If you’re eligible for Social Security, which is usually at age 62, it can be tempting to start taking money out as soon as possible. After all, youve likely been paying into the system for all of your working life, and youre ready to receive your benefits. Plus, guaranteed monthly income is nice to have.

Health status, longevity, and retirement lifestyle are key factors that can play a role in your decision about when to claim your Social Security benefits. You can’t be sure of your health in the future, but you can be sure that if you claim Social Security early instead of later, you will likely get less money to help pay for your retirement for at least 20 years.

Instead of waiting until your full retirement age (FRA), if you start withdrawing your Social Security benefits at age 20, you can expect a 30% reduction in your monthly benefits, with smaller reductions as you get closer to FRA. You can find your on Social Securitys website, or have a paper statement mailed to you.

Your annual cost-of-living adjustment (COLA) is based on your benefits. This means, if you begin claiming Social Security at 62 and start with reduced benefits, your COLA-adjusted benefits will be lower too. The COLA feature can be especially valuable when you experience high inflation during your retirement. Delaying Social Security can create a larger retirement income that is protected from inflation.

Waiting to claim Social Security will result in higher benefits. For every year you delay your claim past your FRA, you get an 8% increase in your benefit. However, make sure to evaluate your decision based on how much youve saved for retirement, your other sources of income in retirement, and your expectations for longevity.

While many people could benefit from waiting to age 70 to take Social Security payments, others may need the income sooner to help pay their bills, or they may anticipate not living long enough to reap the rewards of delaying.

Ah, the magical age of 62. Today is the day when many of us really start to wish we could quit our jobs and retire. I get it! After working for decades, the thought of finally being able to travel, do hobbies, or just chill out sounds great. Hold on, before you hand in your resignation letter! Retiring at 62 may seem like the perfect way to get away from everything, but there are some serious problems you should think about before making this life-changing choice.

I’ve spent countless hours researching this topic (and honestly stressing about my own retirement plans) and I wanna share what I’ve discovered about the potential pitfalls of early retirement. Let’s dive into the disadvantages that might make you think twice about retiring at 62.

Permanently Reduced Social Security Benefits

One of the biggest drawbacks of retiring at 62 is the significant impact on your Social Security benefits. As Maurie Backman points out in a recent Motley Fool article, claiming Social Security at 62 results in permanently reduced monthly payments.

Here’s why this matters

- Your Social Security benefits get reduced by approximately 30% if you claim at 62 instead of waiting until full retirement age (67 for those born in 1960 or later)

- This reduction is permanent and lasts throughout your retirement

- The reduction happens because you’re claiming benefits for more years than if you’d waited

Glenn Kirst, a CFP® at Northwestern Mutual, explains that the closer you get to full retirement age, the smaller this reduction becomes. But if you claim at the earliest possible age (62), you’re looking at the maximum possible reduction.

Consider this: If your full retirement benefit would be $2,000 monthly at age 67, claiming at 62 could reduce it to just $1,400 per month. That’s $600 less EVERY MONTH for the rest of your life! That difference adds up to $7,200 less per year and could mean tens of thousands in lost benefits over your retirement.

Potential for Less Lifetime Social Security Income

Another disadvantage of retiring at 62 is that you might actually receive less Social Security income over your lifetime, contrary to what many people believe.

The Motley Fool article highlights that while an early filing at 62 might make sense if you pass away at a relatively young age, those who live longer typically lose out financially by taking benefits as early as possible.

Think about it:

- If you live into your 80s or 90s (which is increasingly common), the reduced monthly benefit means you’ll receive less total money from Social Security over your lifetime

- Given that you’ve been paying into Social Security your entire career, getting less back than you could have isn’t ideal

- The 8% annual increase in benefits for every year you delay past full retirement age (up to age 70) can result in significantly more lifetime income for those who live longer

The Earnings Test Penalty

Many people don’t realize that if they claim Social Security at 62 but continue working, they face the earnings test penalty. This is a serious disadvantage for those who might need or want to work part-time in early retirement.

