Americans looking to stretch their retirement savings may want to head to states in the South or the Midwest, a recent analysis suggests.

Around the U. S. , a $1 million nest egg can cover an average of 18. 9 years worth of living expenses, GoBankingRates found. But where you retire can have a profound impact on how far your money goes, ranging from as a little as 10 years in Hawaii to more than than 20 years in more than a dozen states.

Tapping government data, the personal finance site estimated the number of years retirees aged 65 or older could live off $1 million in savings based on the cost of housing, transportation, utilities, health care and groceries in each of the 50 U. S. states.

The key finding: Retirees can get the biggest bang for their buck in Mississippi, where the combined cost of food, utilities, housing, health care and other essentials is $44,000 per year. Saving of $1 million in the state would last you nearly 23 years, the personal finance site said.

By contrast, retirees in Hawaii — where the annual living costs are roughly $97,000, or more than double those of retirees in Mississippi — will burn through $ 1 million in just over 10 years, according to GoBankingRates.

Its worth noting that most Americans are nowhere near having that much money socked away. According to data from financial services firm Credit Karma, Baby boomers have median retirement savings of $120,000, while nearly 30% of people aged 59 or older have saved nothing for their golden years.

Thats despite the fact that many retirements now last more than 25 years, according to financial services firm Fidelity. Those meager savings also fall well below the $1. 8 million in savings Americans say they need to live out their golden years comfortably, according to a recent Charles Schwab poll.

Have you ever wished that your savings account would reach $1 million? A lot of people have. There has been a million-dollar retirement goal for many years. Is that still enough to last a lifetime in today’s economy, where people worry about inflation and live longer?

I’ve been researching this question extensively, and what I’ve found might surprise you. The answer isn’t a simple yes or no – it depends on where you live, how you spend, and numerous other factors that we’ll dive into.

The Million-Dollar Reality Check

Let’s face reality – a million dollars ain’t what it used to be. According to Northwestern Mutual’s 2025 Planning and Progress Study, Americans now believe they need closer to $1.26 million for a comfortable retirement. That’s quite a jump from the traditional million-dollar benchmark!

