You can only get the money from someone else’s bank account if you’ve been named as a beneficiary or are a joint owner. If someone else has died and left you money in their account, you can’t just walk into the bank and take it.

Anyone who is entitled to a bank account but isn’t in either of these two groups will usually have to wait until the account is given to them by either the trustee or the executor/administrator when the probate process is over.

Suppose a beneficiary is designated on the bank account. The beneficiary can simply walk into the bank and claim the contents.

Suppose the decedent jointly owned the bank account. The surviving joint owner(s) automatically gain ownership of the deceased owner’s share.

Suppose no beneficiary is named on the bank account, and the decedent died intestate (i. e. , without a will). The account must pass through probate before it is distributed to heirs in accordance with intestate succession laws.

Regardless of your situation, working closely with a probate attorney after a loved one dies is strongly recommended. Your attorney can clarify what your rights are surrounding a deceased person’s bank account, as well as take steps to protect your inheritance.

If you are interested in learning about how non-cash assets are transferred after death, read our article: What Happens to Property When Someone Dies?.

Do you want to know what happens to your bank accounts when you die? Or maybe you’re handling the estate of a loved one and need to know if their bank accounts need to go through probate. Either way you’ve come to the right place!.

In this article, I’ll break down exactly what you need to know about probate and bank accounts – in plain English, no fancy legal jargon necessary. By the end, you’ll understand which accounts typically require probate, which ones don’t, and how you can plan ahead to make things easier for your loved ones.

What is Probate and Why Should You Care?

First things first – let’s clear up what probate actually is. Probate is the court-supervised process for validating a will, paying debts, and distributing a deceased person’s assets. It’s basically the legal system’s way of making sure everything gets handled properly after someone dies.

Probate can be:

- Time-consuming (often taking 6-12 months or longer)

- Expensive (with court fees and attorney costs)

- Public (meaning anyone can see what assets you had and who got them)

That’s why many people try to avoid it when possible, But does probate always involve bank accounts? The answer is it depends

Do Bank Accounts Go Through Probate?

The short answer Some bank accounts go through probate, while others don’t

Long answer: It depends on how the bank account was legally named when the person died to decide if it needs to go through probate. The ownership structure is the determining factor.

Bank Accounts That DO Require Probate

If a bank account is held solely in the name of the deceased person with no beneficiary designated, it is definitely a probate asset. In this scenario:

- The funds are frozen once the bank is notified of the death

- The bank cannot release the money until the probate court appoints a representative

- This representative (executor or administrator) must present the bank with:

- A valid government-issued photo ID

- Proof of appointment (Letters Testamentary or Letters of Administration)

- A certified copy of the death certificate

- A copy of the will (if applicable)

The executor or administrator then uses these funds to pay the deceased person’s final bills, taxes, and other estate expenses. Any remaining money is distributed to the heirs according to the will or state law.

Bank Accounts That DON’T Require Probate

Several types of bank accounts can bypass the probate process entirely:

1. Joint Accounts

When an account is owned jointly with right of survivorship (JTWROS), all owners have equal rights to the account. When one owner dies, their share automatically transfers to the surviving joint owner(s). The survivor just needs to present a certified death certificate and ID to gain full control of the funds.

For example, if you and your spouse have a joint checking account, and one of you passes away, the surviving spouse automatically becomes the sole owner without going through probate.

2. Payable-on-Death (POD) Accounts

A POD account lets you designate a beneficiary who will inherit the account when you die. The beneficiary has no access to the funds while you’re alive, but after your death, they can claim the money directly from the bank by showing:

- A certified copy of the death certificate

- Their government-issued ID

This is probably the simplest way to keep a bank account out of probate while maintaining complete control during your lifetime.

3. Trust Accounts

You can keep your bank account out of probate if you put it in a living trust. The account is changed to be in the name of the trust, and when you die, your successor trustee takes over and gives the money out as the trust says.

To access these funds, the successor trustee needs to provide:

- Death certificate

- Their ID

- A copy of the trust document

The Small Estate Exception

Even if a bank account would normally require probate, it might qualify for a simplified process if the total value of the deceased’s probate estate is below a certain threshold. This “small estate” limit varies by state:

For example, in California, estates valued under $184,500 can avoid full probate. Instead, an heir can use a small estate affidavit to claim the bank account after a mandatory waiting period (usually 30-40 days after death).

How to Find a Deceased Person’s Bank Accounts

If you’re in charge of a person’s estate, you may need to find all of their bank accounts. Here are some practical steps:

- Check their will or estate planning file – Ideally, information about bank accounts will be included here

- Search their home and mail – Look for bank statements, tax returns, and ATM receipts

- Visit banks in their area – Bring the death certificate and proof of your authority

- Contact their employer – They may know where direct deposits were sent

- Search online databases – Try the state’s unclaimed property database or the National Association of Unclaimed Property Administrators (NAUPA)

Remember, banks won’t give you information unless you can prove the account holder has died AND that you have legal authority to access the account.