According to the Motley Fool article, in 2025, you’ll lose $1 for every $2 you earn over $23,400 if you claim benefits before full retirement age. If you’re reaching full retirement age in 2025 but aren’t there yet, you’ll lose $1 for every $3 you earn over $62,160.

You don’t lose these benefits completely because they will be added back to your payments when you reach full retirement age. However, the short-term cut can make it hard to pay your bills when you retire early.

Inadequate Retirement Savings

Let’s be real—retiring at 62 means your retirement savings need to last longer. Like, potentially a LOT longer.

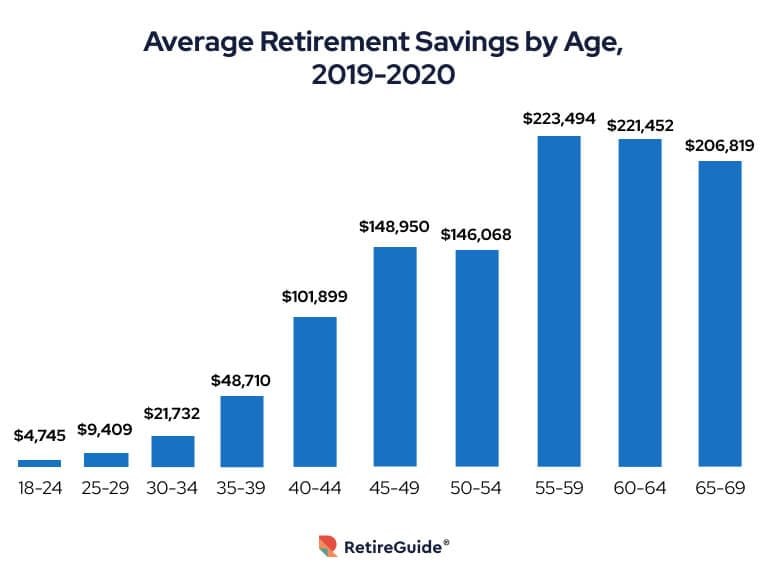

The Federal Reserve data cited in the Motley Fool article shows that median retirement savings for Americans ages 65-75 is just $200,000 as of 2022. That’s… not a lot when you consider retirement could last 25+ years!

Here’s why retiring at 62 can strain your savings:

- Your retirement funds need to cover 5 more years compared to retiring at 67

- You have fewer years to contribute to retirement accounts

- Your investments have less time to grow through compound interest

- You may face early withdrawal penalties if accessing certain retirement accounts before 59½

For someone with little saved, taking less Social Security at age 62 and taking money out of their retirement savings at the same time could cause them to have money problems later on.

Healthcare Coverage Gaps

This is a HUGE one that I think gets overlooked way too often. Medicare eligibility doesn’t begin until age 65, creating a potential 3-year gap in healthcare coverage if you retire at 62.

During this gap, you’ll need to find alternative health insurance, which can be extremely expensive. Options might include:

- COBRA coverage from your former employer (typically very costly)

- Healthcare Marketplace plans (often expensive without income-based subsidies)

- Coverage through a working spouse’s plan (if available)

- Private insurance (usually expensive for older adults)

According to healthcare cost estimates, a couple might need to budget anywhere from $15,000-$25,000 per year for health insurance premiums and out-of-pocket costs during this pre-Medicare period. That’s a serious financial burden that can quickly deplete your savings.

Less Time to Prepare Financially

When you retire at age 62, you miss out on some of your best years for making money. Most people make the most money between the ages of 50 and 60. These final working years are often crucial for:

- Making catch-up contributions to retirement accounts

- Paying off mortgages and other debts

- Building emergency savings

- Increasing Social Security credits (remember, benefits are calculated based on your 35 highest-earning years)

By retiring at 62, you may miss out on these valuable years of financial preparation. As Northwestern Mutual points out, those extra years on the job, especially later in your career when pay is typically higher, can help boost your monthly Social Security check by displacing lower-earning years in your work history.

Potential for Boredom and Loss of Purpose

This disadvantage isn’t financial, but it’s still super important. Many early retirees find themselves struggling with unexpected boredom, loss of identity, or lack of purpose.