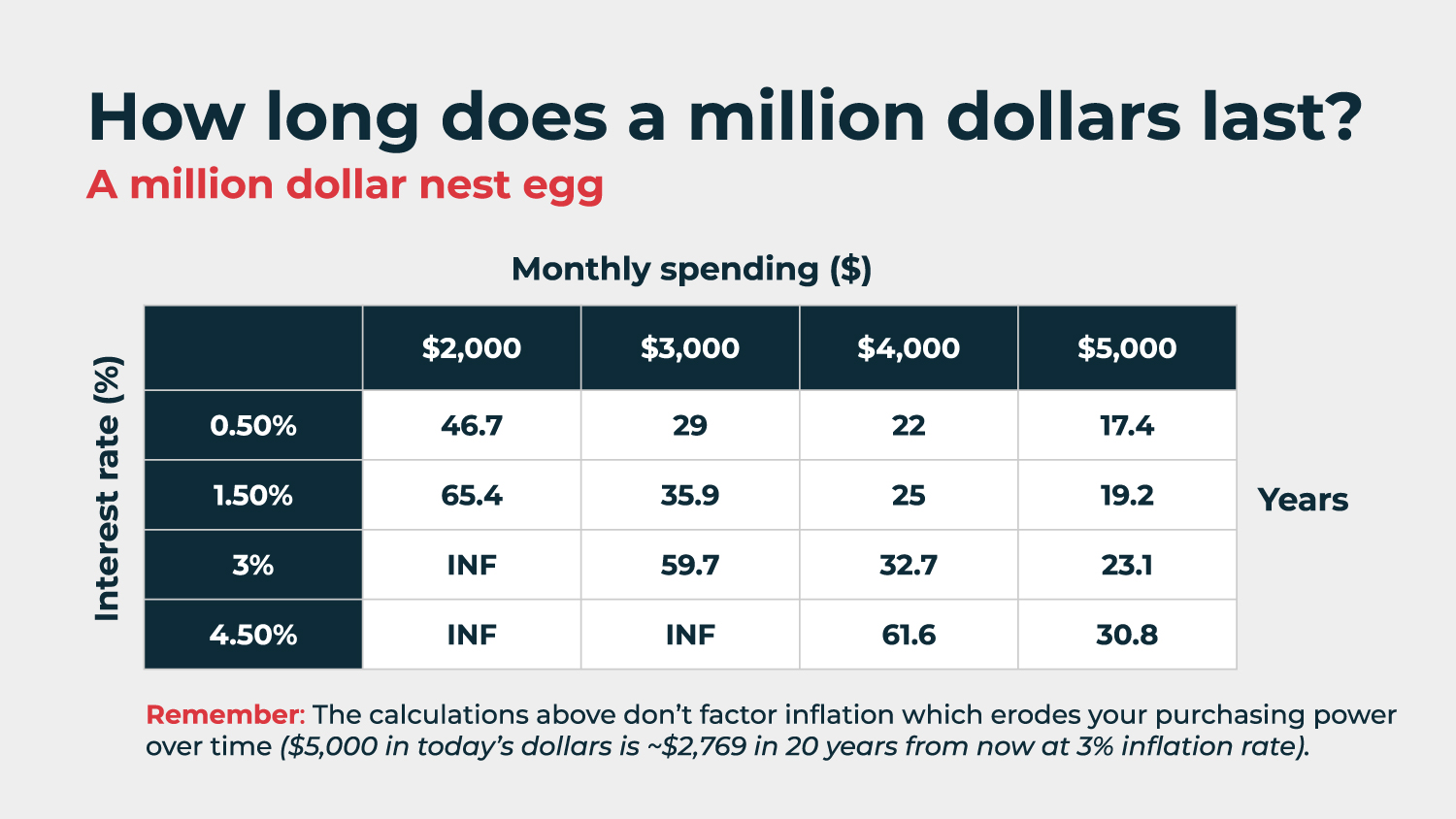

If you withdraw 4% annually (a common retirement rule of thumb), $1 million may last 25-30 years. Living off interest only might generate $40,000-$50,000 per year indefinitely, depending on interest rates. Alternatively, a lifetime income annuity could pay $40,000-$80,000 annually for life, regardless of how long you live.

But these are just averages, Your mileage will vary significantly based on several key factors,

Where You Live Makes a HUGE Difference

According to a recent GOBankingRates analysis highlighted by CNBC, the geographic differences are staggering:

- Hawaii: $1 million covers just 12 years (yikes!)

- California: 16 years

- Massachusetts: 19 years

- West Virginia: 89 years (nearly 7.5x longer than Hawaii!)

- Mississippi: 87 years

The study examined how far $1 million in retirement savings plus Social Security benefits would stretch in each state, factoring in basic living expenses like groceries, housing, utilities, transportation, and healthcare

Here’s a snapshot of how long $1 million lasts in some states

| State | Years $1 Million Lasts |

|---|---|

| West Virginia | 89 |

| Mississippi | 87 |

| Louisiana | 77 |

| Arkansas | 77 |

| Kentucky | 69 |

| Alabama | 67 |

| Iowa | 66 |

| Kansas | 65 |

| Ohio | 62 |

| Missouri | 61 |

At the other end of the spectrum:

| State | Years $1 Million Lasts |

|---|---|

| Hawaii | 12 |

| California | 16 |

| Massachusetts | 19 |

| Washington | 22 |

| New Jersey | 24 |

| Colorado | 25 |

Beyond Location: Other Crucial Factors

1. Longevity

In simple terms, you’ll need more money as you age. Medical progress keeps making us live longer, which is great, but it also means that our money has to go further. If people in your family tend to live long, you may need to plan for 30 years of retirement.

2. Lifestyle Choices

As Tyler Ozanne, a certified financial planner, points out: “How much you spend is a huge factor.” Do you plan to travel extensively? Eat out frequently? Maintain multiple homes? Or will you embrace a more frugal lifestyle? These choices dramatically impact how long your money lasts.

