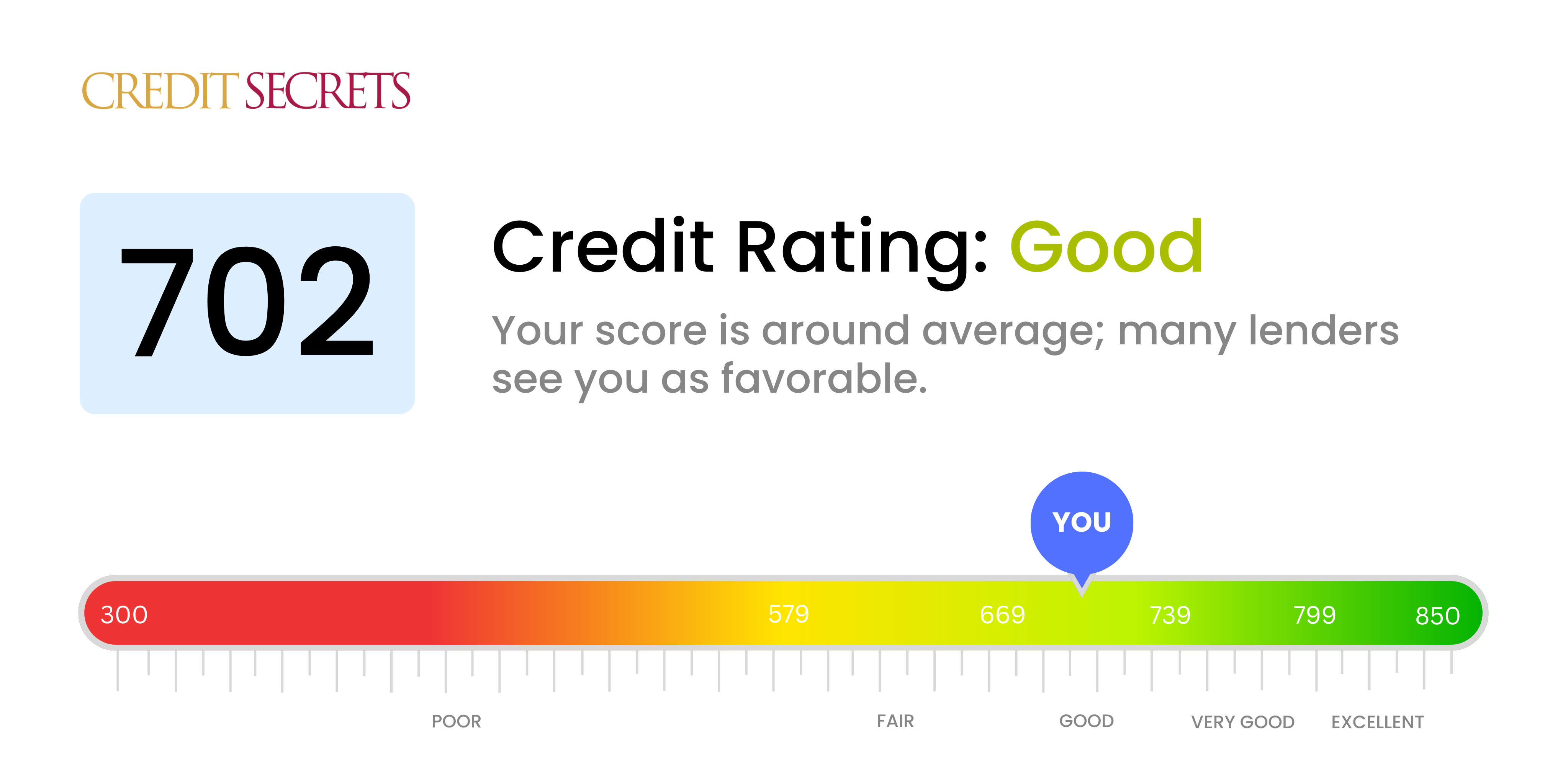

A 702 credit score qualifies as good. According to FICO, a good credit score starts at 670, so you can give yourself a pat on the back if you have a 702 score or thereabouts. You’ll have an easier time landing that mortgage, car loan, or personal loan than if you had a poor or fair score. However, building your score even higher could benefit you with lower interest rates and more appealing terms.

Learn more about what a 702 credit score means to your financial situation and what to expect when accessing loans and lines of credit.

• A 702 credit score is classified as “good” in the FICO® Score range, which runs from 670 to 739.

• It should qualify you for credit and loans, like mortgages and car loans, but perhaps not at the best rates.

• Building on a 702 credit score can lead to better interest rates and loan terms.

• A 702 credit score should access lower interest rates than “fair” or “poor” scores, but not as low as “very good” and “excellent” scores.

Your credit score is one of the most important numbers in your financial life. It represents your creditworthiness and can determine whether you get approved for credit cards, loans, mortgages, apartments, and more So is a 702 credit score considered good or bad?

What is a Credit Score?

A credit score is a three-digit number that summarizes your creditworthiness based on the information in your credit reports, The most commonly used credit scores are FICO scores and VantageScore Both score ranges go from 300 to 850,

Higher scores signal lower credit risk to lenders. People with higher scores are viewed as more likely to make on-time payments and less likely to default on debts. As a result, they typically get approved for credit and qualify for the best terms, like lower interest rates.

