If youre retiring and you qualify for Social Securitys maximum benefit, you could pocket $3,895 per month in Social Security income in 2021. Youll only collect that much money if you begin receiving benefits at 70 years or older, though. The maximum amount you can collect this year if you file at age 62 is $2,324, and the maximum paid if youre 66 is $3,113.

You should know, though, that Social Security’s formula is complicated, and that getting the most money depends on a lot of factors, such as how long you’ve worked. Heres how Social Security calculates maximum benefits and what you can do to get the biggest possible payout.

Figuring out social security benefits can feel like trying to solve a complicated puzzle If you’re approaching retirement age or planning ahead, you might be wondering exactly how much you could receive from Social Security in 2021 Let’s break down the maximum amounts and how they’re calculated in simple terms.

The Maximum Social Security Payment for 2021 at a Glance

The absolute maximum Social Security retirement benefit payable in 2021 is $3,895 per month – but there’s a catch. This amount is only available to those who

- Retire at age 70 (to maximize delayed retirement credits)

- Have earned at or above the maximum taxable income limit for at least 35 years

- Have a long work history with high earnings

However, the maximum benefit varies significantly depending on what age you choose to start collecting:

| Retirement Age | Maximum Monthly Benefit (2021) |

|---|---|

| Age 62 | $2,324 |

| Age 65 | $3,113 |

| Age 66 | $3,113 |

| Age 67 | $3,295 |

| Age 70 | $3,895 |

But let’s face it: most people don’t even come close to these maximum amounts. People who retired in 2021 got an average of only $1,543 a month from Social Security, or $18,516 a year.

How Social Security Calculates Your Benefits

The formula Social Security uses is pretty complex, but I’ll try to simplify it:

-

Work History: They look at your 35 highest-earning years. If you worked less than 35 years, they’ll put zeros in the gaps, which means you’ll get less money.

-

Wage Indexing: Your past earnings are adjusted for inflation to present-day values.

-

Average Indexed Monthly Earnings (AIME) They calculate your average monthly earnings from those top 35 years.

-

Bend Points: They apply a formula that gives you a higher percentage of lower earnings and a lower percentage of higher earnings.

-

Primary Insurance Amount (PIA): This is the benefit you’d receive at your full retirement age.

-

Adjustment for Filing Age: Your benefit increases if you delay claiming (up to age 70) or decreases if you claim early.

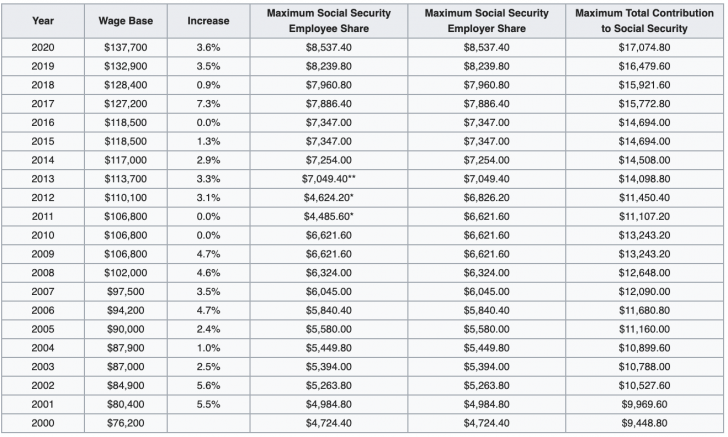

The Maximum Taxable Income Limit

One important thing that affects your maximum possible benefit is the Social Security tax cap. There’s a limit to how much of your income gets taxed for Social Security each year:

| Year | Maximum Taxable Earnings |

|---|---|

| 2021 | $142,800 |

| 2022 | $147,000 |

| 2023 | $160,200 |

| 2024 | $168,600 |

To qualify for the absolute maximum benefit, you would need to earn at or above this limit for at least 35 years of your working life. That’s a pretty high bar – way above what the average American earns (about $51,000 in 2021).

How Your Claiming Age Affects Your Benefit

When you start getting Social Security benefits has a HUGE effect on how much you get each month:

- Claim at 62: You’ll get reduced benefits (as much as 30% less than your full retirement age benefit)

- Claim at Full Retirement Age (66-67 depending on birth year): You get 100% of your calculated benefit

- Claim at 70: You get your full benefit PLUS delayed retirement credits (about 8% per year you delay)

Take the case of a person whose full retirement age is 67 and whose benefit would be $1,000 at that age:

- At age 62, you’d get about $700 (30% reduction)

- At age 70, you’d get about $1,240 (24% increase)

That’s a difference of $540 per month or $6,480 per year! Over 20 years of retirement, that adds up to nearly $130,000 difference.

Can You Actually Get the Maximum Benefit?

Let’s be honest – qualifying for the maximum Social Security benefit is REALLY difficult. You’d need to:

- Earn at or above the maximum taxable amount ($142,800 in 2021) for at least 35 years

- Have a consistent 35+ year work history with no gaps

- Wait until age 70 to start collecting benefits

Most Americans don’t come close to these requirements. But that doesn’t mean you can’t maximize YOUR personal benefit.

How to Maximize YOUR Social Security Benefit

Even if you won’t get the absolute maximum amount, here are strategies to boost your benefit:

- Work at least 35 years: This prevents zeros from being factored into your average

- Boost your income: Higher earnings = higher benefits (up to the annual cap)

- Work longer if your recent earnings are higher: This could replace lower-earning early years in your calculation

- Consider delaying benefits: The difference between claiming at 62 vs. 70 can be as much as 77%

- Coordinate with your spouse: For married couples, there are strategies to maximize household benefits

Example Benefit Calculations

Let’s look at an example from the Social Security Administration for workers with maximum-taxable earnings:

A person who retires in January 2021 at age 70, having earned the maximum taxable amount since age 22, would receive $3,895 per month.

