As you approach retirement, youâll find timing your decision to officially retire hinges on a lot of variables. Thereâs a lot to consider beyond just being ready to stop working.

When you retire, you’ll need to think about how all of your financial plans will fit together. One important part of the plan is deciding when to claim Social Security. While youâre eligible claim at 62, there may be benefits to waiting until age 67 or 70.

Below, we discuss why timing is so important when it comes to your Social Security benefits. We also walk through the pros and cons of claiming Social Security at 62 vs. 67 vs. 70 to help guide your thinking.

Have you been lying awake at night wondering when to claim your Social Security benefits? You’re not alone. This decision could literally mean thousands of dollars difference in your retirement income. Today, I’m breaking down the age-old question: is it better to take Social Security at 66 or 70?

As someone who’s spent countless hours researching retirement strategies, I can tell you this choice ain’t as simple as flipping a coin. Your decision could impact your financial security for decades to come.

The Quick Answer (For Those in a Hurry)

If you want to know the bottom line right away, waiting until age 70 gives most people the most benefits over their lifetime. A large study of 20,000 retirees found that 2057 percent of them would have made the most of their lifetime Social Security income by waiting until they were 70 years old to claim it.

But wait, that doesn’t mean it’s the best choice for everyone! Your unique situation is more important than any number.

Understanding Your Social Security Benefit Ages

Before we dive deeper let’s get clear on the key ages for Social Security

- Age 62: Earliest you can claim (with permanent reduction)

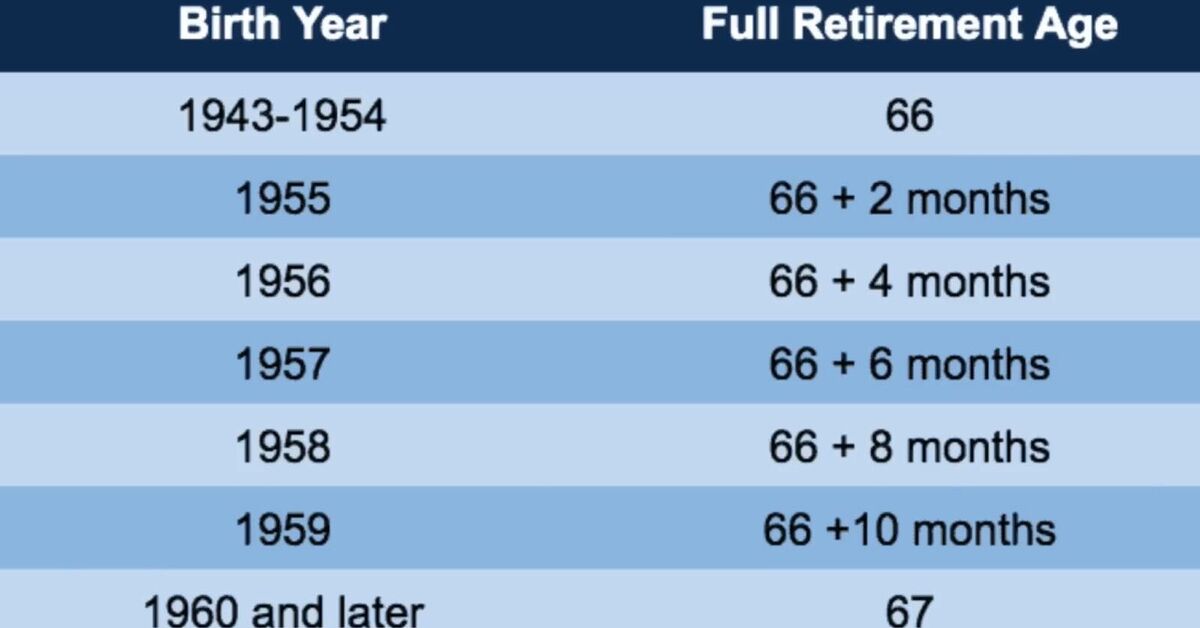

- Age 66-67: Full retirement age (FRA) depending on birth year

- Age 70: Maximum benefit age (no increase for waiting longer)

For those born in 1960 or later, full retirement age is 67. If you were born earlier, your FRA might be 66 or somewhere between 66 and 67.

The Financial Impact of Claiming at 66 vs. 70

Here’s where things get interesting: if you wait to claim your benefit until after age 70, it goes up by 8% every year. That’s not a small increase; you could get an extra 24–32% every month for the rest of your life!

Let me break it down with a simple example:

If your full retirement benefit at age 67 would be $2,000 per month:

- Claiming at 66 (one year early): About $1,933 monthly (-3.3%)

- Claiming at 67 (FRA): $2,000 monthly (100%)

- Claiming at 70: $2,480 monthly (+24%)

That difference of $547 per month between ages 66 and 70 adds up to $6,564 more per year. Over 20 years, that’s an extra $131,280 in benefits!