On the other hand, lower scores indicate higher credit risk. People with lower scores may face more credit denials, higher interest rates, lower credit limits, and stricter loan terms.

What is a Good Credit Score?

Credit bureaus and scoring companies don’t issue official “good” credit score thresholds, but they provide general guidance on score interpretations.

Here are the “good” credit score ranges according to FICO and VantageScore:

- FICO: 670-739

- VantageScore: 661-780

So by both scoring models’ standards, a credit score of 702 falls into the good credit range.

Is 702 a Good Credit Score?

Yes, a credit score of 702 is considered good by both FICO and VantageScore’s standards. It falls right in the middle of the good credit range.

According to FICO, a score of 702 means:

- You have “Very Good” credit.

- 21% of consumers have credit scores in this range.

- You are an acceptable borrower to most lenders.

- You may qualify for competitive interest rates.

- You have a 9% risk of becoming seriously delinquent.

So what can you expect with a 702 credit score? Here are some general guidelines:

Credit Cards

- You’ll likely qualify for most credit cards, including rewards cards.

- You may qualify for top travel and cash back cards with good perks.

- But you may not get approved for extremely exclusive premium cards.

- You’ll likely get approved for credit limit increases.

Loans

- You’ll likely qualify for competitive personal loans at decent rates.

- Most lenders will approve you for an auto loan.

- You have a good chance of approval for a mortgage with good terms.

Renting

- Most landlords will approve your rental application.

- You may qualify for lower security deposits.

So while a score of 702 doesn’t unlock the very best offers, it provides access to an excellent range of credit products. Overall, it’s a score to be proud of.

How to Improve a 702 Credit Score

Here are some tips for boosting your 702 credit score even higher into the “very good” range:

- Lower credit utilization – Keep balances low on credit cards and loans. Shoot for less than 30% of the credit limit.

- Pay bills on time – Payment history is the biggest factor in your scores. Stay on top of due dates.

- Limit new credit – New applications can lower scores temporarily. Space out applications by 6 months.

- Correct errors – Dispute and remove inaccuracies dragging down your reports.

- Increase credit age – Avoid closing old, long-duration accounts if possible.

- Diversify credit mix – Open installment loans if you only have credit cards.

With diligent credit management over time, you can incrementally increase your 702 score.

Average Credit Score by Age

Your 702 credit score is excellent for any age. But how does it compare to the average scores for different age groups?

According to FICO, the average scores by age are:

- 18-29: 680

- 30-39: 691

- 40-49: 704

- 50-59: 721

- 60+: 752

And according to VantageScore, the averages by generation are:

- Gen Z (1997+): 667

- Millennials (1981-1996): 678

- Gen X (1965-1980): 700

- Baby Boomers (1946-1964): 742

- Silent Generation (1928-1945): 753

So your 702 score already exceeds the averages for younger borrowers. As you continue building your credit history, your score has plenty of room to increase over time. The older you get, the higher your score is likely to climb.

How to Check Your Credit Score

Checking your own credit scores does NOT impact them whatsoever. You can monitor your scores over time to see the results of your credit management efforts.

There are a few easy ways to check your credit score for free:

- Online through your bank or credit card issuer’s website

- Credit monitoring sites like Credit Karma

- Personal finance sites like NerdWallet

Checking your credit score regularly is key to understanding and improving your credit health over time.

A credit score of 702 is considered good using industry standards and credit bureau score interpretations. With this score, you’ll have access to an excellent array of credit products, loans, and other services. However, it falls short of the ultra premium credit offers reserved for higher scores. If you stay diligent, you can continue boosting your 702 even higher over time and open the door to even better credit opportunities.

Can I Get an Auto Loan With a 702 Credit Score?

You have a good chance of landing an auto loan with a 702 credit score. According to data from Experian®, in Q2 of 2024, the average credit score for new car loans was 753, and the average for used cars was 689. If you get a used car, you might be able to find lower interest rates and more flexible terms with your 702 score. Doing so could save on the total cost of the car, as insurance and other costs can be cheaper.

While you’ll have an easier time securing a car loan with a good score than a fair one, expect still lower interest rates if you score in “very good” or “excellent” territory. If you’re not in a rush to get a car, you might invest some time and energy on building your credit. You can do so by always making on-time payments, avoiding too many hard credit inquiries, and keeping your credit utilization low.

Received mail from us?

If so, you are in the right place! Get started by entering your personal confirmation number below. Confirmation # Confirmation # invalid Zip Code

Is A 702 Credit Score Good? – CreditGuide360.com

FAQ

What can I do with a credit score of 702?

A FICO® Score of 702 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

What is a really good credit score?

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

Is 702 a good credit score to buy a house?

It should qualify you for credit and loans, like mortgages and car loans, but perhaps not at the best rates. Building on a 702 credit score can lead to better interest rates and loan terms. Lenders also evaluate income, collateral, and debt-to-income ratio before offering loans.

Can I buy a car with a 702 credit score?

Most lending institutions require at least a 600 credit score to approve an auto loan without a downpayment. However, it is possible to purchase a vehicle with a score a score as low as 400.