The same person retiring at age 62 would receive only $2,324 – that’s $1,571 less per month or almost $19,000 less per year!

Final Thoughts

While the maximum Social Security benefit in 2021 is $3,895 per month, very few people actually qualify for this amount. The system is designed to replace only a portion of your pre-retirement income, not all of it.

Social Security should be just one piece of your retirement planning puzzle. If you’re concerned about having enough income in retirement, it’s worth looking into other sources like:

- 401(k)s and IRAs

- Personal savings

- Part-time work

- Pensions (if you’re lucky enough to have one)

We all wanna get the most out of the system we’ve been paying into our whole working lives. By understanding how benefits are calculated and making strategic decisions about when to claim, you can maximize your Social Security payments – even if you don’t reach the absolute maximum amount.

Remember, everyone’s situation is different. What works for your neighbor or coworker might not be the best strategy for you. It might be worth consulting with a financial advisor who specializes in retirement planning to develop a strategy tailored to your specific circumstances.

Additional Resources

If you want to estimate your own benefit amount:

- Visit the Social Security Administration website (ssa.gov)

- Use their retirement estimator tool

- Create a my Social Security account to see your personalized statement

The more you know about how the system works, the better positioned you’ll be to make smart decisions about your retirement income. And isn’t that what we all want? To have a comfortable, worry-free retirement after decades of hard work!

Have you started planning for your Social Security benefits yet? It’s never too early to understand what you might receive and how to maximize your benefits when the time comes.

How Social Security calculates benefits

Social Security benefits are based upon how many years you work, the amount of money subject to payroll taxes you earned over your career, and when you first start receiving benefits.

You can start getting benefits as early as age 20,62, but you’ll only get 10% of your benefit if you claim Social Security at full retirement age, which for people born after 1943 is between age 2066 and 2067. If you claim earlier than full retirement age, your benefit amount is reduced. If you claim later than full retirement age, your benefit is increased because of delayed retirement credits.

To find out if you can get the maximum benefit from Social Security, the system first adjusts your past yearly income for inflation and then figures out your average monthly income by looking at your 35 best earning years. If you don’t have 35 years of income, zeros are added to the formula for those years, which lowers your benefit and makes sure you won’t get the most money possible.

Once Social Security has calculated your average monthly income, it reduces that amount at specific income levels called bend points to determine your primary insurance amount, or the benefit youll receive if you claim at full retirement age.

As I mentioned, if you claim earlier than full retirement age, then your primary insurance amount is reduced. Specifically, its lowered by five-ninths of 1% per month for the first 36 months you claim early and by five-twelfths of 1% for every additional month you claim early. Alternatively, if you delay claiming benefits until after full retirement age, your benefit is increased by two-thirds of 1% for every month you delay, up to age 70, because of delayed retirement credits. This is why the maximum benefit payable varies depending on how old you are when you first file for Social Security.

Calculating the maximum Social Security tax you can pay

FAQ

What is the maximum Social Security payment 2021?

The Social Security wage base limit for 2021 was $142,800. At this point, wages up to this amount were subject to Social Security payroll taxes. However, wages over $142,800 were not.

Are Social Security checks worth a maximum of $5108?

However, actual amounts differ from person to person. A worker who starts getting benefits as early as possible, at age 62, can get up to $2,831 a month. Claiming at full retirement age, currently 67, raises the maximum to $4,018. For those who delay until 70, the monthly benefit can reach $5,108—the highest available.

What is the maximum Social Security benefit for age 70 in 2025?

What is the Social Security tax cap for 2021?

The social security tax limit, also known as the «taxable maximum» or «wage base», for 2021 was $142,800. This means that only the first $142,800 of earnings for a worker were subject to Social Security taxes in 2021, with the tax being split between the employee and employer.

What is Social Security’s maximum payment in 2021?

Social Security’s maximum payment may surprise you. If you’re retiring and you qualify for Social Security ‘s maximum benefit, you could pocket $3,895 per month in Social Security income in 2021. You’ll only collect that much money if you begin receiving benefits at 70 years or older, though.

How much Social Security benefits can you get in 2021?

For 2021, the maximum Social Security benefit is just $3,011, per month, at full retirement age. Those who wait to claim benefits at age 70 could receive as much as $3,895 per month. In case you were wondering, the average Social Security benefit was just $1,543, per month, in 2021.

What is the top Social Security payout for 2021?

For 2021, the top Social Security payout is $3,895 per month. As you’ll see below, getting this maximum benefit isn’t easy. It depends on how much you’ve earned over your lifetime and how old you are when you claim your retirement benefit.

What is the maximum Social Security payout?

Age is absolutely a key factor in the size of your Social Security payout. The top payout of $3,895 is only available to those who delay claiming their benefit as late as possible, which is age 70. If you want to claim Social Security at 62 instead, which is the earliest allowable age, the maximum Social Security benefit drops to $2,324.

How much does social security pay per month?

Then Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most. For 2021, the maximum Social Security benefit is just $3,011, per month, at full retirement age. Those who wait to claim benefits at age 70 could receive as much as $3,895 per month.

How much Social Security benefits do retired workers collect in 2021?

Consider this point: The average retired worker is collecting just $1,554 in benefits in 2021, or about $18,644 per year. That’s not chump change, but it’s probably not going to allow you to live a life of luxury, making it important to consider Social Security planning strategies.