Why Most Experts Recommend Waiting Until 70

According to that extensive analysis of 20,000 retired workers I mentioned earlier, there’s a stark contrast between optimal and actual claiming decisions:

- Only 4% of retirees studied made the optimal claiming decision

- While 79% claimed benefits early (ages 62-64), only 8% of them should have done so to maximize lifetime benefits

- A whopping 57% would have maximized lifetime benefits by waiting until age 70

The math supports patience. If you live into your mid-80s, which is becoming more common, waiting until 70 usually gives you more benefits over your lifetime.

But Is Age 70 Always Better Than 66? Not Necessarily!

This is where I gotta emphasize that personal circumstances matter tremendously. Here are situations where claiming at 66 (or earlier) might make more sense:

When Earlier Claims (Age 66) Make Sense:

-

Poor health or shorter life expectancy: If you don’t expect to live past your early 80s due to health conditions or family history

-

Immediate financial need: If you need the income right away to make ends meet

-

You’re the lower-earning spouse: If your partner was the higher earner and is delaying their benefits

-

You want to retire earlier: If continuing work until 70 would significantly reduce your quality of life

-

You’re skeptical about Social Security’s future: Some people prefer “a bird in hand” approach with concerns about potential benefit cuts

When Delaying to Age 70 Makes Sense:

-

Good health and family longevity: If you expect to live well into your 80s or beyond

-

Still working: If you’re earning enough that taking Social Security would impact the taxability of your benefits

-

You’re the higher-earning spouse: To ensure your surviving spouse receives the highest possible survivor benefit

-

You have sufficient savings: If you can comfortably fund retirement until age 70 without Social Security

-

You want maximum inflation protection: Higher benefits mean larger cost-of-living adjustments in actual dollars

The Break-Even Analysis: When Does Waiting Pay Off?

A common approach to this decision is calculating your “break-even age” – the age at which total benefits received by waiting equals what you’d have received by claiming earlier.

For most people, the break-even point between claiming at 66 vs. 70 falls somewhere between ages 82-84. If you live beyond that age, waiting until 70 provides more total benefits. If you don’t reach that age, claiming at 66 would have given you more total benefits.

But here’s something people often miss: this simple break-even analysis doesn’t account for the “time value of money” or how those benefits integrate with your other retirement resources.

5 Factors That Should Influence Your Decision

Beyond the basic math, consider these critical factors:

1. Your Health Status

Be brutally honest about your health prospects. Family history, current conditions, and lifestyle all matter.

2. Your Financial Situation

Can you afford to wait? Do you have other income sources like:

- 401(k)/IRA withdrawals

- Pension payments

- Part-time work

- Spousal benefits

3. Marital Status

If you’re married, coordinating with your spouse can dramatically impact total household benefits. The higher earner might want to delay to 70 to maximize survivor benefits.

4. Employment Plans

Still working? If you claim before your full retirement age while still employed, you might face benefit reductions due to the earnings test.

5. Tax Implications

Social Security benefits can be taxable depending on your “combined income.” Strategic claiming can sometimes reduce your overall tax burden.

Real Examples: When 66 Beat 70 (and Vice Versa)

Case Study 1: James – Taking Benefits at 66 Worked Better

James had a family history of heart disease, with most male relatives passing in their late 70s. He also wanted to travel while still physically active. By claiming at 66, he enjoyed 12 years of benefits before passing at 78. Had he waited until 70, he would have received benefits for only 8 years, resulting in less lifetime income.

Case Study 2: Maria – Waiting Until 70 Was Optimal

Maria was healthy, had longevity in her family, and continued part-time consulting work. She waited until 70 to claim, maximizing her monthly benefit. Now at 88, she’s received 18 years of higher payments and has collected significantly more than if she’d claimed at 66.

A Strategy Worth Considering: Claim and Suspend

Some couples can benefit from advanced strategies. For example, the higher-earning spouse might file at full retirement age but suspend receiving benefits until 70. This can sometimes allow the lower-earning spouse to claim spousal benefits while the higher earner’s benefit continues to grow.

However, rule changes in recent years have limited some of these strategies, so consult with a financial advisor about current options.

What About Social Security’s Future?

I know some of ya are thinking, “But will Social Security even be around much longer?”

The good news: Social Security isn’t going away. The bad news: The Social Security Board of Trustees has warned of a potential shortfall that could require benefit reductions of around 17% after 2035 if Congress doesn’t act.

But remember, Congress has fixed similar funding issues before, typically through adjustments to payroll taxes or retirement ages. And they’ll likely do so again – cutting benefits for retirees is politically unpopular!

My Personal Take on the 66 vs. 70 Decision

I’ve seen this dilemma from many angles, and here’s what I believe: if you’re in decent health and can afford to wait, delaying until 70 is usually the better financial choice. It essentially buys you longevity insurance – protection against outliving your money.

