Paying off the mortgage after 30 years was a rite of passage for Americans approaching retirement age, but this once-common scenario is no longer the norm. According to research from Fannie Maes Economic and Strategic Research Group, baby boomers, those born between 1946 and 1965, are carrying more mortgage debt than earlier generations and are less likely than earlier generations to own their homes at retirement age.

This is confirmed by Federal Reserve data showing that those 75 and over own more mortgage debt than previous generations. According to separate research, approximately 40% to 50% of Americans in their 60s no longer have a mortgage, which leaves a big chunk that still does.

Whether it makes financial sense for retirees or those nearing retirement to pay off their mortgages depends on factors such as income, mortgage size, savings, and the value of the mortgage interest deduction.

Reaching the big 6-0 is a major milestone. As you enter your 60s, you may be thinking about retiring, spending more time with family, or checking off some bucket list adventures. But one big question on many pre-retirees’ minds is: Should I pay off my mortgage at 60?

This is an important personal finance decision with compelling arguments on both sides Here are some key factors to weigh as you determine if paying off your mortgage right before retirement is the right move

The Potential Benefits of Paying Off Your Mortgage at 60

Lower Expenses in Retirement

One of the biggest advantages of entering retirement mortgage-free is reducing your fixed expenses. For many retirees their biggest monthly bill is often their mortgage payment. Eliminating this expense can give you more room in your budget for other priorities in your golden years.

More Cash Flow

Without a mortgage payment, the extra cash flow each month can be directed to savings, vacations, hobbies, leaving an inheritance, and more. This added flexibility can be especially valuable on a fixed income.

Peace of Mind

Owning your home free and clear can bring tremendous peace of mind. You won’t have to worry about scraping together the monthly payment. This security can be invaluable during economic downturns or if health issues arise.

Guaranteed Savings on Interest

Depending on your mortgage amount and interest rate, you may save tens of thousands of dollars in interest payments by paying off your loan early. This guaranteed savings can give your nest egg a healthy boost.

Tax Benefits

Once your mortgage is paid off, you can no longer claim the mortgage interest deduction on your taxes. While this may seem like a drawback, keep in mind that the increased standard deduction makes this deduction useless for most taxpayers anyway. Paying off your mortgage essentially gives you a tax break by making the interest deduction irrelevant.

Building Home Equity

Paying off your mortgage means your home is 100% yours. If you eventually sell the property, you’ll get to keep all the profits rather than sharing them with a lender. This can help build wealth to pass down.

Reasons You May Not Want to Pay Off Your Mortgage at 60

Penalties for Early Repayment

One obstacle to paying off your mortgage decades early is potential prepayment penalties. Thankfully, most common mortgages types like 30-year fixed rate loans don’t have these penalties. But it’s worth confirming with your lender before making lump sum payments.

Opportunity Cost

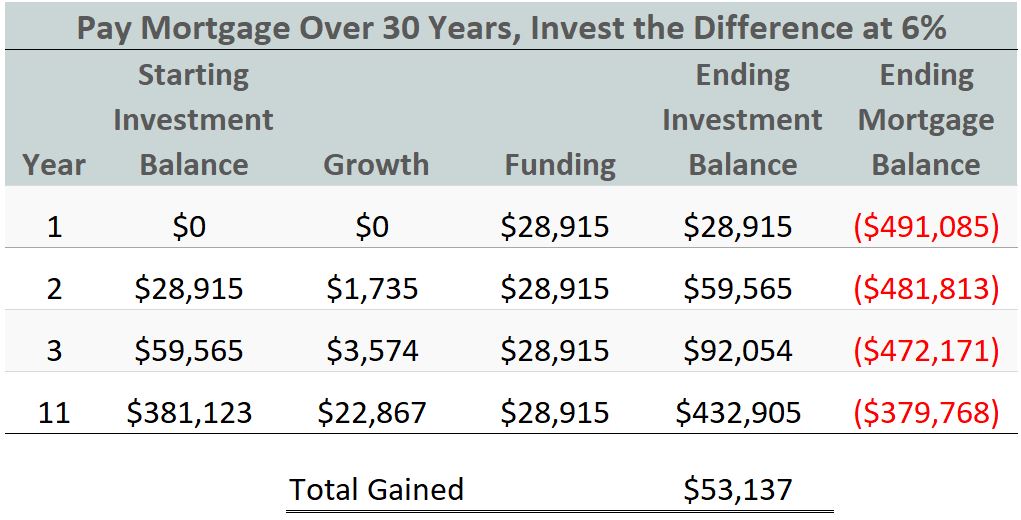

Maybe you could get a better return by investing extra cash rather than putting it toward your mortgage. Run the numbers to see if you come out ahead by keeping your mortgage and contributing money to investments instead.

