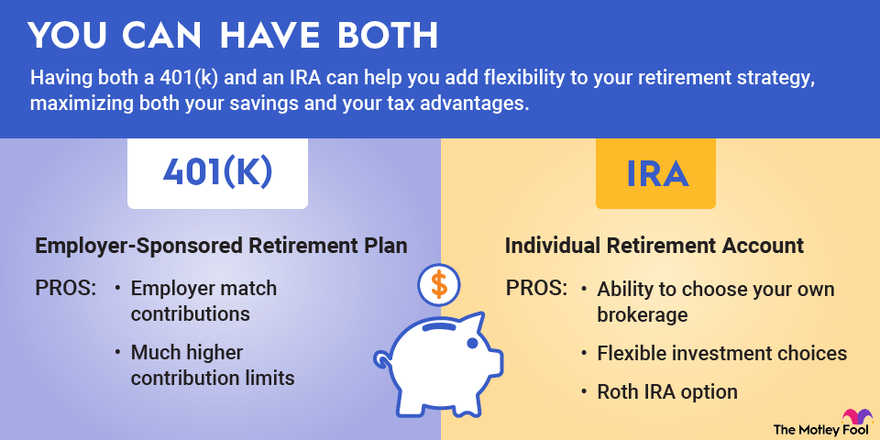

I’m going to tell you the truth: most of us don’t really understand the rules when it comes to planning for retirement. “Can I really max out both my 401(k) and my IRA in the same year?” is a question I get asked a lot.

The short answer is absolutely yes, you can!

I’ve been doing this myself whenever I could for the past few years, so I know it works. It’s one of the best ways to save for retirement, but a lot of people don’t know they can put money into both types of accounts at the same time.

The Basics: Yes, You Can Contribute to Both Plans

Let’s make this crystal clear: The IRS allows you to contribute to both a 401(k) and an IRA in the same tax year. These accounts have completely separate contribution limits, so maxing out one doesn’t reduce how much you can put in the other.

For 2024, here are the max contribution limits:

- 401(k): $23,000 (plus $7,500 catch-up if you’re 50+)

- IRA: $7,000 (plus $1,000 catch-up if you’re 50+)

For 2025 the limits are

- 401(k): $23,500 (plus $7,500 catch-up if you’re 50+)

- IRA: $7,000 (plus $1,000 catch-up if you’re 50+)

That means that if you are younger than 50, you might be able to save $30,000 in 2024 between the two accounts. That amount goes up to $38,500 if you’re 50 or older. That’s a lot of money that could be saved for retirement!

Why Would You Want to Max Out Both?

Before I dive into the how, let’s talk about why you’d wanna do this.

-

More tax-free savings space—You get more space to grow your money without the government taking a bite every year.

-

Different tax treatments – By using both, you can build buckets of money that’ll be taxed differently in retirement (especially if you choose a Roth IRA).

-

Investment flexibility – 401(k)s typically have limited investment options, while IRAs give you waaaay more choices.

-

Employer matching in 401(k)s – Free money! Who doesn’t want that?

-

Diversification of tax advantages – You’re basically hedging your bets against future tax changes.

One of our readers, Sarah from Denver, emailed me last month: “I started maxing out both accounts three years ago, and I can’t believe how much faster my retirement balance is growing!” I hear these stories all the time.

The Strategy: How to Contribute to Both

Ok, so here’s how you can make this work step by step:

Step 1: Get That 401(k) Match First!

Always, ALWAYS start by contributing enough to your 401(k) to get your full employer match. This is literally free money and an instant return on your investment.

For example, if your employer matches 50% of the first 6% you contribute, make sure you’re putting in at least 6% of your salary.

Step 2: Decide Between Traditional and Roth IRAs

Next, figure out whether a traditional or Roth IRA makes more sense for you. This depends on your income and tax situation.

- Traditional IRA: Contributions might be tax-deductible now, but withdrawals are taxed in retirement.

- Roth IRA: No tax deduction now, but qualified withdrawals are completely TAX-FREE in retirement.

Remember that your ability to contribute to a Roth IRA phases out at higher income levels. For 2024, the phase-out ranges are:

- Singles: $146,000 – $161,000

- Married filing jointly: $230,000 – $240,000

Step 3: Max Out Your IRA if Possible

Try to contribute the full $7,000 to your IRA (or $8,000 if you’re 50+). You can do this all at once or spread it throughout the year.

Pro tip: I personally set up automatic monthly transfers to my IRA to make it painless. $583 per month gets you to $7,000 by year end!