3. Healthcare Costs

According to Fidelity’s 2024 Retiree Health Care Cost Estimate, an average 65-year-old retiring last year might need $165,000 in after-tax savings JUST for healthcare costs in retirement. Medicare helps, but it doesn’t cover everything.

4. Long-term Care Needs

This is the budget-buster that many retirees don’t adequately plan for. A private nursing home room costs more than $127,000 annually (according to 2024 Genworth data). Medicare won’t pay for long-term care, and without insurance, these costs can quickly deplete your savings.

5. Other Income Sources

Most retirees don’t rely solely on savings. Social Security, pensions, part-time work, rental income, or other revenue streams can significantly reduce how much you need to withdraw from your nest egg.

6. Investment Approach

As Michael Foguth, president of Foguth Financial Group, says: “You can’t have $1 million in cash and expect that to get you through retirement.” How you invest matters tremendously. Too conservative, and inflation eats away your purchasing power. Too aggressive, and market downturns could devastate your savings.

7. Inflation Impact

After years of minimal inflation, we’ve seen prices jump significantly recently. Even moderate inflation of 3-3.5% annually (the historical average) can dramatically reduce your purchasing power over a 20-30 year retirement.

How to Make $1 Million Last Longer

If you want to reach or are already at the million-dollar mark, here are some ways to make your money go further:

Optimize Your Location

Consider relocating to a lower-cost area. Hawaii is 77 years away from West Virginia, which is a huge difference in retirement funds. Moving from California to Arizona could add another 16 years to your retirement funds.

Create Multiple Income Streams

Don’t rely solely on withdrawals from your investments. Consider:

- Maximizing Social Security benefits

- Part-time work in retirement

- Rental properties

- Dividend-focused investments

- Annuities for guaranteed income

Manage Withdrawal Rates Carefully

The traditional 4% rule suggests withdrawing 4% of your nest egg in year one, then adjusting that amount for inflation each subsequent year. However, some financial planners now recommend a more flexible approach based on market performance and your specific needs.

Plan for Healthcare Costs

Consider long-term care insurance or hybrid life insurance policies with long-term care benefits. Set aside specific funds for healthcare expenses outside your general retirement savings.

Minimize Taxes

Work with a tax professional to develop strategies that minimize your tax burden in retirement. This might include:

- Strategic Roth conversions

- Tax-efficient withdrawal sequencing

- Tax-loss harvesting

- Charitable giving strategies

How Much Should You Save Monthly to Reach $1 Million?

If you’re not yet at retirement age, here’s how much you’d need to save monthly to reach $1 million, assuming a 7% average annual return:

- Starting at age 20: About $330/month

- Starting at age 30: About $650/month

- Starting at age 40: About $1,547/month

- Starting at age 50: Significantly more challenging – you’d need to save around $4,000/month

This shows why starting early is SO important! The power of compounding means that time is literally money when it comes to building wealth.

Is $1 Million Still a Good Retirement Goal?

Despite all the caveats above, having $1 million in retirement savings is still an excellent goal for many Americans. It provides options and flexibility that lower amounts simply don’t offer.

However, it’s crucial to personalize your retirement savings target based on:

- Your desired lifestyle

- Where you plan to live

- Your health expectations

- Other income sources

- Your risk tolerance

As Barbara Taibi, tax partner with Eisner Advisory Group, says: “I think you have to have a more personalized number.”

My Take: The Million-Dollar Question

So, can $1 million last a lifetime? For some people, absolutely yes. For others, definitely not. It depends on too many personal factors to give a one-size-fits-all answer.

What I can tell you with certainty is that saving $1 million is absolutely achievable for most workers who start early and save consistently. And having $1 million puts you in a much better position than the majority of Americans approaching retirement.

The key is to be realistic about what that million will provide based on your specific circumstances. For someone living modestly in West Virginia with minimal health issues, it could fund nearly nine decades of retirement! For a couple wanting to maintain an upper-middle-class lifestyle in Hawaii or California, it might last just 12-16 years.