Think about it—work provides structure, social connections, intellectual stimulation, and a sense of contribution. Retiring at 62 means potentially 20-30+ years without that built-in purpose. That’s a LONG time to fill with hobbies and leisure activities!

I’ve seen friends retire early only to feel lost after the initial excitement wears off. Some even end up looking for part-time work or volunteering opportunities just to regain some structure and purpose.

Increased Risk of Outliving Your Money

One of the scariest disadvantages of retiring at 62 is the increased risk of outliving your money. With improvements in healthcare and longevity, it’s not uncommon for retirement to last 30+ years for someone retiring at 62.

Consider these sobering statistics:

- A 62-year-old woman today has an average life expectancy of about 86

- A 62-year-old man has an average life expectancy of about 84

- Many people live well into their 90s

This means your retirement savings might need to last 25-30+ years! That’s a long time to stretch your money, especially with inflation gradually eroding your purchasing power.

When Retiring at 62 Might Make Sense

Despite these disadvantages, retiring at 62 isn’t always a bad decision. According to Northwestern Mutual, it might make sense if:

- You have health issues that make working difficult

- You have a chronic condition or family history that suggests a shorter life expectancy

- Your spouse earns a higher income and can delay claiming Social Security

- You have substantial retirement savings that can compensate for reduced Social Security benefits

- You’re no longer able to work and don’t have enough savings to get by until full retirement age

Making the Right Decision for Your Situation

So what should you do? As with most financial decisions, there’s no one-size-fits-all answer. The right retirement age depends on your unique circumstances.

Here are some steps I recommend:

- Calculate your retirement needs: Use retirement calculators to estimate how much you’ll need

- Assess your health: Be honest about your health status and family longevity

- Evaluate your savings: Determine if your retirement accounts can support an early retirement

- Consider healthcare costs: Factor in pre-Medicare healthcare expenses

- Think about your purpose: Have a plan for how you’ll spend your time

- Talk to a financial advisor: Get professional guidance tailored to your situation

My Personal Take

I’ve seen too many people jump into early retirement without fully understanding these disadvantages. My uncle retired at 62, excited about his “freedom years,” only to struggle financially by his mid-70s due to the combination of reduced Social Security and depleted savings.

On the flip side, my former colleague waited until 67 to retire, and she’s living comfortably with travel and hobbies well into her 80s because she maximized her Social Security benefits and had more time to build her nest egg.

While retiring at 62 might be the right choice for some, it’s crucial to go into this decision with your eyes wide open to the potential disadvantages. The dream of early retirement can quickly turn into a nightmare if you haven’t prepared adequately for the financial implications.

Retiring at 62 comes with significant disadvantages that many people don’t fully consider, including permanently reduced Social Security benefits, potential for less lifetime income, healthcare coverage gaps, and increased risk of outliving your money.

Before making this major life decision, take time to thoroughly evaluate your financial situation, health status, and retirement goals. Consider consulting with a financial advisor who can help you understand how retiring at 62 would impact your specific circumstances.

Remember, retirement should be something you run toward with excitement, not something you’re desperately running away from. Make sure your decision to retire—whether at 62 or later—sets you up for the comfortable, fulfilling retirement you deserve.

What’s your retirement plan? Have you considered these disadvantages of retiring at 62? I’d love to hear your thoughts in the comments!

Spouses and Social Security

You can claim Social Security benefits based on your spouses work record. Assuming that claiming spousal benefits gives you more, claiming before your FRA on a spouse’s record means you’ll lose even more than claiming on your own record. This is because the maximum benefit reduction for a spouse is 20%35 and the maximum benefit reduction for claiming your own benefit is 20%30. If you are Collins’s spouse (from the previous example) and the same age, you would only be eligible for $650 a month at age 60, which is less than what you would get if you waited until you reached full retirement age.

To learn more about ways that may help maximize your lifetime benefits, read Viewpoints on Fidelity. com: Social Security tips for couples or Social Security tips for singles.