Step 4: Go Back and Max Out Your 401(k)

After securing your employer match and maxing your IRA, circle back and put any remaining retirement savings into your 401(k) up to the $23,000 limit (or $30,500 if you’re 50+).

Important Considerations and Limitations

There’s always fine print, isn’t there? Here are some things to keep in mind:

Income Limits for Traditional IRA Deductibility

If you have a 401(k) at work, your ability to deduct traditional IRA contributions may be limited or eliminated depending on your income. For 2024:

| Filing Status | Full Deduction Below | Partial Deduction Between | No Deduction Above |

|---|---|---|---|

| Single | $77,000 | $77,000-$87,000 | $87,000+ |

| Married Filing Jointly | $123,000 | $123,000-$143,000 | $143,000+ |

For 2025:

| Filing Status | Full Deduction Below | Partial Deduction Between | No Deduction Above |

|---|---|---|---|

| Single | $79,000 | $79,000-$89,000 | $89,000+ |

| Married Filing Jointly | $126,000 | $126,000-$146,000 | $146,000+ |

This doesn’t mean you can’t contribute – you still can! But you might not get the tax deduction. In this case, you might wanna consider a Roth IRA instead if you’re eligible.

Non-Deductible Traditional IRA Contributions

If your income is too high for Roth IRA contributions and you can’t deduct traditional IRA contributions, you can still make non-deductible contributions to a traditional IRA. The investment growth is still tax-deferred, which is better than a regular taxable account.

Some people use this as a backdoor method to get money into a Roth IRA (by converting after), but that’s a topic for another day!

Real Examples of Maxing Out Both Accounts

Let me share a couple examples that might help make this clearer:

Example 1: Mid-Career Professional

Sarah is 30 years old and earns $55,000 per year. Her employer matches 50% of the first 6% she contributes to her 401(k).

Her strategy:

- Contribute 6% to her 401(k): $3,300 per year (plus $1,650 employer match)

- Contribute $7,000 to a Roth IRA

- Total annual retirement savings: $11,950

Example 2: High-Earning Executive

James is 55, earns $300,000, and wants to max everything out.

His strategy:

- Max out 401(k): $23,000 + $7,500 catch-up = $30,500

- His employer matches 6%: $18,000 additional

- Contribute $7,000 + $1,000 catch-up = $8,000 to a non-deductible traditional IRA (he’s above the income limits for both Roth contributions and traditional IRA deductions)

- Total annual retirement savings: $56,500

The Power of Time: How These Contributions Grow

Let’s be real – the magic of maxing out both accounts isn’t just about the contributions; it’s about the growth over time.

Check out how much a consistent max contribution strategy can grow:

Starting at age 25, if you max out both accounts and earn an average 8% return:

- After 10 years: ~$450,000

- After 20 years: ~$1.4 million

- After 30 years: ~$3.4 million

- After 40 years: ~$7.6 million

These numbers aren’t guaranteed (duh, investments fluctuate), but they show the incredible potential of consistently maxing out your accounts.

Common Questions I Get About This Strategy

“Won’t I pay a penalty if I contribute too much?”

Yep! If you contribute more than the limits allow, you’ll face a 6% excise tax on the excess amount for each year it remains in the account. Make sure you’re tracking your contributions carefully.

“I changed jobs mid-year. Does that affect my 401(k) limit?”

Your 401(k) contribution limit applies across all 401(k) plans you participate in during the year. If you change jobs, make sure you don’t exceed the total limit between both employers.

“Does having a 401(k) mean I can’t deduct my IRA contributions?”

Not necessarily! It depends on your income. If you’re below the thresholds I mentioned earlier, you can still deduct your traditional IRA contributions even if you have a 401(k).

“What if my employer doesn’t offer a 401(k)?”

If you don’t have access to a 401(k), you might be eligible for a SEP IRA or a SIMPLE IRA, which have higher contribution limits than regular IRAs. Definitely worth checking out!

My Final Thoughts

Guys, I truly believe that maxing out both your 401(k) and IRA is one of the smartest financial moves you can make if you have the means. I’ve been doing it for years, and it’s dramatically accelerated my retirement savings.

Not everyone can afford to max out both accounts right away – and that’s totally OK! Start with getting your full employer match in your 401(k), then work toward maxing your IRA, and then go back to increasing your 401(k) contributions.

Remember, retirement planning is a marathon, not a sprint. Every additional dollar you can save now will grow exponentially over time.

Have you been maxing out both your accounts? Or are you just getting started? Drop me a comment below – I’d love to hear about your experience!