But life isn’t just about maximizing dollars. Sometimes claiming earlier means more years of freedom, travel, or pursuing passions while you’re still young enough to fully enjoy them.

Final Thoughts: Making Your Decision

The optimal age to claim Social Security is highly personal. Instead of focusing solely on maximizing lifetime benefits, consider your:

- Health status

- Financial needs

- Retirement goals

- Family situation

- Quality of life preferences

When possible, work with a financial advisor who can model different scenarios based on your specific situation. They can show you how different claiming ages affect your overall retirement plan.

Remember, there’s no one-size-fits-all answer to whether 66 or 70 is better. But with careful consideration of your unique circumstances, you can make the choice that’s best for YOUR retirement journey.

Have you decided when you’ll claim your Social Security benefits? Are you leaning toward 66, 70, or another age entirely? Share your thoughts in the comments below!

Disclaimer: This article provides general information about Social Security benefits and is not intended as personalized financial advice. Social Security rules can change, and your specific situation may require professional guidance. Always consult with a qualified financial advisor before making important retirement decisions.

Taking Social Security at age 62

Age 62 is the earliest you can claim Social Security benefits. This is considered early retirement in the eyes of the Social Security Administration.

As was already said, though, if you claim Social Security at age 62, you will get less money—up to a 30 percent cut vs. what you would be entitled to if you retired at your full retirement age. You can also claim at any point after reaching age 62. The closer you get to full retirement age, the smaller the reduction gets.

If claiming early means youâll get less money, you may wonder why anyone would choose to do this. Againâit all depends on your personal situation. Some situations in which it might make sense to claim early include these:

- You can’t work anymore and don’t have enough money saved to last until you reach full retirement age.

- You have a long-term illness or a family history of illness that might shorten your life expectancy.

- Your spouse makes more money and can wait to start getting benefits.

How to decide when to take Social Security

You can see that the age at which you start getting Social Security will affect how much you get over the course of your life.

While it might seem beneficial to delay claiming benefits as long as possible to get the largest possible monthly benefit, this isnât always possibleâor even recommended. Social Security is only one part of your overall financial plan. If there are other factors that are unique to your case, filing earlier may be the best thing to do.

Some factors you may consider when deciding when to take Social Security include:

- Your health and whether you can continue working.

- Your desire to continue working or transition into retirement.

- Benefits your spouse is receiving or entitled to.

- What other retirement savings you have.

Thereâs a lot here to think about. Your financial advisor can help you sort through all these factors and look at your broader plan to help you weigh your options.

Should I Take Social Security at 66 or 70?

FAQ

Why is it better to take Social Security at age 66 instead of 70?

… before you reach full retirement age (FRA) will result in a reduction in benefits — as much as 25% to 30% less than you would have received if you had waited.

What is the smartest age to collect Social Security?

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits only when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

Is there really a downside to claiming Social Security at 70?

Your life expectancy Taking Social Security early reduces your benefits, but you’ll also receive monthly payments for a longer period of time. Taking it later, on the other hand, means you will get fewer Social Security checks over the course of your life, but each one will be bigger.

Is there any benefit to delaying Social Security past age 70?

You can receive benefits even if you still work. Waiting beyond age 70 will not increase your benefits. You can claim your retirement benefits now. Because you are age 70 or older, you will receive no additional benefit increases if you continue to delay claiming them.

Should I collect Social Security at 66?

The potential downside of collecting at 66 is that you risk leaving a substantial amount of Social Security income on the table if you live well into your 80s or beyond. The attraction of an age 70 claim is that you’ll maximize what you’ll receive on a monthly basis.

Is 62 a good age to claim social security?

Age 62 is the earliest you can claim Social Security benefits. This is considered early retirement in the eyes of the Social Security Administration. As noted above, however, claiming Social Security at 62 will result in reduced payments—as much as a 30 percent reduction vs. what you would be entitled to if you retired at your full retirement age.

When should I claim social security if I’m 67?

Your decision about when to claim Social Security, whether at 62, 65, 67, or 70 shouldn’t be made in isolation. Instead, it should be part of a comprehensive retirement planning process that takes into account various factors. This chart illustrates the payout percentage for someone who is 67 at full retirement age 1.

What age should I claim social security?

Claiming Social Security at age 62, 67 or 70 (or increments in between) will change the benefit amount you get. There’s no one “right age” to claim Social Security. The best decision for you will depend on your personal situation.

How much Social Security benefits do you get if you retire at 62?

However, the Social Security Administration reduces benefits by 30% for people who retire at 62, meaning they receive just 70% of their full retirement benefit each month for life. For people born in 1960 or later, full retirement age is 67. This is the age at which you are entitled to 100% of your Social Security retirement benefit.

How much Social Security benefits does a 67 year old get?

According to the most recent data from the Social Security Administration, the average monthly benefit for retired workers at age 67 is $1,929. 73. Someone who files for retirement at age 67 typically receives 100% of their full benefit. You plan to continue working while receiving benefits.