Common Questions About Probate and Bank Accounts

Can an executor use a deceased person’s bank account?

An executor can only use funds from a deceased person’s bank account for estate-related expenses and to pay off the deceased person’s taxes and debts. They can’t use the money for their personal benefit. Any remaining funds must be distributed to the beneficiaries according to the will.

Can a spouse access bank accounts after death?

A spouse can only access a deceased partner’s bank account if:

- They are a joint owner of the account

- They are designated as a POD beneficiary

- They are named as executor/administrator or trustee

- The funds pass to them through intestate succession laws

Being married doesn’t automatically give you access to your spouse’s solely-owned accounts.

Can a power of attorney access bank accounts after death?

No! A power of attorney expires immediately when the person dies. If someone with power of attorney takes funds from a deceased person’s bank account after death, they could face serious legal consequences.

Can a minor be a beneficiary on a bank account?

Yes, but they generally can’t access the asset until they turn 18. In the meantime, a guardian of the estate will need to be appointed to manage the funds for the minor’s benefit.

How to Protect Your Bank Accounts from Probate

If you want to make things easier for your loved ones and keep your bank accounts out of probate, here are your best options:

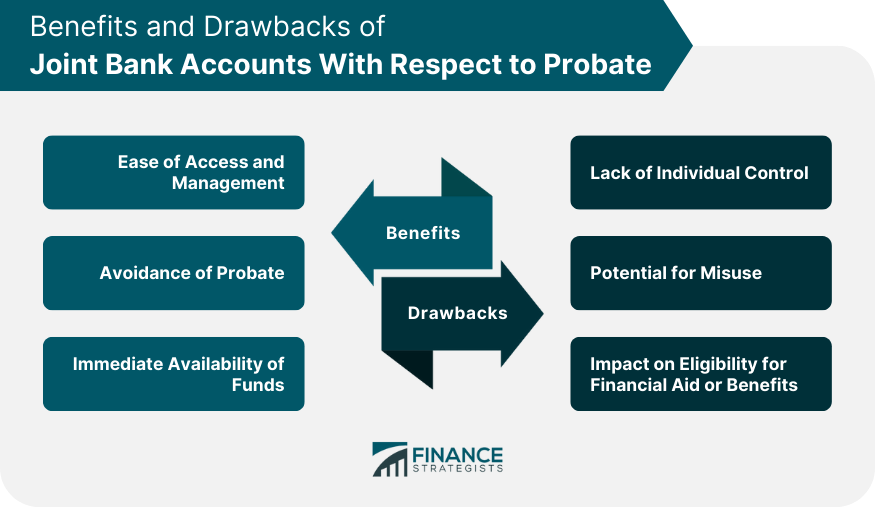

- Add a joint owner – Quick and simple, but gives the co-owner immediate access to your money

- Designate a POD beneficiary – You maintain complete control during your lifetime

- Create a living trust – More complex but offers the most control and privacy

Each method has pros and cons, so think about what works best for your situation.

Conclusion: Planning Ahead Makes All the Difference

So does probate look at bank accounts? Yes, if they’re solely owned with no beneficiary. No, if they have a joint owner, POD beneficiary, or are held in a trust.

By taking a few simple steps now, you can save your loved ones time, money, and stress later. Whether you choose to add a joint owner, designate a beneficiary, or create a trust, the important thing is to make a plan.

I recommend talking to a financial advisor or estate planning attorney to figure out the best approach for your specific situation. The peace of mind knowing your affairs are in order is totally worth it!

Have questions about probate and bank accounts? Drop them in the comments below, and I’ll do my best to help!

Disclaimer: This article provides general information about probate and bank accounts but should not be considered legal advice. Laws vary by state and individual situations differ. Always consult with a qualified attorney for advice specific to your circumstances.

Can an executor use a deceased person’s bank account?

An executor can only use the funds from a deceased person’s bank account for estate-related expenses and to pay off the deceased person’s taxes and debts. If any funds remain, they must distribute them to the estate beneficiaries in accordance with the terms of the deceased person’s will.

It’s important to remember that an executor can only access a deceased person’s bank account if there is no designated beneficiary or joint owner on the account, and the account is not being distributed through the deceased person’s trust.

Can a small estate affidavit be used to claim a deceased person’s bank account?

Yes, so long as there is no beneficiary on the bank account, and the personal property in the estate is valued below the small estate threshold — which is $208,850 as of April 1, 2025 — a deceased person’s bank account can be claimed without a full probate using a shortcut petition known as a small estate affidavit.