Note: This article was last updated in October 2025. Tax laws and contribution limits change regularly, so always check the most current IRS guidelines or consult with a tax professional for your specific situation.

IRA deduction limits for 2024 and 2025

If you save with both a 401(k) and a traditional IRA, you may also face some limits on your ability to deduct your contributions depending on your income.4 Contributions to a Roth are never deductible.4

For instance, if you are covered by a retirement plan at work:

- If you’re single and your Modified Adjusted Gross Income (MAGI) is $77,000 or less in 2024 or $79,000 or less in 2025, you can deduct up to the contribution limit. If you make more than $77,000 but less than $87,000 in 2024, you can deduct some of your income. The range goes up to between $79,000 and $89,000 for the 2025 tax year. Whether you make $87,000 or $89,000 in 2024 or 2025, you won’t get a tax break.

- You can deduct the full amount if your MAGI is $123,000 or less in 2024 or $126,000 or less in 2025 and you are married and file one tax return. In 2024 or 2025, if you make more than $123,000 but less than $143,000, or more than $126,000 but less than $146,000, you can deduct some of your income. No tax break if you make at least $143,000 in 2024 or $146,000 in 2025.

Making pretax IRA contributions may be a great way to save on taxes and invest for retirement. If your MAGI is above the threshold, your contribution would be considered nondeductible. There may be alternative and potentially better strategies to explore instead of making nondeductible contributions. Some other avenues to consider would be a Roth IRA and a taxable brokerage account.

Eligibility for retirement accounts

|

Account type |

Eligibility |

|

Traditional IRA |

Anyone can participate, but you must have earned income. The SECURE Act, passed in December 2019, allows traditional IRA owners with earned income to keep making contributions regardless of their age.2* |

|

Roth IRA |

Contributions can be made at any age, and you must have earned income. There are eligibility restrictions based on your filing status and income. Learn about these restrictions here.* |

|

Pre-tax 401(k) |

You must work for an employer that provides a 401(k). |

|

Roth 401(k) |

You must work for an employer that provides a 401(k) that allows Roth contributions. There are no income limits like a Roth IRA has. |

|

Account type |

Taxes on withdrawals |

|

Traditional IRA |

Assuming an individual received a tax deduction for each contribution, all withdrawals are taxed at federal and state income tax rates. |

|

Roth IRA |

None for qualified distributions. |

|

Pre-tax 401(k) |

All withdrawals are taxed at federal and state income tax rates. |

|

Roth 401(k) |

None for qualified distributions. |

|

Account type |

Penalties |

|

Traditional IRA |

A 10% penalty on withdrawals made before age 59½. There are some exceptions. |

|

Roth IRA |

A 10% penalty on withdrawals of investment earnings made before age 59½, or before meeting the five-year rule, with a few exceptions. You can generally withdraw your contributions at any time. |

|

Pre-tax 401(k) |

A 10% penalty on withdrawals made before age 59½. There are some exceptions. |

|

Roth 401(k) |

A 10% penalty on withdrawals of earnings before age 59½ or before meeting the five-year rule. |

|

Account type |

RMDs |

|

Traditional IRA |

Generally, you must take your first RMD by April 1 of the year following the calendar year in which you reach age 73. After the first year, RMDs must be satisfied by December 31. |

|

Roth IRA |

For 2024 and later years, RMDs are no longer required from designated Roth accounts. |

|

Pre-tax 401(k) |

Generally, you must take your RMD by April 1 following the later of the calendar year in which you reach age 73 or retire (if your plan allows this). After the first year, RMDs must be satisfied by December 31. If you’re still working, generally you don’t have to take RMDs. |

|

Roth 401(k) |

For 2024 and later years, RMDs are no longer required from designated Roth accounts. |

* The IRA contribution limit does not apply to rollovers.3

Remember that contribution limits apply to the total of your contributions to all of your retirement accounts, either an IRA or 401(k), respectively. Keep in mind that the chart above shows the Roth option, which has been around since 2006 for 401(k)s and IRAs.

Paying attention to these limits is important. People who make Roth contributions often put more money into their IRAs than they are allowed to. If this happens to you, you’ll have to pay a tax on the extra money for each year it stays in the account.

Sometimes people put too much money into their 401(k), especially if they change jobs during the year. If you worked at the same company all year, though, it doesn’t happen very often because most plan administrators won’t let it happen.

Thankfully, if either of the situations occurs, you have until April 15 of the following year to remove the excess funds.

If you miss that deadline, you should consider working with a tax professional to calculate any tax liability.