Your decision to take benefits early could outlive you. If you were to die before your spouse, they would be eligible to receive your monthly amount as a survivor benefit—if its higher than their own amount. However, if you start getting your benefits early (at age 62 instead of 70), your spouse’s survivor social security benefit could be 30% less for the rest of their life.

The downside of claiming early: Reduced benefits

Consider the following hypothetical example. If Colleen, 62, waits until age 67 (her FRA) to collect, she will receive approximately $2,000 a month. However, if she begins withdrawing benefits at 62, shell receive only $1,400 a month. This “early retirement” penalty is permanent and results in her receiving 30% less year after year.

However, if Colleen waits until age 70, her monthly benefits will increase another 24% over what she would receive at her FRA, to the total benefit of $2,480 per month.1 If she were to live to age 89, her lifetime benefits would be about $112,200 more provided she waited until age 70 to collect Social Security benefits instead of at 62, or about 25% greater.2 (Note: All figures are in todays dollars and before tax. The actual benefit would be adjusted for inflation and would possibly be subject to income tax.)

Why You SHOULD Retire and Take Social Security at Age 62 (5 Reasons)

FAQ

Is it a mistake to retire at 62?

Retiring at 62 isn’t inherently bad, but it presents significant financial challenges that require careful planning, including a permanently reduced Social Security benefit, potential loss of tax-advantaged savings, and a longer period to fund your retirement. Key factors to consider are your personal financial situation, your health, your spending needs, and your other sources of income.

What is the first reason to take Social Security at 62?

You need to cover expenses and get out of debt Your current living expenses may surpass your Social Security benefit amount, so you decide to take your benefits early because you can’t wait for a larger payout later. Or, you’re drowning in debt, and taking benefits now will help.

What is the penalty for retiring at 62?

The penalty for retiring at age 62 is a permanently reduced Social Security benefit of up to 30%, depending on your full retirement age. For every month you claim benefits before your full retirement age (FRA), your payment is lowered by a certain amount. The lowered amount is calculated as 205/9% of 1% for the first 336 months and 205/12% of 1% for any other months.

How much money will I lose if I retire at 62 instead of 65?

You would lose a portion of your Social Security benefit if you retire at age 62 instead of 65, with the exact amount depending on your full retirement age (FRA). For individuals born in 1960 or later, your FRA is 67, meaning retiring at 62 could reduce your monthly benefit by up to 30% for life.

What happens if you retire at 62?

Deciding to retire immediately at age 62 means losing an additional 5/12 of 1% each month. That means that a monthly benefit of about $1,400 at age 67 would drop to just $983 if you retired at age 62 and started getting checks. The reduction is a permanent one unless you take steps to undo the early claim. 2.

What if I retire at 62 and claim social security?

People who retire at age 62 and claim Social Security will see their benefits cut sharply. This is the biggest problem for these people. The standard benefit that you receive in your government reports is based on the full retirement age (FRA), which is 67 if you were born after 1960.

Is a 62 year old a good age to retire?

It is once you factor in the drop in long-term income. According to the Congressional Research Service, those who claim at 62 years old will see around a 30% reduction in monthly benefits compared to those who delay until full retirement age. Depending on when you were born, full retirement age for 100% benefits lands at about 66 or 67.

Why should you take retirement benefits at 62?

With additional retirement years for relaxation and leisure activities, retirees tend to experience an improved quality of life. Taking benefits at 62 allows for additional active retirement years, enabling individuals to pursue leisure activities, travel, and pursue personal interests.

What happens if you take benefits at 62?

Taking benefits at 62 allows for additional active retirement years, enabling individuals to pursue leisure activities, travel, and pursue personal interests. The average American life expectancy, according to the CDC, is approximately 77 years, so those who apply for benefits at 62 may have the opportunity to live 15 or more years in retirement.

Is 62 a good age to get Social Security?

You may not think of age 62 as such a major milestone in the context of retirement. Age 65 tends to get a lot more attention. But age 62 is significant in that it’s the earliest age to sign up for Social Security. Once you reach 62, you can file for benefits at any point in time. But that doesn’t mean claiming Social Security at 62 is a smart idea.