Equifax, Experian, and TransUnion can differ in the information they collect Part of the Series Guide to FICO

Equifax, Experian, and TransUnion are the top three credit bureaus in the U.S. They are private businesses that collect and sell data on the spending and borrowing habits of individual consumers. The data is compiled into a credit report on every individual, with a score that rates the individuals creditworthiness on a scale that ranges from “poor” to “excellent.”

Whether an application is approved for a credit card, mortgage, car loan, or lease depends mainly on a persons credit rating with one or more of the three major credit bureaus.

Your credit score is one of the most important numbers in your financial life It affects everything from getting approved for credit cards and loans to securing a mortgage and even renting an apartment But with three major credit bureaus in the US – Equifax, Experian, and TransUnion – reporting varied information to generate your score, you may be wondering which credit bureau has the most accurate credit score?

The short answer is there is no single “most accurate” credit score. However, looking at the key differences between the credit bureaus and being aware of which scoring model most lenders rely on can help you better understand your creditworthiness.

The Three Major Credit Bureaus

The three main credit bureaus – Equifax, Experian, and TransUnion – are private companies that collect information about your borrowing and payment history from lenders, creditors, and other sources They package this information into credit reports which they sell to lenders and businesses

While these three credit bureaus are the largest and most widely used, they are not the only credit reporting agencies out there. Plus, not all lenders report account information to all three bureaus. This inconsistency means that the information contained in your credit reports from each bureau may vary slightly.

Here’s a quick overview of the three major bureaus:

-

Equifax – The oldest credit bureau, founded in 1899. Offers free credit monitoring services. Known for its free credit lock product.

-

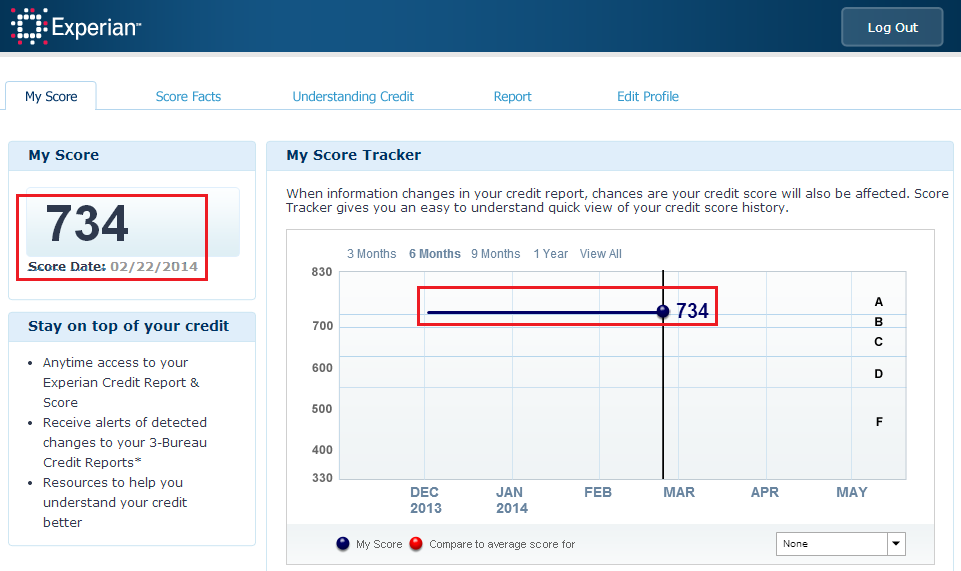

Experian – Founded in 1996. The largest credit bureau with over 235 million credit files. Offers monitoring of reports from all three bureaus.

-

TransUnion – Founded in 1968. Has extensive business credit products and services. Known for credit monitoring innovations.

While there are some differences, all three collect comprehensive credit data on individuals and provide credit reports to lenders and businesses who have a permissible purpose under the Fair Credit Reporting Act.

Why Credit Scores Vary

Since the three credit bureaus don’t all receive the exact same credit information from lenders, the data in your three reports may not be identical. These minor inconsistencies mean that the credit scores calculated using your reports at each bureau will be slightly different.

