If youve ever inherited a retirement account, youve probably wondered how to use the funds best. Your new account can help jump-start your journey towards financial freedom. Converting some of your inherited IRA to a Roth account could be a great way to minimize your taxes on retirement income.

So you’ve inherited an IRA and now you’re wondering if it’s gonna mess up your backdoor Roth conversion plans? I totally get it – this stuff can be confusing as heck. The good news is that inherited IRAs do NOT affect backdoor Roth conversions Let me break this down for ya in simple terms so you can stop worrying and get back to planning your retirement strategy!

What’s a Backdoor Roth Conversion Anyway?

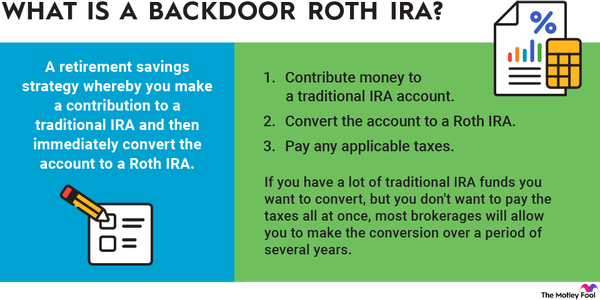

Before we dive into the nitty-gritty, let’s make sure we’re on the same page about what a backdoor Roth conversion actually is:

A backdoor Roth conversion is basically a workaround strategy for folks who make too much money to contribute directly to a Roth IRA. The process involves:

- Making a non-deductible contribution to a traditional IRA (using after-tax dollars)

- Converting that traditional IRA to a Roth IRA shortly after

This two-step dance lets high-income earners bypass those pesky income restrictions that would normally prevent them from contributing to a Roth IRA. Pretty clever, right?

Understanding Inherited IRAs

An inherited IRA is exactly what it sounds like – an IRA you inherit when someone passes away. These accounts have their own special rules:

- They’re kept separate from your personal IRAs

- They’re typically titled differently (like “John Smith, Beneficiary of Jane Smith’s IRA”)

- Non-spouse beneficiaries can’t make contributions to inherited IRAs

- You usually have to take distributions according to specific rules (more on that later)

The Big Question: Do Inherited IRAs Count in the Pro-Rata Calculation?

Here’s where things get interesting. When you do a backdoor Roth conversion, the IRS uses something called the “pro-rata rule” (also known as the “IRA aggregation rule”) to determine how much of your conversion is taxable.

The short answer is no, inherited IRAs do not count toward the pro-rata for backdoor Roth conversions.

The pro-rata rule requires that all of your own traditional, SEP, and SIMPLE IRAs be aggregated when calculating the taxable portion of a Roth conversion. But – and this is super important – it does not include inherited IRAs or Roth IRAs. That’s because the IRS views inherited IRAs as separate accounts with their own ownership and distribution rules.

Why This Matters: An Example

Let’s say you have:

- $10,000 in a non-deductible traditional IRA (that you want to convert)

- $90,000 in another pre-tax traditional IRA (that you’ve had for years)

- $50,000 in an inherited IRA from your father

The pro-rata rule says that 90% of your conversion would be taxed if you didn’t have the inherited IRA. This is because 90% of your $100,000 IRA balance is pre-tax money.

The math stays the same, though, because the inherited IRA doesn’t count in this calculation: 90% of your conversion is taxed, not 93%. 3 percent of what it would be if the inherited IRA were added.

What Form 8606 Tells Us

You’ll need to fill out Form 8606 to tell the IRS about non-deductible contributions and Roth conversions. Looking at the instructions for this form provides more clarity:

- Line 6 instructions say to include “the total value of all your traditional, SEP, and SIMPLE IRAs” (emphasis on “your”)

- The instructions don’t mention including inherited IRAs in the calculation

Also, IRS Publication 590-B specifically states that if you inherit a traditional IRA, you can’t combine its basis with any basis you have in your own traditional IRAs (unless you’re the spouse and choose to treat the IRA as your own).

A Real-World Perspective

I spoke with a client recently who was in this exact situation. She inherited her mom’s IRA last year and was worried it would mess up her backdoor Roth strategy that she’d been using for years. She was relieved to learn that the inherited IRA wouldn’t impact her ability to do clean backdoor Roth conversions.

“So I can still do my backdoor Roth conversion even though I now have this inherited IRA?” she asked.

“Absolutely,” I told her. “The inherited IRA is kept separate for tax purposes.”

What About Converting an Inherited IRA to Roth?

