citizens, resident aliens, and nonresident aliens.

Nonresident aliens.

A nonresident alien is an individual who isnt a citizen or a resident alien of the United States. If you are a nonresident alien, you are subject to U.S. tax on your SSEB portion of tier 1 benefits at a 30% rate, unless exempt or subject to a lower treaty rate. See Pub. 519, U.S. Tax Guide for Aliens, for more information.

If your rate of tax changed or your country of legal residence changed during the tax year, you may receive more than one Form RRB-1042S or RRB-1099-R. To determine your total benefits paid or repaid and total tax withheld for the year, you should add the amounts shown on all forms you received for that year.

Tax withholding.

To request or change your income tax withholding from SSEB payments, U.S. citizens should contact the IRS for Form W-4V, Voluntary Withholding Request, and file it with the RRB. To elect, revoke, or change your income tax withholding from NSSEB, tier 2, VDB, and supplemental annuity payments received, use Form RRB W-4P, Withholding Certificate for Railroad Retirement Payments. If you are a nonresident alien or a U.S. citizen living abroad, you should provide Form RRB-1001, Nonresident Questionnaire, to the RRB to furnish citizenship and residency information and to claim any treaty exemption from U.S. tax withholding. Nonresident U.S. citizens cant elect to be exempt from withholding on payments delivered outside the United States.

Help from the RRB.

To request an RRB form or to get help with questions about an RRB benefit, you should contact your nearest RRB field office if you reside in the United States (call 877-772-5772 for the nearest field office) or U.S. Consulate/Embassy if you reside outside the United States. You can visit the RRB on the Internet at RRB.gov.

Form RRB-1099-R.

The following discussion explains the items shown on Form RRB-1099-R. The amounts shown on this form are before any deduction for:

- Federal income tax withholding;

- Medicare premiums;

- Legal process garnishment payments;

- Getting back an overpayment from the previous year of an NSSEB, tier 2 benefit, VDB, or supplemental annuity benefit; or

- Get back the Railroad Unemployment Insurance Act benefits you got while you were waiting for your railroad retirement annuity to be paid.

The amounts shown on this form are after any offset for:

- Social security benefits;

- Age reduction;

- Public service pensions or public disability benefits;

- Dual railroad retirement entitlement under another RRB claim number;

- Work deductions;

- Legal process partition deductions;

- Actuarial adjustment;

- Annuity waiver; or

- getting back an overpayment of NSSEB, tier 2 benefits, VDB, or supplemental annuity benefits in the current year

The amounts shown on Form RRB-1099-R dont reflect any special rules, such as capital gain treatment or the special 10-year tax option for lump-sum payments, or tax-free rollovers. To determine if any of these rules apply to your benefits, see the discussions about them later.

Generally, amounts shown on your Form RRB-1099-R are considered a normal distribution. Use distribution code “7” if you are asked for a distribution code. Distribution codes arent shown on Form RRB-1099-R.

There are three copies of this form. Copy B is to be included with your income tax return if federal income tax is withheld. Copy C is for your own records. Copy 2 is filed with your state, city, or local income tax return when required. See the illustrated Copy B (Form RRB-1099-R), later.

. Each beneficiary will receive their own Form RRB-1099-R. If you receive benefits on more than one railroad retirement record, you may get more than one Form RRB-1099-R. So that you get your form timely, make sure the RRB always has your current mailing address..

Each beneficiary will receive their own Form RRB-1099-R. If you receive benefits on more than one railroad retirement record, you may get more than one Form RRB-1099-R. So that you get your form timely, make sure the RRB always has your current mailing address..

Form RRB-1099-R Annuities or Pensions by the Railroad Retirement Board 2024

Summary: This is an example of Form RRB-1099-R 2024 with these line items to be completed by the railroad retirement board with information regarding annuity and pension payments:

| “1. Claim number and Payee Code” field | |

| “2. Recipients Identification Number” field | |

|

|

| “3. Employee Contribution Amount” field | |

| “4. Contributory Amount Paid” field | |

| “5. Vested Dual Benefit” field | |

| “6. Supplemental Annuity” field | |

| “7. Total Gross Paid” field | |

| “8. Repayments” field | |

| “9. Federal Income Tax Withheld” field | |

| “10. Rate of Tax” field | |

| “11. Country” field | |

| “12. Medicare Premium Total” field |

Box 1—Claim Number and Payee Code.

Your claim number is a six- or nine-digit number preceded by an alphabetical prefix. This is the number under which the RRB paid your benefits. Your payee code follows your claim number and is the last number in this box. It is used by the RRB to identify you under your claim number. In all your correspondence with the RRB, be sure to use the claim number and payee code shown in this box.

Box 2—Recipients Identification Number.

This is the recipients U.S. taxpayer identification number (TIN). It is the social security number (SSN), individual taxpayer identification number (ITIN), or employer identification number (EIN), if known, for the person or estate listed as the recipient.

. If you are a resident or nonresident alien who must furnish a TIN to the IRS and aren’t eligible to obtain an SSN, use Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN. The Instructions for Form W-7 explain how and when to apply. .