Loss of Tax Deductions

As mentioned above, paying off your mortgage means losing the ability to deduct interest on your taxes. For some homeowners, this deduction is still valuable and worth keeping. Check with your CPA to understand the implications.

Shortage of Liquid Savings

Ideally, you should have an emergency fund established before putting extra cash toward paying off your mortgage. Make sure you have adequate liquidity and won’t be tempted to rack up high-interest debt.

Unknown Healthcare Costs

Entering your 60s also means potential health issues could arise. It’s generally wise to keep some mortgage debt for flexibility in case you need to access home equity for medical bills.

Low Interest Rate

If you locked in a very low rate, the savings from paying off your mortgage early may not outweigh other uses for the money. It likely makes sense to keep a 2-3% mortgage.

Tips for Pre-Retirees Considering Paying Off Their Mortgage

-

Take advantage of online calculators to run the numbers and see if paying off your mortgage early makes financial sense. Consider factors like interest rate and investment returns.

-

Talk to a financial advisor or CPA who can review your full financial picture and help determine the wisest use of extra funds. Their insight can be invaluable.

-

Make sure you have adequate liquid savings and emergency funds established before making lump sum mortgage payments.

-

Consider making extra principal payments each month rather than paying the full balance. This builds home equity while maintaining flexibility.

-

Keep future healthcare costs in mind and consider leaving some mortgage debt intact in case you need to tap home equity.

-

If downsizing to a smaller home, consider selling your current house and paying cash for your next home. This allows you to become mortgage free while keeping financial flexibility.

The Bottom Line

Deciding if you should pay off your mortgage right before retirement is ultimately a personal choice that depends on your financial situation. While being mortgage free at 60 can provide many benefits, it’s wise to consider all factors especially healthcare costs, low interest rates, and maintaining liquid funds. With careful planning, you can develop the optimal payoff strategy.

Strategies to Pay Off or Reduce Your Mortgage

You can use certain strategies to pay off your mortgage early or at least reduce your payments before retirement. Making payments every other week instead of once monthly means that you’ll make 26 payments in a year instead of just 12. You might also just pay a little extra each time you make a monthly mortgage payment to whittle down your loan.

Another option is downsizing if you have a larger home. You might be able to buy a smaller home outright with the profit from the sale if you structure the sale correctly, leaving you mortgage-free. The pitfalls include overestimating the worth of your current home, underestimating the cost of a new home, ignoring the tax implications of the deal, and overlooking closing costs.

Avoid Tapping Retirement Funds

Generally, it’s not a good idea to withdraw from a retirement plan such as an individual retirement account (IRA) or a 401(k) to pay off a mortgage. You’ll incur both taxes and early-payment penalties if you withdraw before you reach age 59½.

The tax hit of taking a large distribution from a retirement plan could push you into a higher tax bracket for the year even if you wait until you’re older than age 59½.

It’s also not a good idea to pay off a mortgage at the expense of funding a retirement account. Those nearing retirement should be making maximum contributions to their retirement plans. Research shows that the majority of people are not saving enough for retirement.

According to Pew, 51% of Americans worry theyll run out of money once they stop working and 70% of retirees wish they had started saving for retirement earlier. Additionally, the report states that 56 million private-sector workers dont have a retirement plan at work; employees who dont have retirement plans, save less.

The report goes on to state that those earning less than $75,000 but above the poverty line will fall short of their retirement income target by approximately $7,050 a year.

Should I Pay Down My Mortgage Or Save For Retirement?

FAQ

Should I pay off my mortgage at age 60?

Key Takeaways. Paying off a mortgage can be smart for retirees or those who are just about to retire if they’re in a lower-income tax bracket. It can also benefit those who have a high-interest mortgage or who don’t benefit from the mortgage interest tax deduction.

What does Suze Orman say about paying off your mortgage?

For those nearing retirement age, though, Orman offers different advice: If you’re in your forever home, pay off your mortgage by the time you retire. Considering that baby boomers own 38% of America’s housing stock—and more than half plan to never sell—is an important caveat.

At what age should my house be paid off?

“Shark Tank” investor Kevin O’Leary has said the ideal age to be debt-free is 45, especially if you want to retire by age 60. Being debt-free — including paying off your mortgage — by your mid-40s puts you on the early path toward success, O’Leary argued.