This is where things get a bit tricky. If you’re wondering if you can convert your inherited IRA to a Roth IRA, the answer depends on your relationship to the original owner:

- If you’re the spouse of the deceased: You can make the inherited IRA your own and then convert it to a Roth IRA (and pay taxes on the conversion)

- If you’re not the spouse: Sorry, you cannot convert an inherited IRA to a Roth IRA. The law simply doesn’t allow it.

Required Minimum Distributions (RMDs) and Inherited IRAs

One important thing to remember about inherited IRAs is that they come with distribution requirements:

- For most non-spouse beneficiaries, the entire account must be emptied within 10 years of the original owner’s death (the “10-year rule”)

- If the original owner had already reached their required beginning date for taking RMDs, you might need to take annual RMDs during that 10-year period

- Failing to take required distributions can result in penalties (up to 25% of the amount not taken!)

A smart distribution strategy might be to distribute 1/10 of the account in year 1, 1/9 of the remaining balance in year 2, 1/8 in year 3, and so on. This approach can help spread out the tax impact over the full 10-year period.

Pro Tips for Managing Both Inherited IRAs and Backdoor Roth Conversions

If you’re juggling both an inherited IRA and doing backdoor Roth conversions, here are some things to keep in mind:

- Keep good records: Make sure your inherited IRA is properly titled as an inherited account

- Track non-deductible contributions: Maintain accurate records of your non-deductible contributions to traditional IRAs

- Consider timing: If possible, complete your backdoor Roth conversion early in the year to minimize any earnings that would be taxable

- Plan your distributions: Create a thoughtful plan for taking distributions from your inherited IRA to minimize the tax impact

- Consult a tax pro: This stuff gets complicated – working with a tax professional can help ensure you’re doing everything correctly

Common Questions About Inherited IRAs and Backdoor Roth Conversions

Can I do a backdoor Roth if I already have a traditional IRA?

Yes, but if you have pre-tax money in any traditional IRA, a portion of your conversion will be taxable according to the pro-rata rule.

When should I avoid a backdoor Roth IRA?

You might want to skip the backdoor Roth if you’re able to meet your savings goals through your workplace retirement account or if you have a large pre-tax IRA balance that would make the conversion inefficient from a tax perspective.

Who is not eligible for a backdoor Roth IRA?

Anyone can do a backdoor Roth conversion, but direct Roth IRA contributions are limited by income. For 2024, the income limits are $161,000 for single filers and $240,000 for married filing jointly.

Real-World Example: Meeting Jack’s Situation

Jack recently inherited his father’s $200,000 traditional IRA. He also earns $180,000 per year, which puts him above the income limit for direct Roth IRA contributions. Jack has been doing backdoor Roth conversions for years and was worried that the inherited IRA would mess up his strategy.

Jack was relieved to learn that the inherited IRA wouldn’t affect his backdoor Roth conversions. He could continue making non-deductible contributions to his traditional IRA and converting them to his Roth IRA just as he’d been doing.

For his inherited IRA, Jack decided to take distributions spread over the 10-year period to minimize the tax impact rather than waiting until the final year to withdraw everything.

The Bottom Line

The good news is that an inherited IRA won’t throw a wrench in your backdoor Roth conversion plans. They’re kept separate for tax purposes, which means:

- The inherited IRA doesn’t count in the pro-rata calculation

- You can continue doing backdoor Roth conversions even if you have an inherited IRA

- You’ll need to manage distributions from your inherited IRA according to IRS rules, but this doesn’t impact your personal backdoor Roth strategy

We all want to maximize our retirement savings while minimizing taxes, and understanding these rules helps us do just that. Now you can proceed with your backdoor Roth conversions with confidence, knowing that your inherited IRA isn’t going to complicate things.

Remember, though, that tax laws can change, so it’s always a good idea to stay informed or work with a tax professional who can help guide you through the process.

Have you dealt with both inherited IRAs and backdoor Roth conversions? What has your experience been like? Drop a comment below to share your thoughts!

What If I Inherit My Deceased Spouse’s IRA?

When you inherit an IRA from your spouse, the IRS allows you to treat the account as your own. This means you can move the IRA from your deceased spouses name into your own. From there, you could do Roth conversions to move some or all of the funds into an account that will grow and can be withdrawn tax-free.

How You Can Convert Your Late Spouse’s IRA To A Roth

The biggest hassle here is usually moving the account from your spouses name to your own. Talk to the investment company; they can give you the likely very long list of forms you need to open a new IRA in your name. MORE FROM.

It’s easy to make the most of a Roth conversion tax-planning strategy once the money is in your own IRA. Just follow the normal steps.