If you are a resident or nonresident alien who must furnish a TIN to the IRS and aren’t eligible to obtain an SSN, use Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN. The Instructions for Form W-7 explain how and when to apply. .

Box 3—Employee Contributions.

This is the amount of taxes withheld from the railroad employees earnings that exceeds the amount of taxes that would have been withheld had the earnings been covered under the social security system. This amount is the employees cost that you use to figure the tax-free part of the NSSEB and tier 2 benefit you received (the amount shown in box 4). (For information on how to figure the tax-free part, see Partly Taxable Payments under Taxation of Periodic Payments, later.) The amount shown is the total employee contribution amount, not reduced by any amounts that the RRB calculated as previously recovered. It is the latest amount reported for 2024 and may have increased or decreased from a previous Form RRB-1099-R. If this amount has changed, the change is retroactive. You may need to refigure the tax-free part of your NSSEB/tier 2 benefit for 2024 and prior tax years. If this box is blank, it means that the amount of your NSSEB and tier 2 payments shown in box 4 is fully taxable.

. If you had a previous annuity entitlement that ended and you are figuring the tax-free part of your NSSEB/tier 2 benefit for your current annuity entitlement, you should contact the RRB for confirmation of your correct employee contribution amount..

If you had a previous annuity entitlement that ended and you are figuring the tax-free part of your NSSEB/tier 2 benefit for your current annuity entitlement, you should contact the RRB for confirmation of your correct employee contribution amount..

Box 4—Contributory Amount Paid.

This is the gross amount of the NSSEB and tier 2 benefit you received in 2024, less any 2024 benefits you repaid in 2024. (Any benefits you repaid in 2024 for an earlier year or for an unknown year are shown in box 8.) This amount is the total contributory pension paid in 2024. It may be partly taxable and partly tax free or fully taxable. If you determine you are eligible to compute a tax-free part, as explained later in Partly Taxable Payments under Taxation of Periodic Payments, use the latest reported employee contribution amount shown in box 3 as the cost.

Box 5—Vested Dual Benefit.

This is the gross amount of VDB payments paid in 2024, less any 2024 VDB payments you repaid in 2024. It is fully taxable. VDB payments you repaid in 2024 for an earlier year or for an unknown year are shown in box 8.

The amounts shown in boxes 4 and 5 may represent payments for 2024 and/or other years after 1983.

Box 6—Supplemental Annuity.

This is the gross amount of supplemental annuity benefits paid in 2024, less any 2024 supplemental annuity benefits you repaid in 2023. It is fully taxable. Supplemental annuity benefits you repaid in 2024 for an earlier year or for an unknown year are shown in box 8.

Box 7—Total Gross Paid.

This is the sum of boxes 4, 5, and 6. The amount represents the total pension paid in 2024. Include this amount on Form 1040, 1040-SR, or 1040-NR, line 5a.

Box 8—Repayments.

This amount represents any NSSEB, tier 2 benefit, VDB, and supplemental annuity benefit you repaid to the RRB in 2024 for years before 2024 or for unknown years. The amount shown in this box hasnt been deducted from the amounts shown in boxes 4, 5, and 6. It only includes repayments of benefits that were taxable to you. This means it only includes repayments in 2024 of NSSEB paid after 1985, tier 2 benefits and VDB paid after 1983, and supplemental annuity benefits paid in any year. If you included the benefits in your income in the year you received them, you may be able to deduct the repaid amount. For more information about repayments, see Repayment of benefits received in an earlier year, later.

. You may have repaid an overpayment of benefits by returning a payment, by making a payment, or by having an amount withheld from your railroad retirement annuity payment..

You may have repaid an overpayment of benefits by returning a payment, by making a payment, or by having an amount withheld from your railroad retirement annuity payment..

Box 9—Federal Income Tax Withheld.

This is the total federal income tax withheld from your NSSEB, tier 2 benefit, VDB, and supplemental annuity benefit. Include this on your income tax return as tax withheld. If you are a nonresident alien and your tax withholding rate and/or country of legal residence changed during 2024, you will receive more than one Form RRB-1099-R for 2024. Determine the total amount of U.S. federal income tax withheld from your 2024 RRB NSSEB, tier 2, VDB, and supplemental annuity payments by adding the amounts in box 9 of all original 2024 Forms RRB-1099-R, or the latest corrected or duplicate Forms RRB-1099-R you receive.

Box 10—Rate of Tax.

If you are a nonresident alien, an entry in this box indicates the rate at which tax was withheld on the NSSEB, tier 2, VDB, and supplemental annuity payments that were paid to you in 2024. If you are a nonresident alien whose tax was withheld at more than one rate during 2024, you will receive a separate Form RRB-1099-R for each rate change during 2024. If you are taxed as a U.S. citizen or resident alien, this box doesnt apply to you.

Box 11—Country.

If you are a nonresident alien, an entry in this box indicates the country of which you were a resident for tax purposes at the time you received railroad retirement payments in 2024. If you are a nonresident alien who was a resident of more than one country during 2024, you will receive a separate Form RRB-1099-R for each country of residence during 2024. If you are taxed as a U.S. citizen or resident alien, this box doesnt apply to you.