Additionally, the bureaus use different formulas and models to actually tabulate your credit score. The two primary scoring models are:

-

FICO Score – Created by the Fair Isaac Corporation, this is the most commonly used model and factors heavily in lending decisions.

-

VantageScore – A collaborative model from the three credit bureaus released in 2006 as a competitor to FICO.

Within these models there can also be variations. For instance, there is not just one single FICO score. Some of the more specialized FICO scores include:

-

FICO 8 – Most widely used version that has been adapted for current consumer trends.

-

FICO Auto Score – Tweaked model for auto loan lending decisions.

-

FICO Bankcard Score – Specific to credit card accounts.

While the algorithms differ, all credit scores generally take into account five common factors:

- Payment history

- Credit utilization

- Length of credit history

- Credit mix

- New credit inquiries

In the FICO model, payment history and amounts owed make up a significant 65% of your total score.

The main point is that even using the same scoring model, your exact credit score may fluctuate between bureaus based on their credit report data.

Which Credit Score Matters Most to Lenders

When it comes to your credit score, the version that matters most to potential lenders and creditors is your FICO Score.

It’s estimated that over 90% of lending decisions in the U.S. are based on FICO Scores from the three major credit bureaus. Almost every lender prefers the FICO credit score above other options because the FICO model has been time-tested with decades of consumer data.

Within FICO, the most commonly used version is the basic FICO 8 which weighs recent payment behaviors more heavily than older scores. Industry-specific FICO Auto and Bankcard Scores are also relied on by lenders in those sectors.

That’s not to say other credit scores are unimportant. Scores like the VantageScore may be used by some specialized lenders. Monitoring services may provide VantageScores or educational credit scores to give you an idea of your creditworthiness.

But the FICO Score reigns supreme in lending decisions. Focusing on maximizing this score by maintaining good credit behaviors will serve you best in getting approved for new credit at the optimal terms.

Tips for Managing Your Credit Score

While checking all three of your credit reports is wise, keep a close eye on your FICO Score when applying for mortgages, auto loans, credit cards and other lines of credit. Here are some tips for building and protecting your credit score:

-

Check reports annually – Review reports from Equifax, Experian, and TransUnion each year to spot errors or suspicious activity.

-

Dispute inaccuracies – If you find incorrect information, dispute it with the bureau in writing. This can boost your score.

-

Pay bills on time – Payment history is the top factor. Even one late payment can ding your score.

-

Lower balances – High balances hurt your score. Pay down cards and keep usage under 30%.

-

Limit new credit – New applications cause hard inquiries that temporarily lower scores.

-

Monitor FICO Score – Many banks offer this key score for free to customers.

-

Practice good habits – Building credit takes time. Stick to responsible habits.

While credit scores involve some complexity, being aware of the major factors, checking all three bureaus, and monitoring your key FICO Score will help ensure it reflects your true creditworthiness. Responsible financial behaviors over time are rewarded with higher scores and better credit opportunities.

Regulation of Credit Bureaus

Credit bureaus are regulated under the federal Fair Credit Reporting Act (FCRA), which defines how they may collect, disburse, and disclose consumer information.

The bureaus rely on information supplied by the banks, finance companies, retailers, and sometimes landlords with which you do business.

How Overdue Bills Are Recorded

If you are delinquent in making a student loan payment, Sallie Mae, for example, may report that to a credit bureau, usually when it is 45 days late. Federal loans provide more leeway, allowing 90 days to pass before the loan servicer will file a report of a delinquency.

Not all lenders report credit activity to every credit bureau, so one bureau’s credit report can differ from another credit bureau’s. Even when lenders report to all three bureaus, their information may appear on credit reports at different times simply because the bureaus compile data on different schedules.

Which credit bureau has the highest score? Lowest credit scores? Equifax? TransUnion? Experian?

FAQ

Which credit bureau gives the highest score?

Similar to credit scores, there’s no single credit report that’s the most accurate. Lenders might report to all three major credit bureaus. Or they may only report to one or two. This means you might find slightly different information on each of your credit reports.

Which credit bureau is most accurate?

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important.Jan 31, 2025

Is TransUnion or Equifax more accurate?

Is Experian or FICO more accurate?