We should all aim to save as much as we reasonably can while still enjoying our pre-retirement years. A million dollars is a great benchmark, but your personal “magic number” might be higher or lower depending on your unique situation.

What’s your retirement savings goal? Have you calculated how much you’ll need based on your specific circumstances? I’d love to hear your thoughts in the comments!

Ready to Start Building Your Million?

If you’re feeling behind on retirement savings, don’t panic! Remember that even small steps can make a big difference over time:

- Maximize employer matches in retirement plans

- Increase savings rates gradually (1% per year)

- Save windfalls like tax refunds and bonuses

- Reduce fees in your investment accounts

- Consider working with a financial advisor to develop a personalized plan

With smart planning and consistent effort, you can build a retirement nest egg that supports your desired lifestyle – whether that’s $1 million or more!

More from CBS News

Elizabeth Napolitano is a freelance reporter at CBS MoneyWatch, where she covers business and technology news. She also writes for CoinDesk. Before joining CBS, she interned at NBC News BizTech Unit and worked on The Associated Press web scraping team.

How $1,000,000 Can Be Enough For Retirement

FAQ

How long would 1 million dollars last?

One million dollars can last anywhere from under a decade to several decades, with the timeframe highly dependent on your spending habits, investment returns, and cost of living. In states with high costs of living, like California, $1 million might last for 16 years. In states with low costs of living, like Mississippi, it might last for more than 80 years.

Can I live off the interest of 1 million dollars?

Yes, you can potentially live off the “interest” (or returns) of $1 million, but your lifestyle depends on your expenses, investment strategy, and ability to account for inflation and taxes. A common guideline is the 4% rule, suggesting $40,000 annually, but conservative estimates often target 3-5% returns, or $30,000-$50,000 per year, to preserve capital.

Can I retire at 60 with $1 million dollars?

Yes, you can potentially retire at 60 with $1 million, but it’s not guaranteed and depends heavily on your lifestyle, expenses, health care costs, and potential supplemental income sources like Social Security and pensions.

Can 1 billion dollars last a lifetime?

Yes, $1 billion can easily last a lifetime for most people, even if they live a very fancy life. This is especially true if the money is invested wisely to make it grow and fight inflation. For example, spending $1,000 a day would still run out of money in over 2,700 years, but an annual withdrawal of $40 million (a 4% return on the principle) could last for generations.

How long will $1 million last?

How long $1 million will last depends on how much a retiree spends on housing, health care and other expenses. Retirement savings can be supplemented with other income, such as Social Security and pensions, to make them last longer. Saving $1 million is achievable for workers who begin saving early in their careers.

How long will 1 million dollars last in retirement?

One million dollars is a lot of money for most people and you might be hoping to retire with that amount in the bank. But how long will $1 million last in retirement? The answer can depend on the age at which you retire, your life expectancy and the kind of lifestyle you plan to live.

Can you retire on 1 million dollars?

Saving a million dollars is doable if you start early, and it could last you decades in retirement. Can You Retire on $1 Million? Factors such as housing and health care will also impact your budget and determine whether $1 million is the right savings goal for your needs. Many people think $1 million is sufficient savings for retirement.

Is 1 million enough savings for retirement?

Many people think $1 million is sufficient savings for retirement. How long $1 million will last depends on how much a retiree spends on housing, health care and other expenses. Retirement savings can be supplemented with other income, such as Social Security and pensions, to make them last longer.

How long would a $1 million savings account last?

Example #1: You have $1 million in savings and earn a 6% annual return. Assuming you’re in the 24% tax bracket and withdraw $5,000 per month, your savings could last just over 30 years. Example #2: Your $1 million in savings earns a 5% annual return. With the same tax bracket and monthly withdrawal amount, you’d run out of money in 26 years.

Should you invest $1 million a year?

But invested smartly, this sum should ensure they can live in a typical U.S. big city—such as Chicago, Los Angeles, or Houston— without worrying about poverty or an inability to pay the bills. Retiring on $1 million necessitates a strategy and budgeting to ensure this nest egg lasts as long as it needs to.